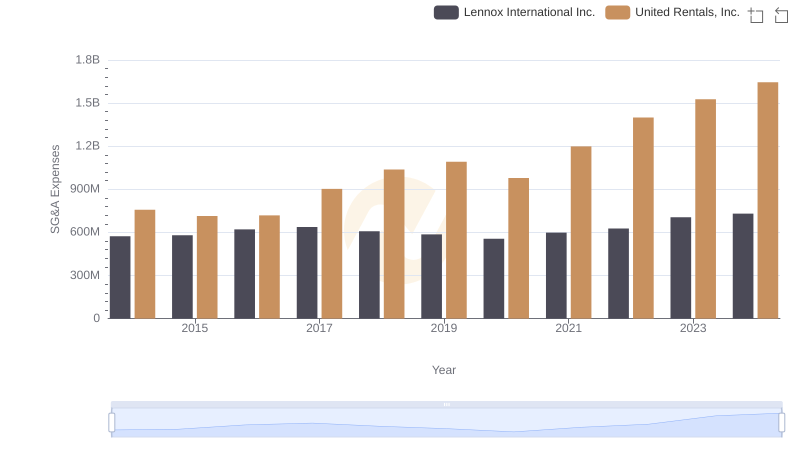

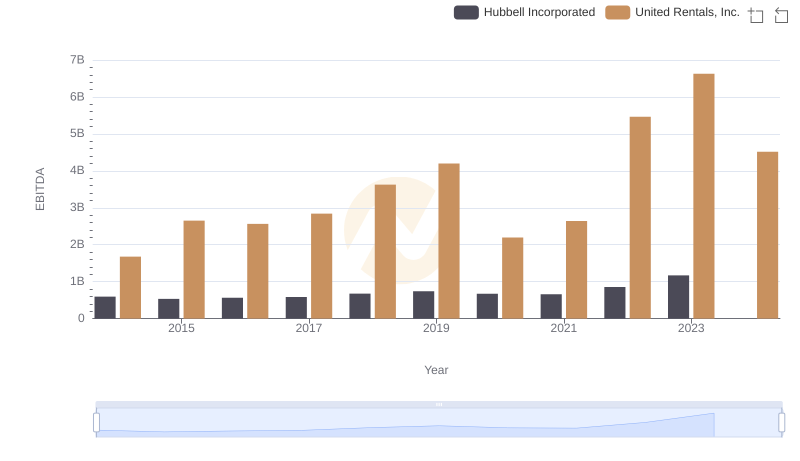

| __timestamp | Hubbell Incorporated | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 591600000 | 758000000 |

| Thursday, January 1, 2015 | 617200000 | 714000000 |

| Friday, January 1, 2016 | 622900000 | 719000000 |

| Sunday, January 1, 2017 | 648200000 | 903000000 |

| Monday, January 1, 2018 | 743500000 | 1038000000 |

| Tuesday, January 1, 2019 | 756100000 | 1092000000 |

| Wednesday, January 1, 2020 | 676300000 | 979000000 |

| Friday, January 1, 2021 | 619200000 | 1199000000 |

| Saturday, January 1, 2022 | 762500000 | 1400000000 |

| Sunday, January 1, 2023 | 848600000 | 1527000000 |

| Monday, January 1, 2024 | 812500000 | 1645000000 |

Unleashing insights

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. United Rentals, Inc. and Hubbell Incorporated, two industry giants, have shown distinct strategies over the past decade. From 2014 to 2023, United Rentals consistently reported higher SG&A expenses, peaking at approximately $1.53 billion in 2023, a 102% increase from 2014. In contrast, Hubbell Incorporated's SG&A expenses grew by about 43% over the same period, reaching $848 million in 2023.

This divergence highlights United Rentals' aggressive expansion strategy, reflected in their rising SG&A costs, while Hubbell's more conservative approach suggests a focus on cost efficiency. The data for 2024 is incomplete, but the trends suggest that United Rentals may continue its upward trajectory. As businesses navigate economic uncertainties, these insights into SG&A management offer valuable lessons in balancing growth and cost control.

