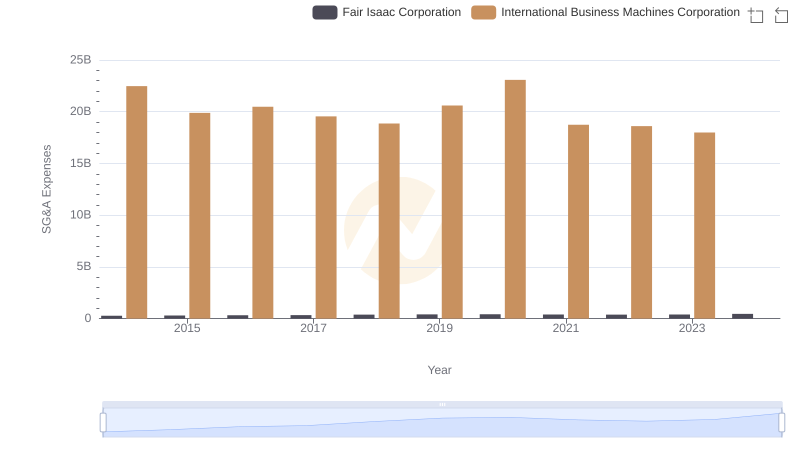

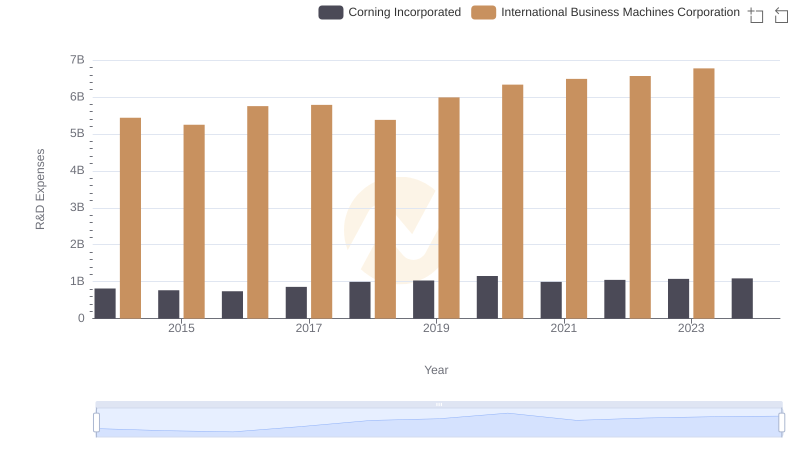

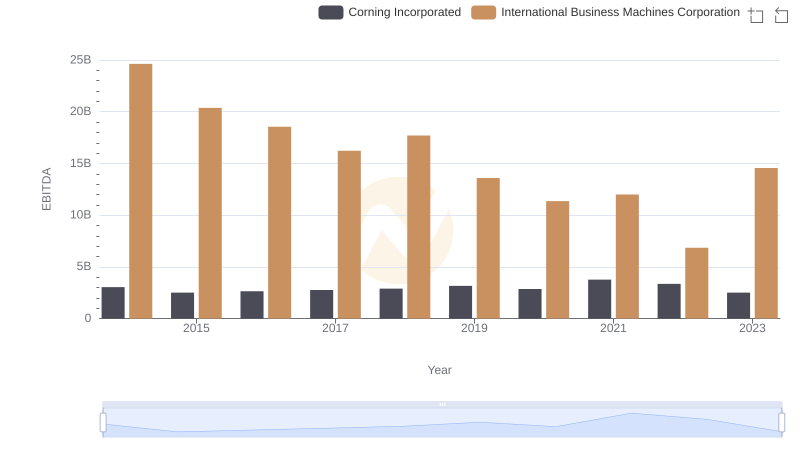

| __timestamp | Corning Incorporated | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1211000000 | 22472000000 |

| Thursday, January 1, 2015 | 1523000000 | 19894000000 |

| Friday, January 1, 2016 | 1472000000 | 20279000000 |

| Sunday, January 1, 2017 | 1467000000 | 19680000000 |

| Monday, January 1, 2018 | 1799000000 | 19366000000 |

| Tuesday, January 1, 2019 | 1585000000 | 18724000000 |

| Wednesday, January 1, 2020 | 1747000000 | 20561000000 |

| Friday, January 1, 2021 | 1827000000 | 18745000000 |

| Saturday, January 1, 2022 | 1898000000 | 17483000000 |

| Sunday, January 1, 2023 | 1843000000 | 17997000000 |

| Monday, January 1, 2024 | 1931000000 | 29536000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, International Business Machines Corporation (IBM) and Corning Incorporated have showcased distinct financial strategies. From 2014 to 2023, IBM's SG&A expenses have consistently dwarfed those of Corning, averaging nearly 12 times higher. This disparity highlights IBM's expansive operational scale and its commitment to maintaining a robust administrative framework.

