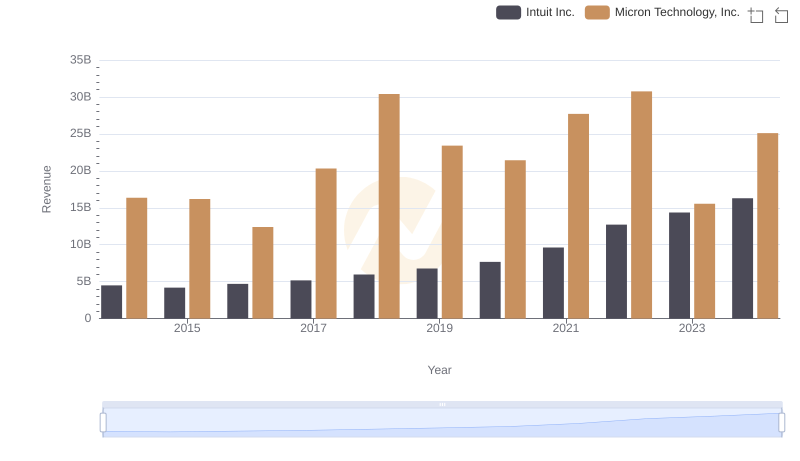

| __timestamp | Intuit Inc. | Micron Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 10921000000 |

| Thursday, January 1, 2015 | 725000000 | 10977000000 |

| Friday, January 1, 2016 | 752000000 | 9894000000 |

| Sunday, January 1, 2017 | 809000000 | 11886000000 |

| Monday, January 1, 2018 | 977000000 | 12500000000 |

| Tuesday, January 1, 2019 | 1167000000 | 12704000000 |

| Wednesday, January 1, 2020 | 1378000000 | 14883000000 |

| Friday, January 1, 2021 | 1683000000 | 17282000000 |

| Saturday, January 1, 2022 | 2406000000 | 16860000000 |

| Sunday, January 1, 2023 | 3143000000 | 16956000000 |

| Monday, January 1, 2024 | 3465000000 | 19498000000 |

Cracking the code

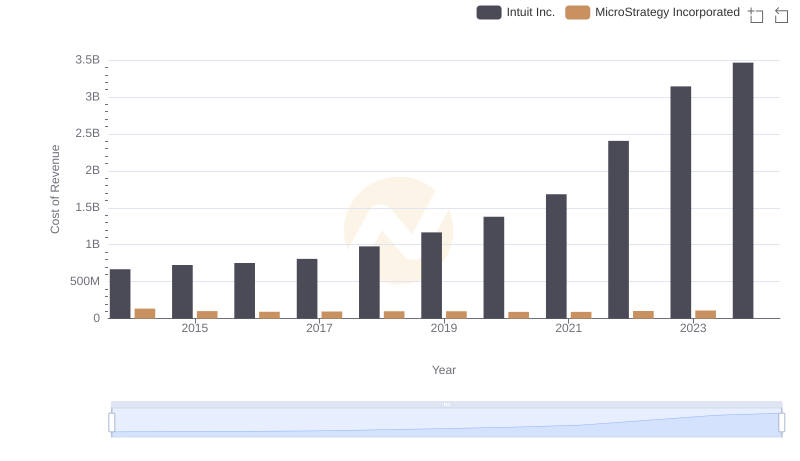

In the ever-evolving landscape of technology, Intuit Inc. and Micron Technology, Inc. have carved distinct paths. Over the past decade, from 2014 to 2024, these industry titans have showcased contrasting trends in their cost of revenue. Intuit Inc., known for its financial software, has seen a steady rise, with costs increasing by over 400% from 2014 to 2024. This growth reflects its expanding product offerings and market reach.

Conversely, Micron Technology, a leader in memory and storage solutions, has maintained a more stable trajectory. Despite fluctuations, its cost of revenue has hovered around a consistent range, peaking in 2024. This stability underscores Micron's efficient production processes and strategic market positioning.

As we delve into these trends, it's evident that while both companies operate in the tech sector, their financial strategies and market dynamics differ significantly, offering valuable insights into their operational efficiencies.

