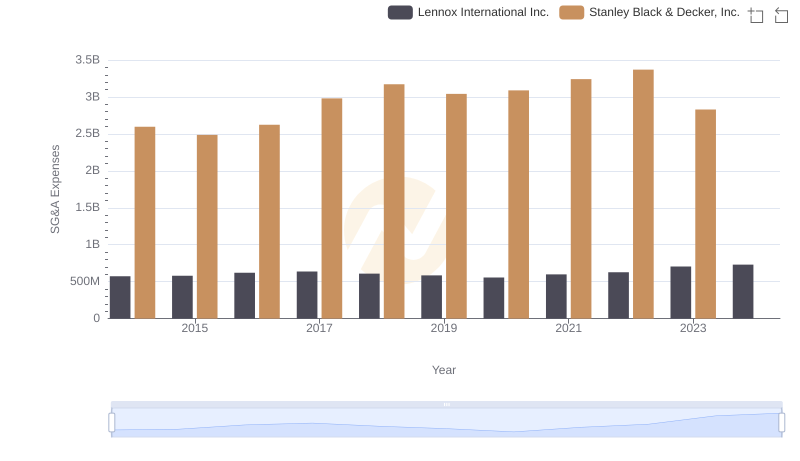

| __timestamp | Lennox International Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 573700000 | 2595900000 |

| Thursday, January 1, 2015 | 580500000 | 2486400000 |

| Friday, January 1, 2016 | 621000000 | 2623900000 |

| Sunday, January 1, 2017 | 637700000 | 2980100000 |

| Monday, January 1, 2018 | 608200000 | 3171700000 |

| Tuesday, January 1, 2019 | 585900000 | 3041000000 |

| Wednesday, January 1, 2020 | 555900000 | 3089600000 |

| Friday, January 1, 2021 | 598900000 | 3240400000 |

| Saturday, January 1, 2022 | 627200000 | 3370000000 |

| Sunday, January 1, 2023 | 705500000 | 2829300000 |

| Monday, January 1, 2024 | 730600000 | 3310500000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Lennox International Inc. and Stanley Black & Decker, Inc. have been at the forefront of this challenge since 2014. Over the past decade, Lennox has demonstrated a steady control over its SG&A costs, with an average annual expense of approximately $620 million. In contrast, Stanley Black & Decker's SG&A expenses have averaged around $2.94 billion, reflecting the scale of its operations.

Interestingly, Lennox's SG&A costs have increased by about 27% from 2014 to 2023, while Stanley Black & Decker saw a 9% rise over the same period. The data for 2024 is incomplete, highlighting the need for continuous monitoring. This analysis underscores the importance of strategic cost management in sustaining competitive advantage in the industrial sector.

