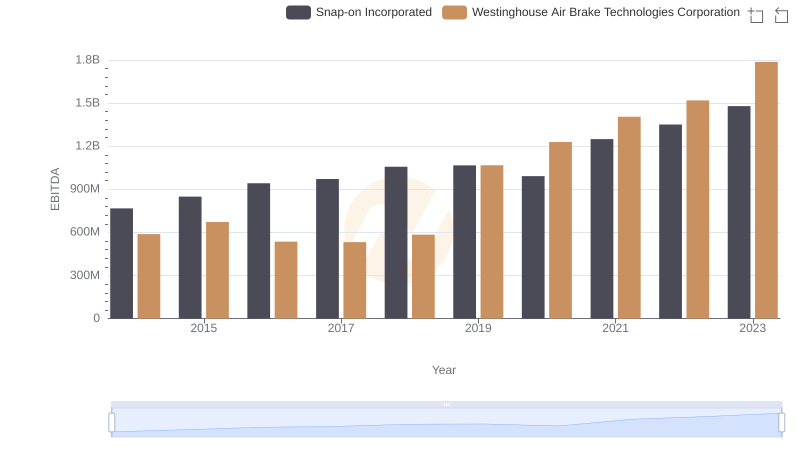

| __timestamp | Snap-on Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1047900000 | 324539000 |

| Thursday, January 1, 2015 | 1009100000 | 319173000 |

| Friday, January 1, 2016 | 1001400000 | 327505000 |

| Sunday, January 1, 2017 | 1101300000 | 482852000 |

| Monday, January 1, 2018 | 1080700000 | 573644000 |

| Tuesday, January 1, 2019 | 1071500000 | 936600000 |

| Wednesday, January 1, 2020 | 1054800000 | 877100000 |

| Friday, January 1, 2021 | 1202300000 | 1005000000 |

| Saturday, January 1, 2022 | 1181200000 | 1020000000 |

| Sunday, January 1, 2023 | 1249000000 | 1139000000 |

| Monday, January 1, 2024 | 0 | 1248000000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Snap-on Incorporated and Westinghouse Air Brake Technologies Corporation have demonstrated distinct trajectories in managing these costs.

From 2014 to 2023, Snap-on Incorporated consistently maintained higher SG&A expenses, peaking at approximately 1.25 billion in 2023. This represents a 19% increase from 2014, reflecting strategic investments in operational efficiency. In contrast, Westinghouse Air Brake Technologies Corporation saw a more dramatic rise, with SG&A expenses surging by 251% over the same period, reaching 1.14 billion in 2023.

These trends highlight differing corporate strategies: Snap-on's steady growth versus Westinghouse's aggressive expansion. As businesses navigate the complexities of the modern market, these insights offer valuable lessons in balancing cost management with growth ambitions.