Breaking Down Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

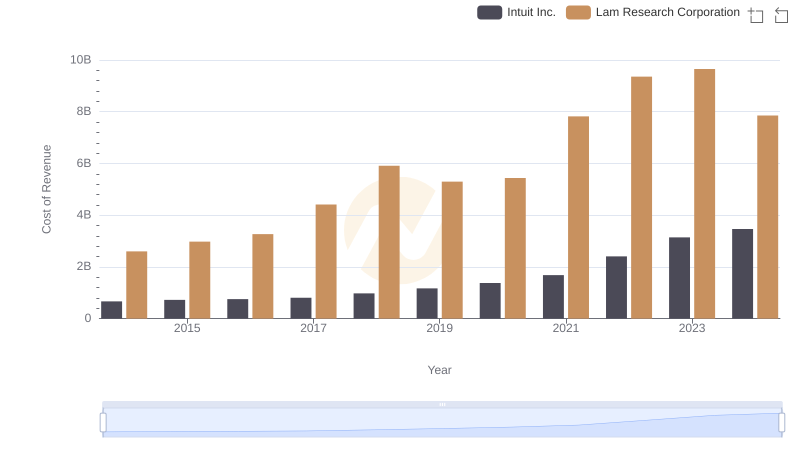

Analyzing Cost of Revenue: Intuit Inc. and Lam Research Corporation

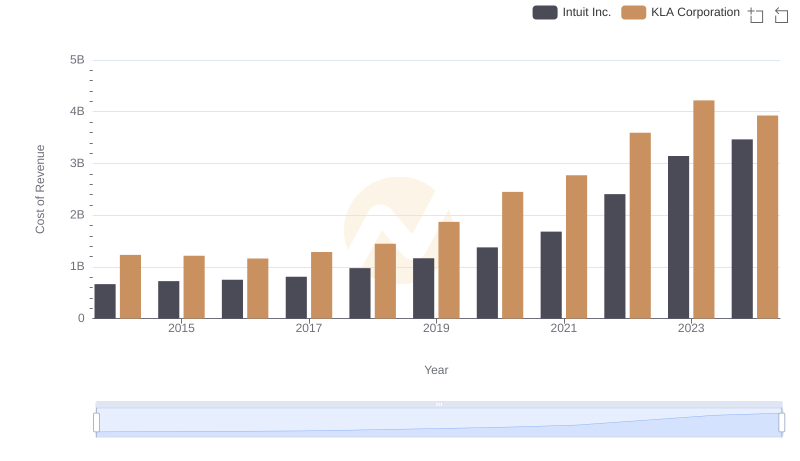

Cost of Revenue Trends: Intuit Inc. vs KLA Corporation

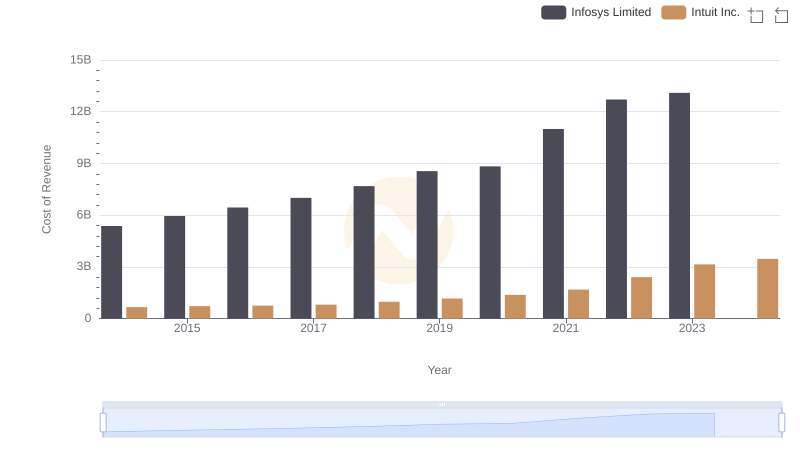

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Infosys Limited

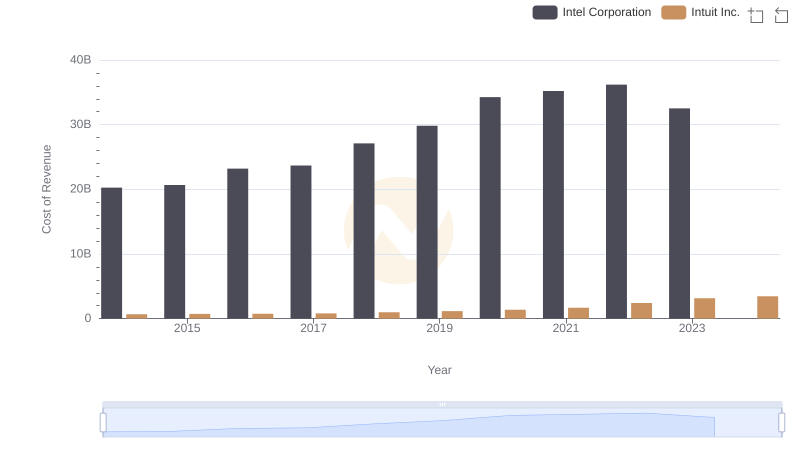