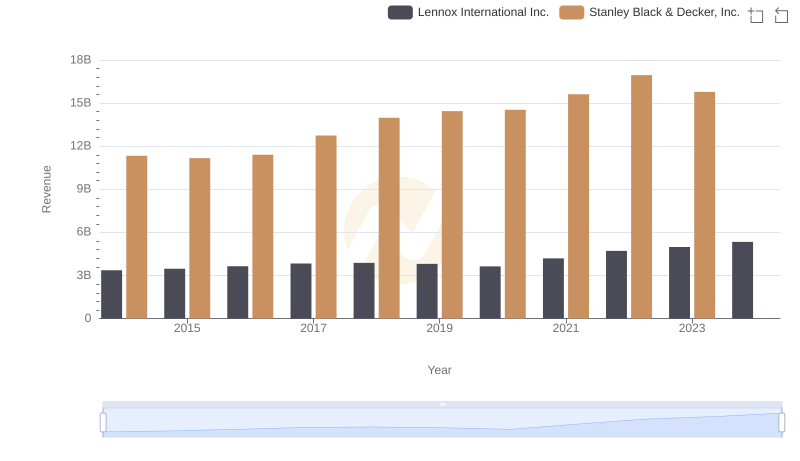

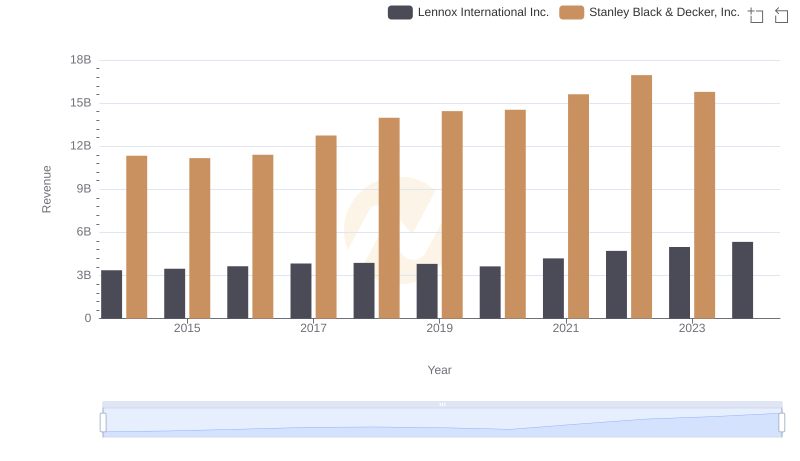

Lennox International Inc. vs Stanley Black & Decker, Inc.: Annual Revenue Growth Compared

