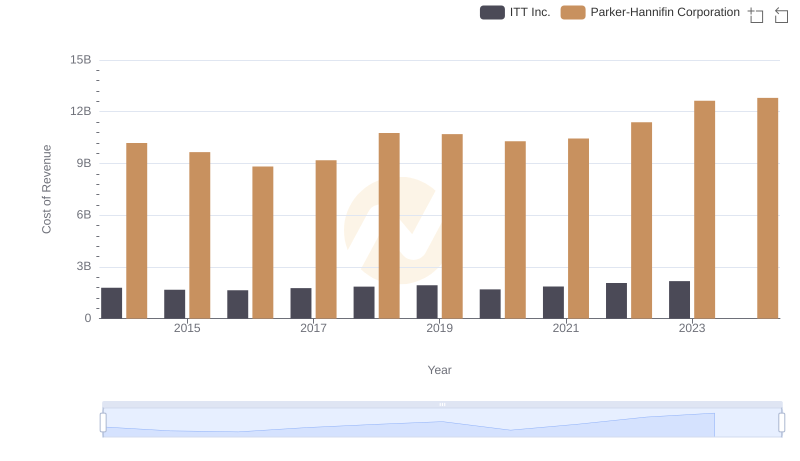

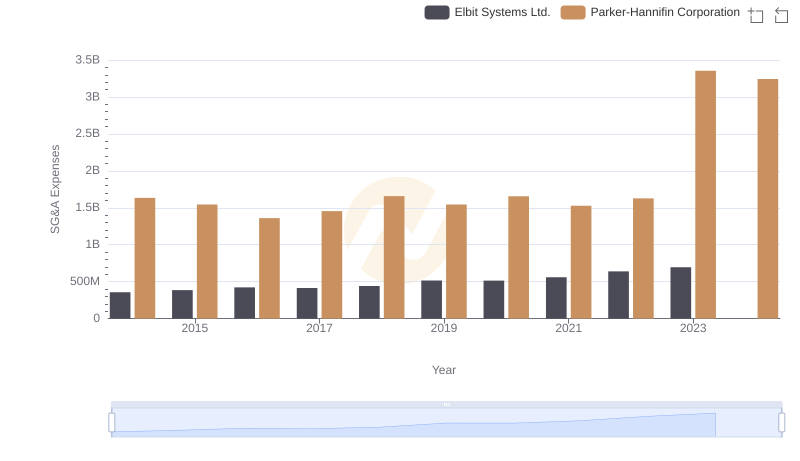

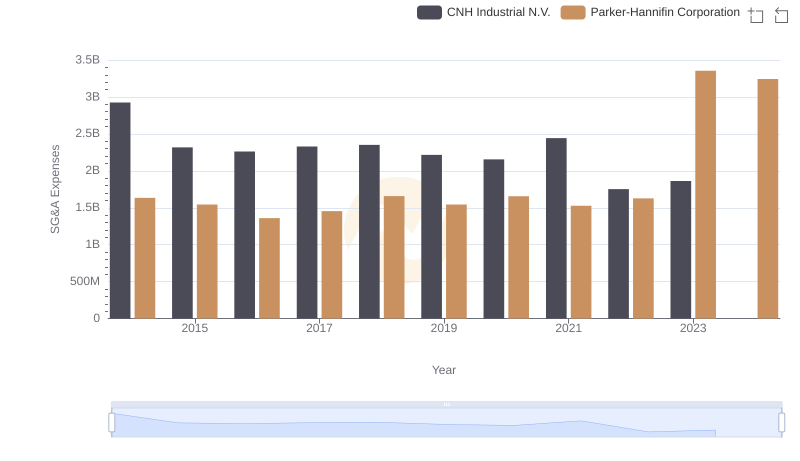

| __timestamp | ITT Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 519500000 | 1633992000 |

