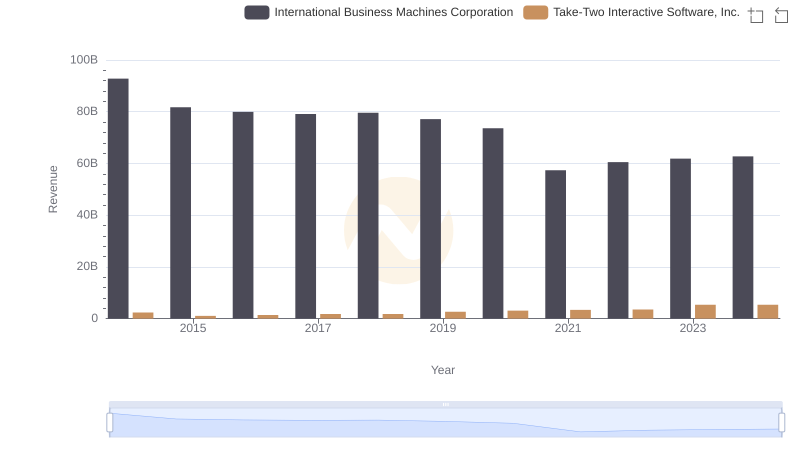

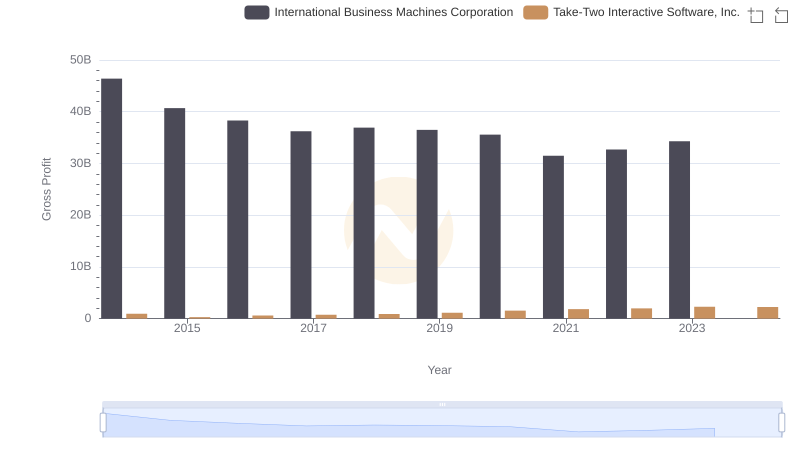

| __timestamp | International Business Machines Corporation | Take-Two Interactive Software, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46386000000 | 1414327000 |

| Thursday, January 1, 2015 | 41057000000 | 794867000 |

| Friday, January 1, 2016 | 41403000000 | 813873000 |

| Sunday, January 1, 2017 | 42196000000 | 1022959000 |

| Monday, January 1, 2018 | 42655000000 | 898311000 |

| Tuesday, January 1, 2019 | 26181000000 | 1523644000 |

| Wednesday, January 1, 2020 | 24314000000 | 1542450000 |

| Friday, January 1, 2021 | 25865000000 | 1535085000 |

| Saturday, January 1, 2022 | 27842000000 | 1535401000 |

| Sunday, January 1, 2023 | 27560000000 | 3064600000 |

| Monday, January 1, 2024 | 27202000000 | 3107800000 |

Unleashing the power of data

In the ever-evolving landscape of technology and entertainment, understanding cost structures is crucial. From 2014 to 2024, International Business Machines Corporation (IBM) and Take-Two Interactive Software, Inc. have shown contrasting trends in their cost of revenue. IBM, a stalwart in the tech industry, saw a significant decline of approximately 41% in its cost of revenue, dropping from 46.4 billion in 2014 to 27.2 billion in 2024. This reduction reflects IBM's strategic shift towards more efficient operations and possibly a focus on higher-margin services.

Conversely, Take-Two Interactive, a leader in the gaming industry, experienced a remarkable increase of over 120% in its cost of revenue, rising from 1.4 billion in 2014 to 3.1 billion in 2024. This surge aligns with the company's expansion and investment in blockbuster gaming titles. These insights highlight the dynamic nature of cost management in different sectors.

