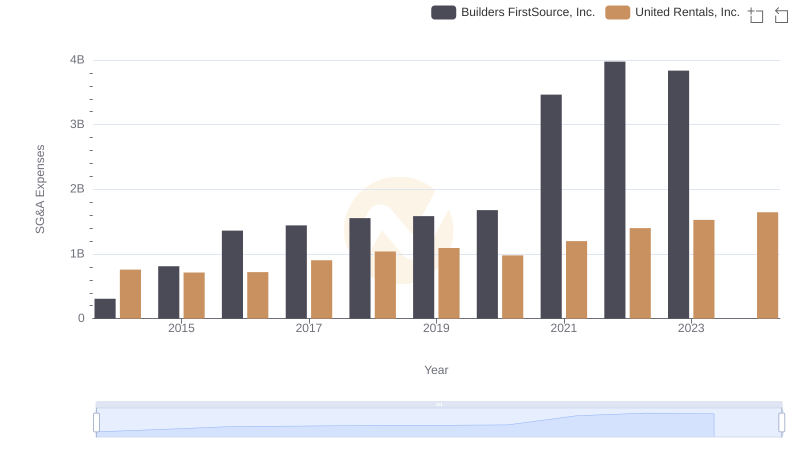

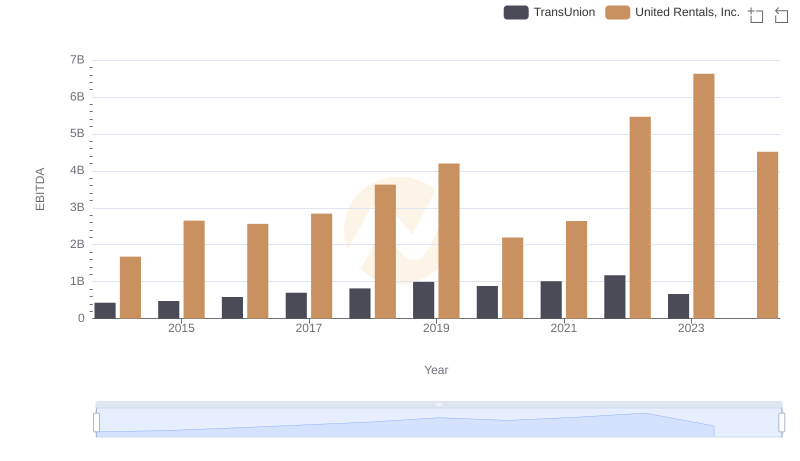

| __timestamp | TransUnion | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 436000000 | 758000000 |

| Thursday, January 1, 2015 | 499700000 | 714000000 |

| Friday, January 1, 2016 | 560100000 | 719000000 |

| Sunday, January 1, 2017 | 585400000 | 903000000 |

| Monday, January 1, 2018 | 707700000 | 1038000000 |

| Tuesday, January 1, 2019 | 812100000 | 1092000000 |

| Wednesday, January 1, 2020 | 860300000 | 979000000 |

| Friday, January 1, 2021 | 943900000 | 1199000000 |

| Saturday, January 1, 2022 | 1337400000 | 1400000000 |

| Sunday, January 1, 2023 | 1171600000 | 1527000000 |

| Monday, January 1, 2024 | 1239300000 | 1645000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, United Rentals, Inc. and TransUnion have showcased distinct trajectories in their SG&A expenditures. From 2014 to 2023, United Rentals, Inc. consistently outpaced TransUnion, with a notable 50% increase in SG&A expenses, peaking at approximately $1.53 billion in 2023. In contrast, TransUnion's expenses grew by nearly 170%, reaching their zenith in 2022 before a slight dip in 2023. This divergence highlights United Rentals' steady growth strategy, while TransUnion's fluctuations suggest a more dynamic approach to managing operational costs. As we look to 2024, United Rentals projects further growth, while TransUnion's data remains elusive, leaving room for speculation on their future financial strategies.