Interestingly, while IBM's expenses peaked in 2024, reaching a staggering 29.5 billion, Corning's expenses have shown a steady growth, culminating in a 60% increase over the same period. This trend underscores Corning's strategic investments in innovation and market expansion. As businesses navigate the complexities of the modern economy, these insights into SG&A expenses offer a window into the strategic priorities and operational efficiencies of two industry giants.

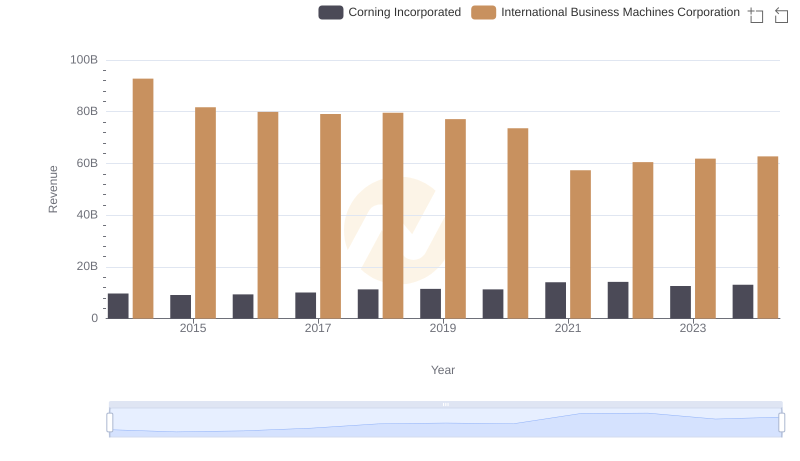

International Business Machines Corporation vs Corning Incorporated: Annual Revenue Growth Compared

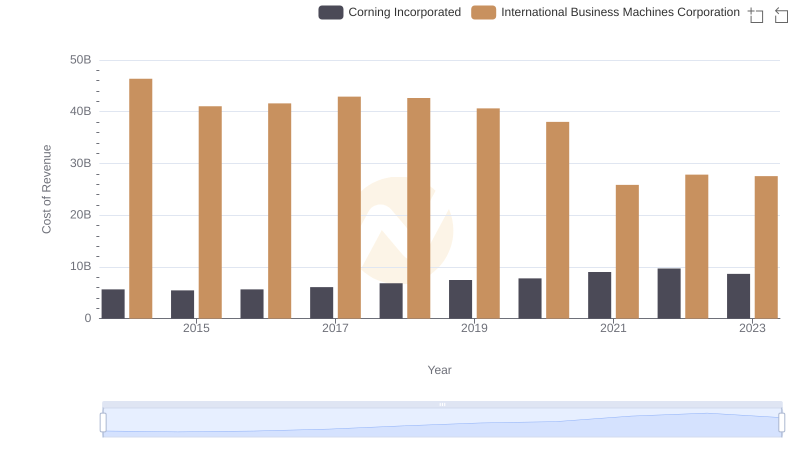

Cost of Revenue: Key Insights for International Business Machines Corporation and Corning Incorporated

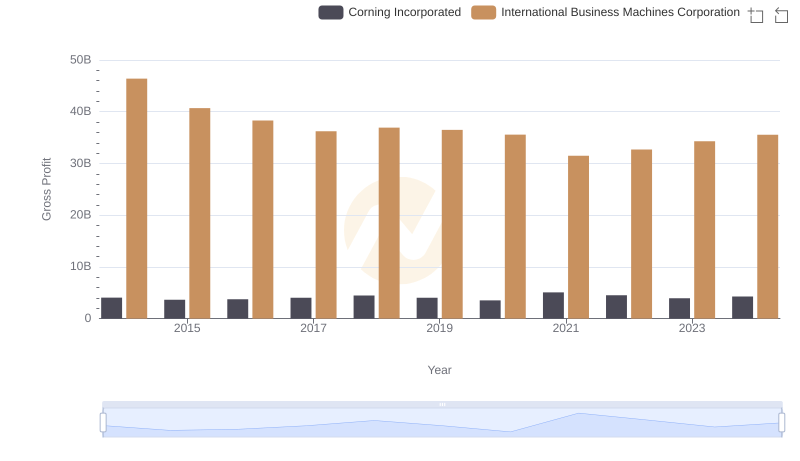

Key Insights on Gross Profit: International Business Machines Corporation vs Corning Incorporated

