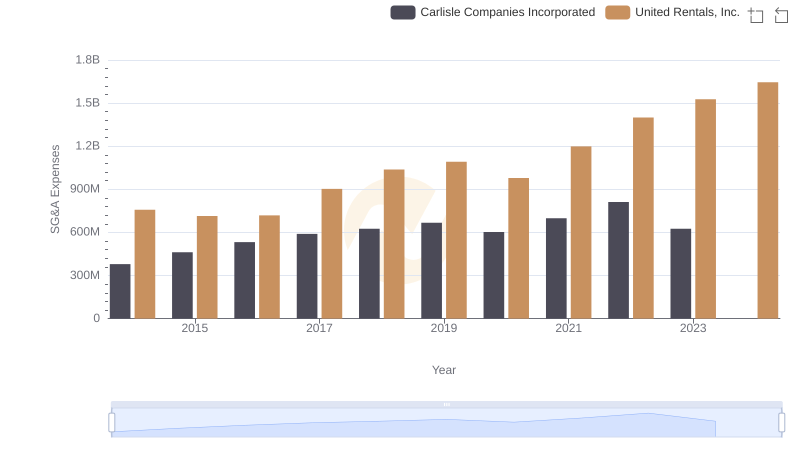

| __timestamp | Carlisle Companies Incorporated | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 512300000 | 1678000000 |

| Thursday, January 1, 2015 | 631900000 | 2653000000 |

| Friday, January 1, 2016 | 580200000 | 2566000000 |

| Sunday, January 1, 2017 | 609300000 | 2843000000 |

| Monday, January 1, 2018 | 696100000 | 3628000000 |

| Tuesday, January 1, 2019 | 851000000 | 4200000000 |

| Wednesday, January 1, 2020 | 733100000 | 2195000000 |

| Friday, January 1, 2021 | 816100000 | 2642000000 |

| Saturday, January 1, 2022 | 1483400000 | 5464000000 |

| Sunday, January 1, 2023 | 1210700000 | 6627000000 |

| Monday, January 1, 2024 | 1356800000 | 4516000000 |

Infusing magic into the data realm

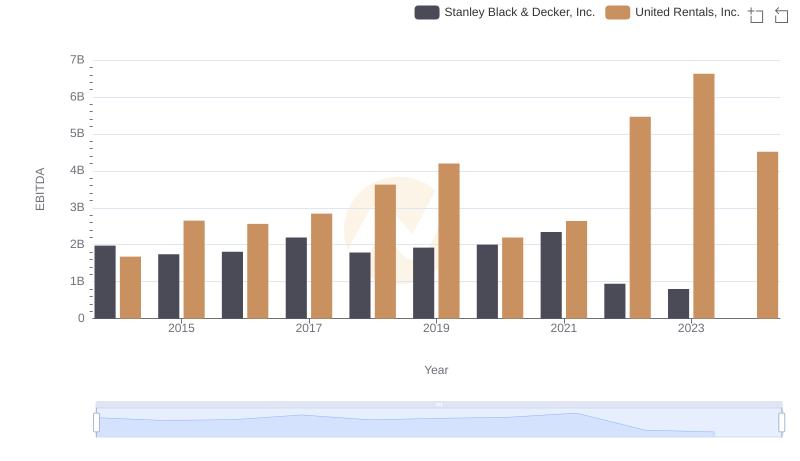

In the competitive landscape of industrial services, United Rentals, Inc. and Carlisle Companies Incorporated have showcased distinct financial trajectories over the past decade. From 2014 to 2023, United Rentals consistently outperformed Carlisle in EBITDA, with a remarkable 295% increase, peaking at $6.63 billion in 2023. In contrast, Carlisle's EBITDA grew by approximately 136%, reaching its zenith at $1.48 billion in 2022.

United Rentals' robust growth can be attributed to strategic acquisitions and expanding market presence, while Carlisle's steady rise reflects its diversified product offerings. Notably, 2020 marked a dip for both companies, likely due to global economic disruptions. However, United Rentals rebounded strongly, underscoring its resilience. As we look to 2024, the absence of Carlisle's data suggests potential challenges or strategic shifts. This analysis highlights the dynamic nature of industrial giants navigating economic tides.