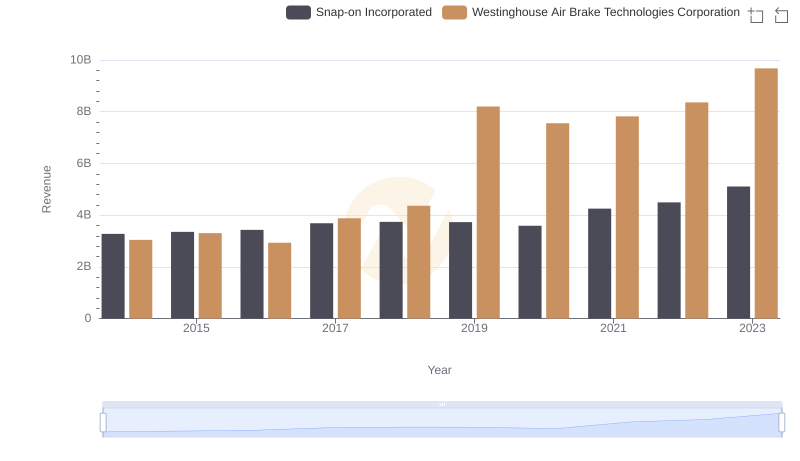

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Performance Compared

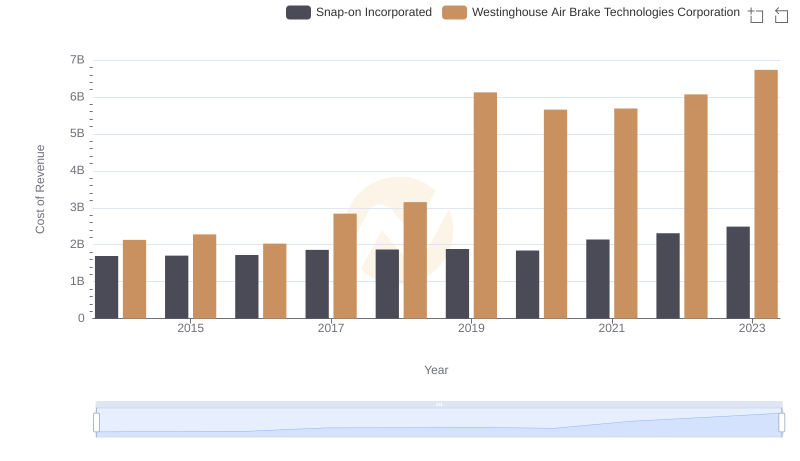

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Snap-on Incorporated

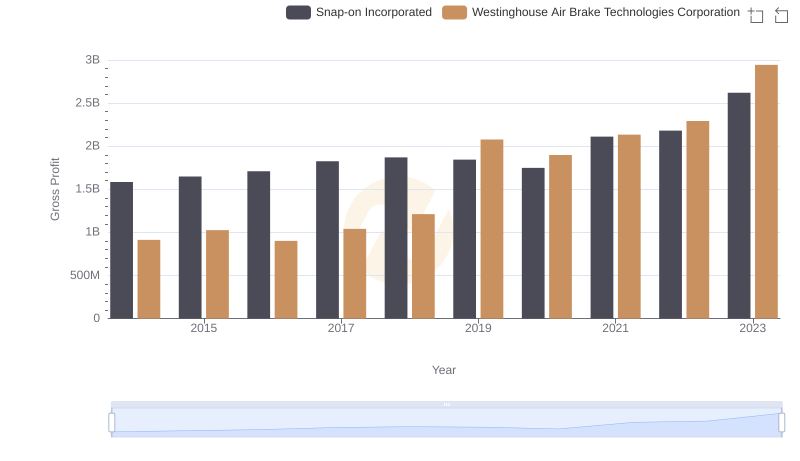

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

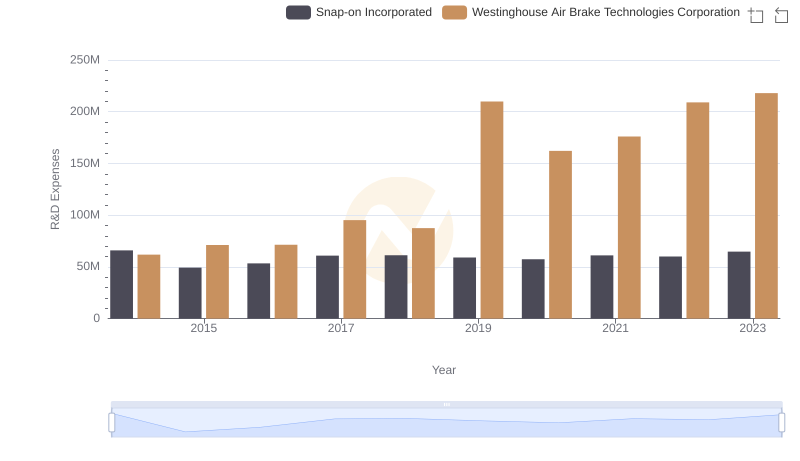

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Allocate Funds