International Business Machines Corporation or Fair Isaac Corporation: Who Manages SG&A Costs Better?

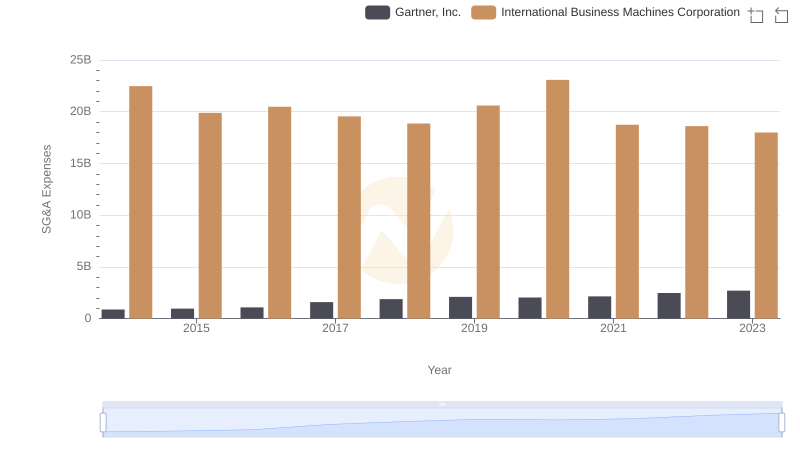

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Gartner, Inc.

Research and Development: Comparing Key Metrics for International Business Machines Corporation and Corning Incorporated

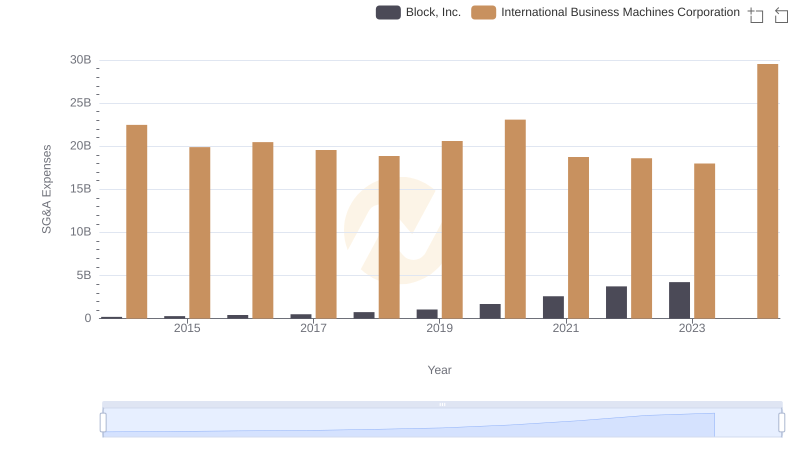

International Business Machines Corporation vs Block, Inc.: SG&A Expense Trends

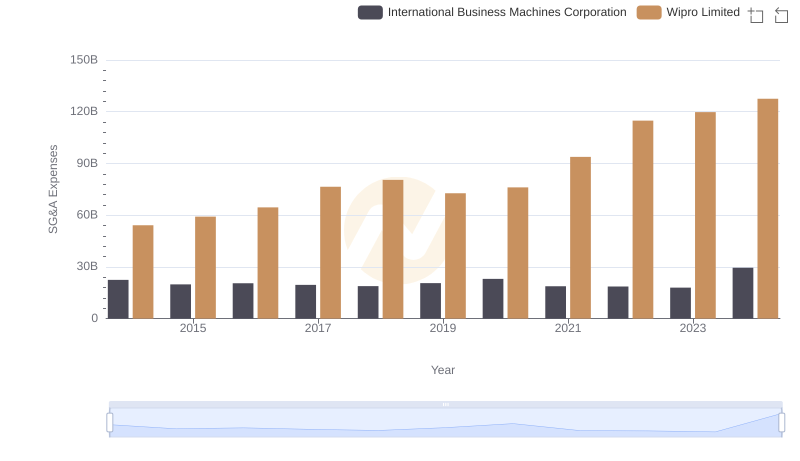

Selling, General, and Administrative Costs: International Business Machines Corporation vs Wipro Limited