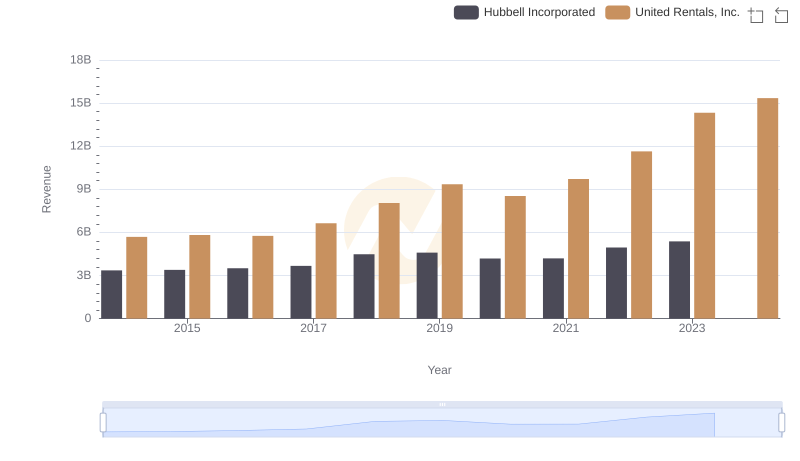

Revenue Showdown: United Rentals, Inc. vs Hubbell Incorporated

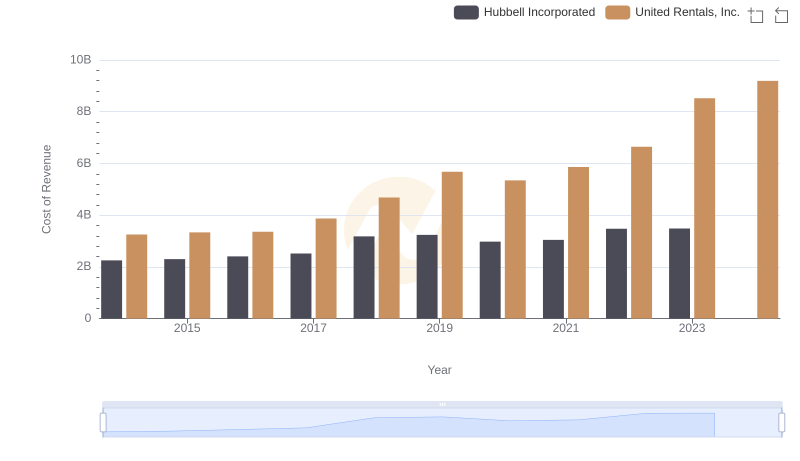

Comparing Cost of Revenue Efficiency: United Rentals, Inc. vs Hubbell Incorporated

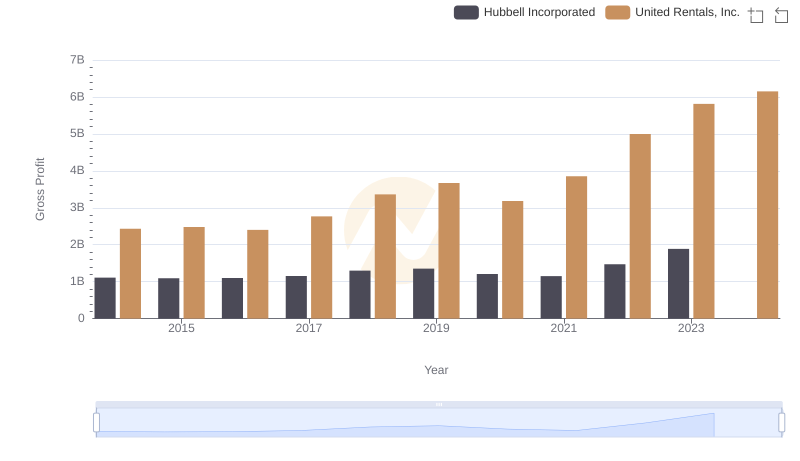

Who Generates Higher Gross Profit? United Rentals, Inc. or Hubbell Incorporated

United Rentals, Inc. and Lennox International Inc.: SG&A Spending Patterns Compared

