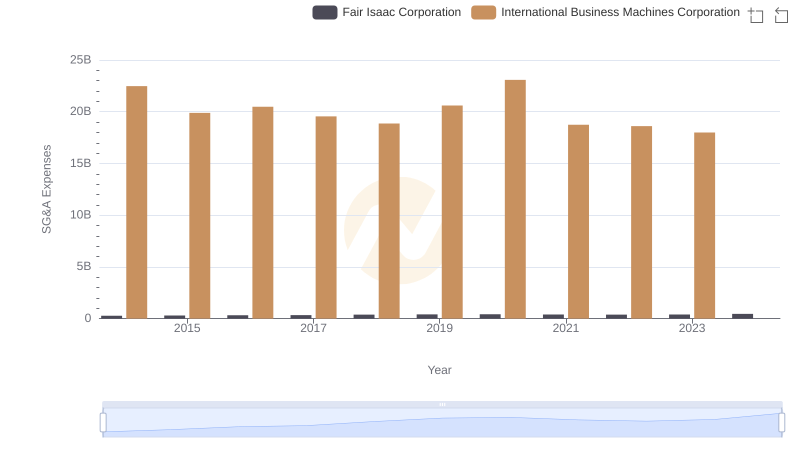

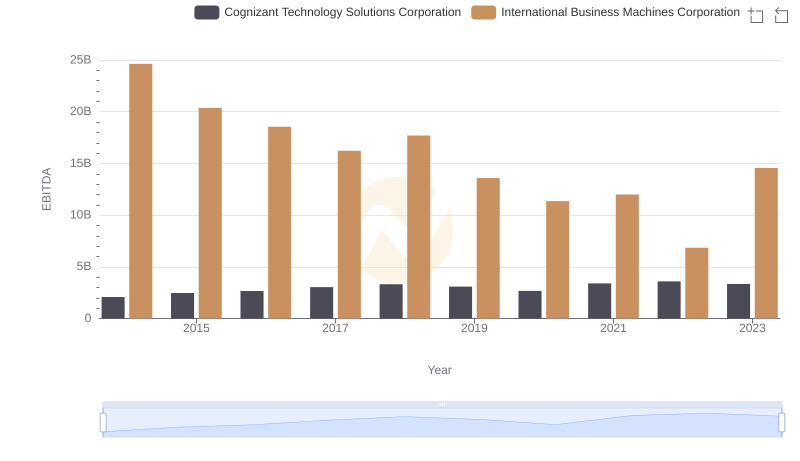

| __timestamp | Cognizant Technology Solutions Corporation | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2037021000 | 22472000000 |

| Thursday, January 1, 2015 | 2508600000 | 19894000000 |

| Friday, January 1, 2016 | 2731000000 | 20279000000 |

| Sunday, January 1, 2017 | 2769000000 | 19680000000 |

| Monday, January 1, 2018 | 3026000000 | 19366000000 |

| Tuesday, January 1, 2019 | 2972000000 | 18724000000 |

| Wednesday, January 1, 2020 | 3100000000 | 20561000000 |

| Friday, January 1, 2021 | 3503000000 | 18745000000 |

| Saturday, January 1, 2022 | 3443000000 | 17483000000 |

| Sunday, January 1, 2023 | 3252000000 | 17997000000 |

| Monday, January 1, 2024 | 3223000000 | 29536000000 |

Infusing magic into the data realm

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, International Business Machines Corporation (IBM) and Cognizant Technology Solutions Corporation have showcased contrasting strategies in this domain. From 2014 to 2023, IBM's SG&A expenses have consistently been higher, peaking at nearly $30 billion in 2024, while Cognizant's expenses remained below $4 billion annually. This disparity highlights IBM's expansive operational scale compared to Cognizant's more streamlined approach. Interestingly, IBM's expenses saw a significant drop of about 20% from 2014 to 2023, indicating a strategic shift towards cost optimization. Meanwhile, Cognizant's expenses grew by approximately 60% during the same period, reflecting its aggressive expansion strategy. These trends underscore the diverse paths these tech giants have taken in navigating the ever-evolving market landscape.

