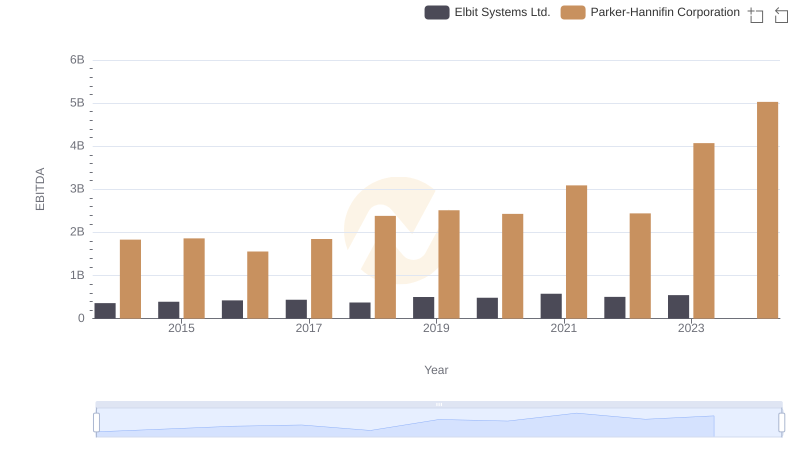

| __timestamp | Elbit Systems Ltd. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 356171000 | 1633992000 |

| Thursday, January 1, 2015 | 385059000 | 1544746000 |

| Friday, January 1, 2016 | 422390000 | 1359360000 |

| Sunday, January 1, 2017 | 413560000 | 1453935000 |

| Monday, January 1, 2018 | 441362000 | 1657152000 |

| Tuesday, January 1, 2019 | 516149000 | 1543939000 |

| Wednesday, January 1, 2020 | 514638000 | 1656553000 |

| Friday, January 1, 2021 | 559113000 | 1527302000 |

| Saturday, January 1, 2022 | 639067000 | 1627116000 |

| Sunday, January 1, 2023 | 696022000 | 3354103000 |

| Monday, January 1, 2024 | 3315177000 |

Infusing magic into the data realm

In the competitive landscape of industrial and defense sectors, understanding SG&A (Selling, General, and Administrative) efficiency is crucial. Parker-Hannifin Corporation, a leader in motion and control technologies, and Elbit Systems Ltd., a prominent defense electronics company, offer a fascinating comparison. From 2014 to 2023, Parker-Hannifin consistently outpaced Elbit Systems in SG&A expenses, with figures peaking at over $3.35 billion in 2023, a staggering 100% increase from 2022. In contrast, Elbit Systems saw a steady rise, reaching approximately $696 million in 2023, marking a 9% increase from the previous year. This data highlights Parker-Hannifin's expansive operational scale, while Elbit Systems demonstrates a more conservative growth trajectory. Notably, 2024 data for Elbit Systems is missing, leaving room for speculation on future trends. This analysis underscores the strategic financial management differences between these industry titans.

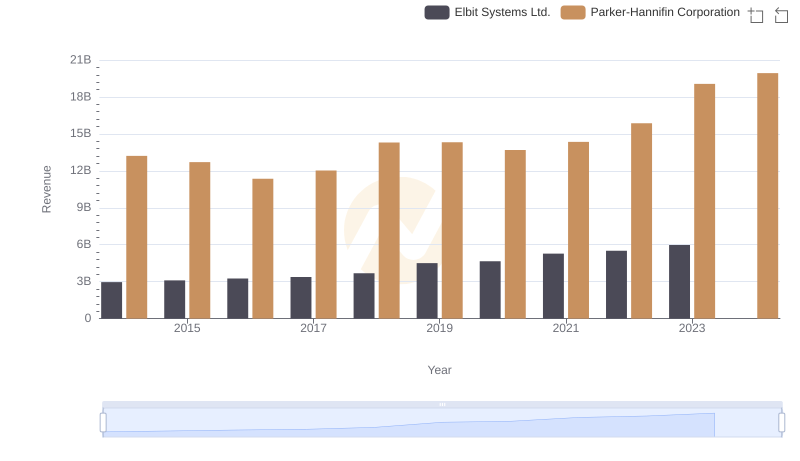

Comparing Revenue Performance: Parker-Hannifin Corporation or Elbit Systems Ltd.?

