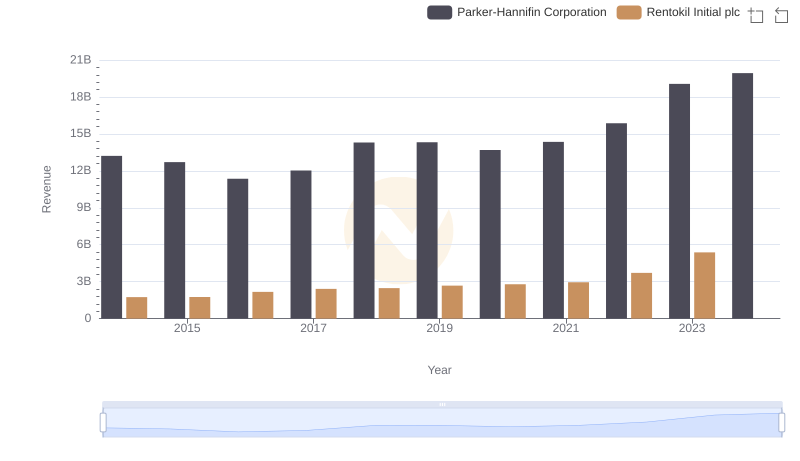

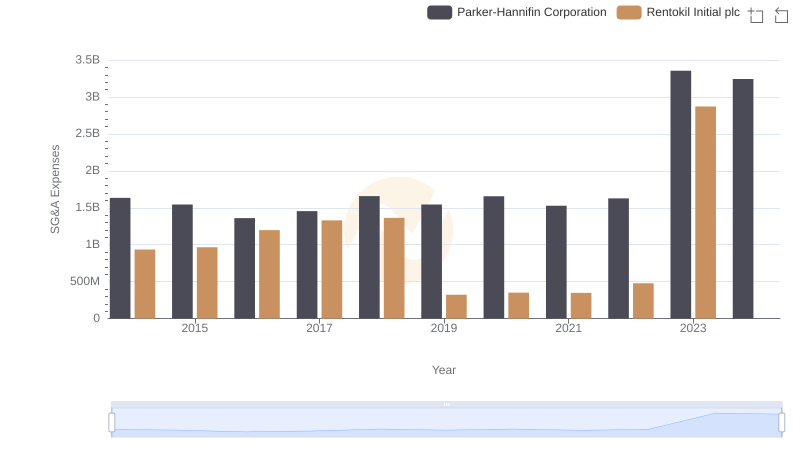

| __timestamp | Parker-Hannifin Corporation | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 10188227000 | 297500000 |

| Thursday, January 1, 2015 | 9655245000 | 310200000 |

| Friday, January 1, 2016 | 8823384000 | 376100000 |

| Sunday, January 1, 2017 | 9188962000 | 474900000 |

| Monday, January 1, 2018 | 10762841000 | 514200000 |

| Tuesday, January 1, 2019 | 10703484000 | 2099000000 |

| Wednesday, January 1, 2020 | 10286518000 | 2136400000 |

| Friday, January 1, 2021 | 10449680000 | 2239100000 |

| Saturday, January 1, 2022 | 11387267000 | 2737000000 |

| Sunday, January 1, 2023 | 12635892000 | 927000000 |

| Monday, January 1, 2024 | 12801816000 |

Data in motion

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's financial health. Parker-Hannifin Corporation, a leader in motion and control technologies, and Rentokil Initial plc, a global pest control and hygiene services provider, offer a fascinating study in contrasts.

From 2014 to 2023, Parker-Hannifin's cost of revenue has shown a consistent upward trend, peaking at approximately $12.6 billion in 2023. This represents a 24% increase over the decade, reflecting the company's robust growth and expansion strategies.

Rentokil Initial, on the other hand, experienced a more volatile trajectory. While their cost of revenue surged by over 800% from 2014 to 2022, reaching nearly $2.7 billion, 2023 saw a significant drop to $927 million, highlighting potential challenges or strategic shifts.

This analysis underscores the diverse strategies and market conditions faced by these industry leaders.

