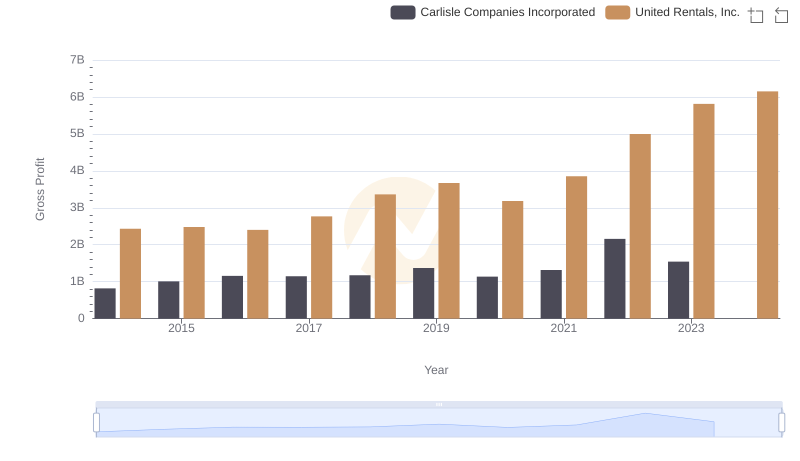

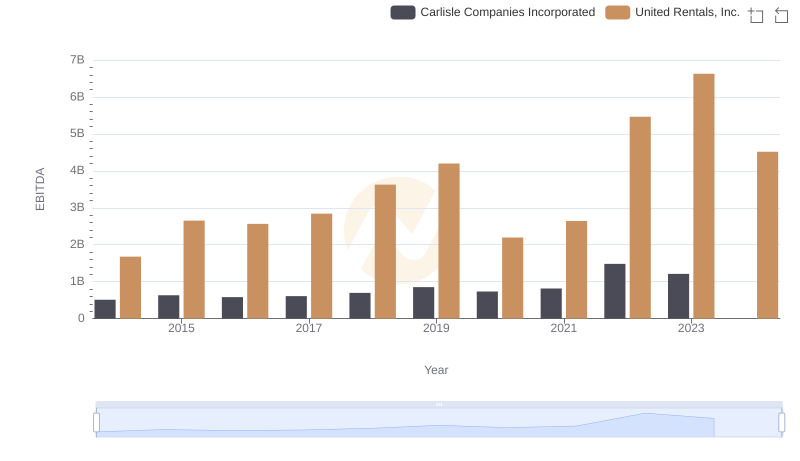

| __timestamp | Carlisle Companies Incorporated | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 379000000 | 758000000 |

| Thursday, January 1, 2015 | 461900000 | 714000000 |

| Friday, January 1, 2016 | 532000000 | 719000000 |

| Sunday, January 1, 2017 | 589400000 | 903000000 |

| Monday, January 1, 2018 | 625400000 | 1038000000 |

| Tuesday, January 1, 2019 | 667100000 | 1092000000 |

| Wednesday, January 1, 2020 | 603200000 | 979000000 |

| Friday, January 1, 2021 | 698200000 | 1199000000 |

| Saturday, January 1, 2022 | 811500000 | 1400000000 |

| Sunday, January 1, 2023 | 625200000 | 1527000000 |

| Monday, January 1, 2024 | 722800000 | 1645000000 |

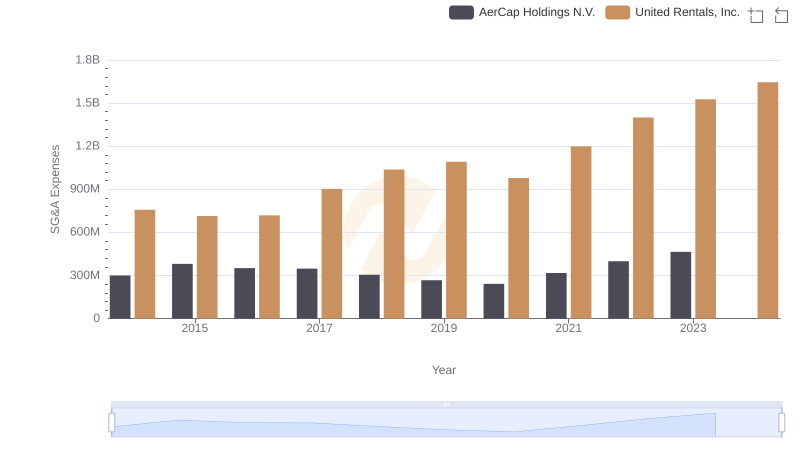

Data in motion

In the competitive landscape of corporate America, optimizing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. United Rentals, Inc. and Carlisle Companies Incorporated, two industry giants, have shown distinct approaches to managing these costs over the past decade.