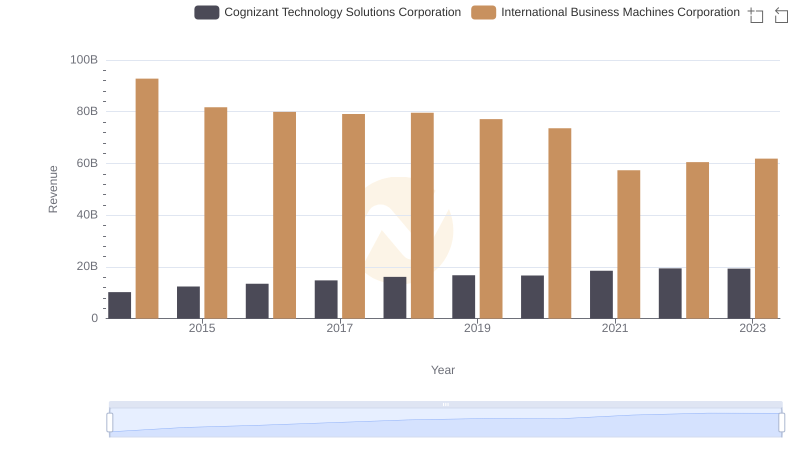

Breaking Down Revenue Trends: International Business Machines Corporation vs Cognizant Technology Solutions Corporation

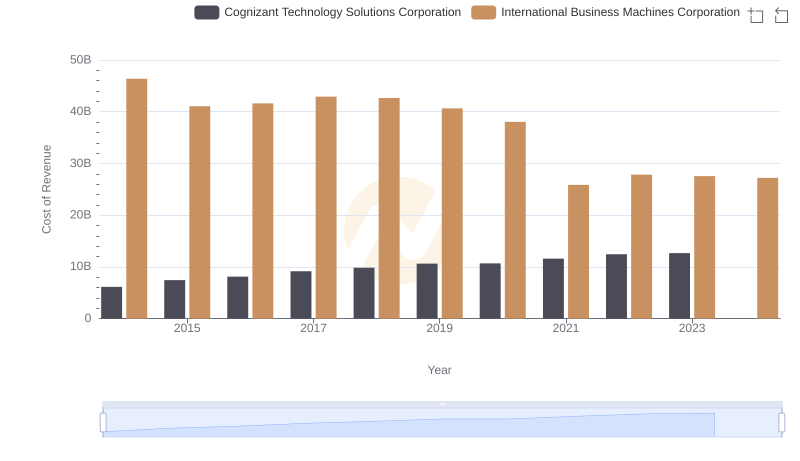

Analyzing Cost of Revenue: International Business Machines Corporation and Cognizant Technology Solutions Corporation

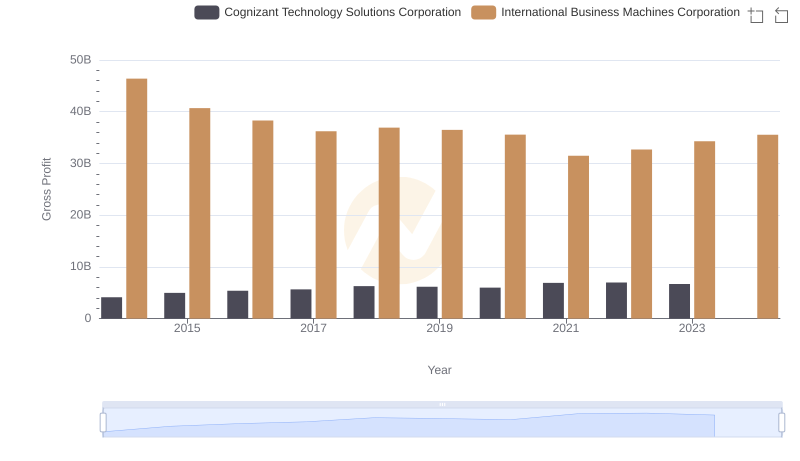

International Business Machines Corporation vs Cognizant Technology Solutions Corporation: A Gross Profit Performance Breakdown

International Business Machines Corporation or Fair Isaac Corporation: Who Manages SG&A Costs Better?

