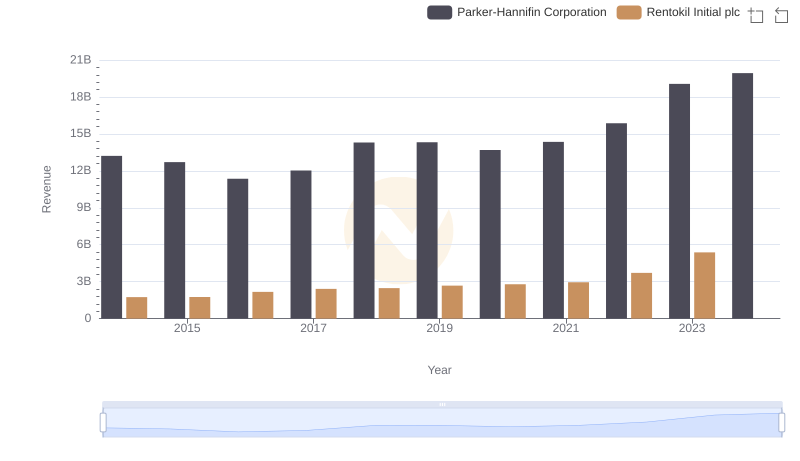

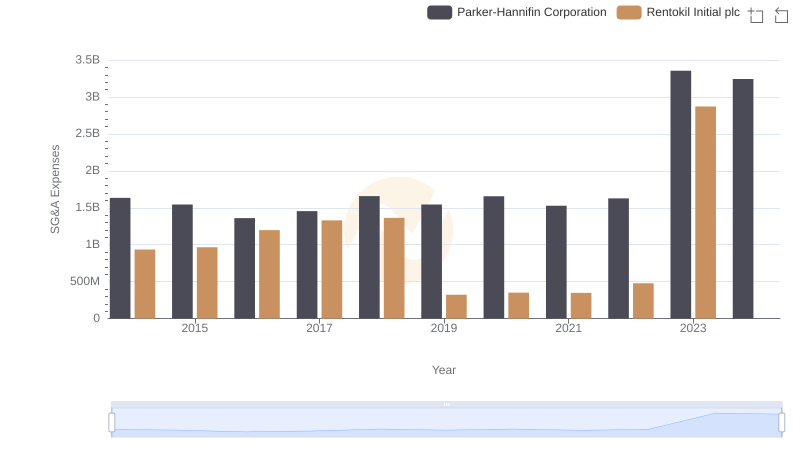

| __timestamp | Parker-Hannifin Corporation | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1832903000 | 410400000 |

| Thursday, January 1, 2015 | 1861551000 | 408700000 |

| Friday, January 1, 2016 | 1558088000 | 489000000 |

| Sunday, January 1, 2017 | 1846306000 | 503200000 |

| Monday, January 1, 2018 | 2382235000 | 149800000 |

| Tuesday, January 1, 2019 | 2513468000 | 580600000 |

| Wednesday, January 1, 2020 | 2431500000 | 581000000 |

| Friday, January 1, 2021 | 3092383000 | 656000000 |

| Saturday, January 1, 2022 | 2441242000 | 767000000 |

| Sunday, January 1, 2023 | 4071687000 | 1157000000 |

| Monday, January 1, 2024 | 5028229000 |

Unlocking the unknown

In the ever-evolving landscape of global business, understanding the financial health of corporations is paramount. This analysis delves into the EBITDA performance of Parker-Hannifin Corporation and Rentokil Initial plc from 2014 to 2023. Over this decade, Parker-Hannifin has consistently outperformed Rentokil Initial, with its EBITDA growing by approximately 175%, peaking at $5 billion in 2023. In contrast, Rentokil Initial's EBITDA saw a more modest increase of around 182%, reaching $1.16 billion in the same year.

The data reveals a significant surge for Parker-Hannifin in 2023, marking a 67% increase from the previous year. Meanwhile, Rentokil Initial's growth trajectory was steady, albeit with a notable jump in 2023. However, data for 2024 is missing for Rentokil Initial, leaving room for speculation on its future performance. This analysis underscores the importance of strategic financial planning in maintaining competitive advantage.

