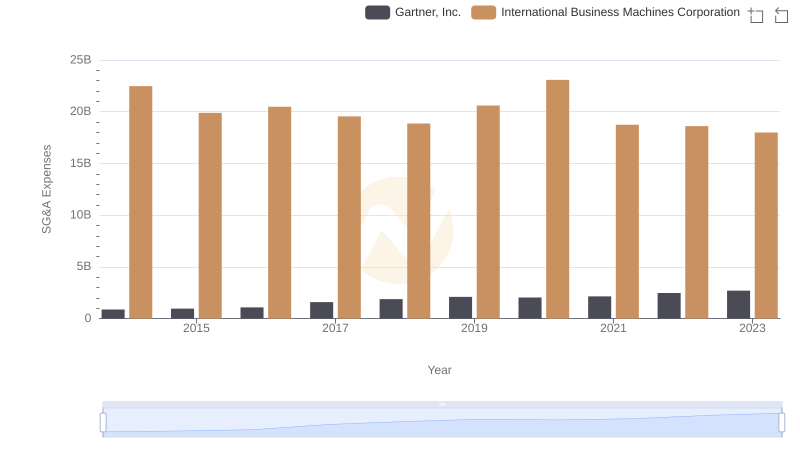

| __timestamp | International Business Machines Corporation | Take-Two Interactive Software, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 402370000 |

| Thursday, January 1, 2015 | 19894000000 | 410434000 |

| Friday, January 1, 2016 | 20279000000 | 390761000 |

| Sunday, January 1, 2017 | 19680000000 | 496862000 |

| Monday, January 1, 2018 | 19366000000 | 503920000 |

| Tuesday, January 1, 2019 | 18724000000 | 672634000 |

| Wednesday, January 1, 2020 | 20561000000 | 776659000 |

| Friday, January 1, 2021 | 18745000000 | 835668000 |

| Saturday, January 1, 2022 | 17483000000 | 1027284000 |

| Sunday, January 1, 2023 | 17997000000 | 2435700000 |

| Monday, January 1, 2024 | 29536000000 | 2266300000 |

Igniting the spark of knowledge

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, International Business Machines Corporation (IBM) and Take-Two Interactive Software, Inc. have showcased contrasting strategies in this domain.

From 2014 to 2024, IBM's SG&A expenses fluctuated, peaking in 2024 with a 42% increase from its lowest point in 2023. In contrast, Take-Two Interactive's expenses grew steadily, with a notable 500% surge from 2014 to 2023. This divergence highlights IBM's volatile cost management against Take-Two's consistent growth strategy.

While IBM's expenses are significantly higher, reflecting its vast operational scale, Take-Two's rising costs indicate aggressive expansion in the gaming industry. Understanding these trends offers valuable insights into how these companies navigate financial challenges and opportunities in their respective sectors.

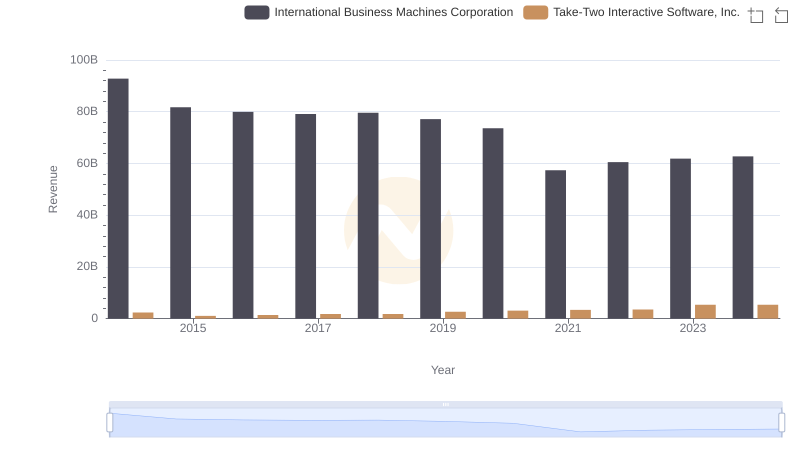

Breaking Down Revenue Trends: International Business Machines Corporation vs Take-Two Interactive Software, Inc.