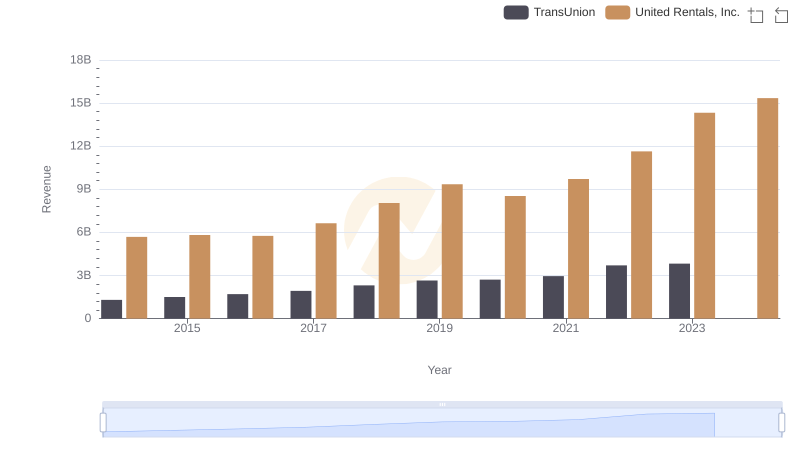

Comparing Revenue Performance: United Rentals, Inc. or TransUnion?

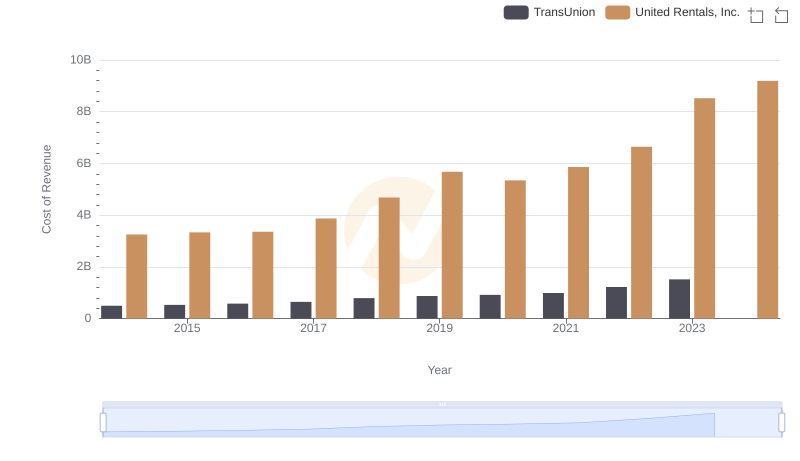

Cost of Revenue: Key Insights for United Rentals, Inc. and TransUnion

Who Optimizes SG&A Costs Better? United Rentals, Inc. or Builders FirstSource, Inc.

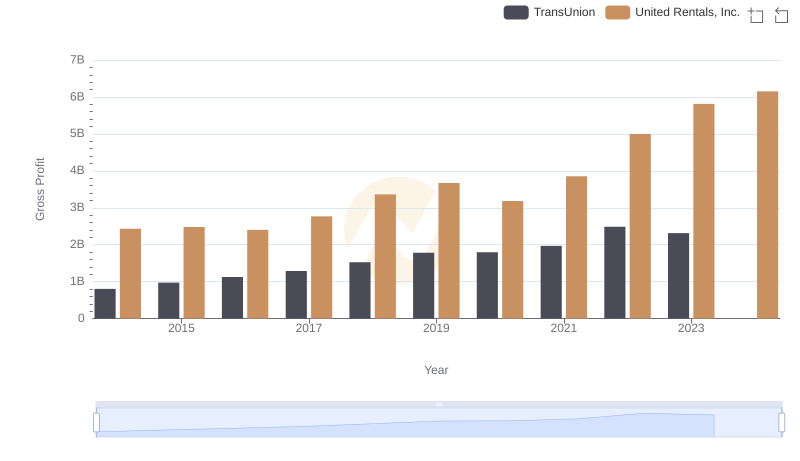

United Rentals, Inc. and TransUnion: A Detailed Gross Profit Analysis

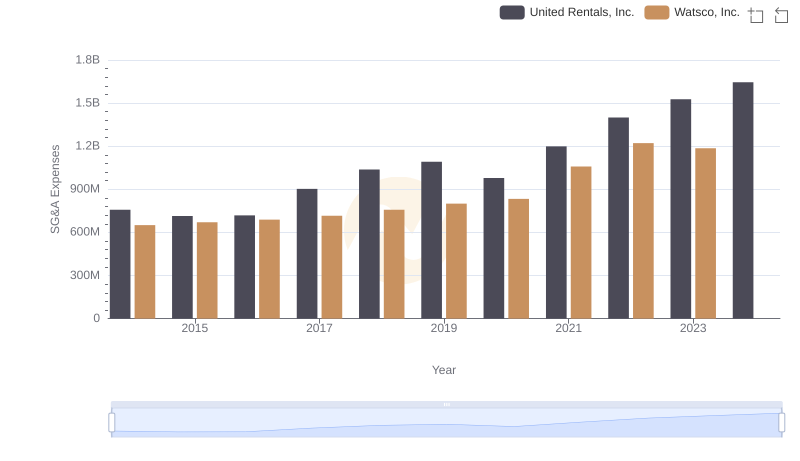

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Watsco, Inc.

