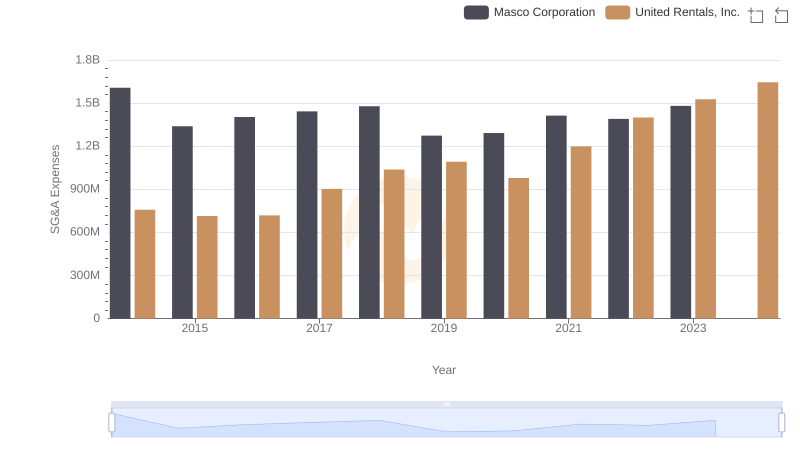

| __timestamp | Booz Allen Hamilton Holding Corporation | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 758000000 |

| Thursday, January 1, 2015 | 2159439000 | 714000000 |

| Friday, January 1, 2016 | 2319592000 | 719000000 |

| Sunday, January 1, 2017 | 2568511000 | 903000000 |

| Monday, January 1, 2018 | 2719909000 | 1038000000 |

| Tuesday, January 1, 2019 | 2932602000 | 1092000000 |

| Wednesday, January 1, 2020 | 3334378000 | 979000000 |

| Friday, January 1, 2021 | 3362722000 | 1199000000 |

| Saturday, January 1, 2022 | 3633150000 | 1400000000 |

| Sunday, January 1, 2023 | 4341769000 | 1527000000 |

| Monday, January 1, 2024 | 1281443000 | 1645000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding the spending patterns of industry giants can offer valuable insights. Over the past decade, Booz Allen Hamilton Holding Corporation and United Rentals, Inc. have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, Booz Allen Hamilton's SG&A expenses surged by approximately 95%, peaking in 2023. This reflects a strategic investment in operational capabilities, possibly to enhance their consulting prowess. In contrast, United Rentals, Inc. exhibited a more modest increase of around 101% over the same period, indicating a steady expansion strategy.

Interestingly, 2024 marks a significant drop in Booz Allen's expenses, suggesting a potential shift in strategy or cost optimization efforts. Meanwhile, United Rentals continues its upward trend, hinting at ongoing growth initiatives. These patterns underscore the dynamic nature of corporate strategies in response to market demands.

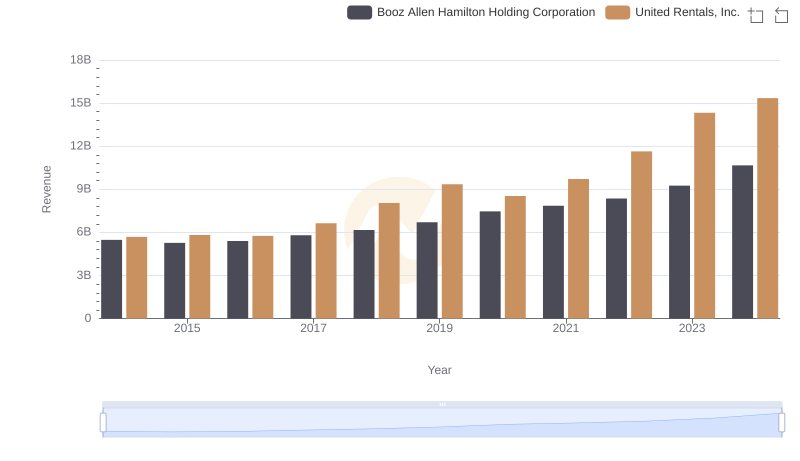

United Rentals, Inc. and Booz Allen Hamilton Holding Corporation: A Comprehensive Revenue Analysis