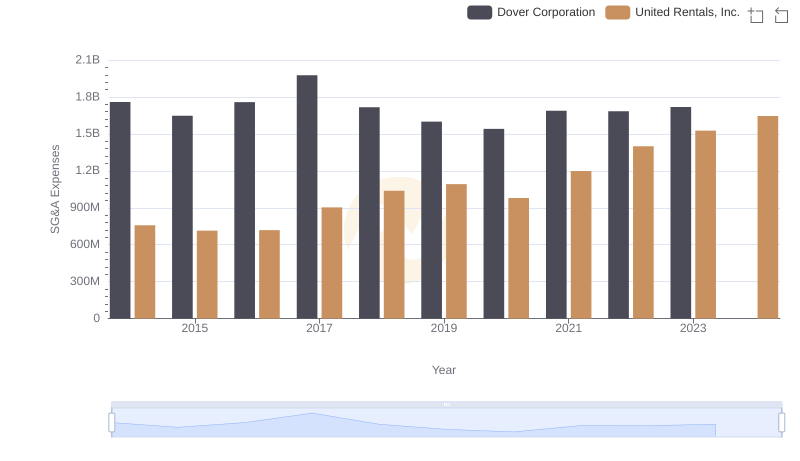

Operational Costs Compared: SG&A Analysis of United Rentals, Inc. and Dover Corporation

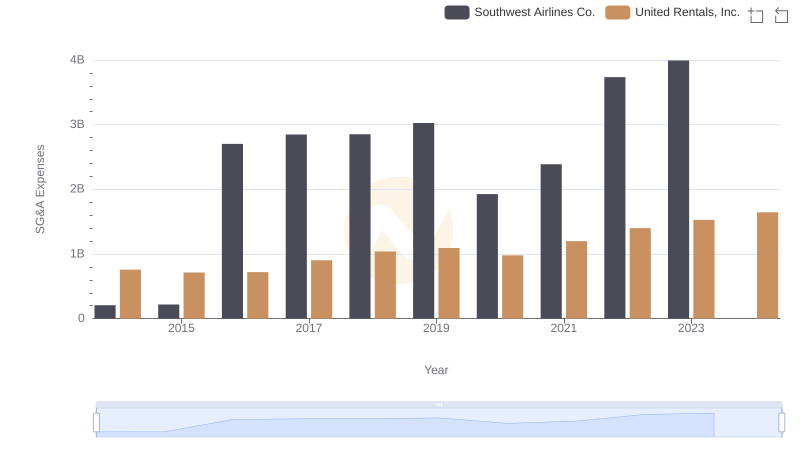

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Southwest Airlines Co.

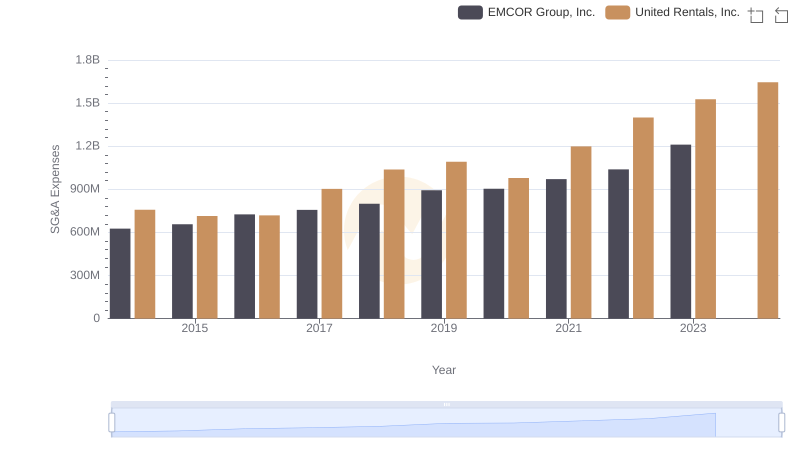

SG&A Efficiency Analysis: Comparing United Rentals, Inc. and EMCOR Group, Inc.

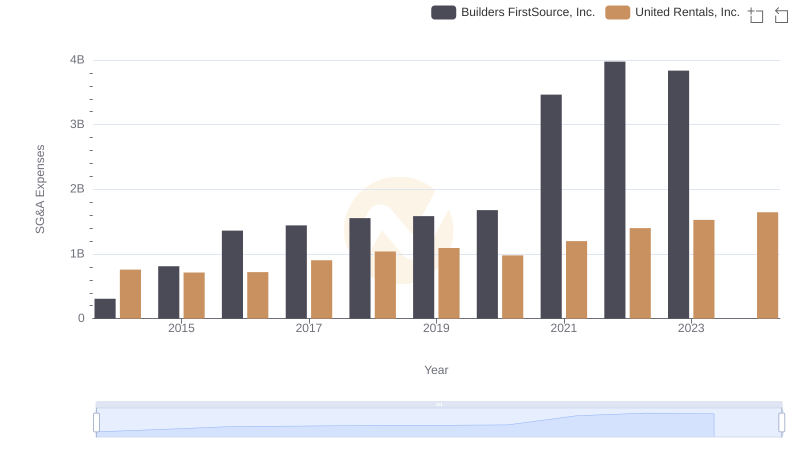

Who Optimizes SG&A Costs Better? United Rentals, Inc. or Builders FirstSource, Inc.

