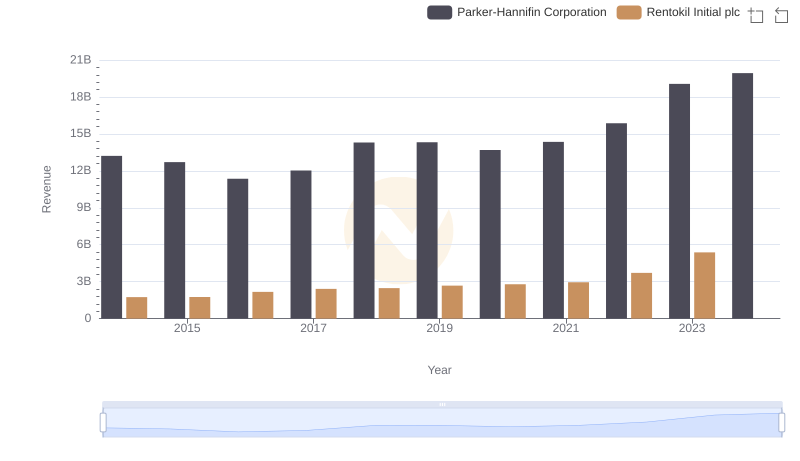

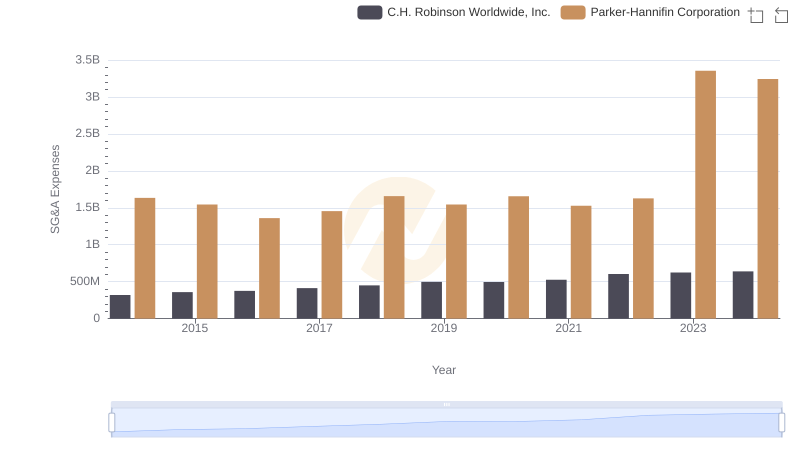

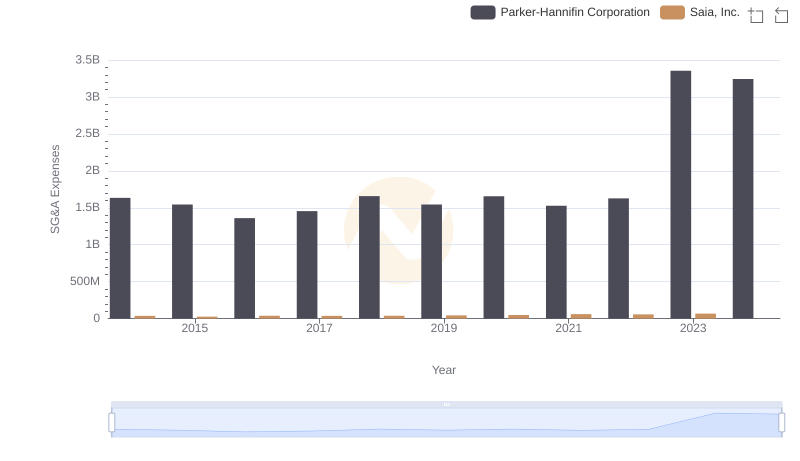

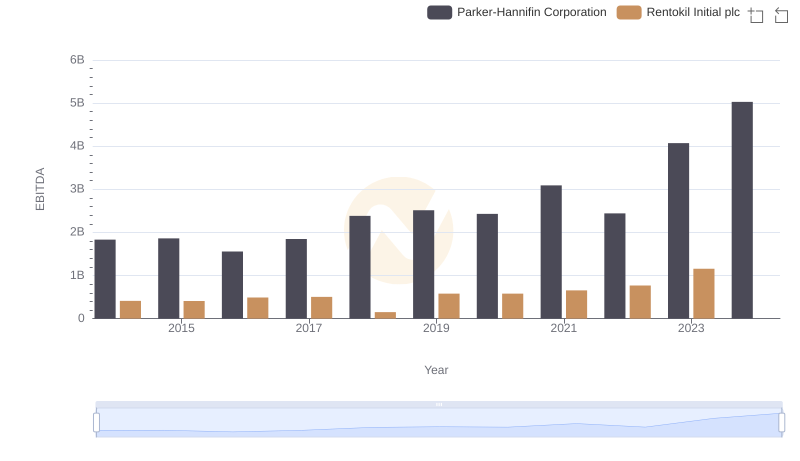

| __timestamp | Parker-Hannifin Corporation | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 935700000 |

| Thursday, January 1, 2015 | 1544746000 | 965700000 |

| Friday, January 1, 2016 | 1359360000 | 1197600000 |

| Sunday, January 1, 2017 | 1453935000 | 1329600000 |

| Monday, January 1, 2018 | 1657152000 | 1364000000 |

| Tuesday, January 1, 2019 | 1543939000 | 322500000 |

| Wednesday, January 1, 2020 | 1656553000 | 352000000 |

| Friday, January 1, 2021 | 1527302000 | 348600000 |

| Saturday, January 1, 2022 | 1627116000 | 479000000 |

| Sunday, January 1, 2023 | 3354103000 | 2870000000 |

| Monday, January 1, 2024 | 3315177000 |

Data in motion

In the competitive landscape of industrial and service sectors, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Parker-Hannifin Corporation and Rentokil Initial plc, two industry leaders, have shown distinct