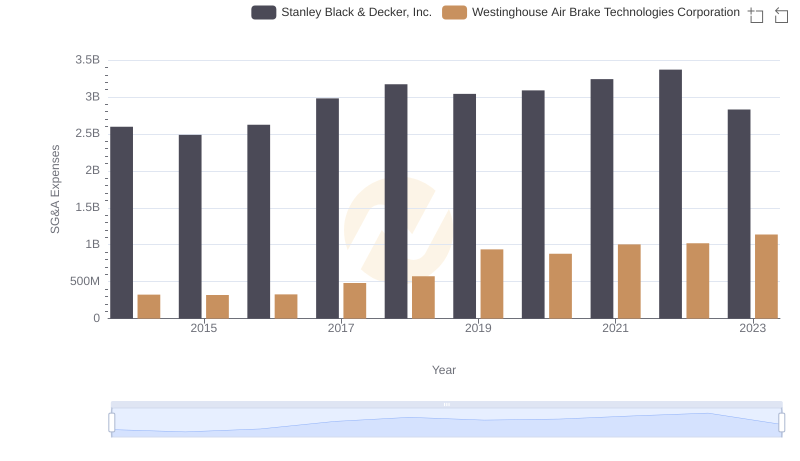

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

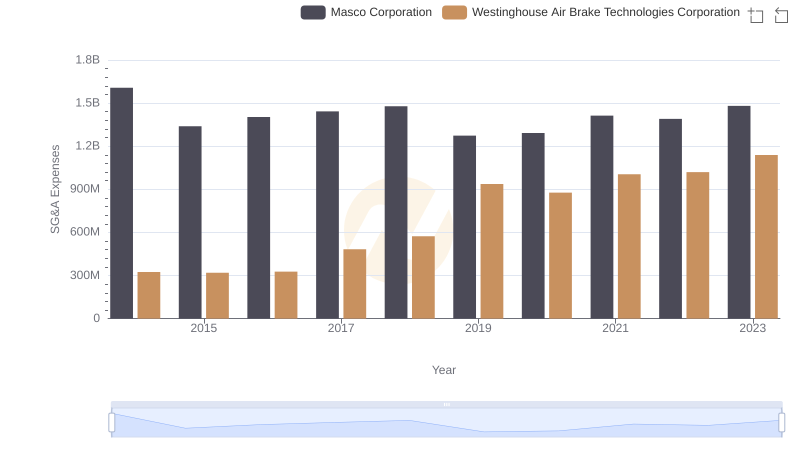

Westinghouse Air Brake Technologies Corporation or Masco Corporation: Who Manages SG&A Costs Better?

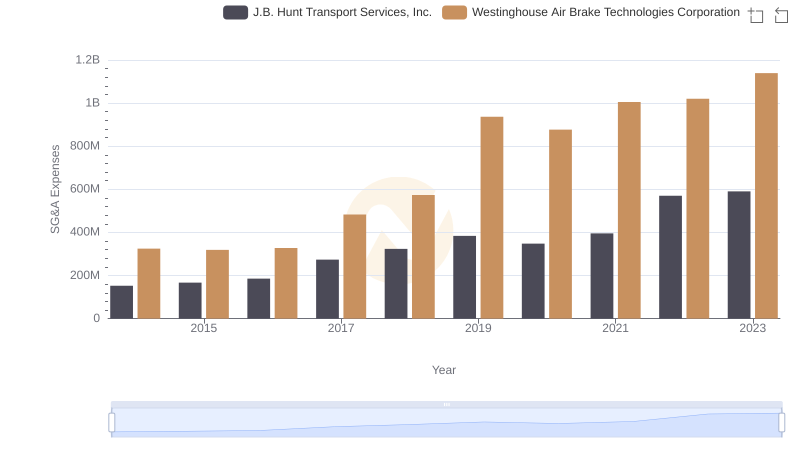

Westinghouse Air Brake Technologies Corporation and J.B. Hunt Transport Services, Inc.: SG&A Spending Patterns Compared