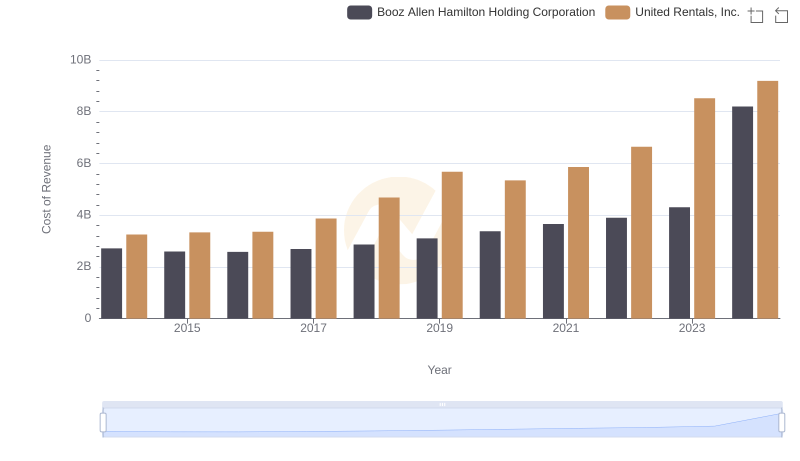

Cost of Revenue: Key Insights for United Rentals, Inc. and Booz Allen Hamilton Holding Corporation

SG&A Efficiency Analysis: Comparing United Rentals, Inc. and Masco Corporation

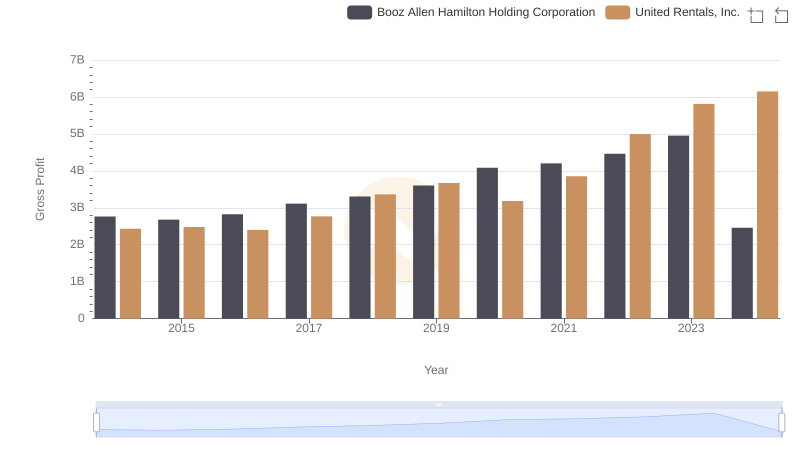

Gross Profit Comparison: United Rentals, Inc. and Booz Allen Hamilton Holding Corporation Trends

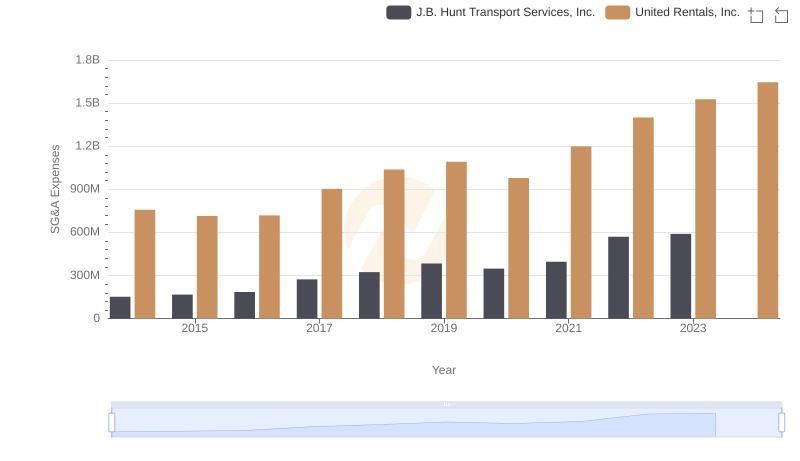

Breaking Down SG&A Expenses: United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.