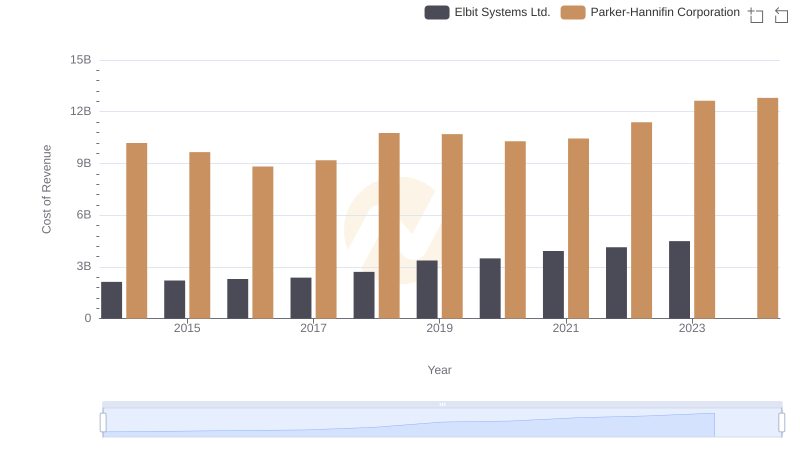

Cost of Revenue Trends: Parker-Hannifin Corporation vs Elbit Systems Ltd.

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Curtiss-Wright Corporation

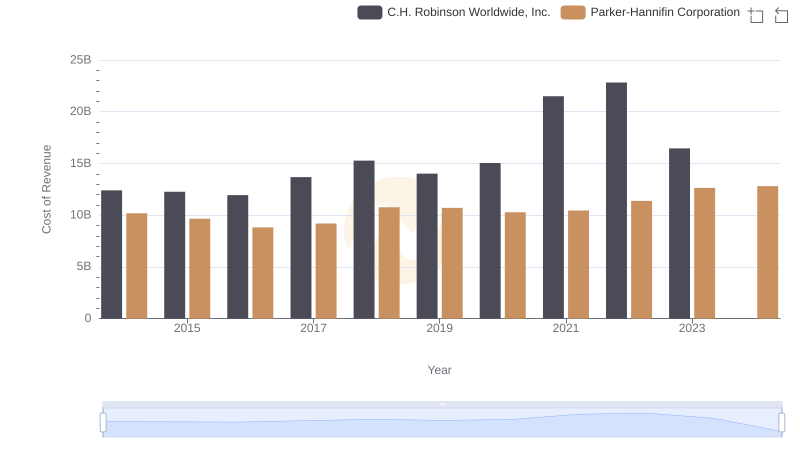

Cost of Revenue Trends: Parker-Hannifin Corporation vs C.H. Robinson Worldwide, Inc.

Parker-Hannifin Corporation and Rentokil Initial plc: A Comprehensive Revenue Analysis

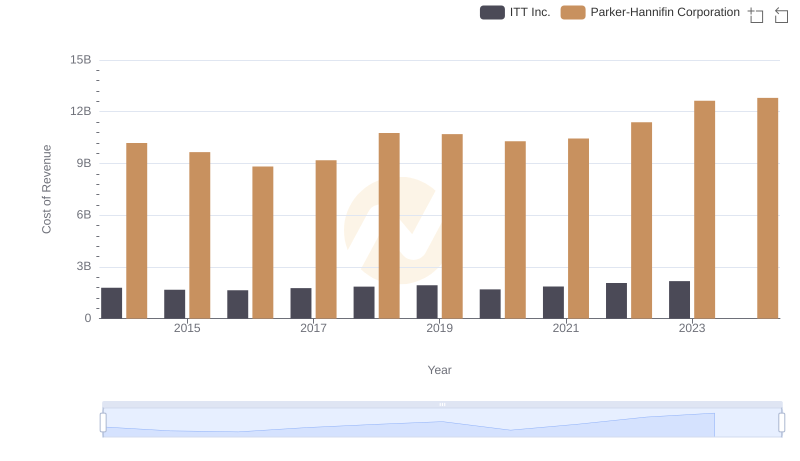

Cost of Revenue Trends: Parker-Hannifin Corporation vs ITT Inc.

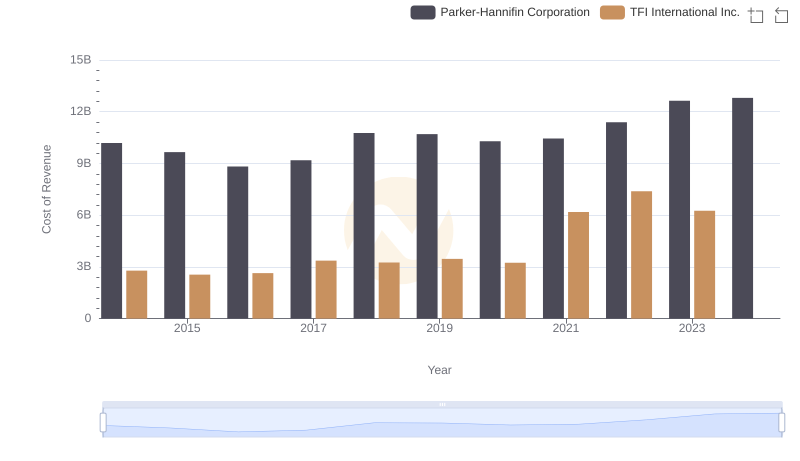

Cost of Revenue: Key Insights for Parker-Hannifin Corporation and TFI International Inc.