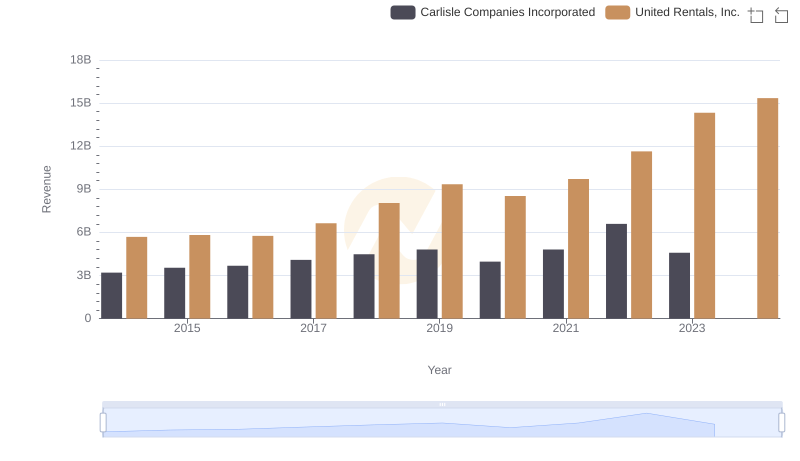

Annual Revenue Comparison: United Rentals, Inc. vs Carlisle Companies Incorporated

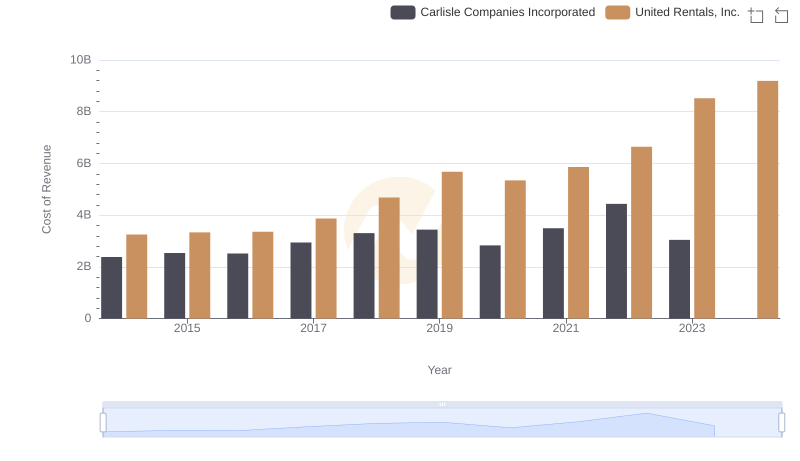

Analyzing Cost of Revenue: United Rentals, Inc. and Carlisle Companies Incorporated

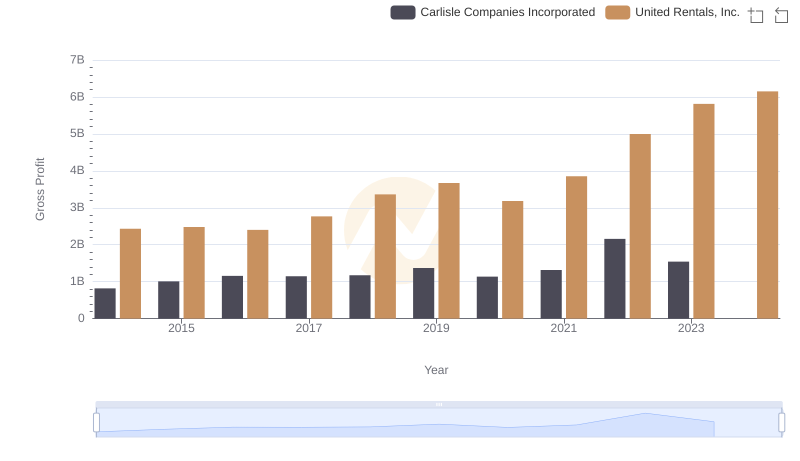

Gross Profit Comparison: United Rentals, Inc. and Carlisle Companies Incorporated Trends

A Side-by-Side Analysis of EBITDA: United Rentals, Inc. and Stanley Black & Decker, Inc.

