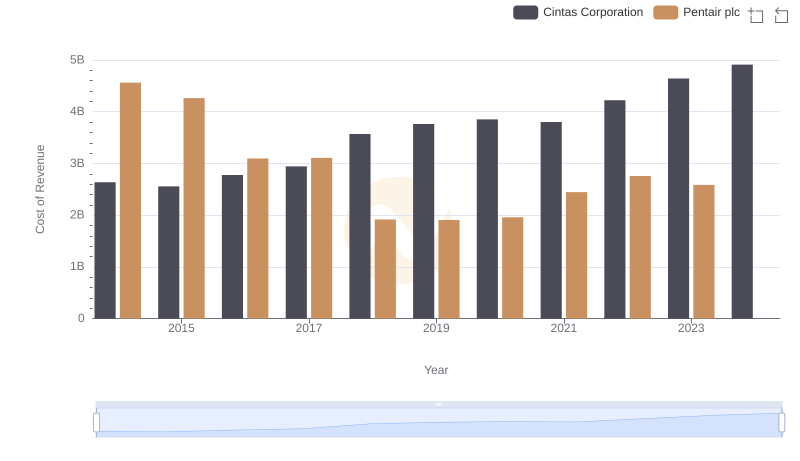

| __timestamp | Cintas Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 7039000000 |

| Thursday, January 1, 2015 | 4476886000 | 6449000000 |

| Friday, January 1, 2016 | 4905458000 | 4890000000 |

| Sunday, January 1, 2017 | 5323381000 | 4936500000 |

| Monday, January 1, 2018 | 6476632000 | 2965100000 |

| Tuesday, January 1, 2019 | 6892303000 | 2957200000 |

| Wednesday, January 1, 2020 | 7085120000 | 3017800000 |

| Friday, January 1, 2021 | 7116340000 | 3764800000 |

| Saturday, January 1, 2022 | 7854459000 | 4121800000 |

| Sunday, January 1, 2023 | 8815769000 | 4104500000 |

| Monday, January 1, 2024 | 9596615000 | 4082800000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate America, Cintas Corporation and Pentair plc have carved distinct paths over the past decade. From 2014 to 2023, Cintas has demonstrated a robust growth trajectory, with its revenue surging by approximately 110%, from $4.6 billion to $9.6 billion. This impressive growth underscores Cintas's strategic prowess in the uniform and facility services industry.

Conversely, Pentair plc, a leader in water treatment solutions, experienced a more volatile revenue pattern. Starting at $7 billion in 2014, Pentair's revenue saw a decline, stabilizing around $4.1 billion by 2023. This represents a 41% decrease, reflecting challenges in the market and strategic shifts.

While Cintas's consistent upward trend highlights its resilience and adaptability, Pentair's journey illustrates the dynamic nature of the water solutions sector. The missing data for 2024 suggests potential shifts or strategic pivots on the horizon.

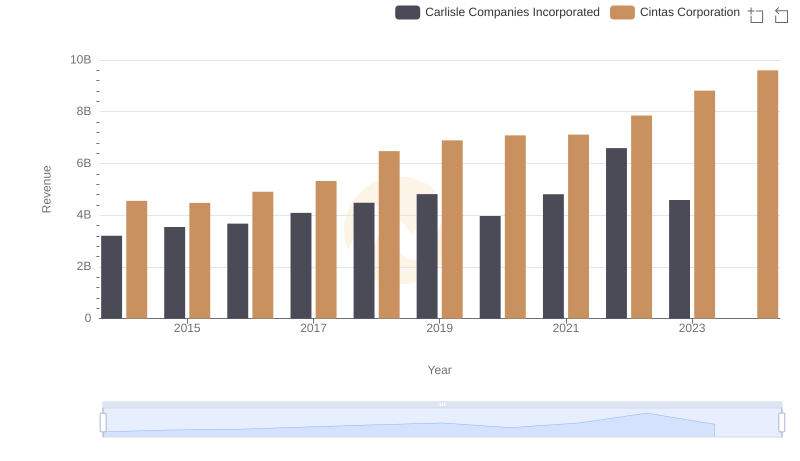

Cintas Corporation vs Carlisle Companies Incorporated: Annual Revenue Growth Compared

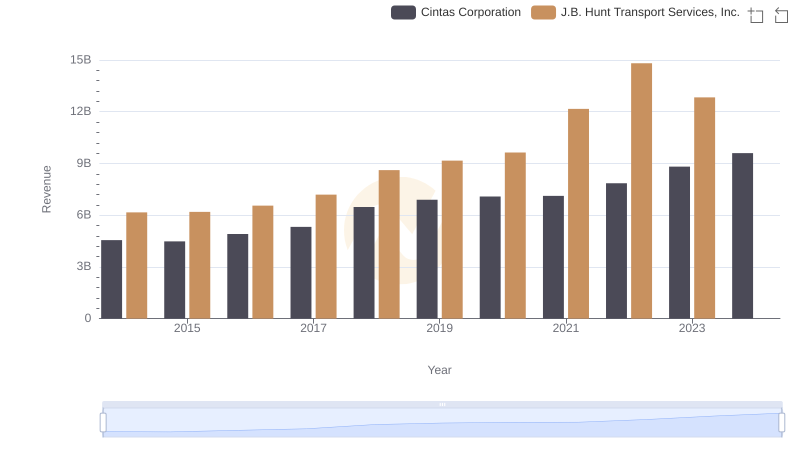

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Comprehensive Revenue Analysis