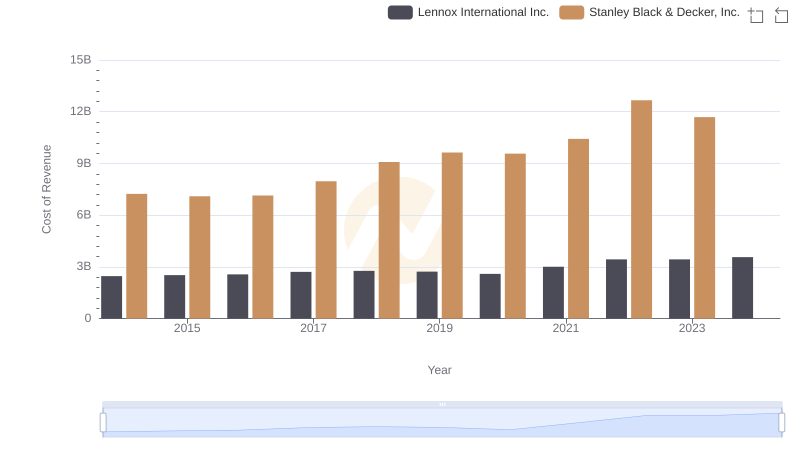

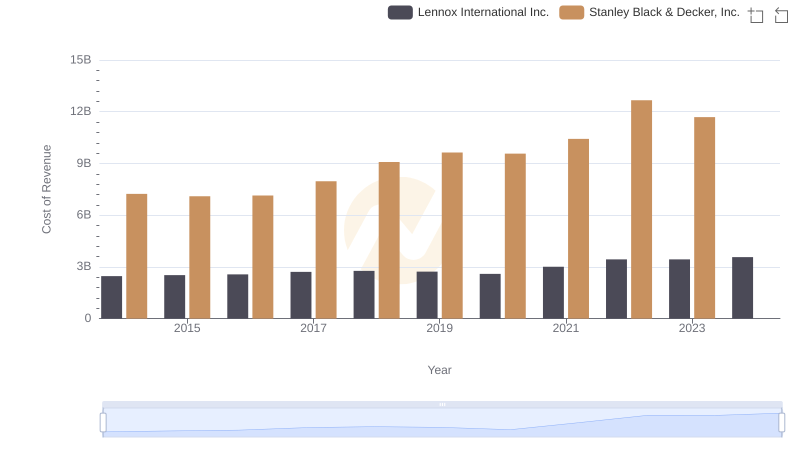

Lennox International Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

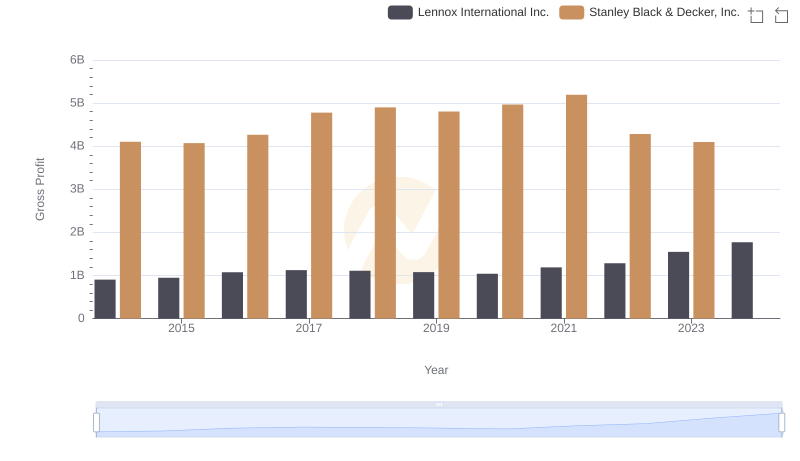

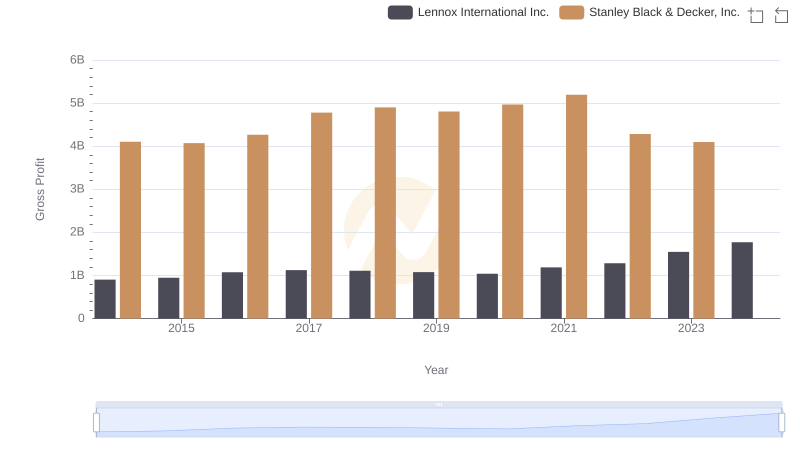

Key Insights on Gross Profit: Lennox International Inc. vs Stanley Black & Decker, Inc.