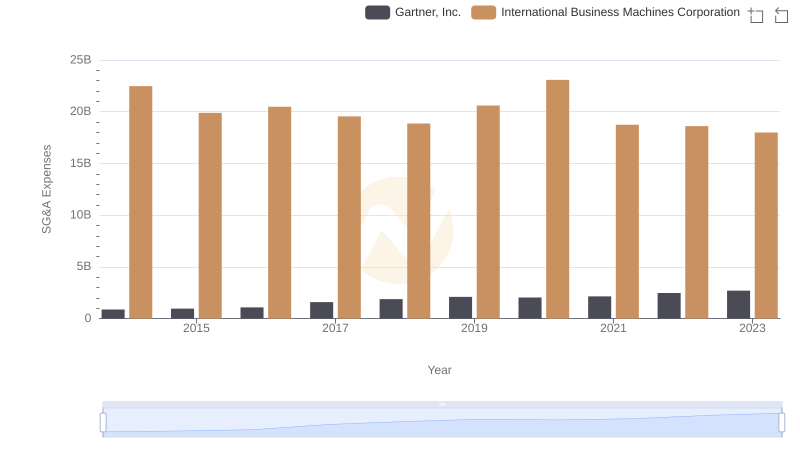

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Gartner, Inc.

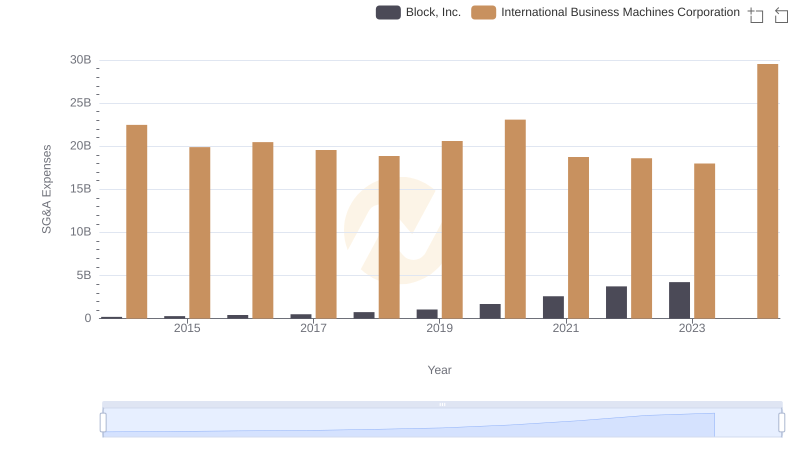

International Business Machines Corporation vs Block, Inc.: SG&A Expense Trends

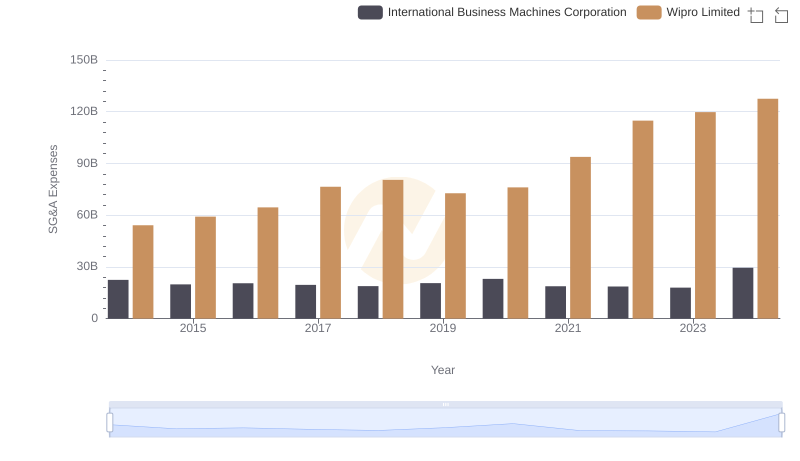

Selling, General, and Administrative Costs: International Business Machines Corporation vs Wipro Limited

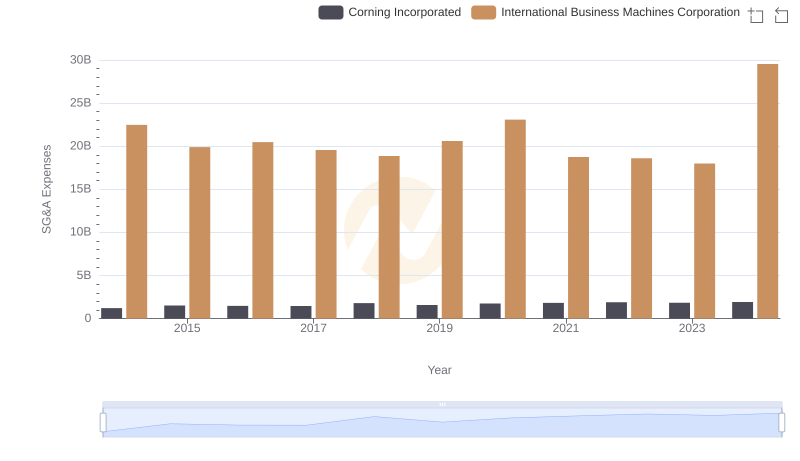

Selling, General, and Administrative Costs: International Business Machines Corporation vs Corning Incorporated