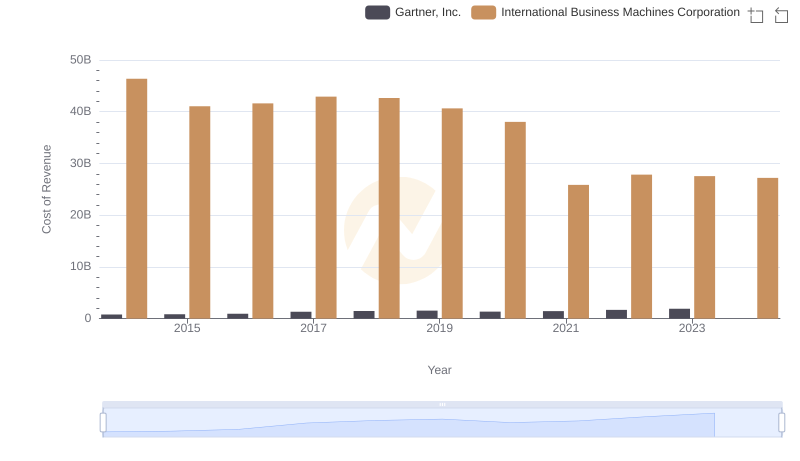

Cost Insights: Breaking Down International Business Machines Corporation and Gartner, Inc.'s Expenses

Breaking Down Revenue Trends: International Business Machines Corporation vs Take-Two Interactive Software, Inc.

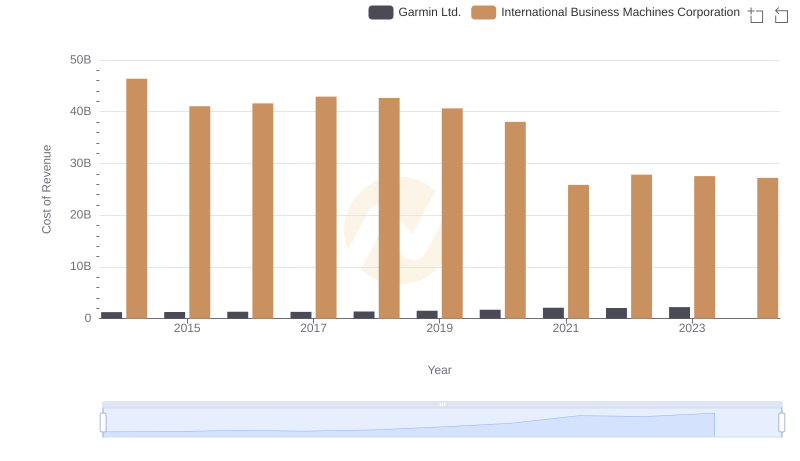

Cost of Revenue Comparison: International Business Machines Corporation vs Garmin Ltd.

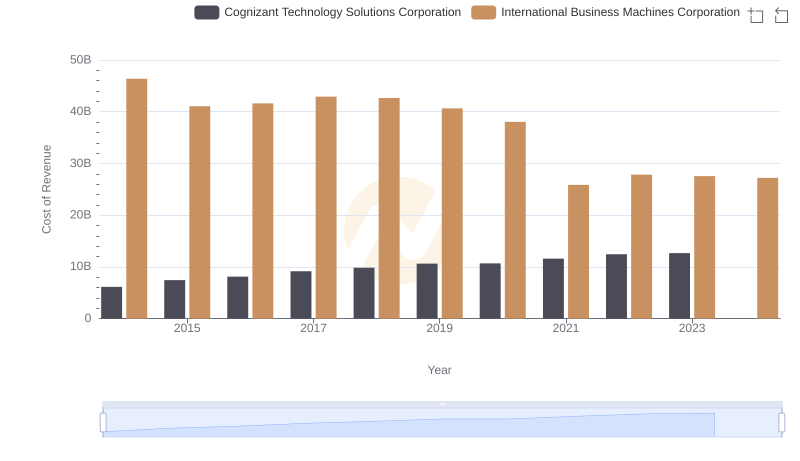

Analyzing Cost of Revenue: International Business Machines Corporation and Cognizant Technology Solutions Corporation