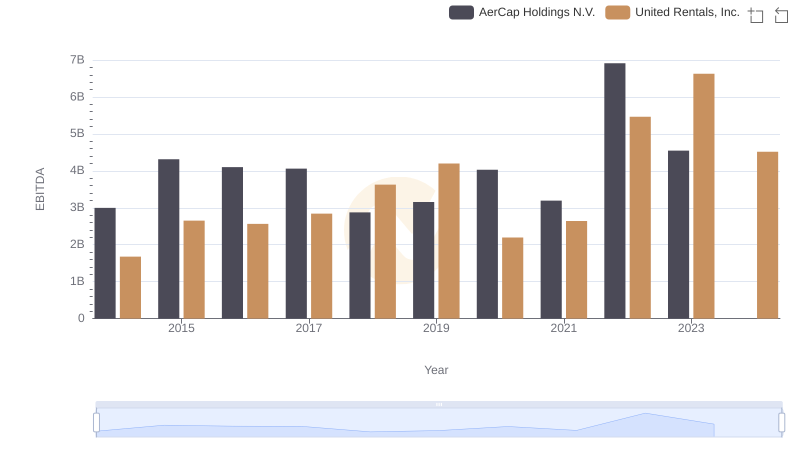

Comparative EBITDA Analysis: United Rentals, Inc. vs AerCap Holdings N.V.

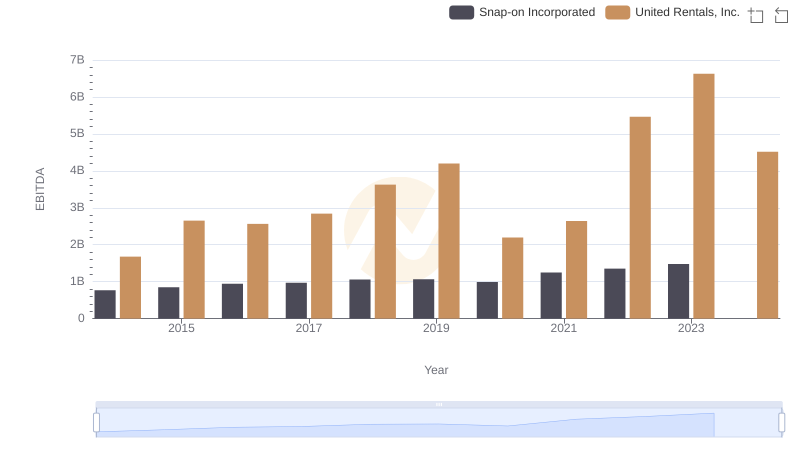

Comparative EBITDA Analysis: United Rentals, Inc. vs Snap-on Incorporated

Who Optimizes SG&A Costs Better? United Rentals, Inc. or Carlisle Companies Incorporated