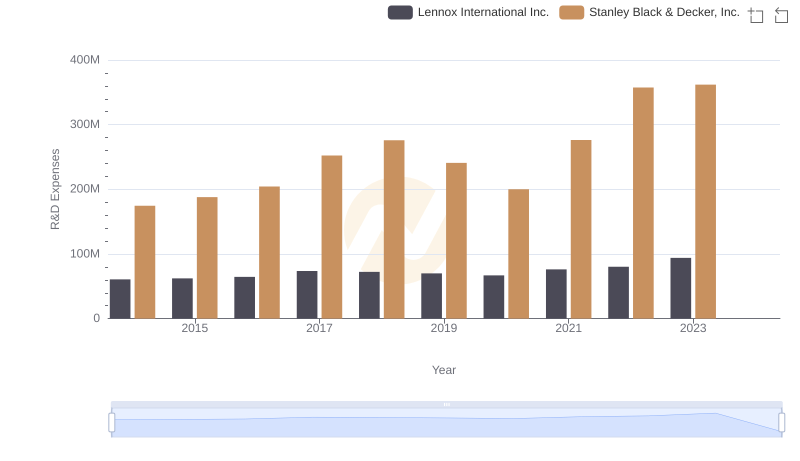

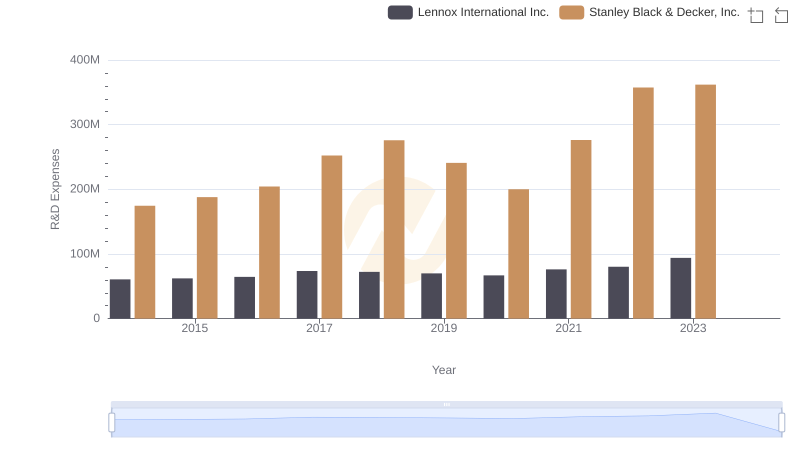

Research and Development Expenses Breakdown: Lennox International Inc. vs Stanley Black & Decker, Inc.

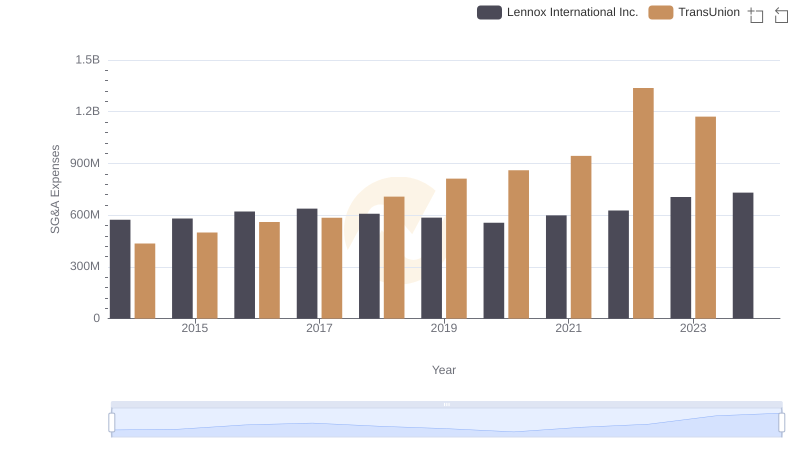

SG&A Efficiency Analysis: Comparing Lennox International Inc. and TransUnion

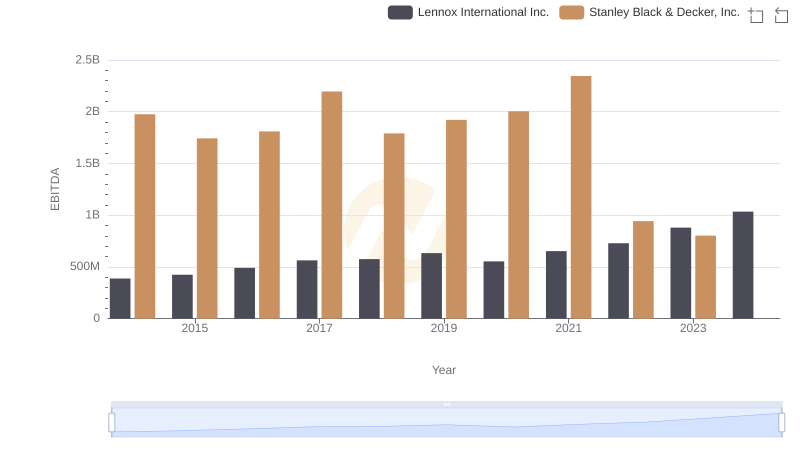

A Professional Review of EBITDA: Lennox International Inc. Compared to Stanley Black & Decker, Inc.

Lennox International Inc. and Stanley Black & Decker, Inc.: A Comprehensive Revenue Analysis

Analyzing Cost of Revenue: Lennox International Inc. and Stanley Black & Decker, Inc.

Lennox International Inc. vs Stanley Black & Decker, Inc.: A Gross Profit Performance Breakdown

Research and Development: Comparing Key Metrics for Lennox International Inc. and Stanley Black & Decker, Inc.

Comparing SG&A Expenses: Lennox International Inc. vs Stanley Black & Decker, Inc. Trends and Insights

Professional EBITDA Benchmarking: Lennox International Inc. vs Stanley Black & Decker, Inc.