| __timestamp | J.B. Hunt Transport Services, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 152469000 | 324539000 |

| Thursday, January 1, 2015 | 166799000 | 319173000 |

| Friday, January 1, 2016 | 185436000 | 327505000 |

| Sunday, January 1, 2017 | 273440000 | 482852000 |

| Monday, January 1, 2018 | 323587000 | 573644000 |

| Tuesday, January 1, 2019 | 383981000 | 936600000 |

| Wednesday, January 1, 2020 | 348076000 | 877100000 |

| Friday, January 1, 2021 | 395533000 | 1005000000 |

| Saturday, January 1, 2022 | 570191000 | 1020000000 |

| Sunday, January 1, 2023 | 590242000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Unleashing insights

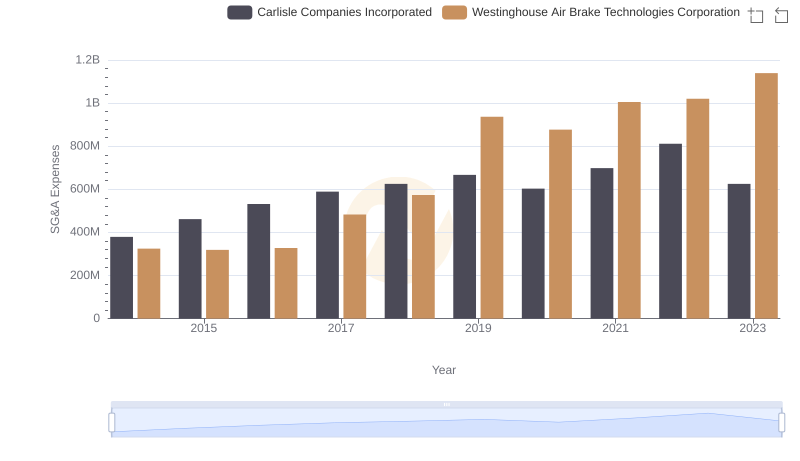

In the world of transportation and technology, understanding the financial strategies of industry leaders is crucial. Over the past decade, Westinghouse Air Brake Technologies Corporation and J.B. Hunt Transport Services, Inc. have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, Westinghouse's SG&A expenses surged by approximately 250%, peaking at over $1.1 billion in 2023. This reflects their aggressive expansion and investment in innovation. In contrast, J.B. Hunt's SG&A expenses grew by nearly 290%, reaching around $590 million in the same period, indicating a steady yet robust growth strategy.

These patterns highlight the diverse approaches of these companies in managing operational costs while navigating the competitive landscape. As they continue to evolve, their financial strategies will undoubtedly play a pivotal role in shaping their future trajectories.

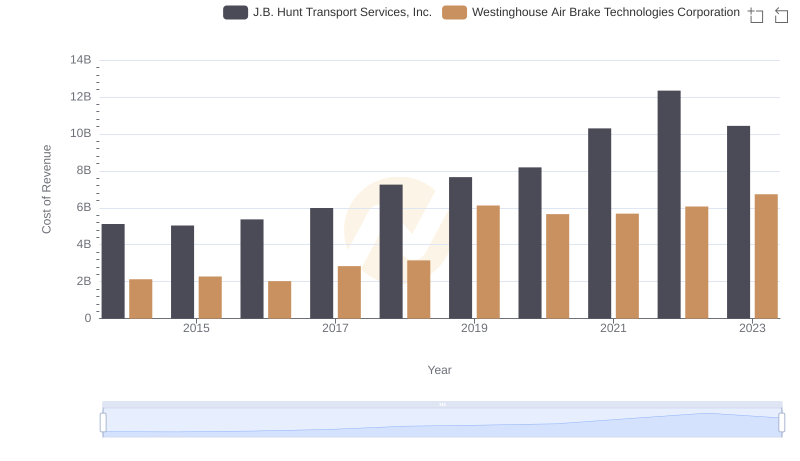

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs J.B. Hunt Transport Services, Inc.