Parker-Hannifin Corporation and Rentokil Initial plc: A Comprehensive Revenue Analysis

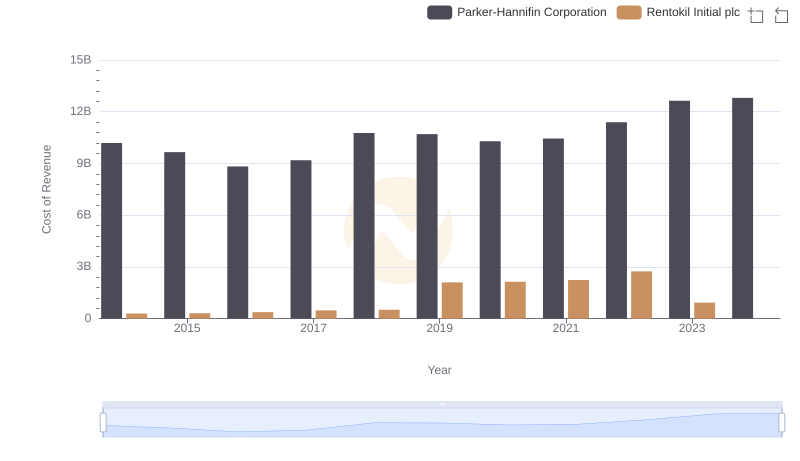

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Rentokil Initial plc

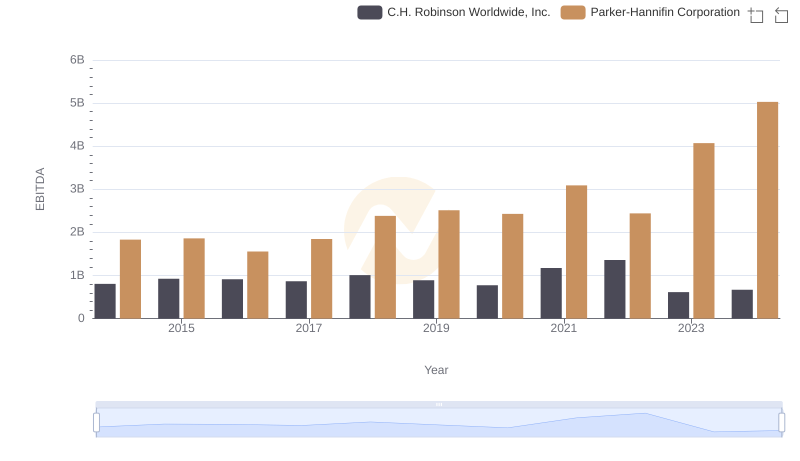

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.

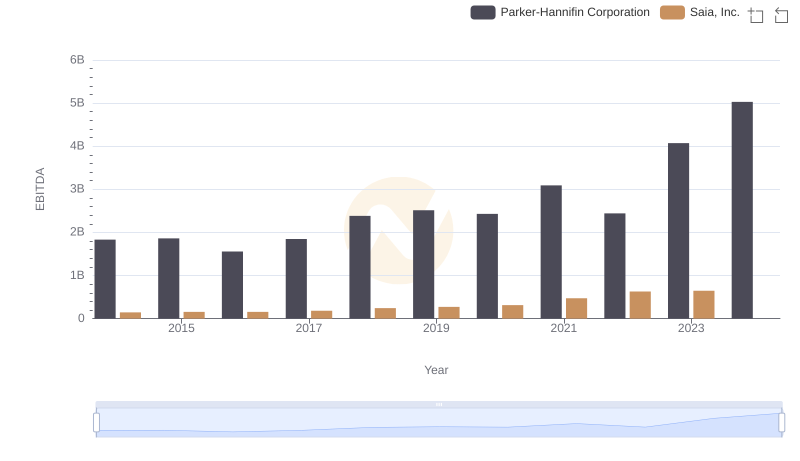

Parker-Hannifin Corporation vs Saia, Inc.: In-Depth EBITDA Performance Comparison