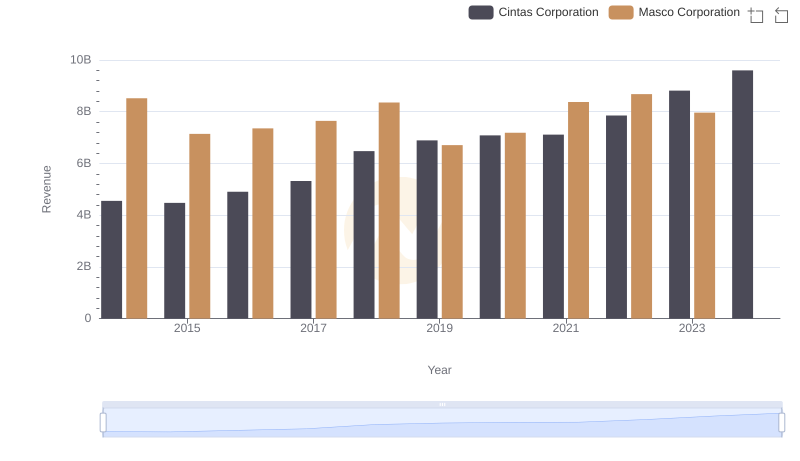

Who Generates More Revenue? Cintas Corporation or Masco Corporation

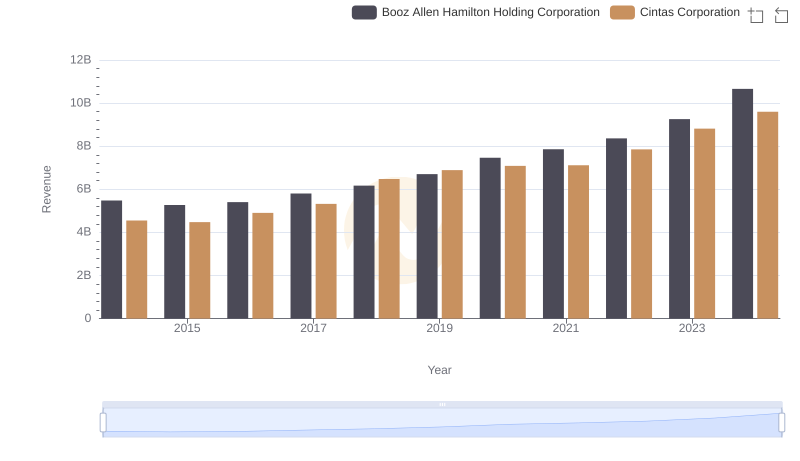

Cintas Corporation vs Booz Allen Hamilton Holding Corporation: Examining Key Revenue Metrics

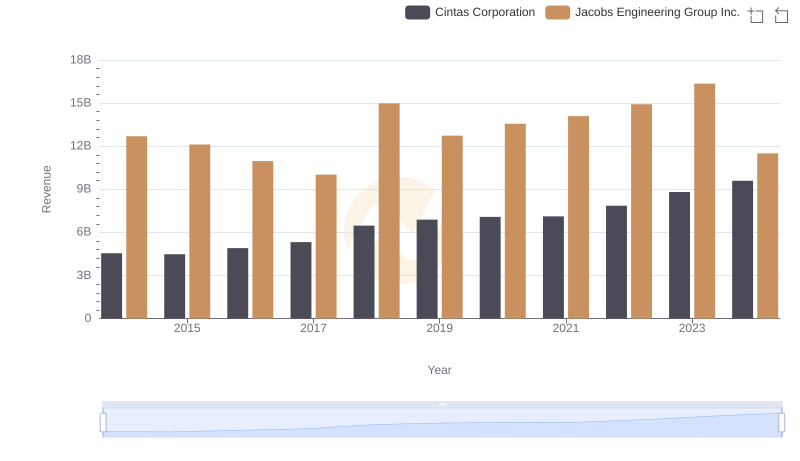

Comparing Revenue Performance: Cintas Corporation or Jacobs Engineering Group Inc.?

