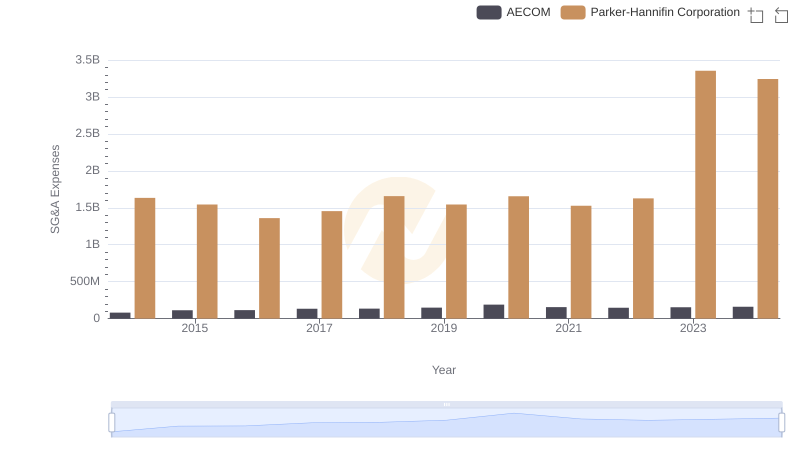

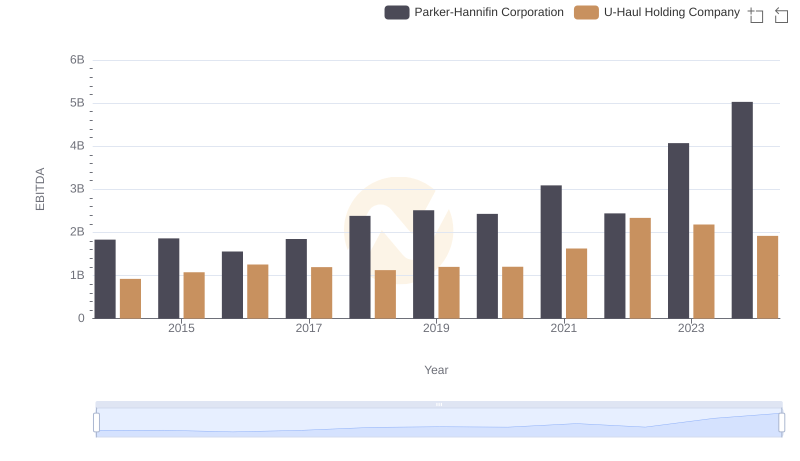

| __timestamp | Parker-Hannifin Corporation | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 257168000 |

| Thursday, January 1, 2015 | 1544746000 | 238558000 |

| Friday, January 1, 2016 | 1359360000 | 217216000 |

| Sunday, January 1, 2017 | 1453935000 | 220053000 |

| Monday, January 1, 2018 | 1657152000 | 219271000 |

| Tuesday, January 1, 2019 | 1543939000 | 133435000 |

| Wednesday, January 1, 2020 | 1656553000 | 201718000 |

| Friday, January 1, 2021 | 1527302000 | 207982000 |

| Saturday, January 1, 2022 | 1627116000 | 216557000 |

| Sunday, January 1, 2023 | 3354103000 | 58753000 |

| Monday, January 1, 2024 | 3315177000 | 32654000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate America, operational efficiency is paramount. Over the past decade, Parker-Hannifin Corporation and U-Haul Holding Company have showcased contrasting trajectories in their Selling, General, and Administrative (SG&A) expenses. Parker-Hannifin, a leader in motion and control technologies, saw its SG&A expenses surge by over 100% from 2014 to 2023, peaking in 2023 with a notable increase. In contrast, U-Haul, a household name in moving and storage, experienced a more modest fluctuation, with a 77% decrease in SG&A expenses by 2023. This divergence highlights Parker-Hannifin's aggressive expansion and investment strategies, while U-Haul's cost-cutting measures reflect a focus on operational efficiency. As we look to 2024, these trends offer a glimpse into the strategic priorities of these industry giants.

