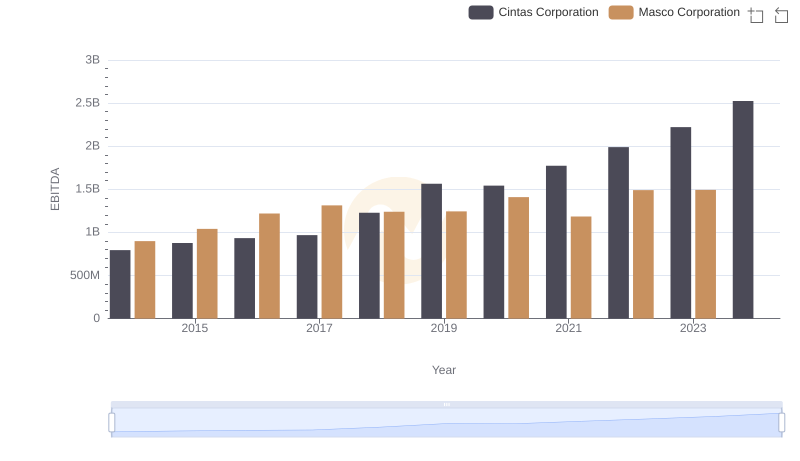

| __timestamp | Cintas Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 1109300000 |

| Thursday, January 1, 2015 | 877761000 | 842400000 |

| Friday, January 1, 2016 | 933728000 | 890400000 |

| Sunday, January 1, 2017 | 968293000 | 488600000 |

| Monday, January 1, 2018 | 1227852000 | 552800000 |

| Tuesday, January 1, 2019 | 1564228000 | 513200000 |

| Wednesday, January 1, 2020 | 1542737000 | 527600000 |

| Friday, January 1, 2021 | 1773591000 | 714400000 |

| Saturday, January 1, 2022 | 1990046000 | 830400000 |

| Sunday, January 1, 2023 | 2221676000 | 852000000 |

| Monday, January 1, 2024 | 2523857000 | 803800000 |

Data in motion

In the competitive landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Cintas Corporation has demonstrated a remarkable upward trajectory in its EBITDA, growing by approximately 218% from 2014 to 2023. This growth reflects Cintas's strategic initiatives and robust market positioning. In contrast, Pentair plc has experienced a more modest increase of around 74% over the same period, indicating steady but slower growth.

From 2014 to 2023, Cintas consistently outperformed Pentair, with its EBITDA peaking in 2023. Notably, Pentair's EBITDA saw a significant dip in 2017, highlighting potential challenges faced during that year. The data for 2024 is incomplete, with Pentair's figures missing, suggesting a need for further analysis. This comparison underscores the dynamic nature of financial performance and the importance of strategic planning in achieving sustained growth.