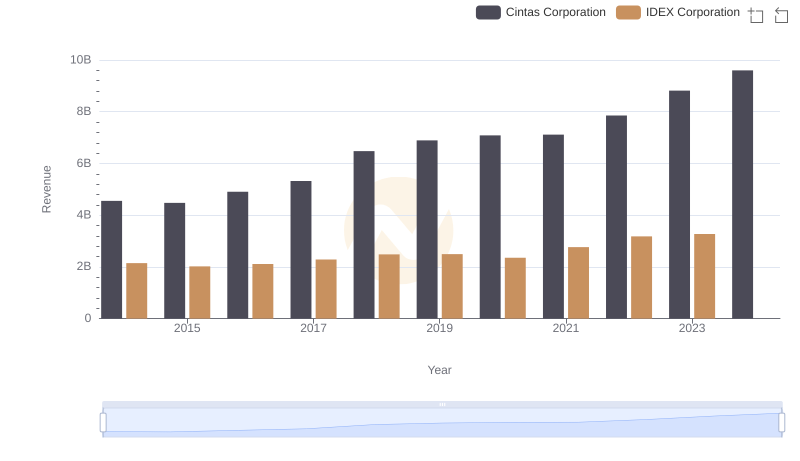

Comparing Revenue Performance: Cintas Corporation or IDEX Corporation?

Cost of Revenue Comparison: Cintas Corporation vs Pentair plc

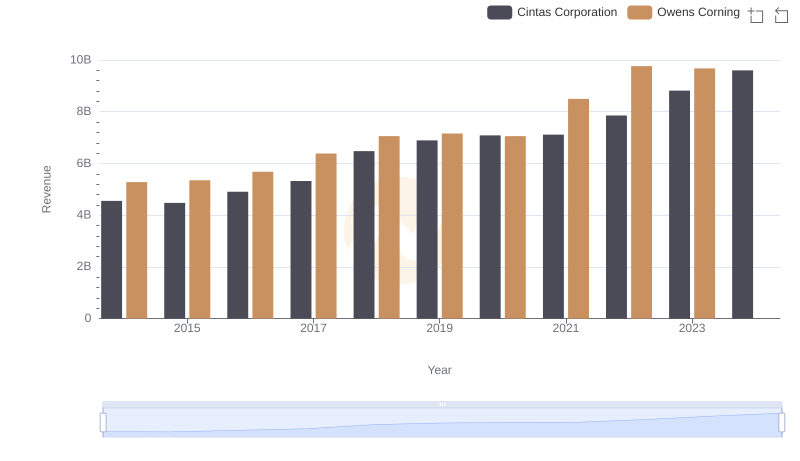

Cintas Corporation and Owens Corning: A Comprehensive Revenue Analysis

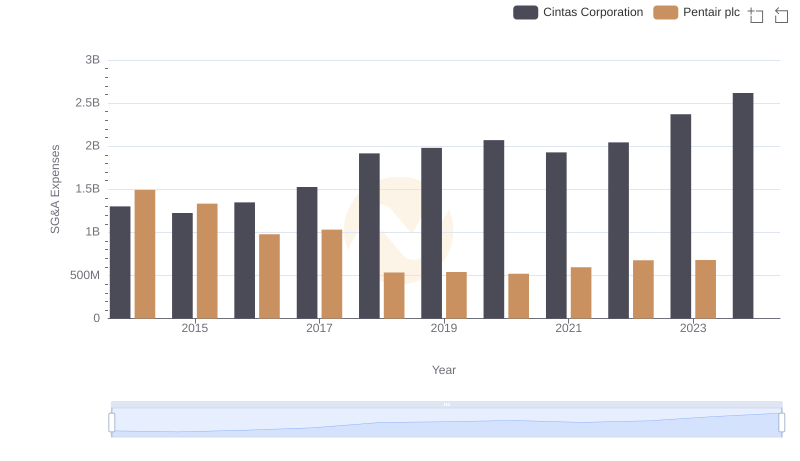

Breaking Down SG&A Expenses: Cintas Corporation vs Pentair plc

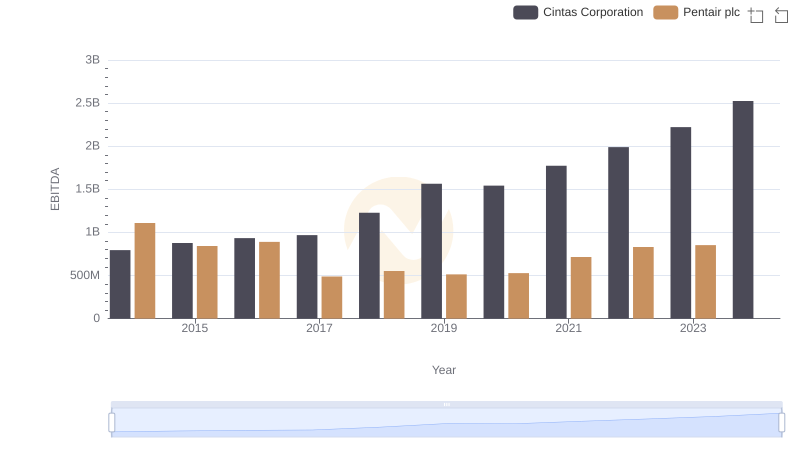

Professional EBITDA Benchmarking: Cintas Corporation vs Pentair plc