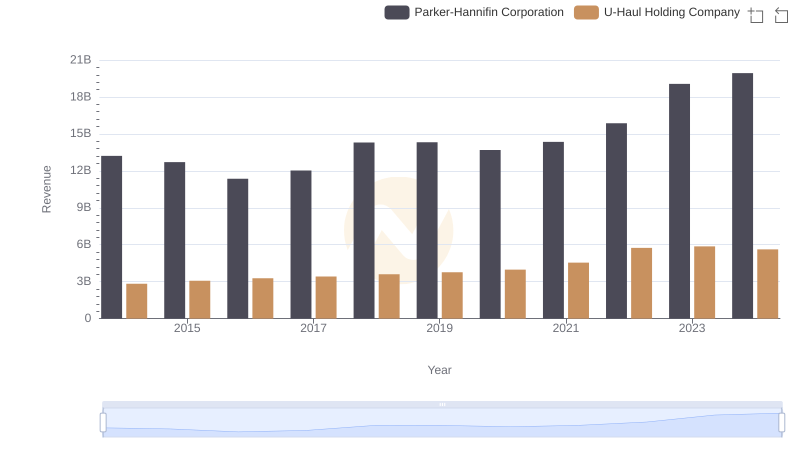

Parker-Hannifin Corporation vs U-Haul Holding Company: Annual Revenue Growth Compared

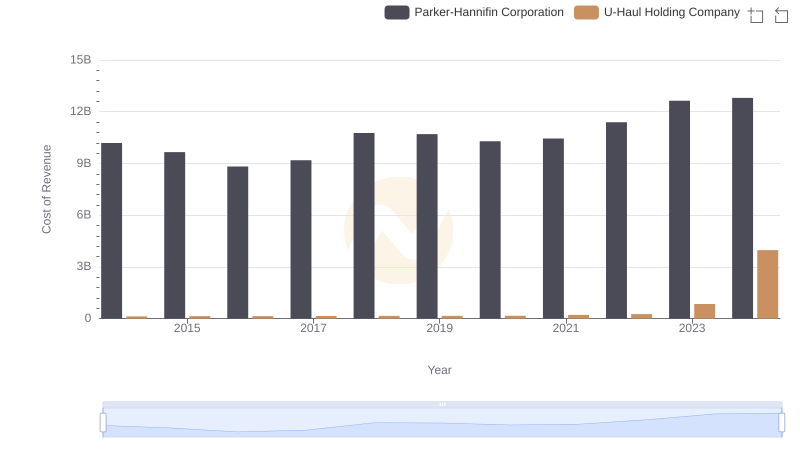

Cost Insights: Breaking Down Parker-Hannifin Corporation and U-Haul Holding Company's Expenses

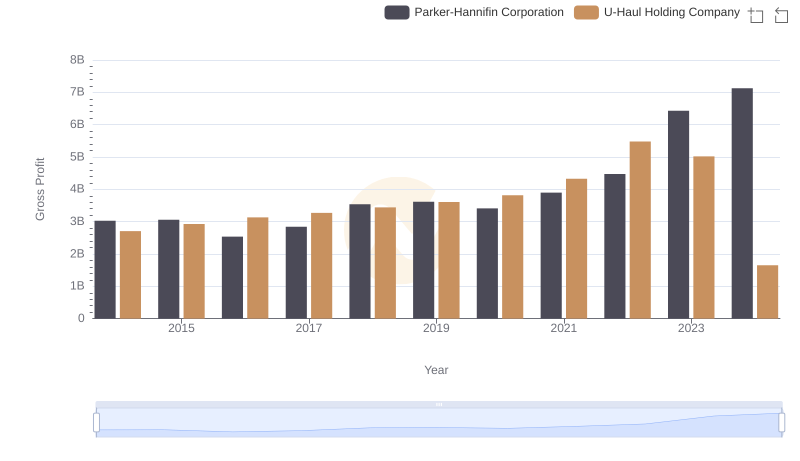

Gross Profit Trends Compared: Parker-Hannifin Corporation vs U-Haul Holding Company