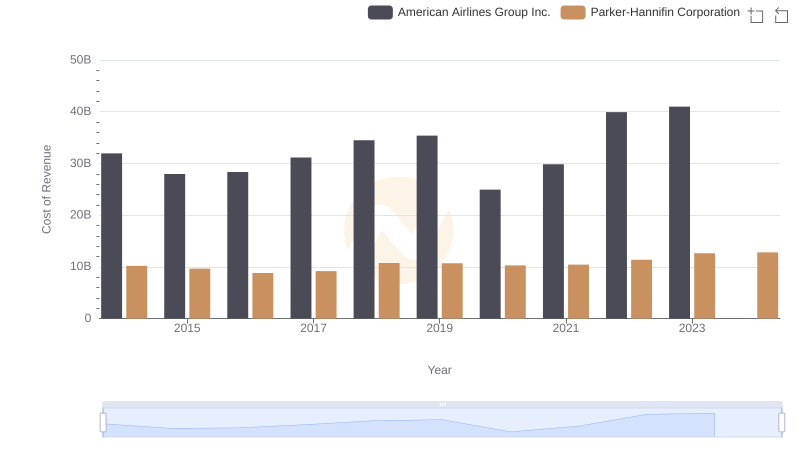

Analyzing Cost of Revenue: Parker-Hannifin Corporation and American Airlines Group Inc.

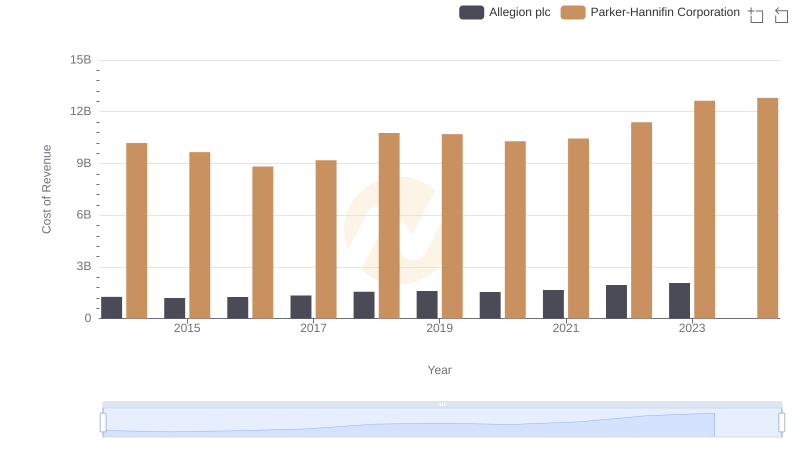

Cost of Revenue Comparison: Parker-Hannifin Corporation vs Allegion plc

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Rentokil Initial plc

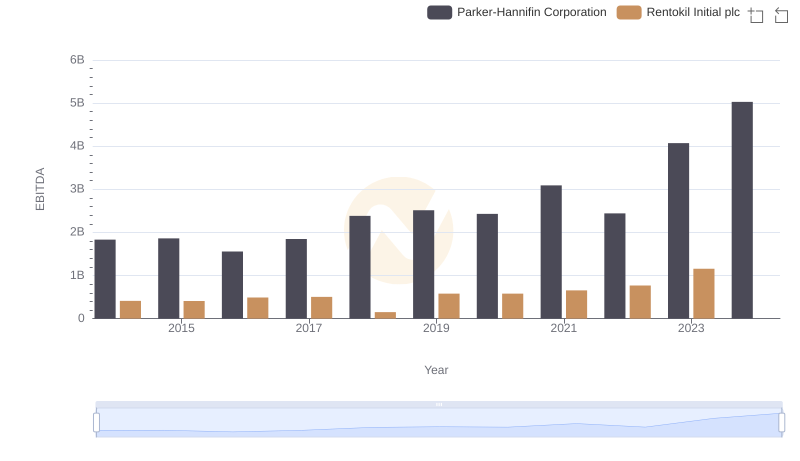

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Rentokil Initial plc