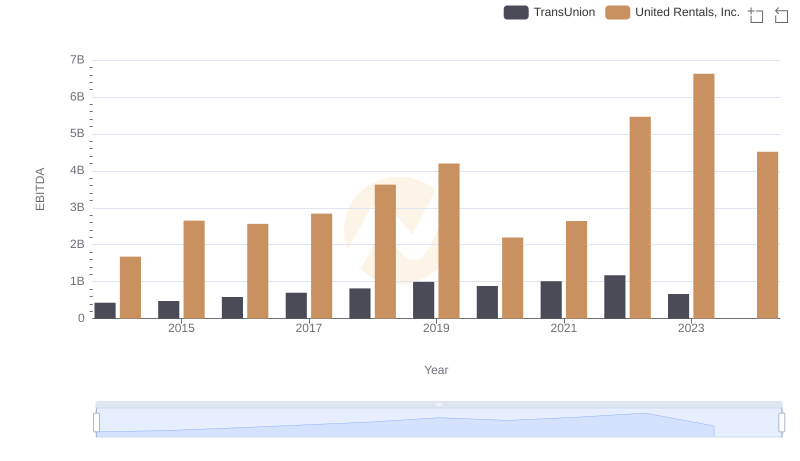

EBITDA Performance Review: United Rentals, Inc. vs TransUnion

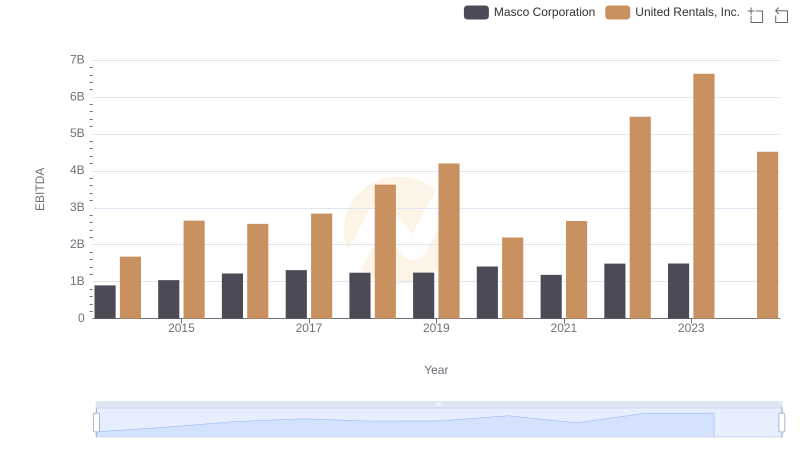

United Rentals, Inc. and Masco Corporation: A Detailed Examination of EBITDA Performance

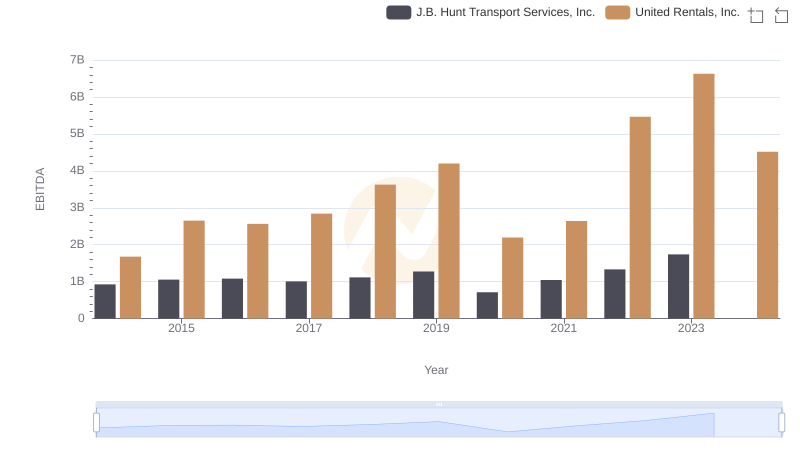

EBITDA Analysis: Evaluating United Rentals, Inc. Against J.B. Hunt Transport Services, Inc.

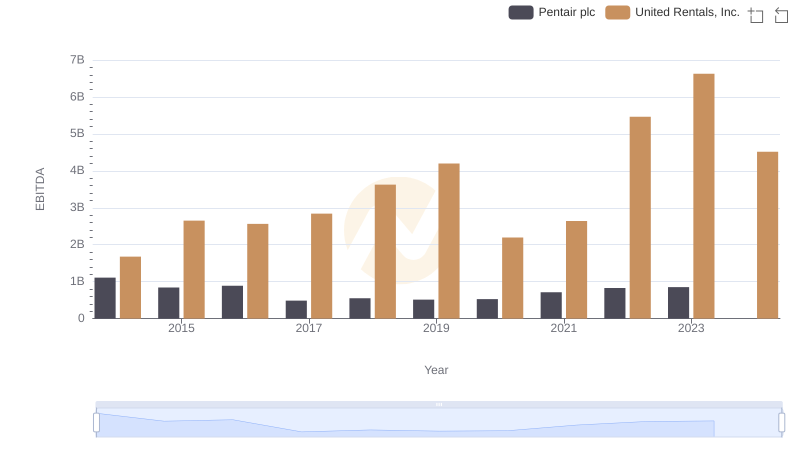

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Pentair plc