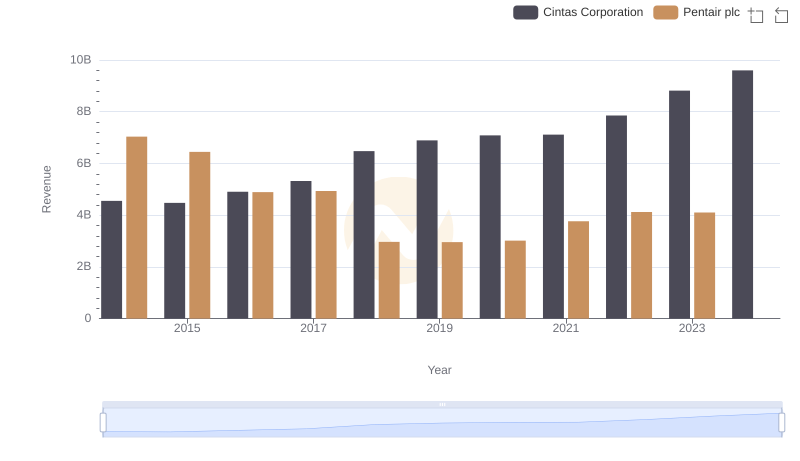

Annual Revenue Comparison: Cintas Corporation vs Pentair plc

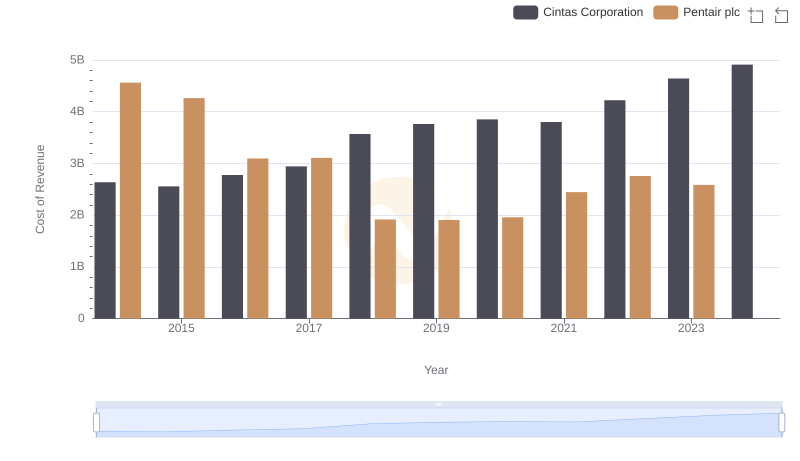

Cost of Revenue Comparison: Cintas Corporation vs Pentair plc

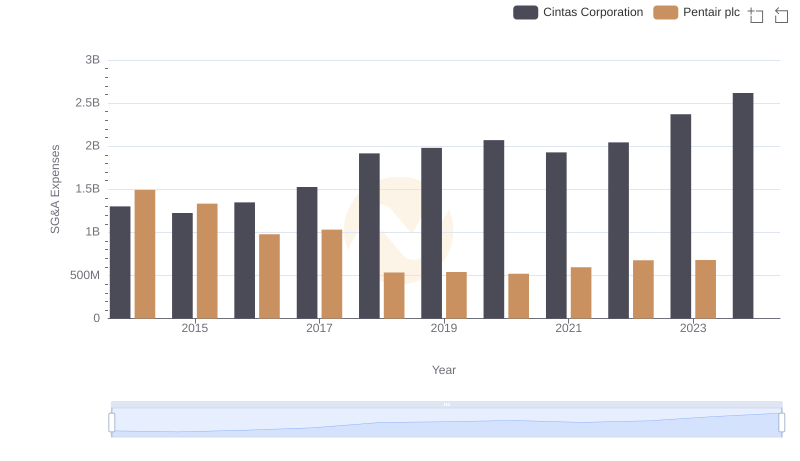

Breaking Down SG&A Expenses: Cintas Corporation vs Pentair plc

Cintas Corporation and Masco Corporation: A Detailed Examination of EBITDA Performance

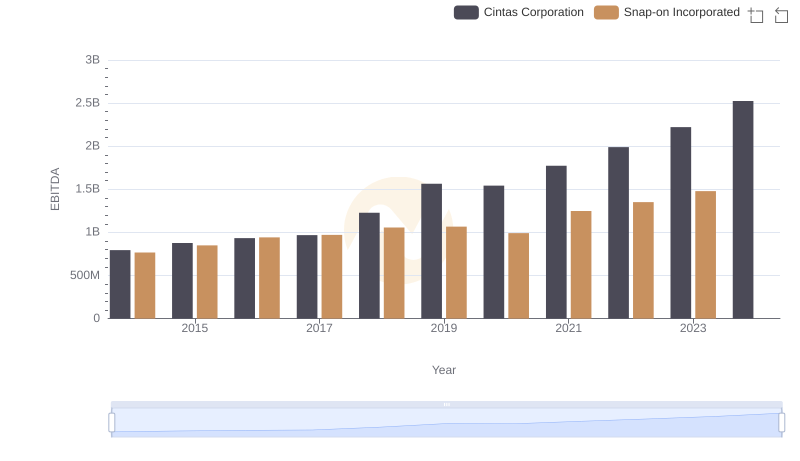

EBITDA Metrics Evaluated: Cintas Corporation vs Snap-on Incorporated

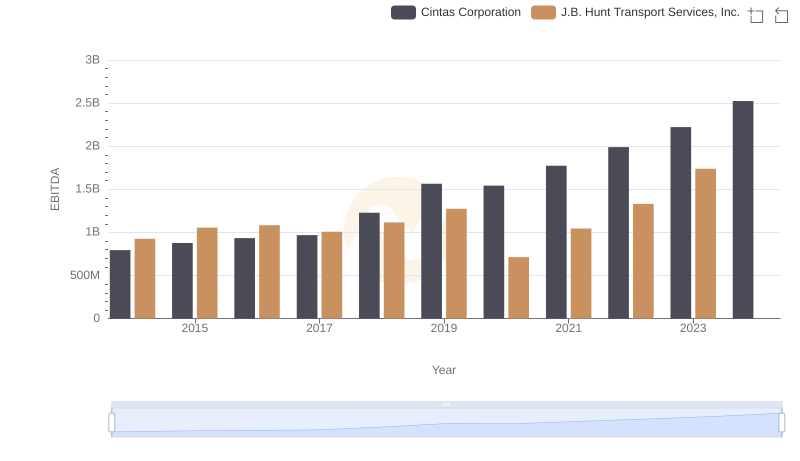

Comparative EBITDA Analysis: Cintas Corporation vs J.B. Hunt Transport Services, Inc.