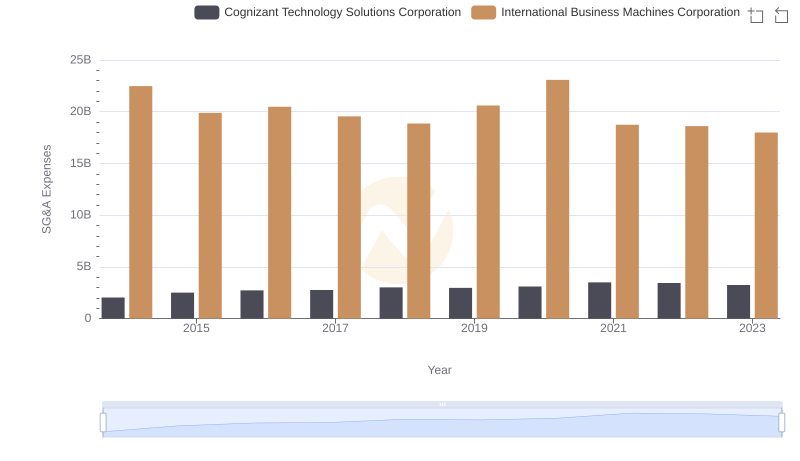

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Cognizant Technology Solutions Corporation

Comprehensive EBITDA Comparison: International Business Machines Corporation vs Corning Incorporated

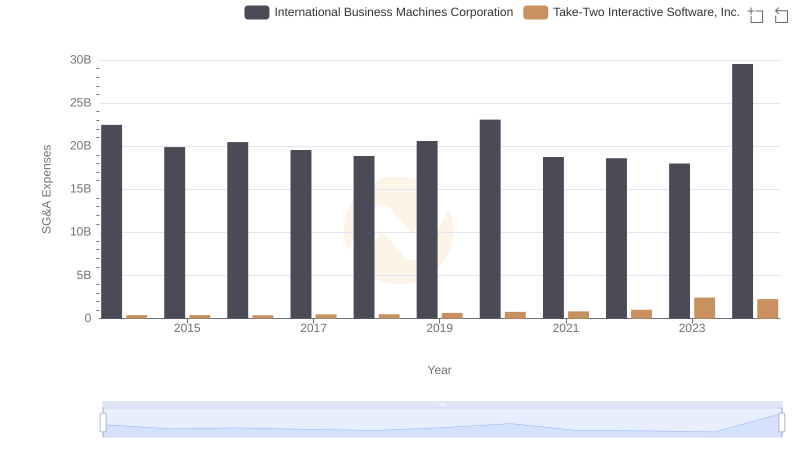

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Take-Two Interactive Software, Inc.

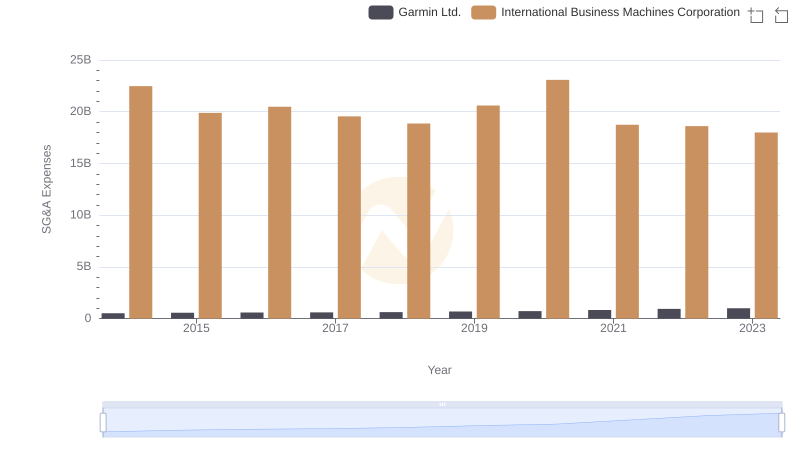

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Garmin Ltd.