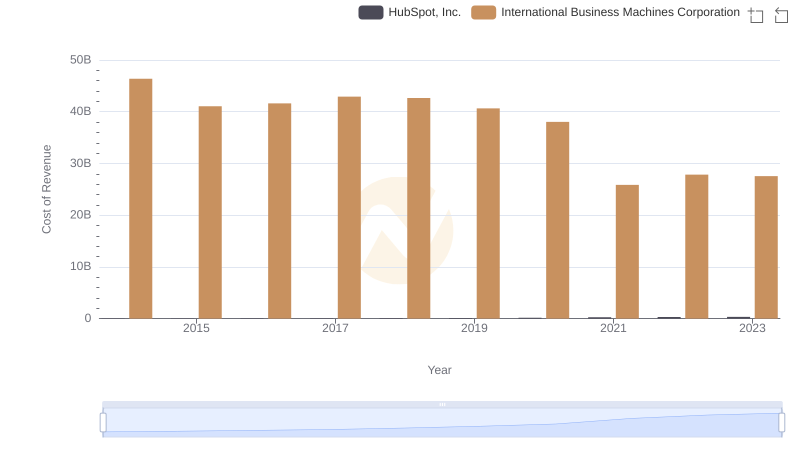

Cost of Revenue Trends: International Business Machines Corporation vs HubSpot, Inc.

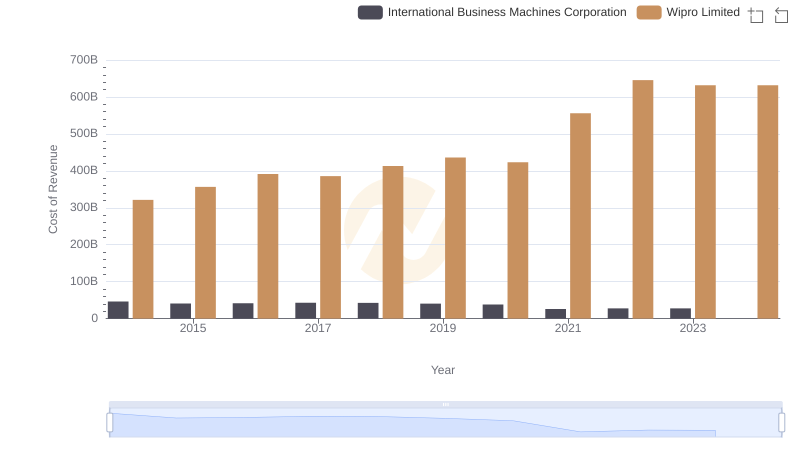

Analyzing Cost of Revenue: International Business Machines Corporation and Wipro Limited

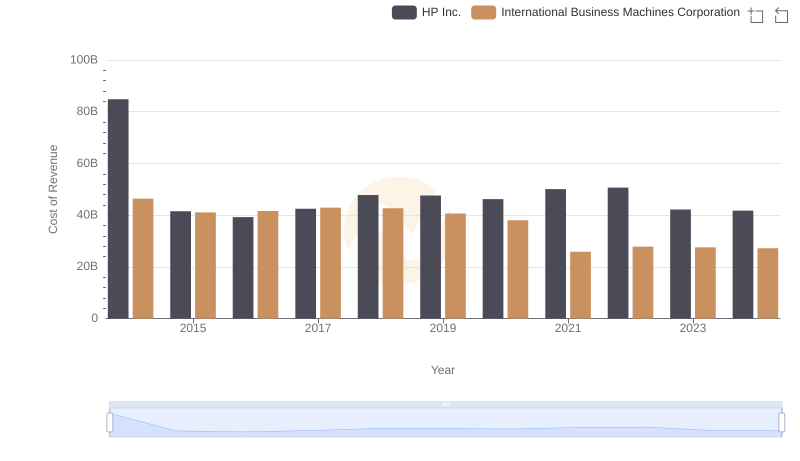

Cost of Revenue: Key Insights for International Business Machines Corporation and HP Inc.

International Business Machines Corporation and Take-Two Interactive Software, Inc.: A Detailed Gross Profit Analysis

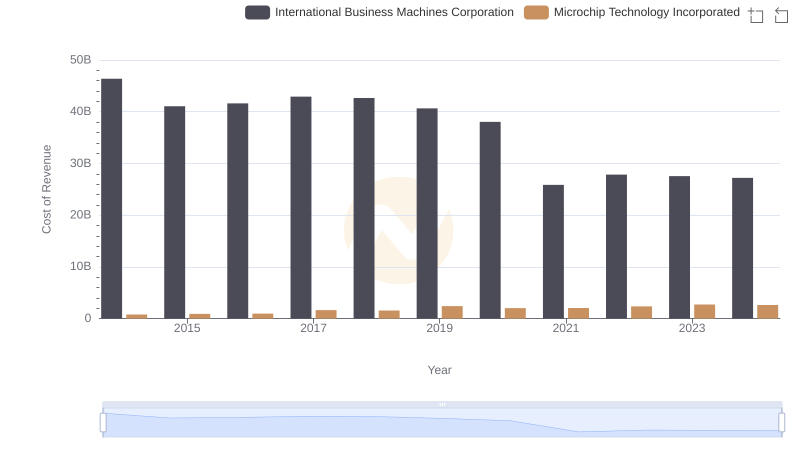

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Microchip Technology Incorporated

