| __timestamp | Curtiss-Wright Corporation | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 426301000 | 1633992000 |

| Thursday, January 1, 2015 | 411801000 | 1544746000 |

| Friday, January 1, 2016 | 383793000 | 1359360000 |

| Sunday, January 1, 2017 | 418544000 | 1453935000 |

| Monday, January 1, 2018 | 433110000 | 1657152000 |

| Tuesday, January 1, 2019 | 422272000 | 1543939000 |

| Wednesday, January 1, 2020 | 412825000 | 1656553000 |

| Friday, January 1, 2021 | 443096000 | 1527302000 |

| Saturday, January 1, 2022 | 445679000 | 1627116000 |

| Sunday, January 1, 2023 | 496812000 | 3354103000 |

| Monday, January 1, 2024 | 518857000 | 3315177000 |

In pursuit of knowledge

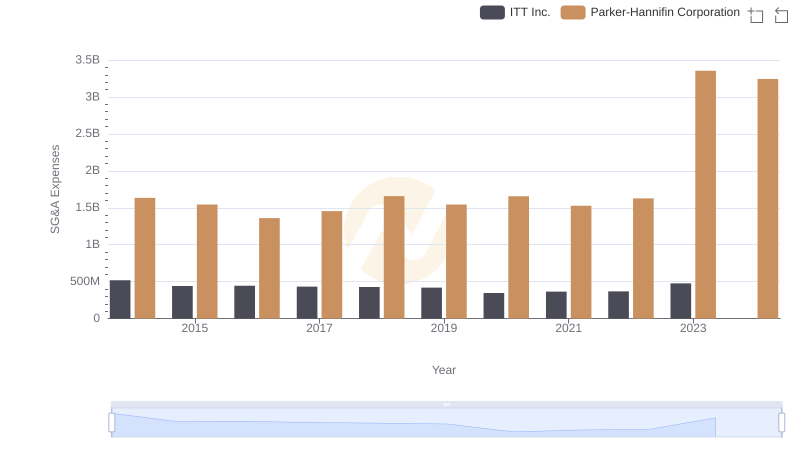

In the ever-evolving landscape of industrial manufacturing, operational efficiency is paramount. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Parker-Hannifin Corporation and Curtiss-Wright Corporation, from 2014 to 2023.

Parker-Hannifin, a leader in motion and control technologies, consistently reported higher SG&A expenses, peaking in 2023 with a staggering 3.35 billion USD, marking a 105% increase from 2014. In contrast, Curtiss-Wright, known for its precision-engineered products, maintained a more stable SG&A expenditure, with a modest 17% rise over the same period, reaching approximately 497 million USD in 2023.

This disparity highlights Parker-Hannifin's aggressive expansion and investment strategies, while Curtiss-Wright's steady approach underscores its focus on operational stability. Such insights are crucial for investors and stakeholders aiming to understand the financial dynamics of these corporations.

Parker-Hannifin Corporation or Curtiss-Wright Corporation: Who Leads in Yearly Revenue?