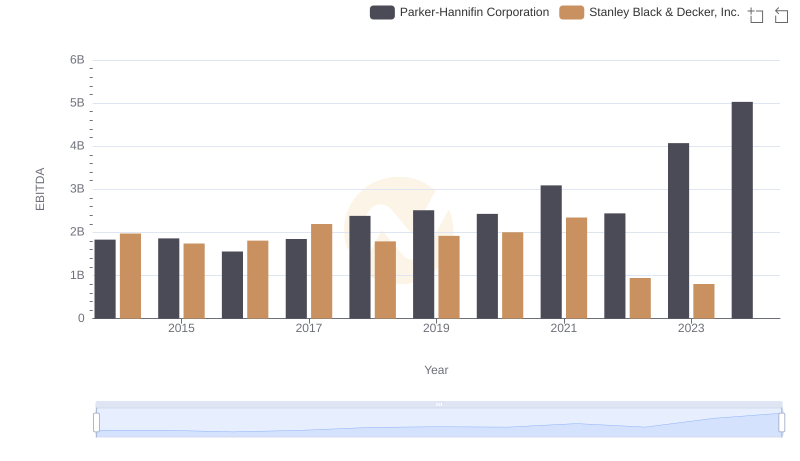

Parker-Hannifin Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

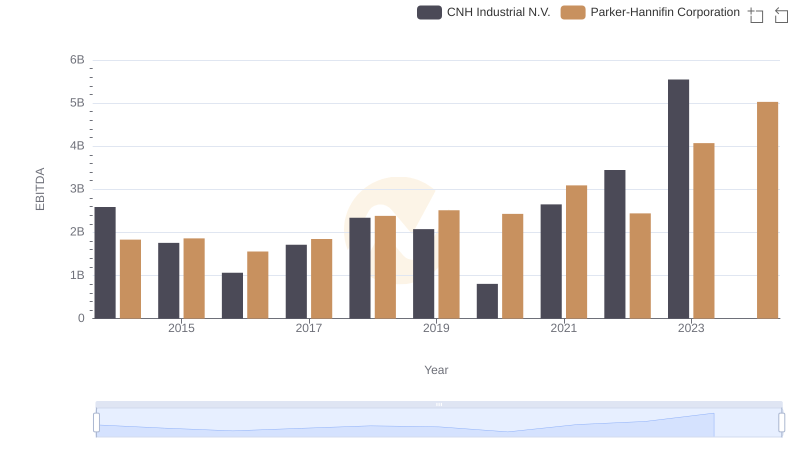

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs CNH Industrial N.V.

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Rentokil Initial plc

EBITDA Performance Review: Parker-Hannifin Corporation vs Curtiss-Wright Corporation

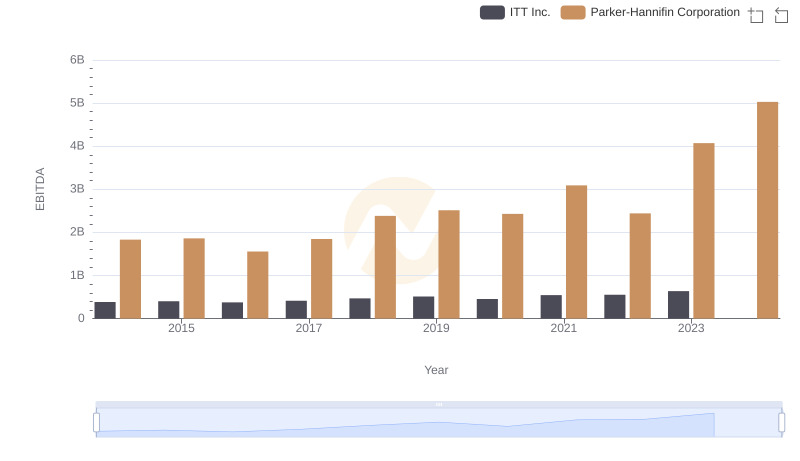

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to ITT Inc.