Intuit Inc. vs Intel Corporation: Efficiency in Cost of Revenue Explored

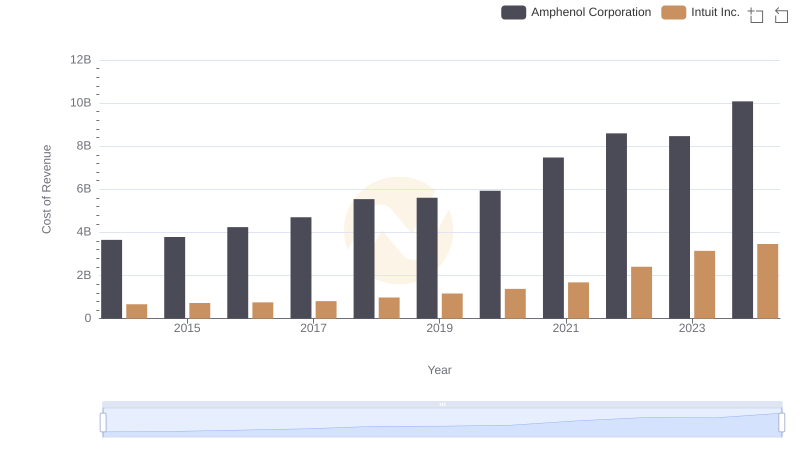

Analyzing Cost of Revenue: Intuit Inc. and Amphenol Corporation

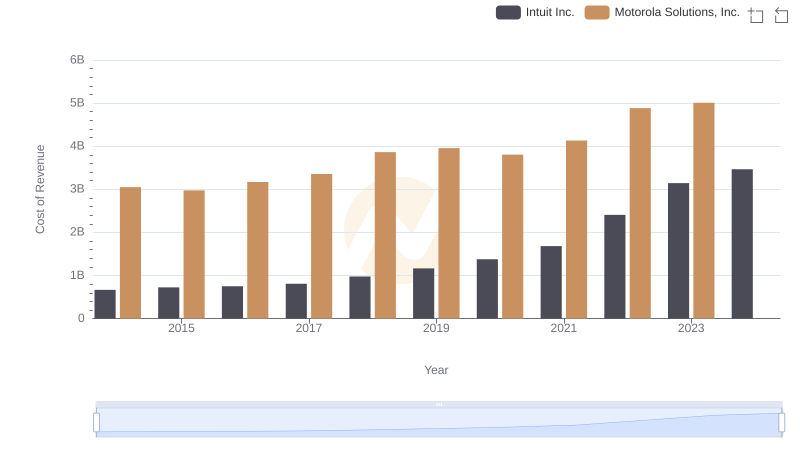

Cost Insights: Breaking Down Intuit Inc. and Motorola Solutions, Inc.'s Expenses

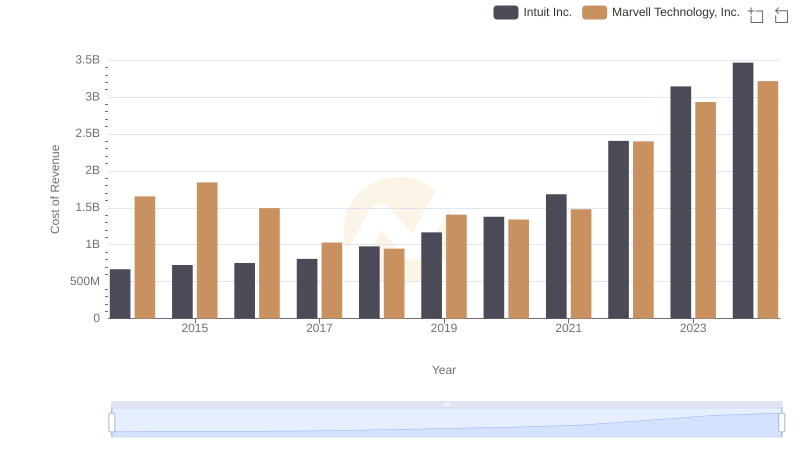

Cost of Revenue Comparison: Intuit Inc. vs Marvell Technology, Inc.