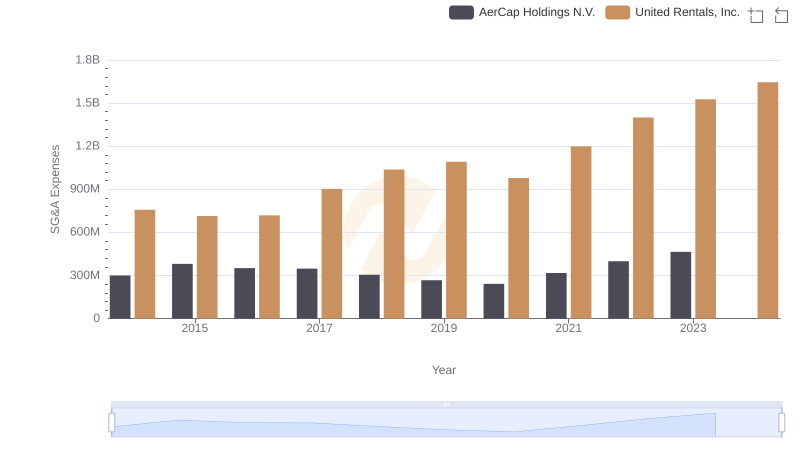

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and AerCap Holdings N.V.

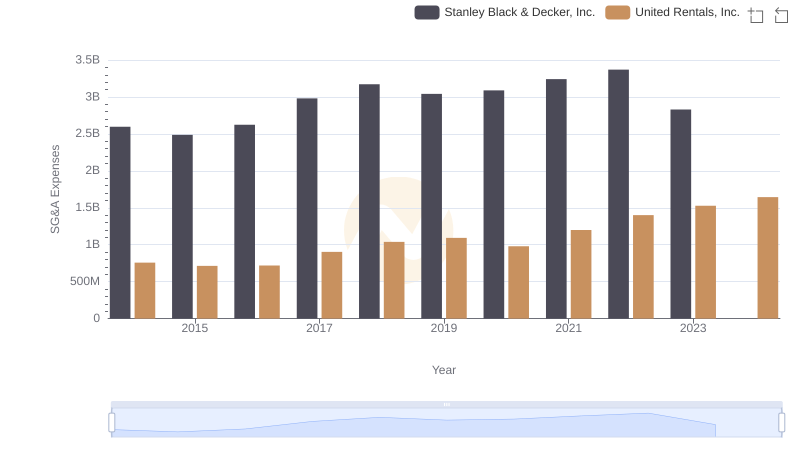

Selling, General, and Administrative Costs: United Rentals, Inc. vs Stanley Black & Decker, Inc.