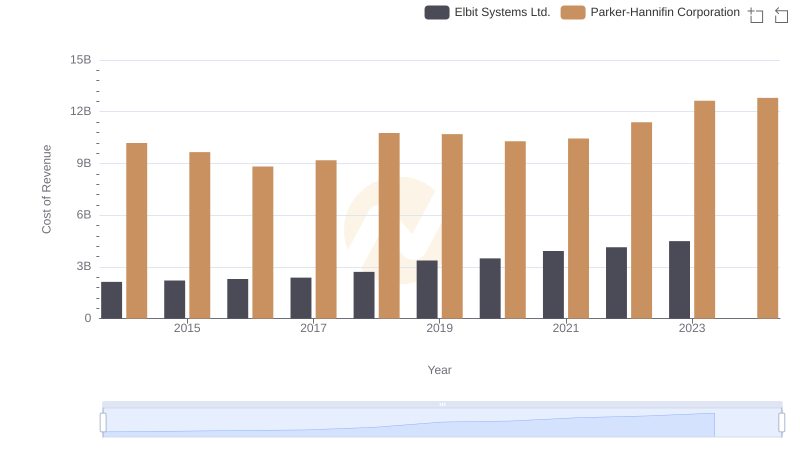

Cost of Revenue Trends: Parker-Hannifin Corporation vs Elbit Systems Ltd.

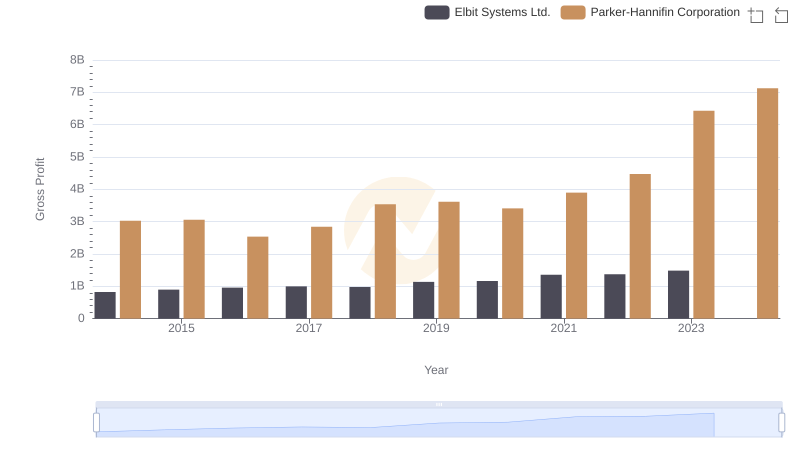

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Elbit Systems Ltd.

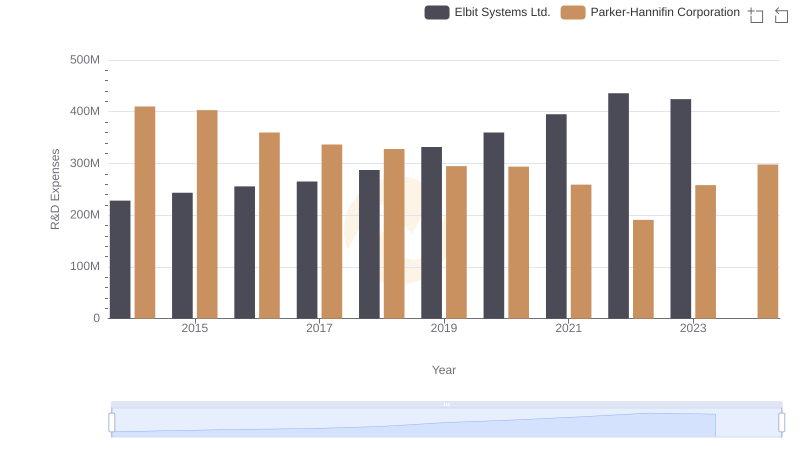

Parker-Hannifin Corporation vs Elbit Systems Ltd.: Strategic Focus on R&D Spending