From 2014 to 2023, United Rentals consistently reported higher SG&A expenses, peaking at approximately $1.53 billion in 2023. This represents a 101% increase from their 2014 figures. In contrast, Carlisle Companies saw a more modest rise, with their SG&A expenses increasing by about 65% over the same period, reaching a high of $811 million in 2022.

While United Rentals' higher expenses might suggest aggressive expansion strategies, Carlisle's steadier growth could indicate a more conservative approach. The data for 2024 is incomplete, leaving room for speculation on future trends. As these companies continue to evolve, their strategies in managing SG&A costs will remain a key factor in their financial health.

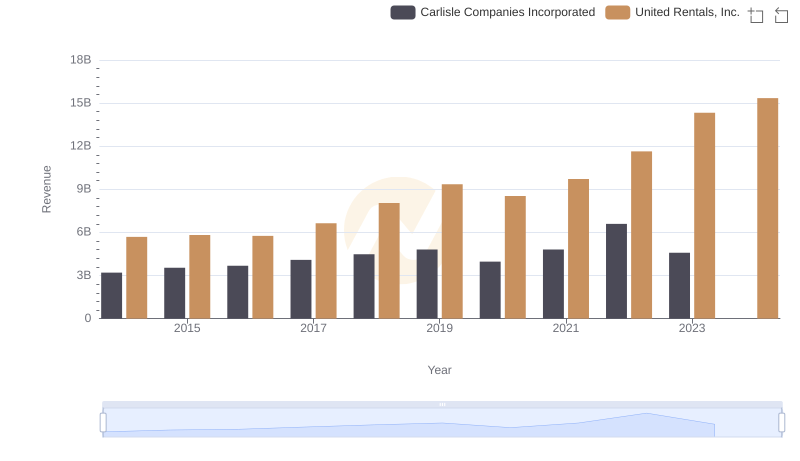

Annual Revenue Comparison: United Rentals, Inc. vs Carlisle Companies Incorporated

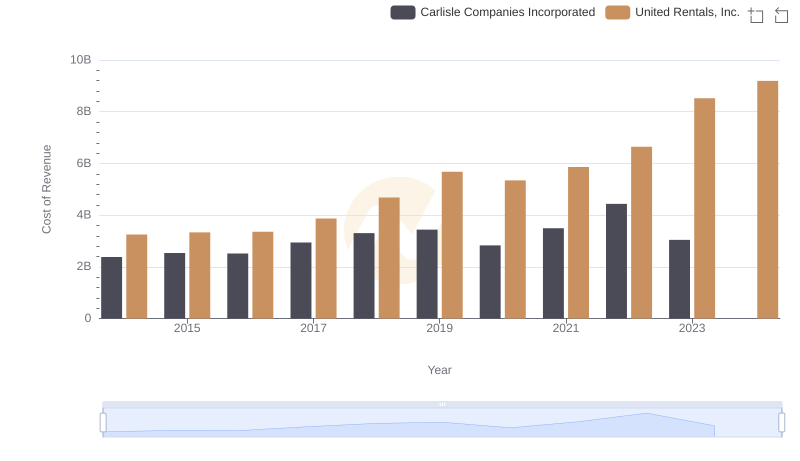

Analyzing Cost of Revenue: United Rentals, Inc. and Carlisle Companies Incorporated

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and AerCap Holdings N.V.