| Thursday, January 1, 2015 | 441500000 | 1544746000 |

| Friday, January 1, 2016 | 444100000 | 1359360000 |

| Sunday, January 1, 2017 | 433700000 | 1453935000 |

| Monday, January 1, 2018 | 427300000 | 1657152000 |

| Tuesday, January 1, 2019 | 420000000 | 1543939000 |

| Wednesday, January 1, 2020 | 347200000 | 1656553000 |

| Friday, January 1, 2021 | 365100000 | 1527302000 |

| Saturday, January 1, 2022 | 368500000 | 1627116000 |

| Sunday, January 1, 2023 | 476600000 | 3354103000 |

| Monday, January 1, 2024 | 502300000 | 3315177000 |

Unleashing insights

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Parker-Hannifin Corporation and ITT Inc. have demonstrated contrasting approaches to SG&A cost management. From 2014 to 2023, Parker-Hannifin's SG&A expenses have shown a significant upward trend, peaking in 2023 with a staggering 105% increase from 2014. In contrast, ITT Inc. has maintained a more stable SG&A expense profile, with a modest 8% decrease over the same period. This divergence highlights Parker-Hannifin's aggressive expansion strategy, while ITT Inc. focuses on cost efficiency. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends. As these industrial giants continue to evolve, their SG&A strategies will remain a key indicator of their financial health and operational priorities.

Cost of Revenue Trends: Parker-Hannifin Corporation vs ITT Inc.

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Elbit Systems Ltd.

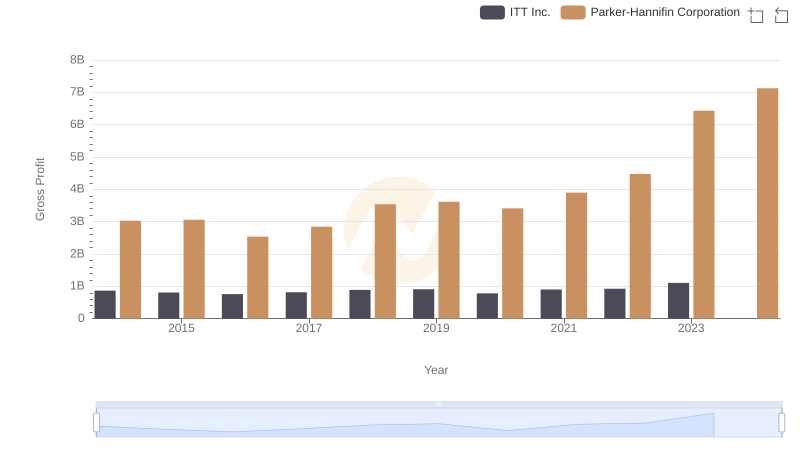

Key Insights on Gross Profit: Parker-Hannifin Corporation vs ITT Inc.

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or CNH Industrial N.V.

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs American Airlines Group Inc.

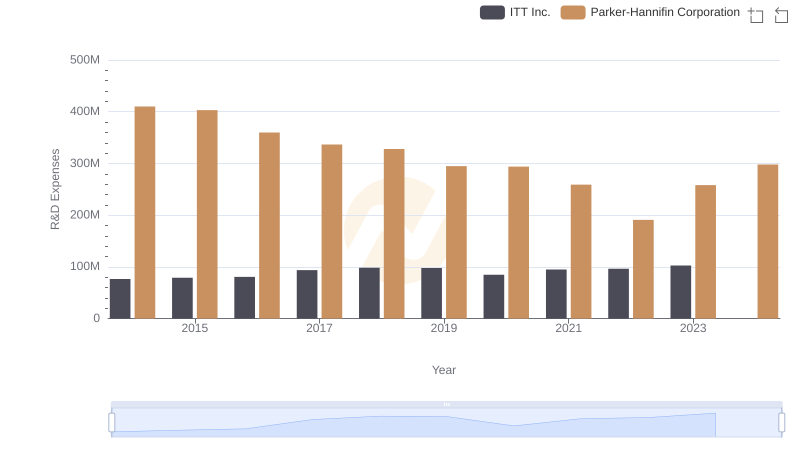

R&D Spending Showdown: Parker-Hannifin Corporation vs ITT Inc.