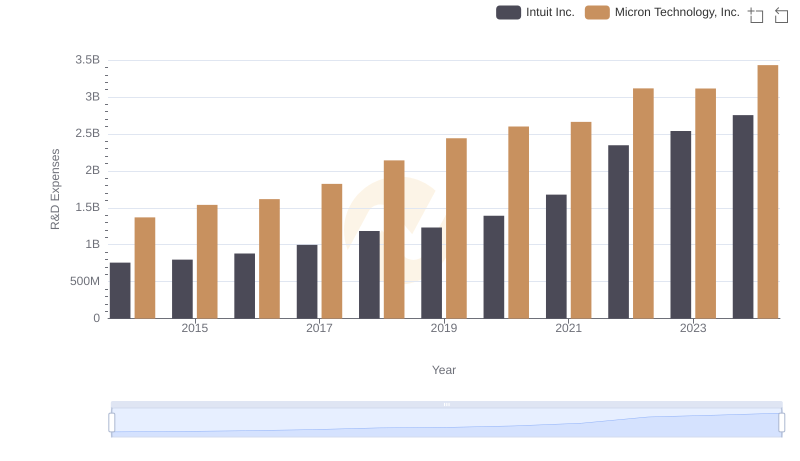

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Micron Technology, Inc.

Analyzing Cost of Revenue: Intuit Inc. and MicroStrategy Incorporated

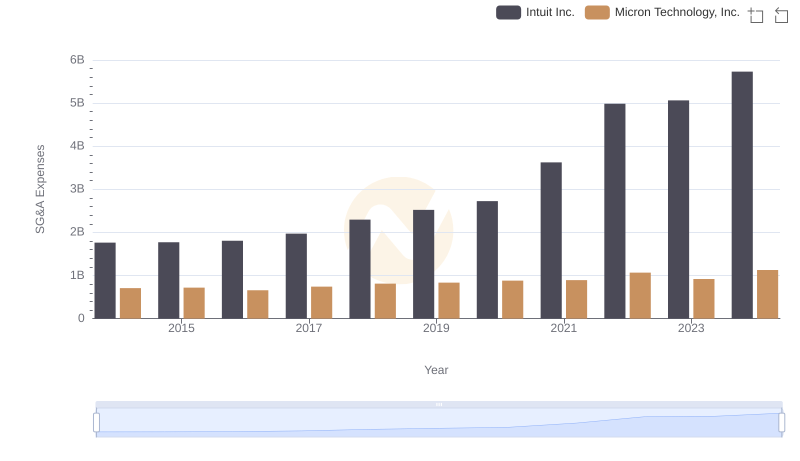

Who Optimizes SG&A Costs Better? Intuit Inc. or Micron Technology, Inc.

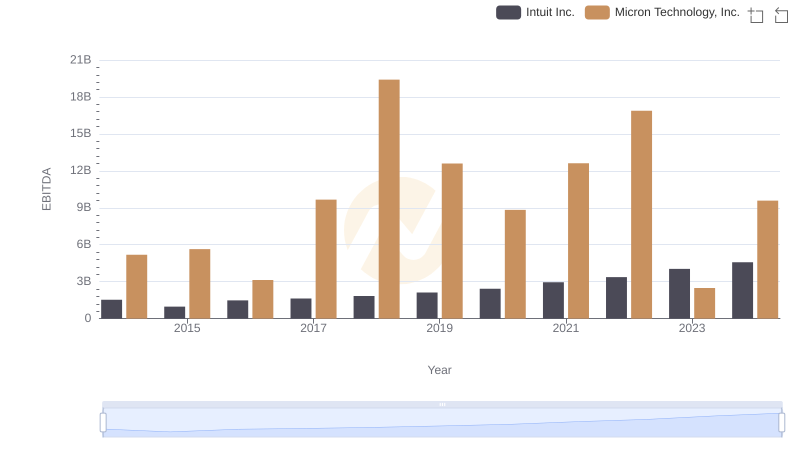

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Micron Technology, Inc.