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and AECOM

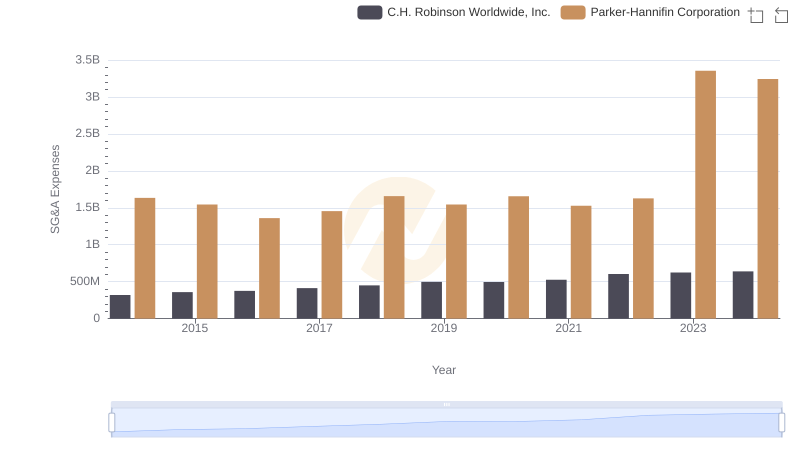

Parker-Hannifin Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

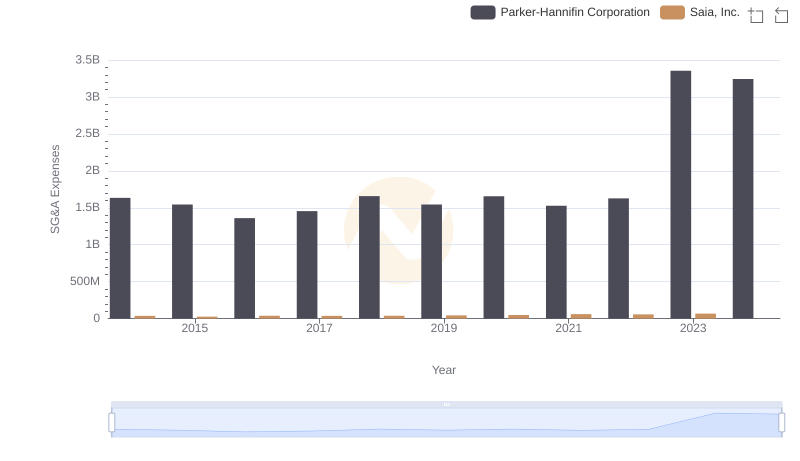

Parker-Hannifin Corporation and Saia, Inc.: SG&A Spending Patterns Compared

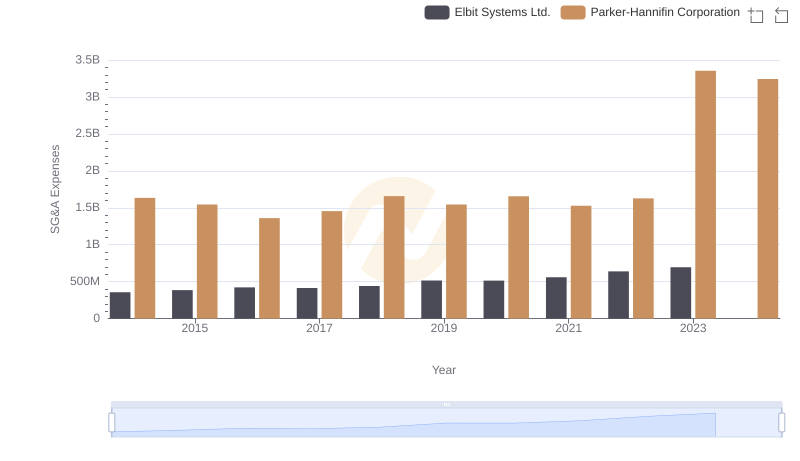

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Elbit Systems Ltd.

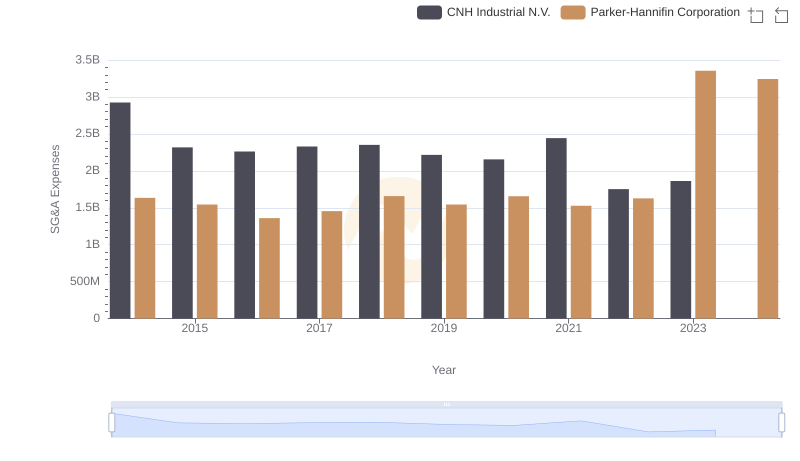

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or CNH Industrial N.V.

EBITDA Metrics Evaluated: Parker-Hannifin Corporation vs U-Haul Holding Company

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs American Airlines Group Inc.