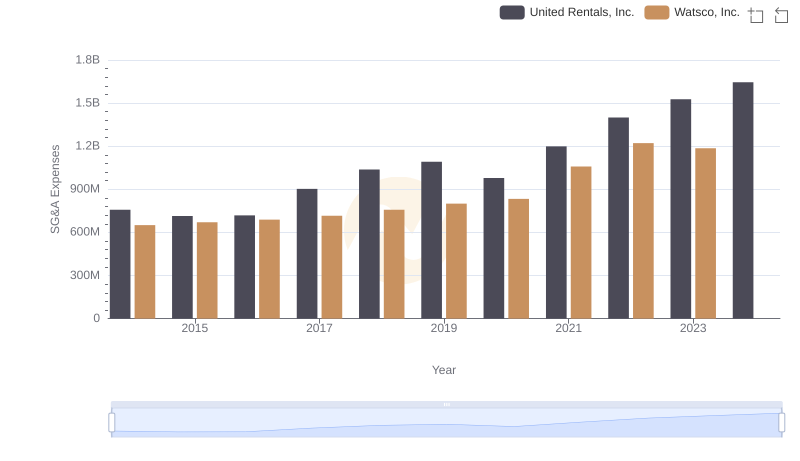

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Watsco, Inc.

EBITDA Analysis: Evaluating United Rentals, Inc. Against Hubbell Incorporated

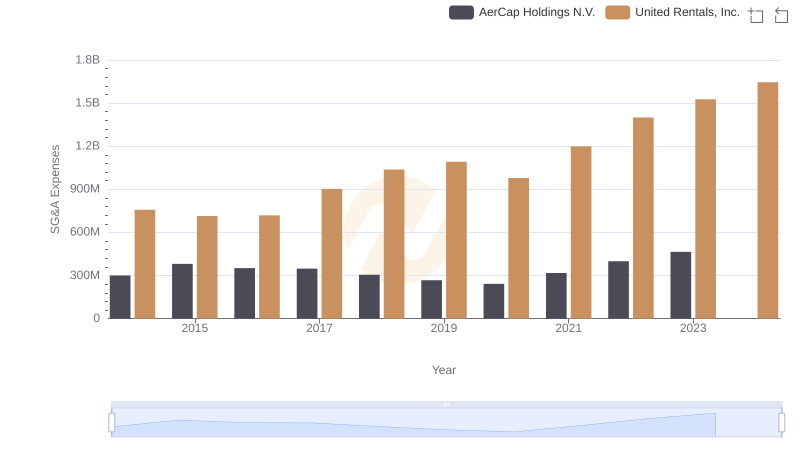

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and AerCap Holdings N.V.

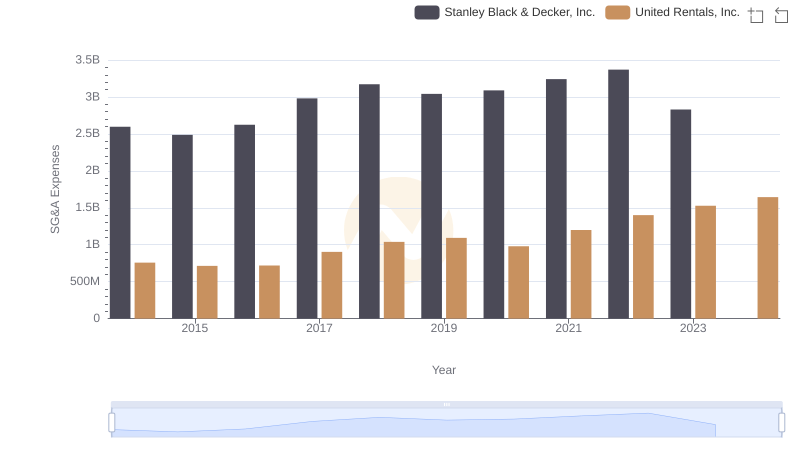

Selling, General, and Administrative Costs: United Rentals, Inc. vs Stanley Black & Decker, Inc.