strategies over the past decade. From 2014 to 2023, Parker-Hannifin's SG&A expenses fluctuated, peaking in 2023 with a 105% increase from 2014. Meanwhile, Rentokil Initial's expenses saw a dramatic drop in 2019, reducing by 66% compared to 2018, before rising again in 2023. This suggests a strategic shift or operational efficiency. Notably, Parker-Hannifin's expenses in 2023 were nearly double their 2022 figures, indicating potential expansion or increased operational costs. In contrast, Rentokil's data for 2024 is missing, leaving room for speculation on their future strategy. These trends highlight the dynamic nature of cost management in global corporations.

Parker-Hannifin Corporation and Rentokil Initial plc: A Comprehensive Revenue Analysis

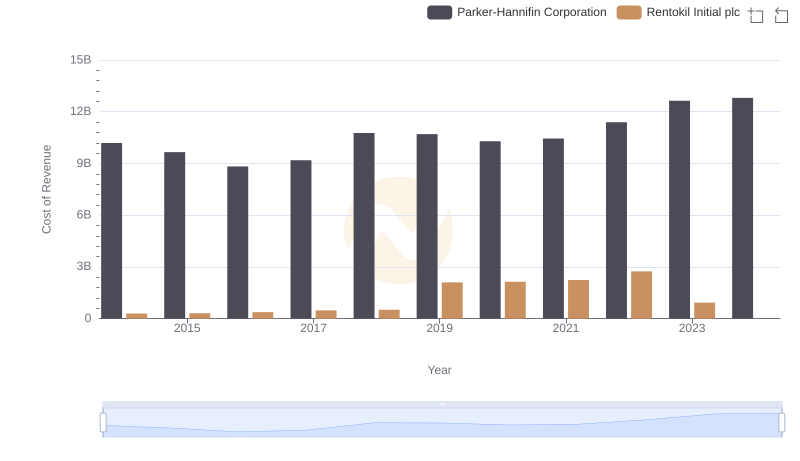

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Rentokil Initial plc

Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

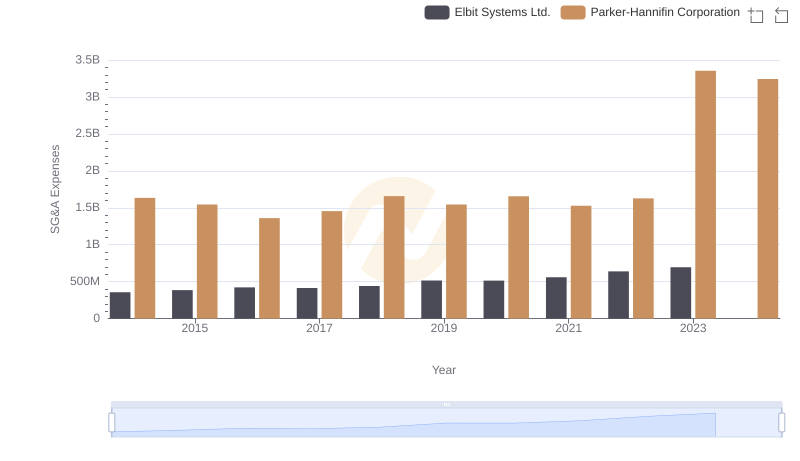

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Elbit Systems Ltd.