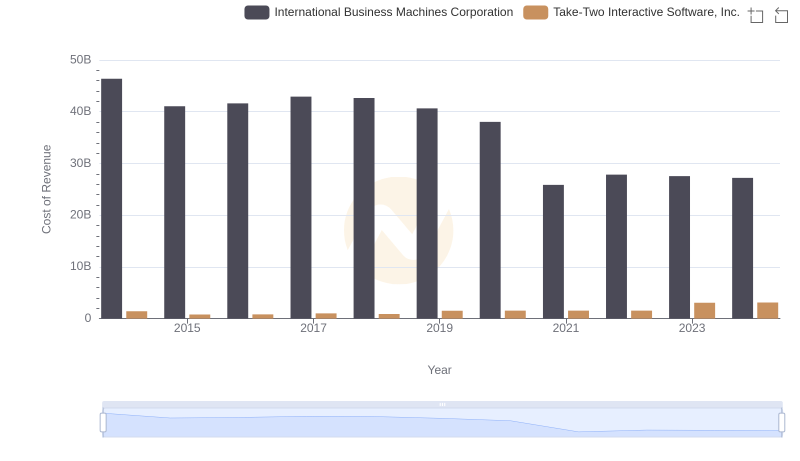

Cost of Revenue: Key Insights for International Business Machines Corporation and Take-Two Interactive Software, Inc.

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Gartner, Inc.

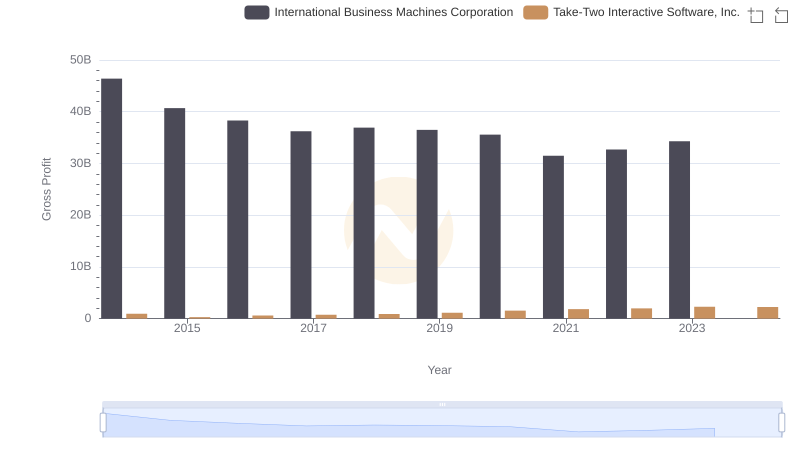

International Business Machines Corporation and Take-Two Interactive Software, Inc.: A Detailed Gross Profit Analysis