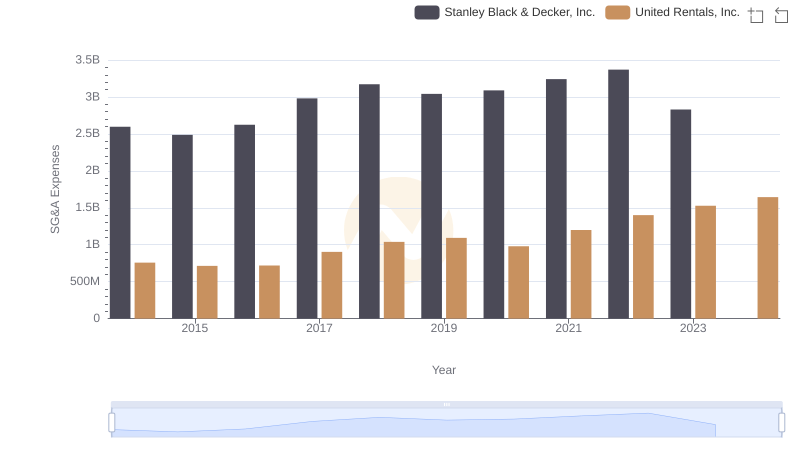

Selling, General, and Administrative Costs: United Rentals, Inc. vs Stanley Black & Decker, Inc.

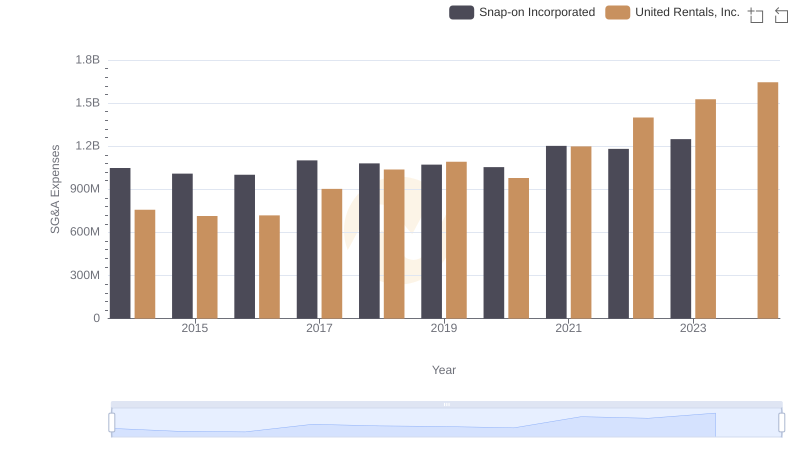

United Rentals, Inc. and Snap-on Incorporated: SG&A Spending Patterns Compared

Gross Profit Comparison: United Rentals, Inc. and Carlisle Companies Incorporated Trends

