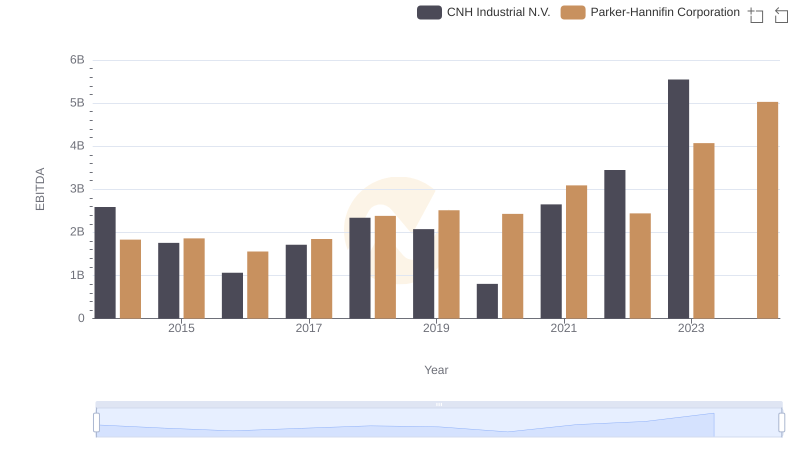

| __timestamp | CNH Industrial N.V. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2925000000 | 1633992000 |

| Thursday, January 1, 2015 | 2317000000 | 1544746000 |

| Friday, January 1, 2016 | 2262000000 | 1359360000 |

| Sunday, January 1, 2017 | 2330000000 | 1453935000 |

| Monday, January 1, 2018 | 2351000000 | 1657152000 |

| Tuesday, January 1, 2019 | 2216000000 | 1543939000 |

| Wednesday, January 1, 2020 | 2155000000 | 1656553000 |

| Friday, January 1, 2021 | 2443000000 | 1527302000 |

| Saturday, January 1, 2022 | 1752000000 | 1627116000 |

| Sunday, January 1, 2023 | 1863000000 | 3354103000 |

| Monday, January 1, 2024 | 3315177000 |

Unleashing the power of data

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Parker-Hannifin Corporation and CNH Industrial N.V. have showcased contrasting strategies in optimizing these costs. From 2014 to 2023, CNH Industrial N.V. consistently maintained higher SG&A expenses, peaking in 2014 with a 29% higher cost than Parker-Hannifin. However, by 2022, CNH's expenses dropped by 40%, indicating a strategic shift towards cost efficiency. In contrast, Parker-Hannifin's SG&A expenses remained relatively stable until a significant spike in 2023, doubling from the previous year. This anomaly suggests a potential strategic investment or restructuring. As we look towards 2024, Parker-Hannifin's data remains incomplete, leaving room for speculation on their future cost management strategies. This analysis highlights the dynamic nature of cost optimization in the industrial sector.

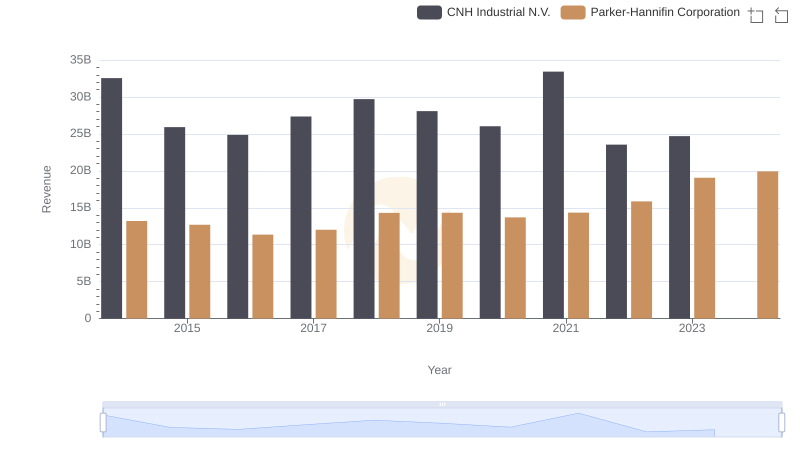

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs CNH Industrial N.V.

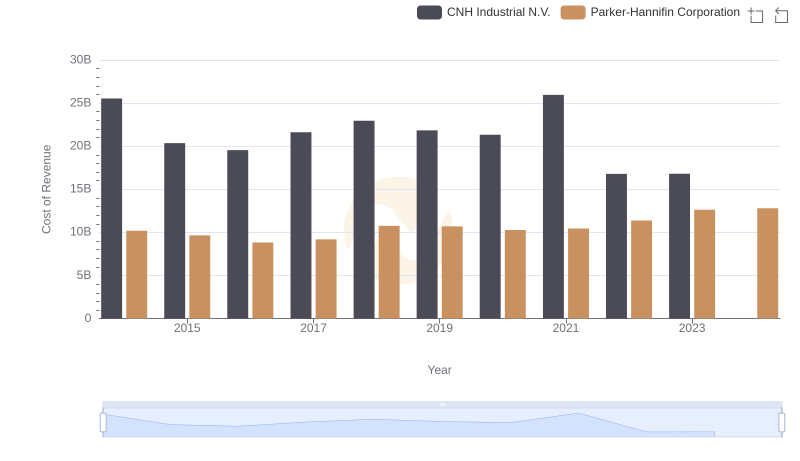

Analyzing Cost of Revenue: Parker-Hannifin Corporation and CNH Industrial N.V.