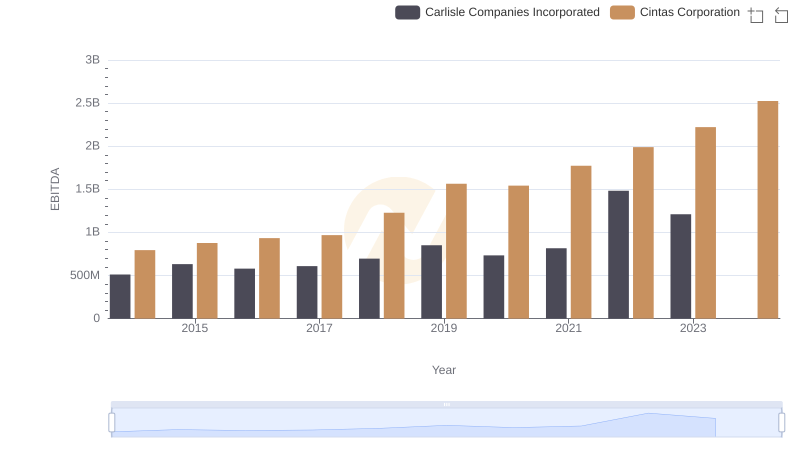

EBITDA Metrics Evaluated: Cintas Corporation vs Carlisle Companies Incorporated

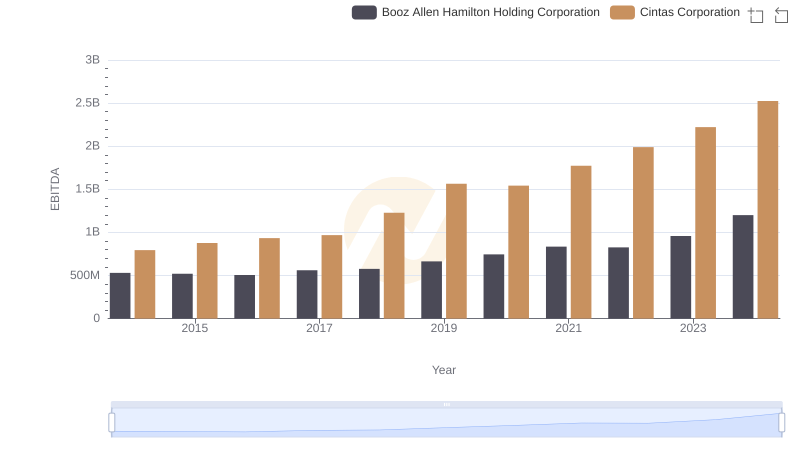

Cintas Corporation and Booz Allen Hamilton Holding Corporation: A Detailed Examination of EBITDA Performance

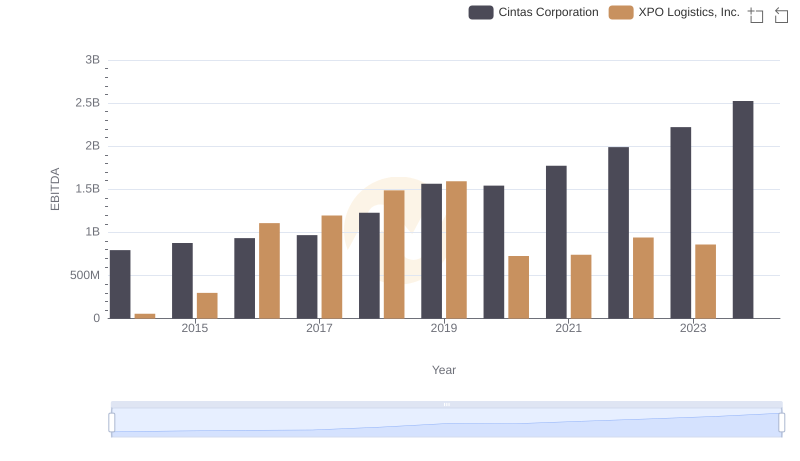

Cintas Corporation and XPO Logistics, Inc.: A Detailed Examination of EBITDA Performance

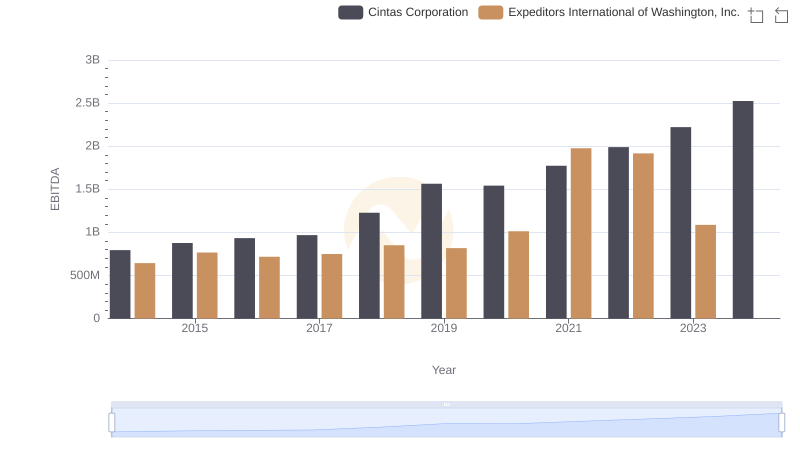

EBITDA Analysis: Evaluating Cintas Corporation Against Expeditors International of Washington, Inc.