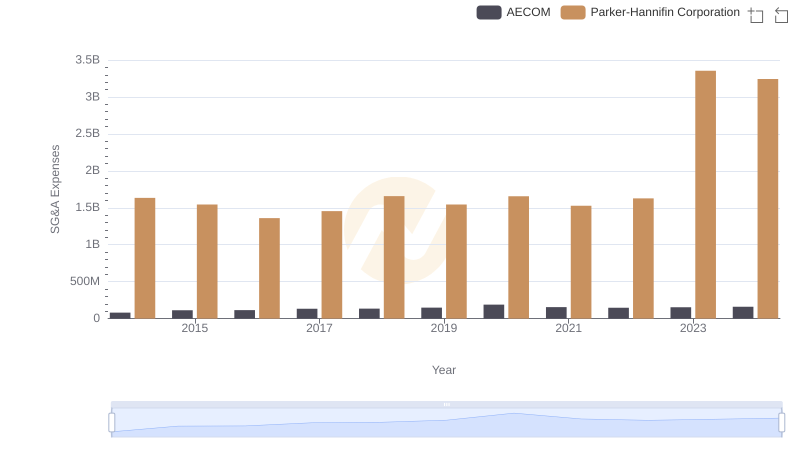

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and AECOM

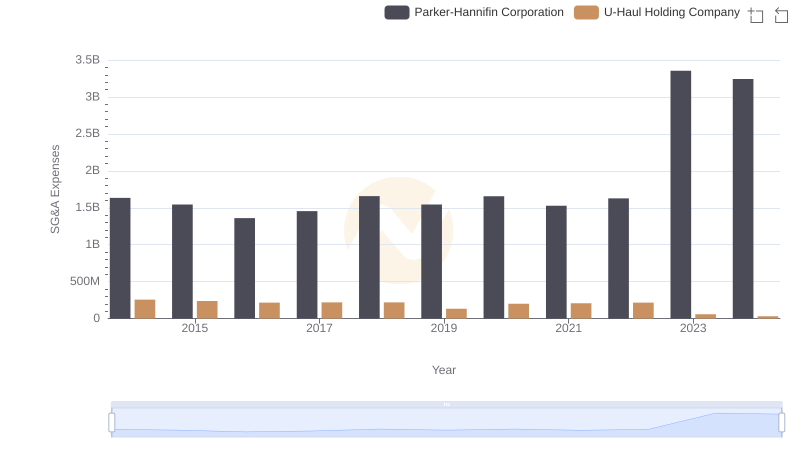

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and U-Haul Holding Company

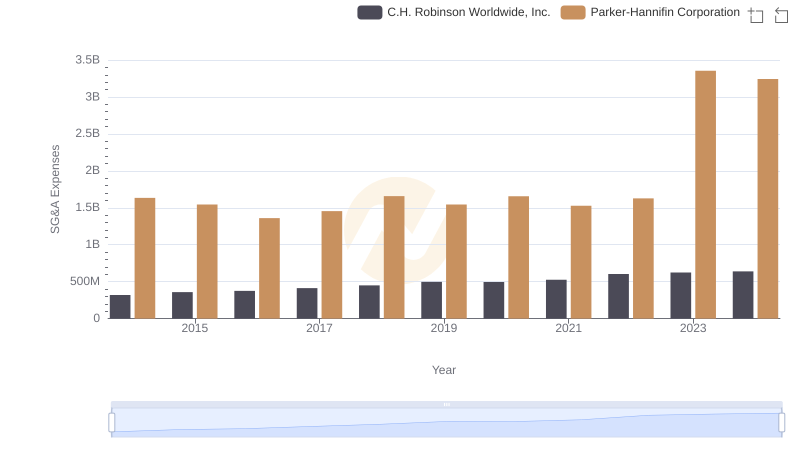

Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

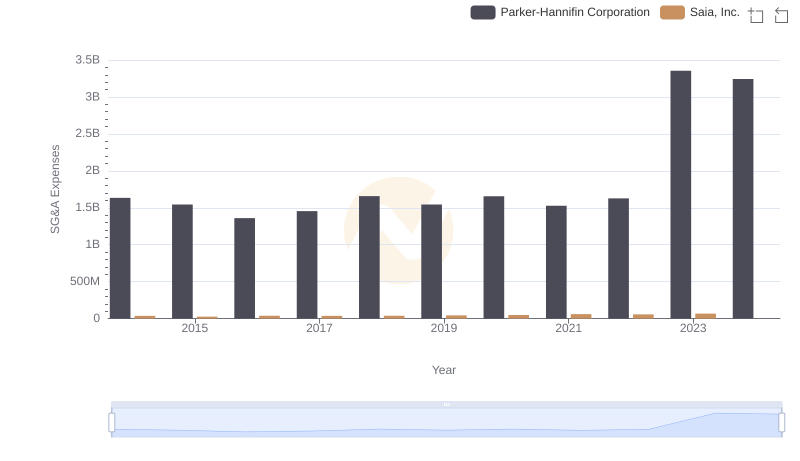

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

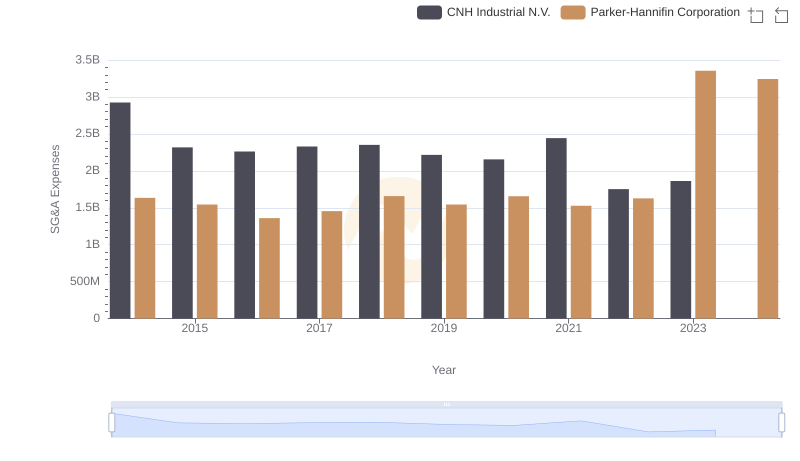

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or CNH Industrial N.V.

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs Elbit Systems Ltd.

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs American Airlines Group Inc.