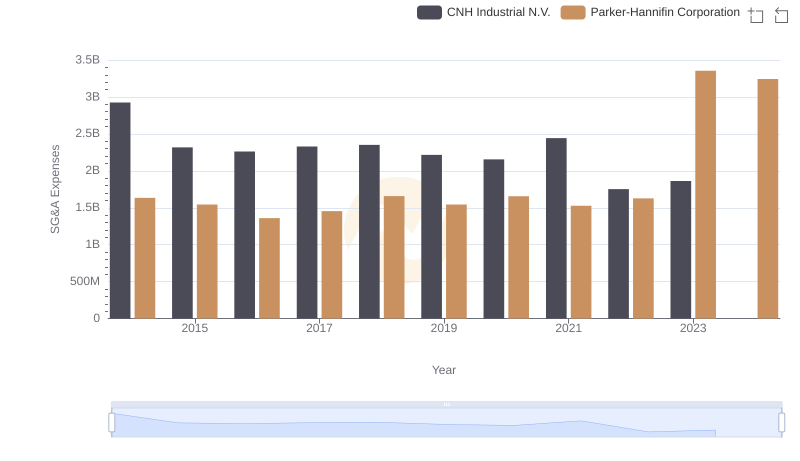

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or CNH Industrial N.V.

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs American Airlines Group Inc.

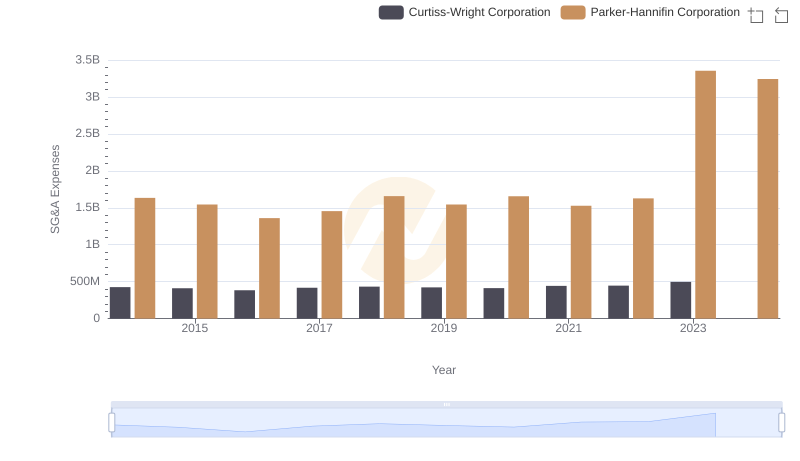

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Curtiss-Wright Corporation

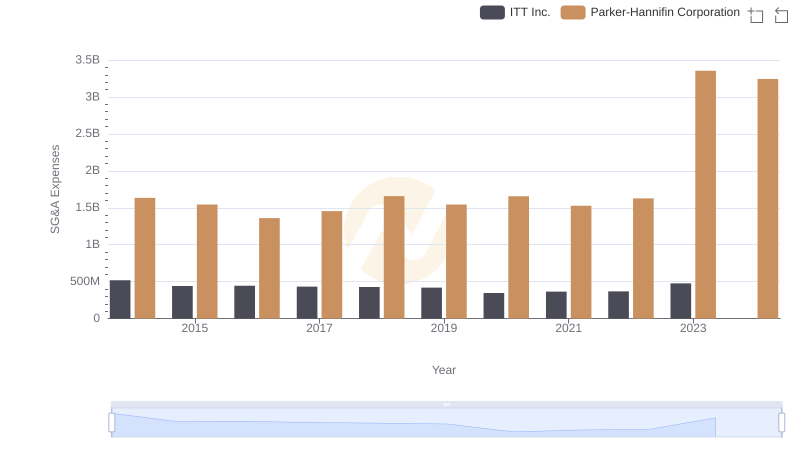

Parker-Hannifin Corporation or ITT Inc.: Who Manages SG&A Costs Better?

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Rentokil Initial plc