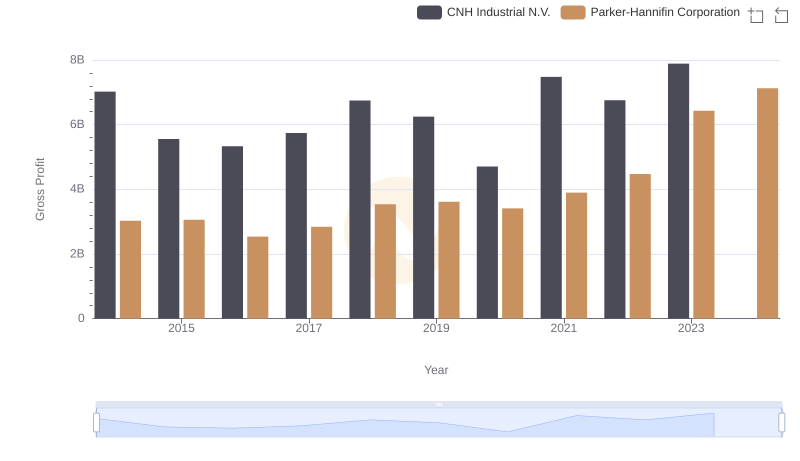

Parker-Hannifin Corporation and CNH Industrial N.V.: A Detailed Gross Profit Analysis

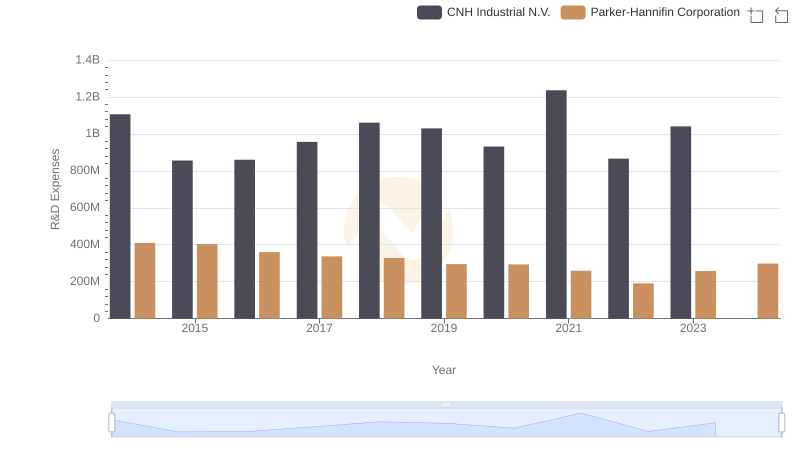

Parker-Hannifin Corporation vs CNH Industrial N.V.: Strategic Focus on R&D Spending