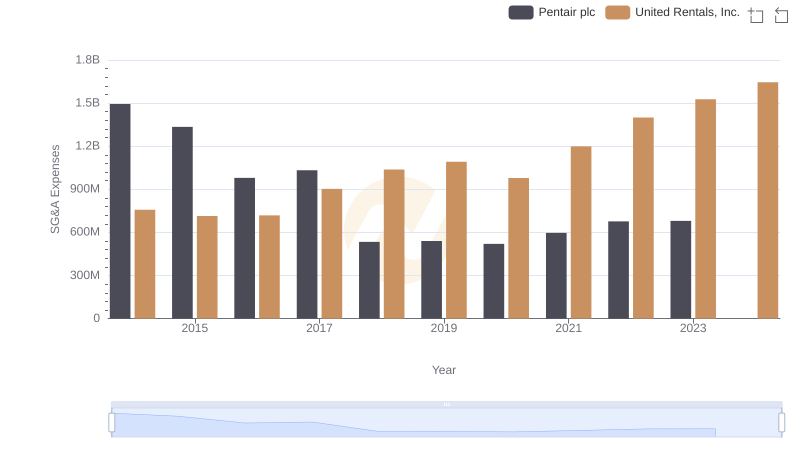

United Rentals, Inc. vs Pentair plc: SG&A Expense Trends

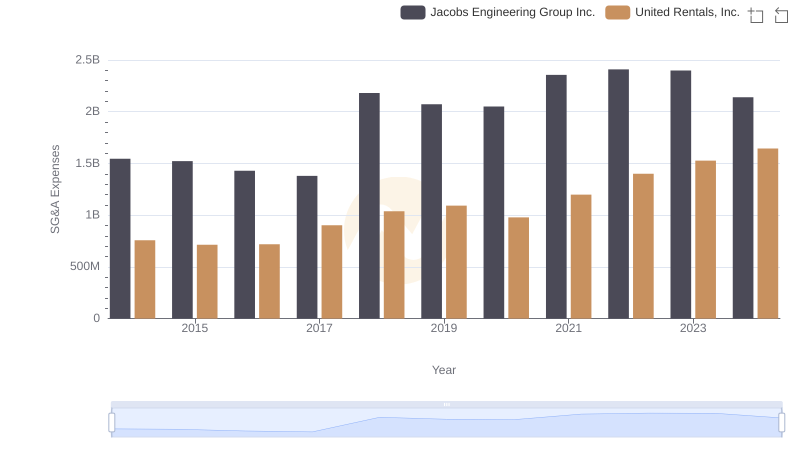

Who Optimizes SG&A Costs Better? United Rentals, Inc. or Jacobs Engineering Group Inc.