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation

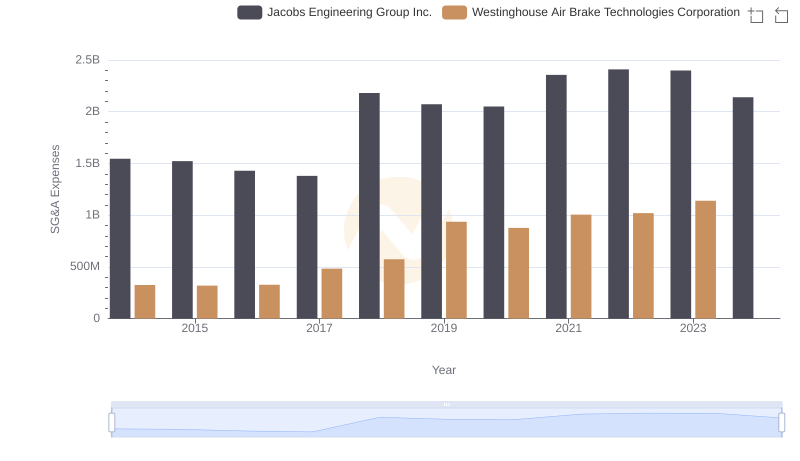

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc. Trends and Insights

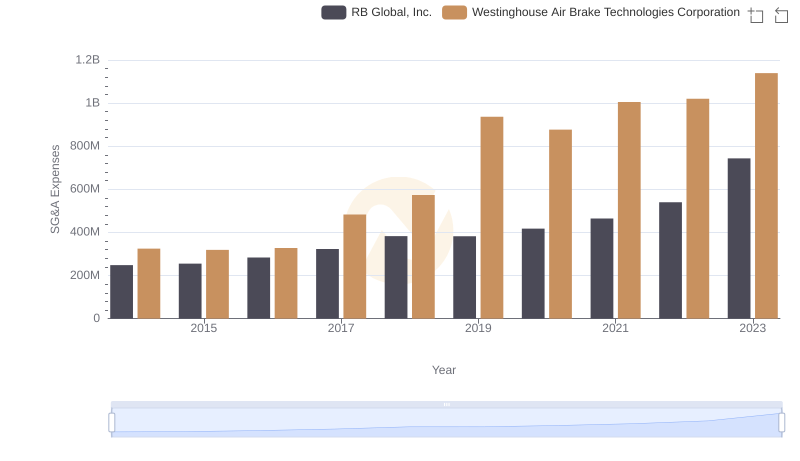

Westinghouse Air Brake Technologies Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

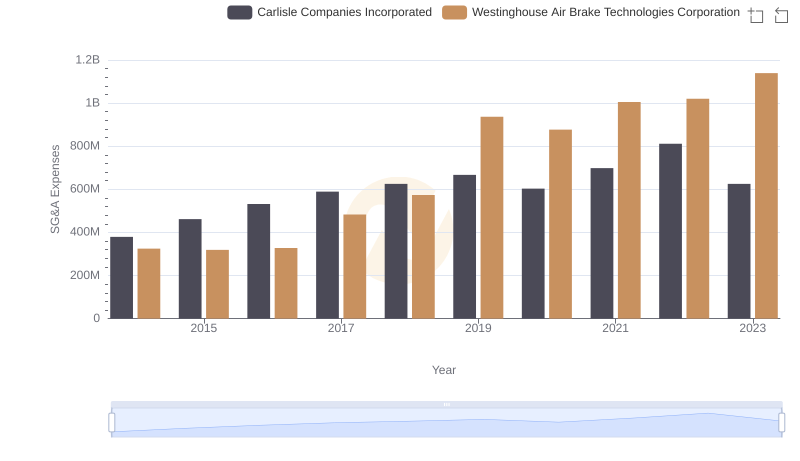

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against Snap-on Incorporated