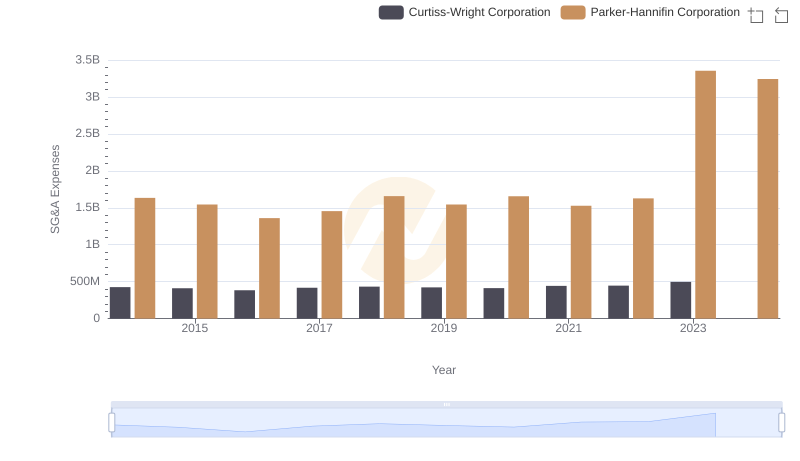

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Curtiss-Wright Corporation

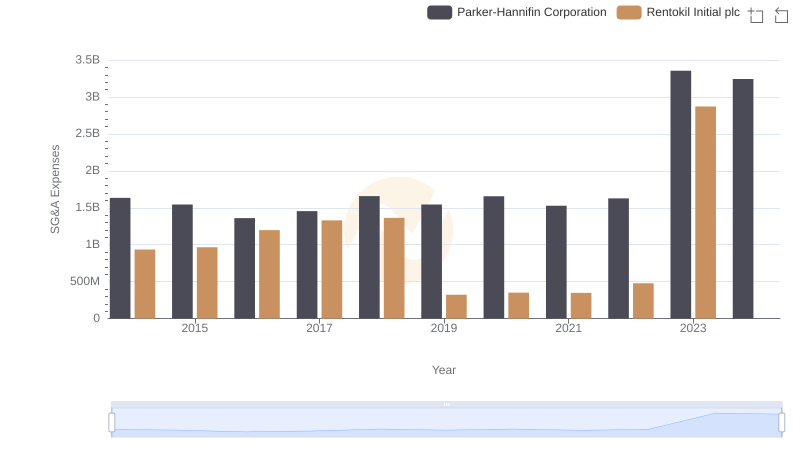

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Rentokil Initial plc

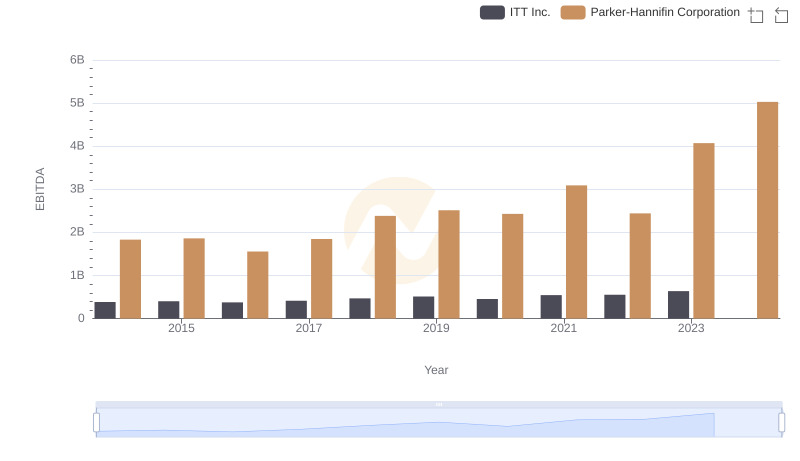

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to ITT Inc.