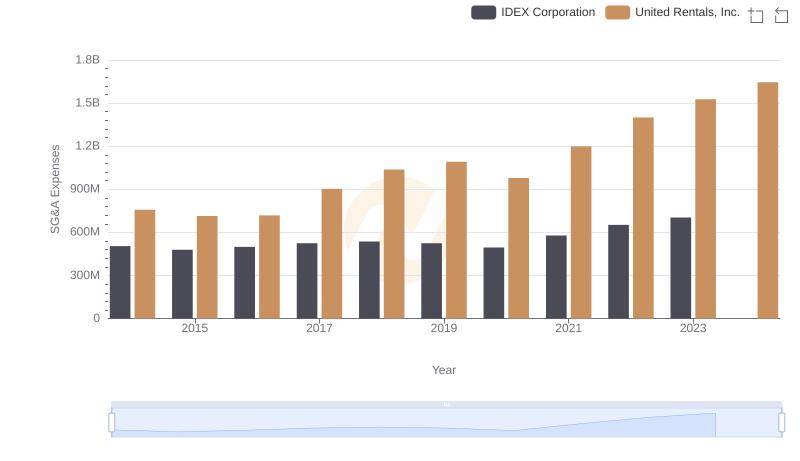

United Rentals, Inc. and IDEX Corporation: SG&A Spending Patterns Compared

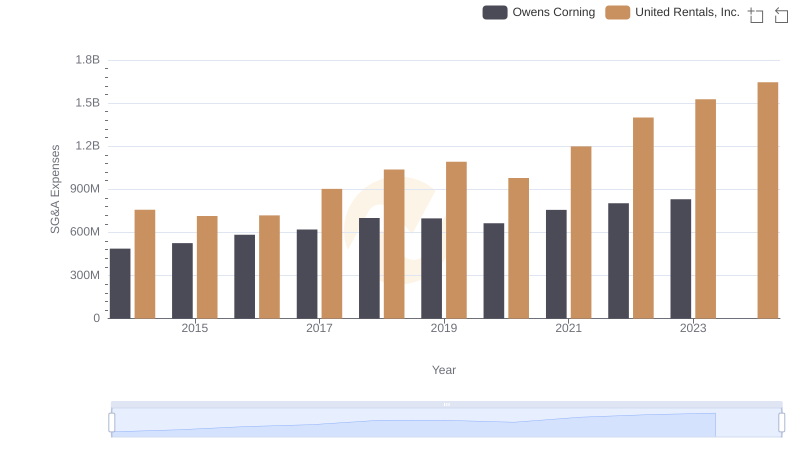

Breaking Down SG&A Expenses: United Rentals, Inc. vs Owens Corning

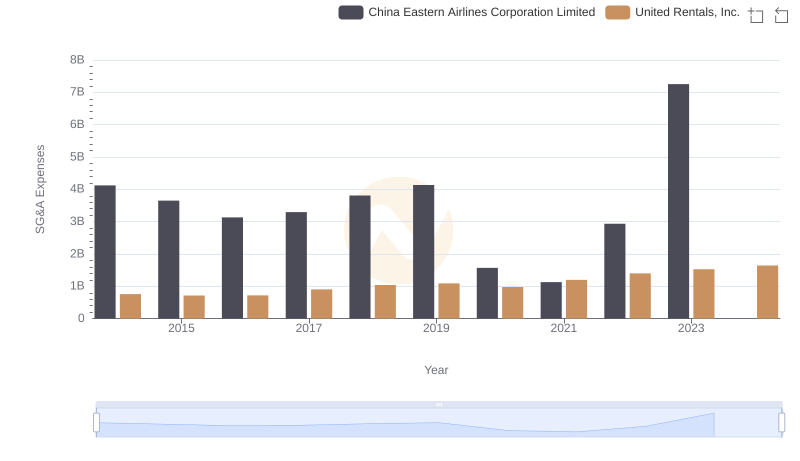

United Rentals, Inc. or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

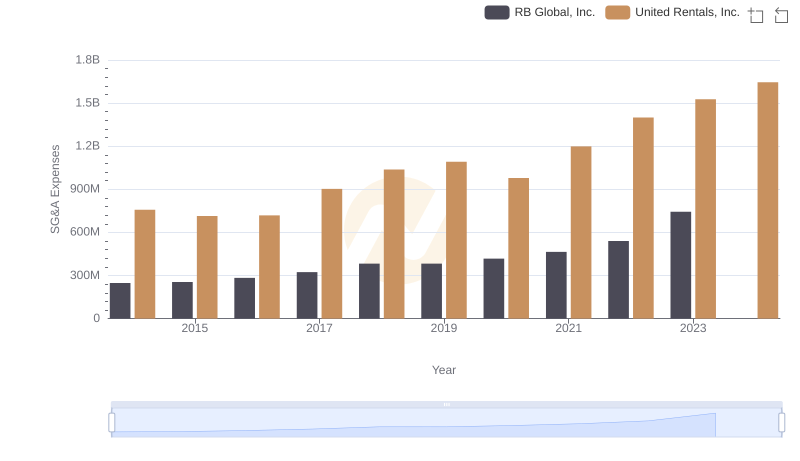

United Rentals, Inc. and RB Global, Inc.: SG&A Spending Patterns Compared