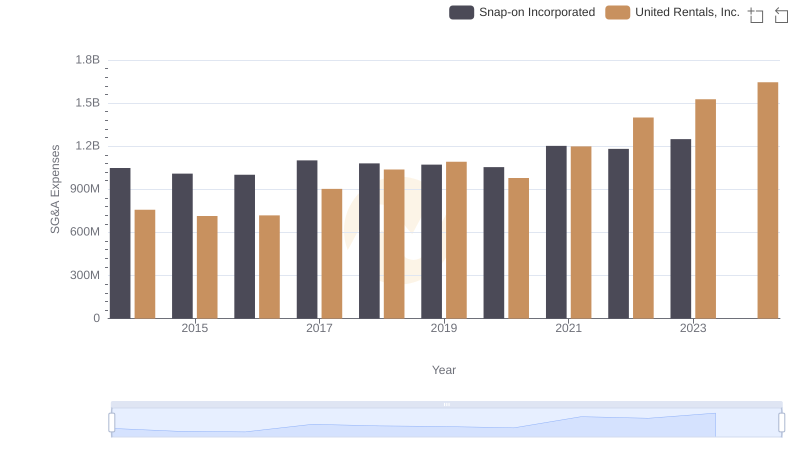

United Rentals, Inc. and Snap-on Incorporated: SG&A Spending Patterns Compared

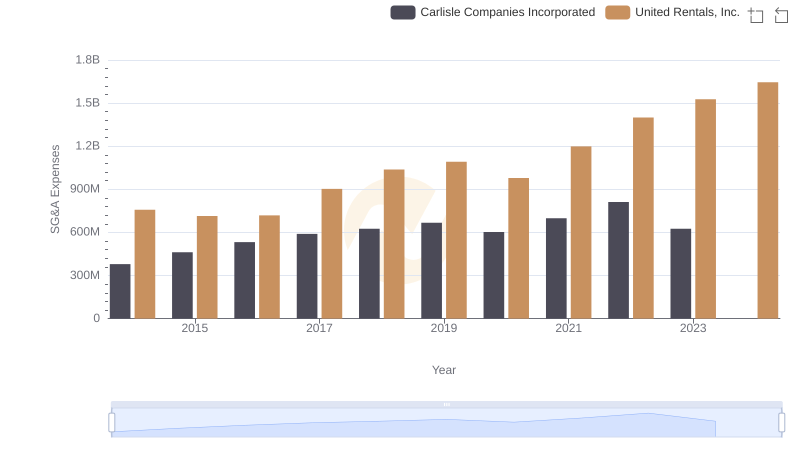

Who Optimizes SG&A Costs Better? United Rentals, Inc. or Carlisle Companies Incorporated

EBITDA Performance Review: United Rentals, Inc. vs TransUnion

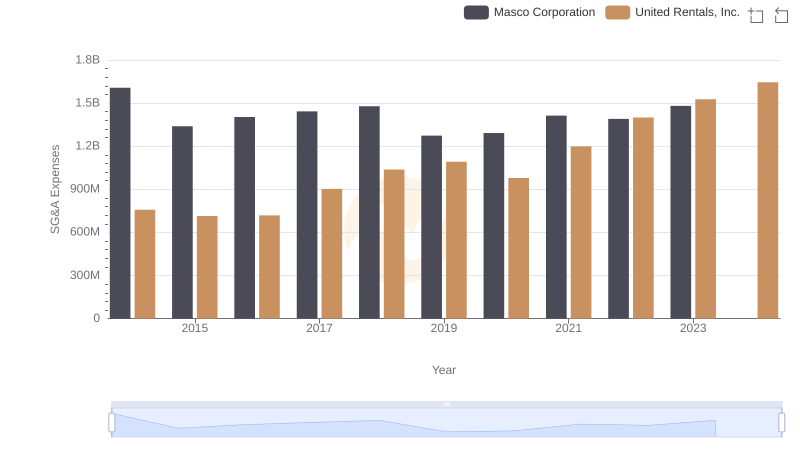

SG&A Efficiency Analysis: Comparing United Rentals, Inc. and Masco Corporation

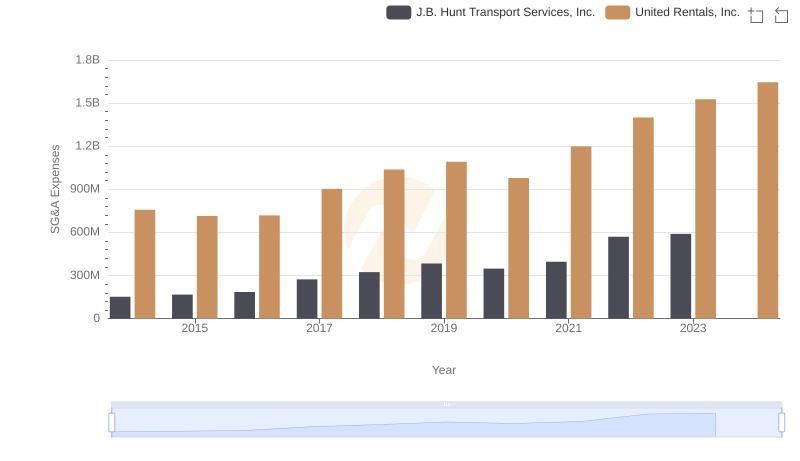

Breaking Down SG&A Expenses: United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.