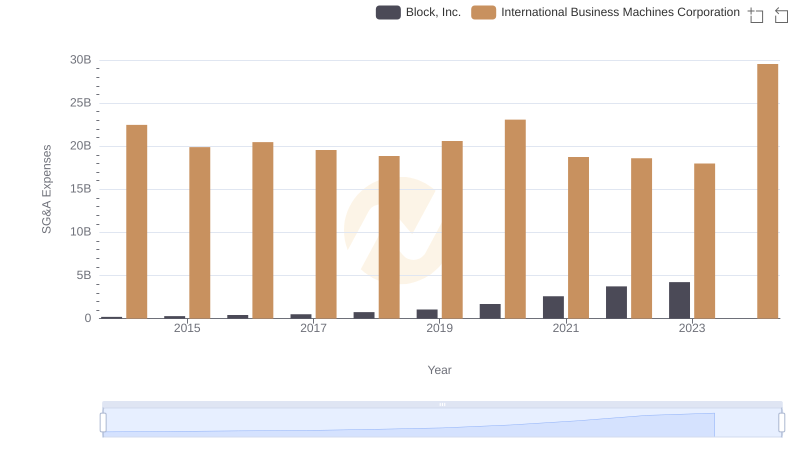

International Business Machines Corporation vs Block, Inc.: SG&A Expense Trends

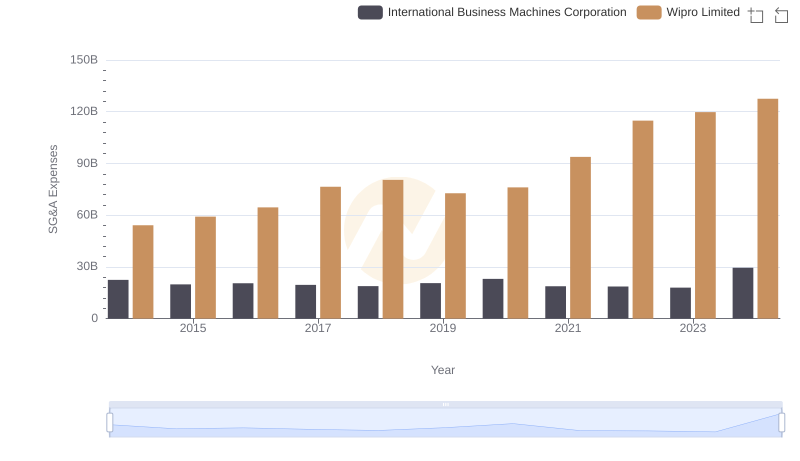

Selling, General, and Administrative Costs: International Business Machines Corporation vs Wipro Limited

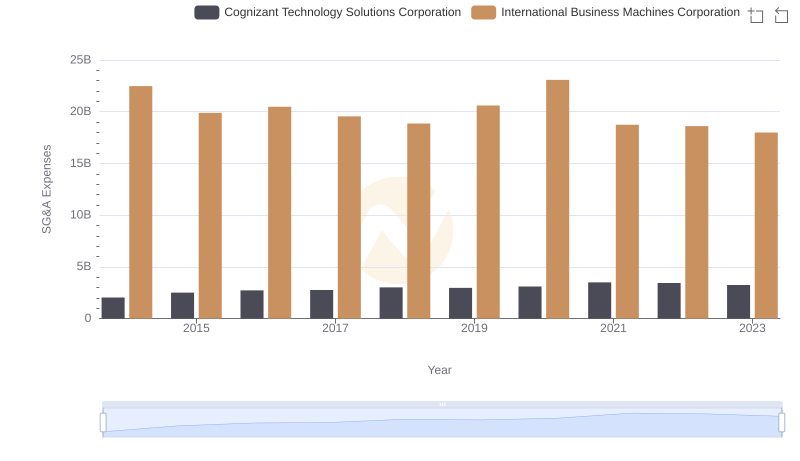

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Cognizant Technology Solutions Corporation

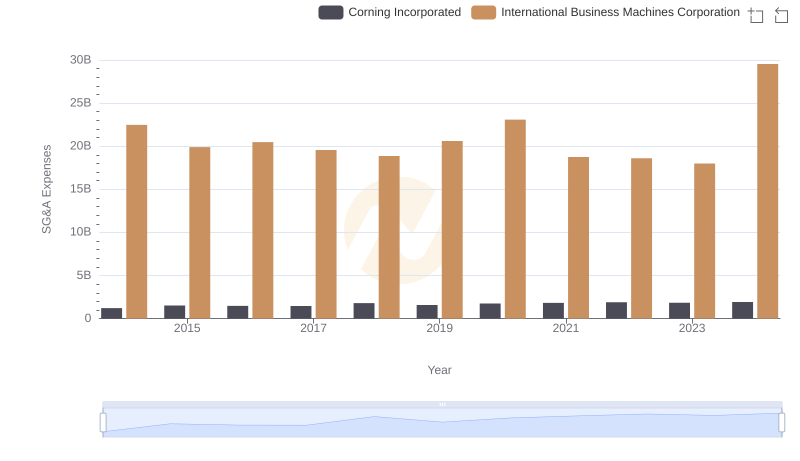

Selling, General, and Administrative Costs: International Business Machines Corporation vs Corning Incorporated

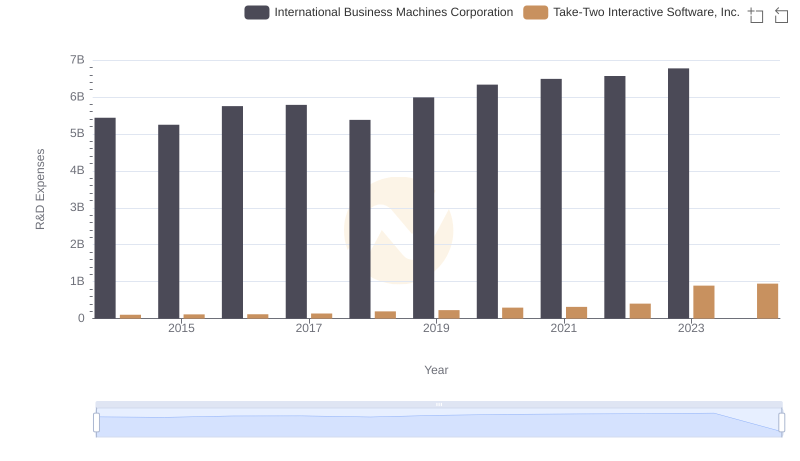

Research and Development Expenses Breakdown: International Business Machines Corporation vs Take-Two Interactive Software, Inc.