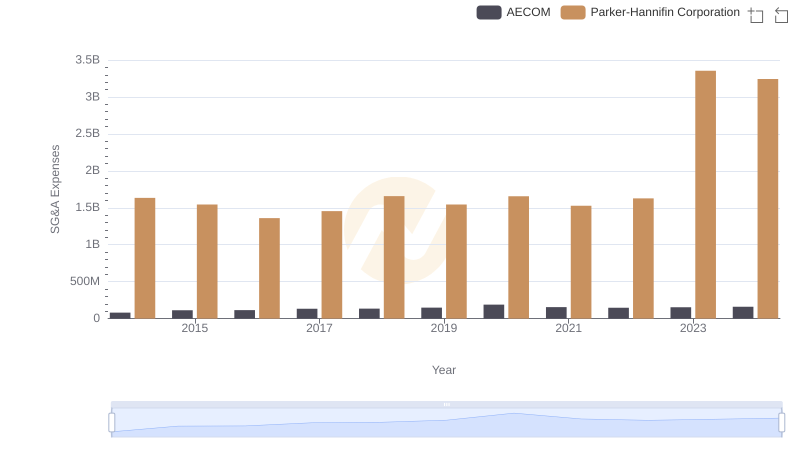

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and AECOM

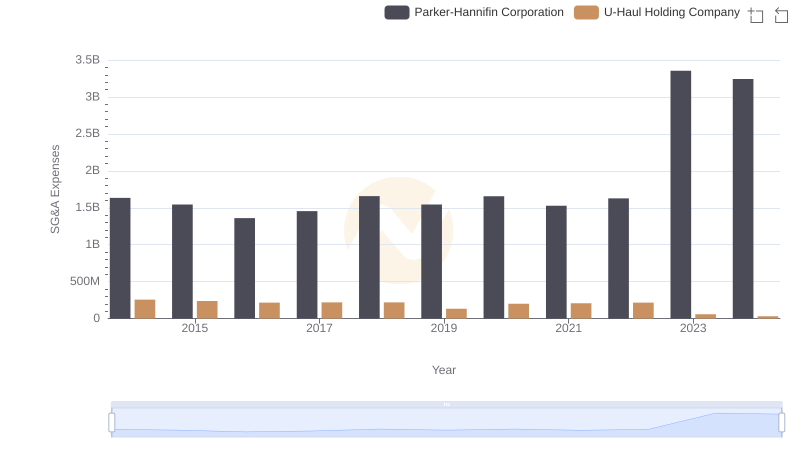

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and U-Haul Holding Company

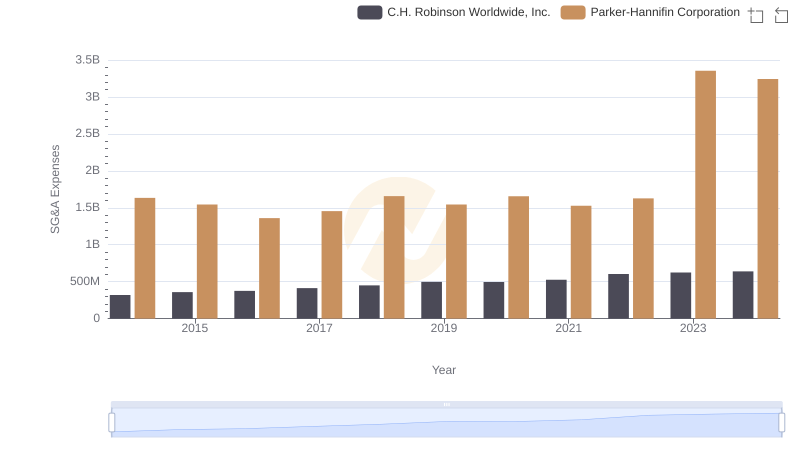

Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

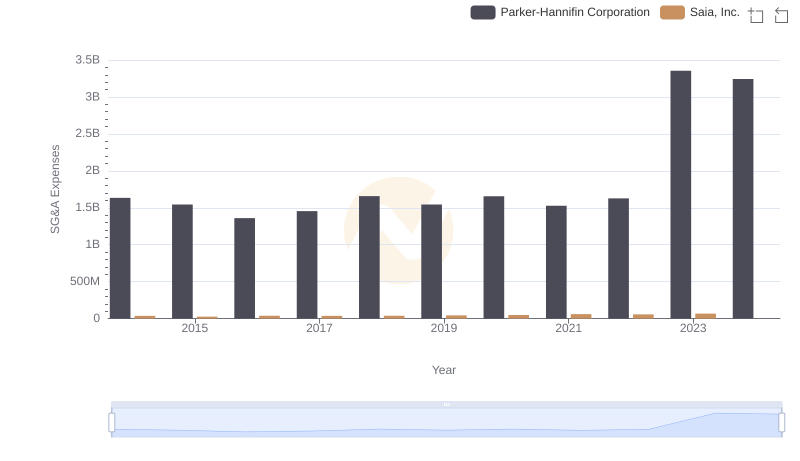

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

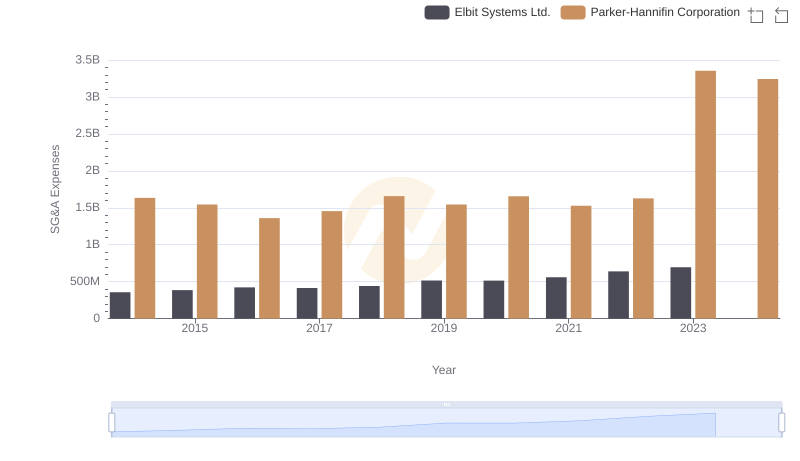

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Elbit Systems Ltd.

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs American Airlines Group Inc.

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs CNH Industrial N.V.