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Curtiss-Wright Corporation

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Curtiss-Wright Corporation

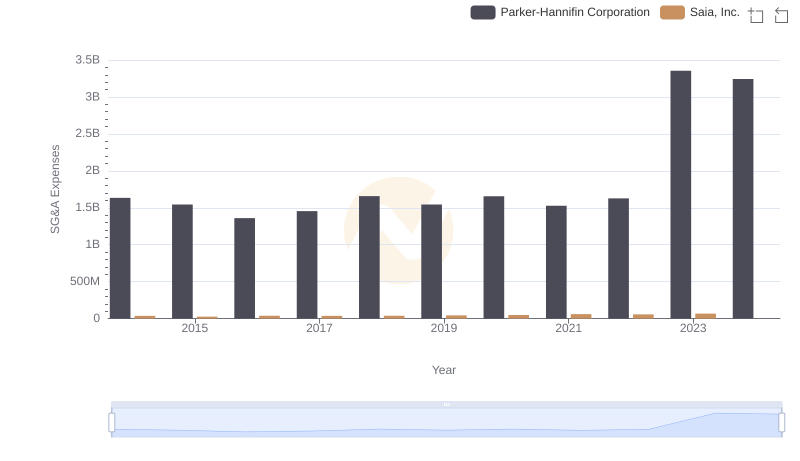

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

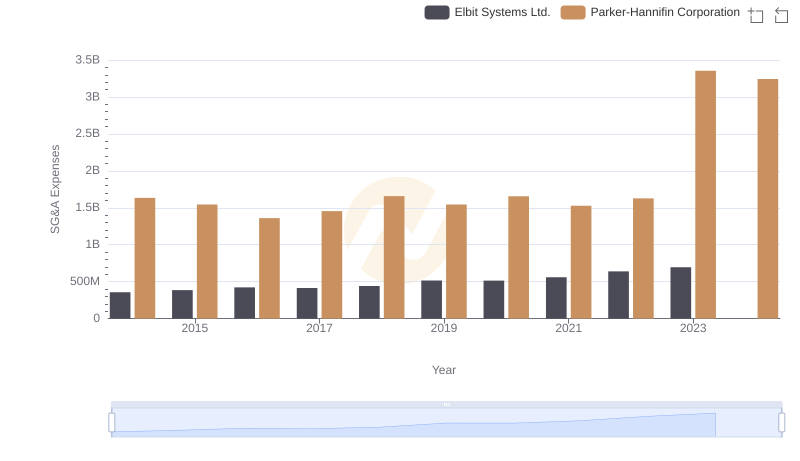

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Elbit Systems Ltd.

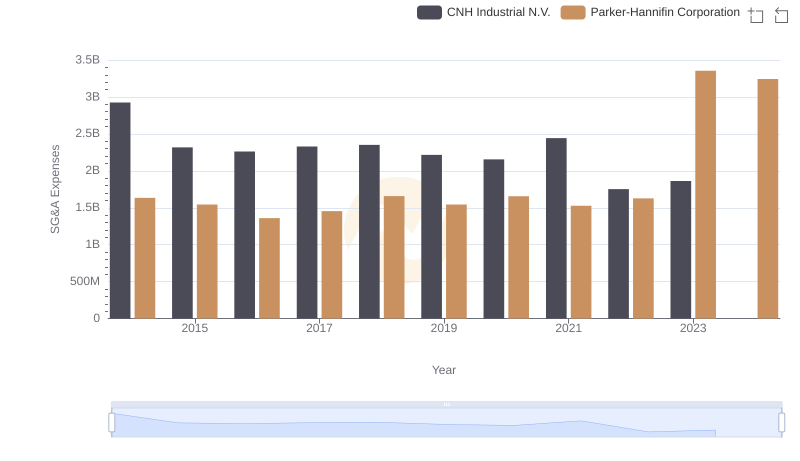

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or CNH Industrial N.V.

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs American Airlines Group Inc.

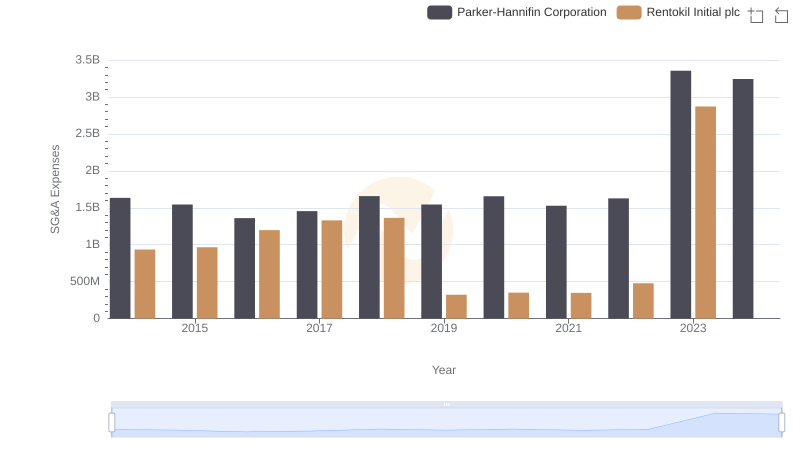

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Rentokil Initial plc

Parker-Hannifin Corporation or ITT Inc.: Who Manages SG&A Costs Better?

EBITDA Performance Review: Parker-Hannifin Corporation vs Curtiss-Wright Corporation