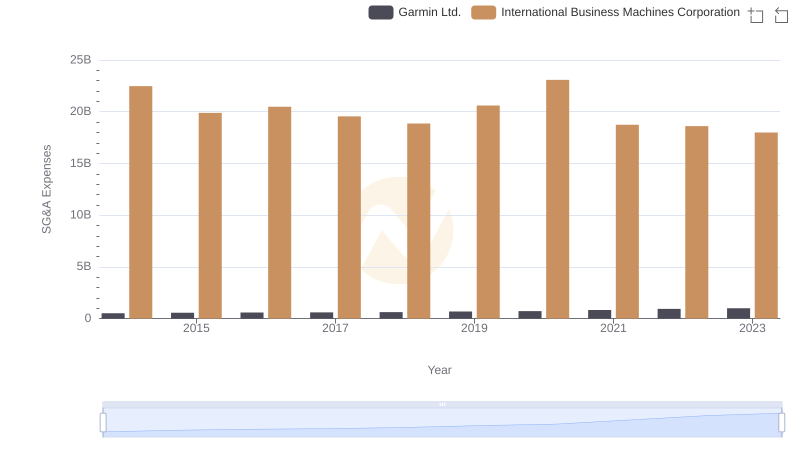

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Garmin Ltd.

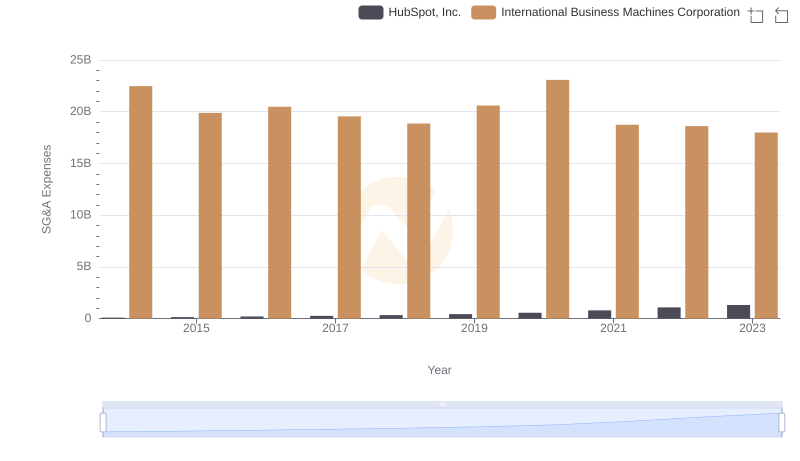

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and HubSpot, Inc.

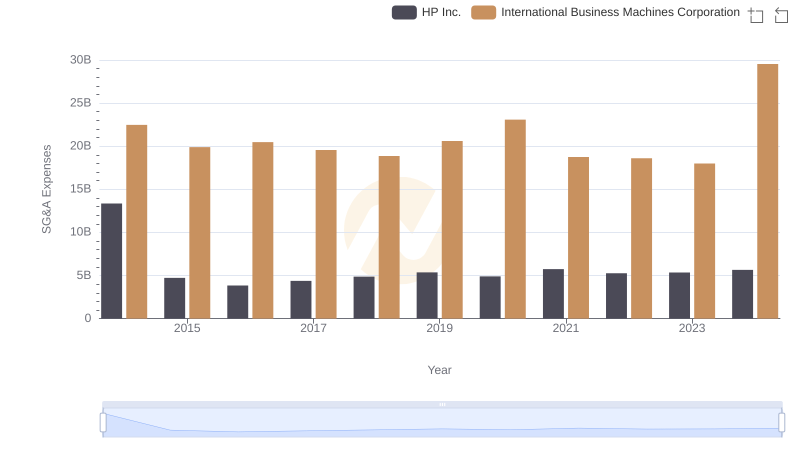

Breaking Down SG&A Expenses: International Business Machines Corporation vs HP Inc.