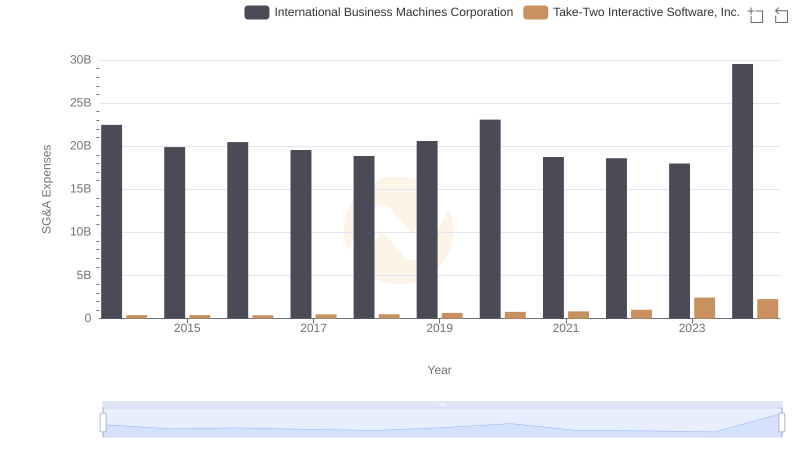

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Take-Two Interactive Software, Inc.

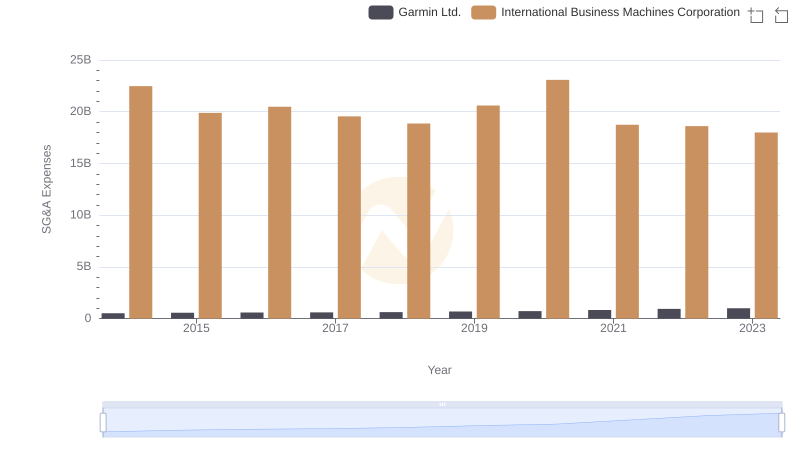

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Garmin Ltd.

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and Cognizant Technology Solutions Corporation

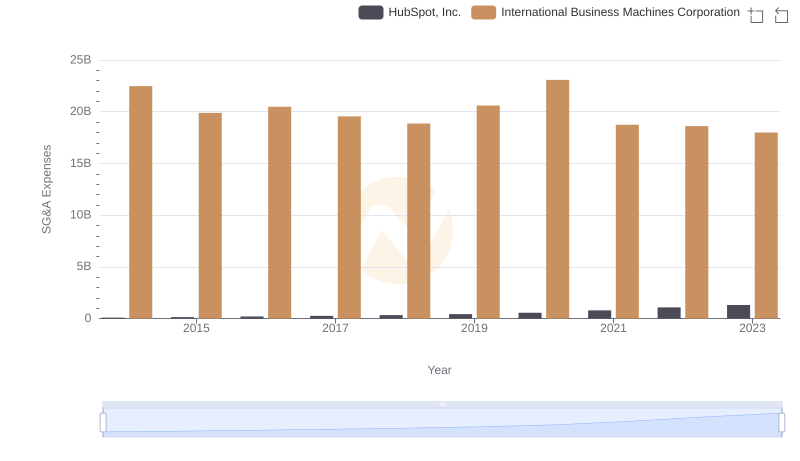

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and HubSpot, Inc.