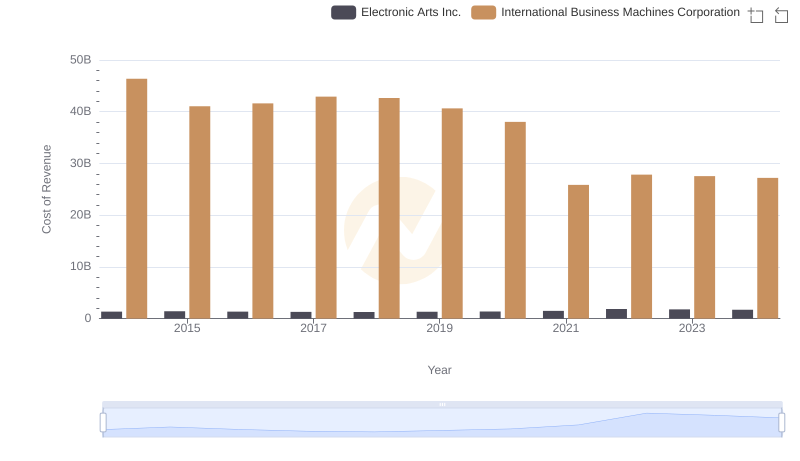

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Electronic Arts Inc.

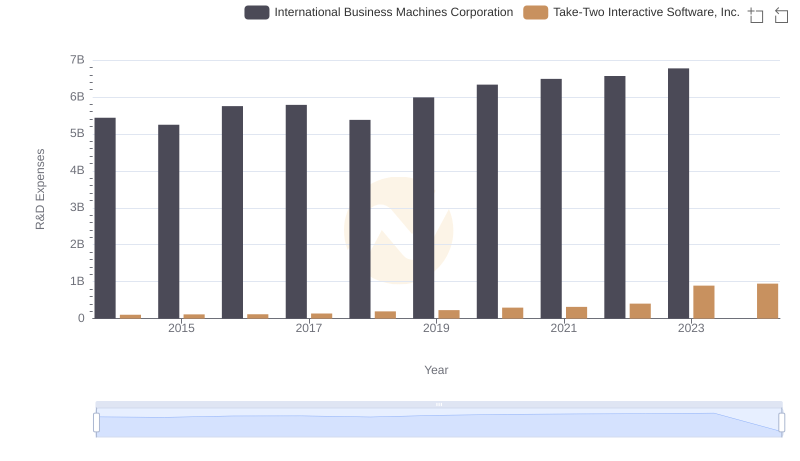

Research and Development Expenses Breakdown: International Business Machines Corporation vs Take-Two Interactive Software, Inc.

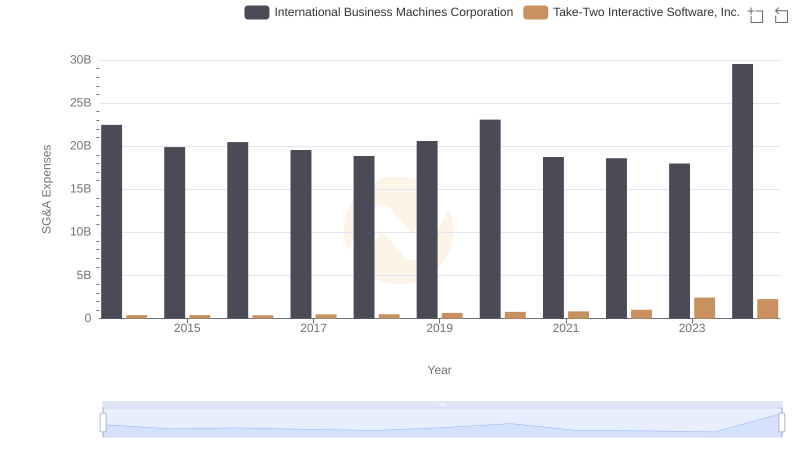

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Take-Two Interactive Software, Inc.