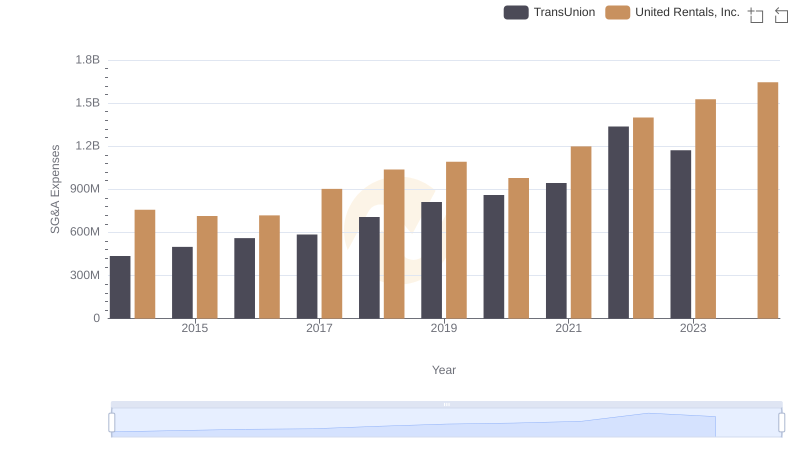

Breaking Down SG&A Expenses: United Rentals, Inc. vs TransUnion

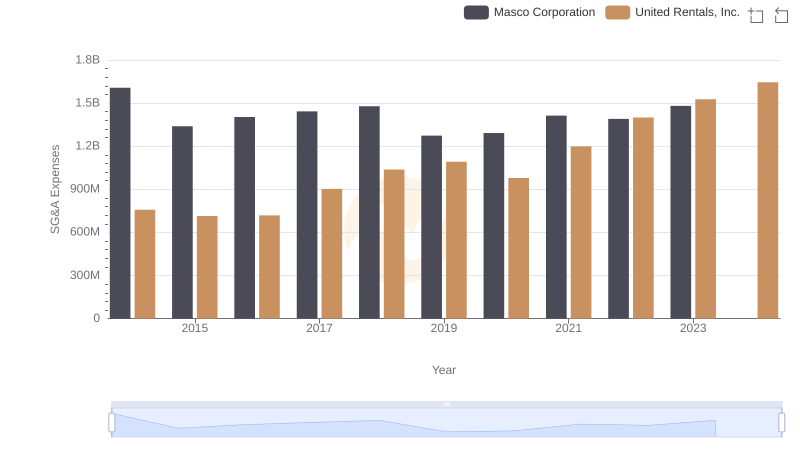

SG&A Efficiency Analysis: Comparing United Rentals, Inc. and Masco Corporation

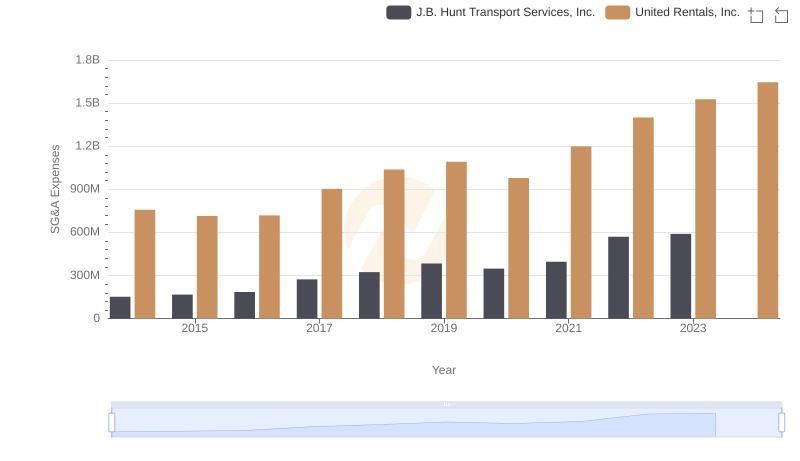

Breaking Down SG&A Expenses: United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.

EBITDA Analysis: Evaluating United Rentals, Inc. Against Carlisle Companies Incorporated

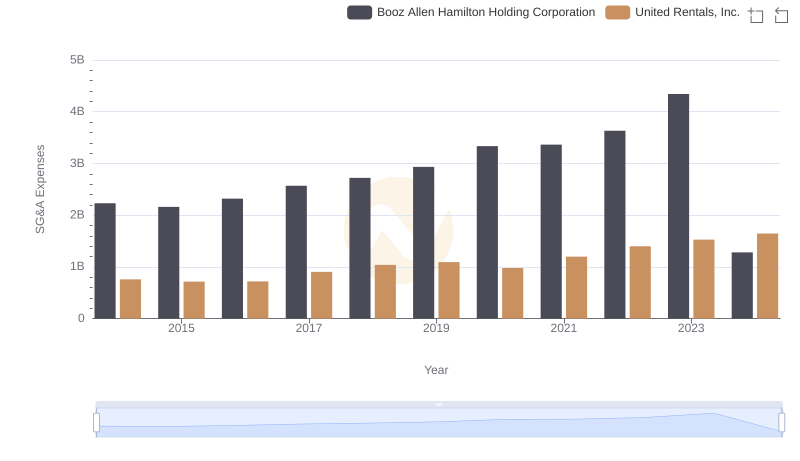

United Rentals, Inc. and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

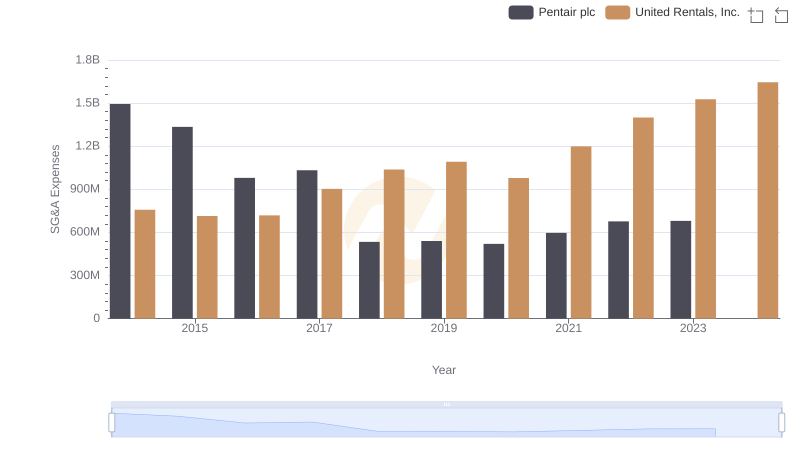

United Rentals, Inc. vs Pentair plc: SG&A Expense Trends