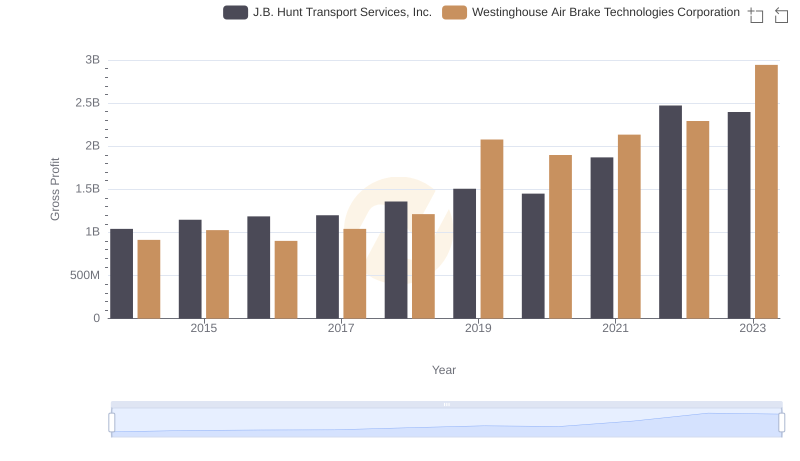

Westinghouse Air Brake Technologies Corporation vs J.B. Hunt Transport Services, Inc.: A Gross Profit Performance Breakdown

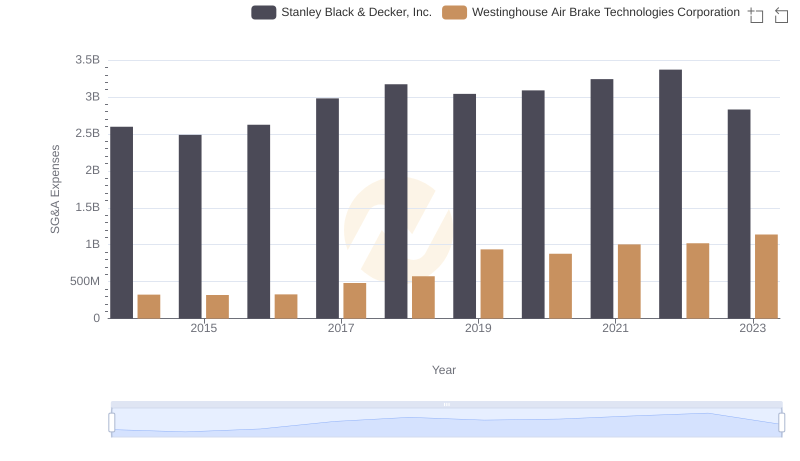

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

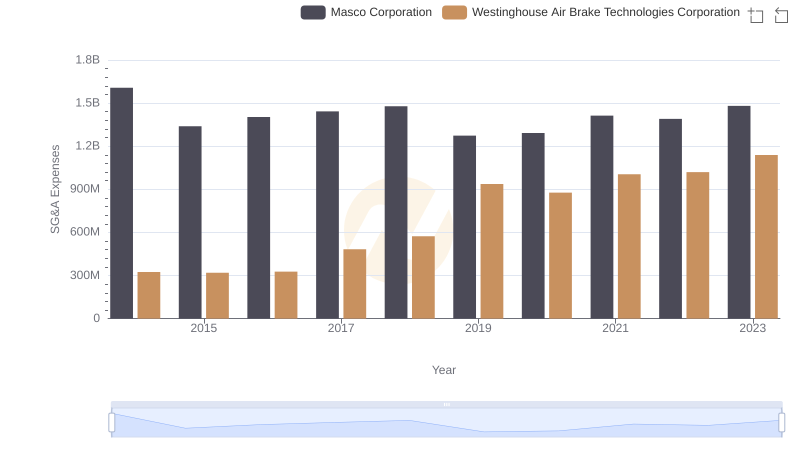

Westinghouse Air Brake Technologies Corporation or Masco Corporation: Who Manages SG&A Costs Better?

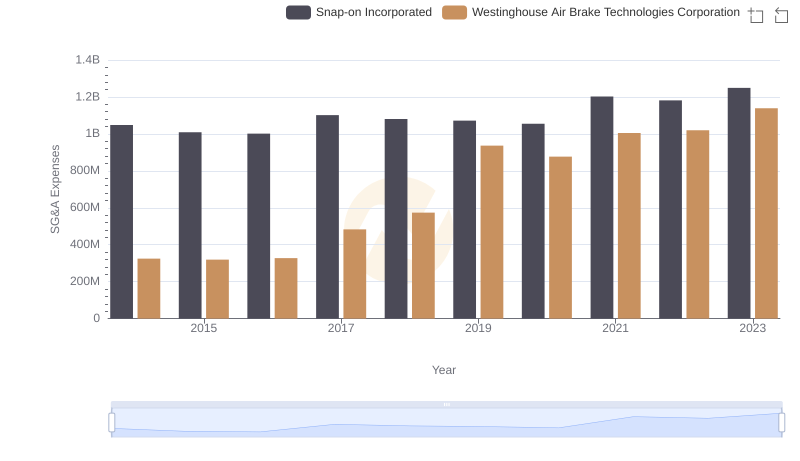

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

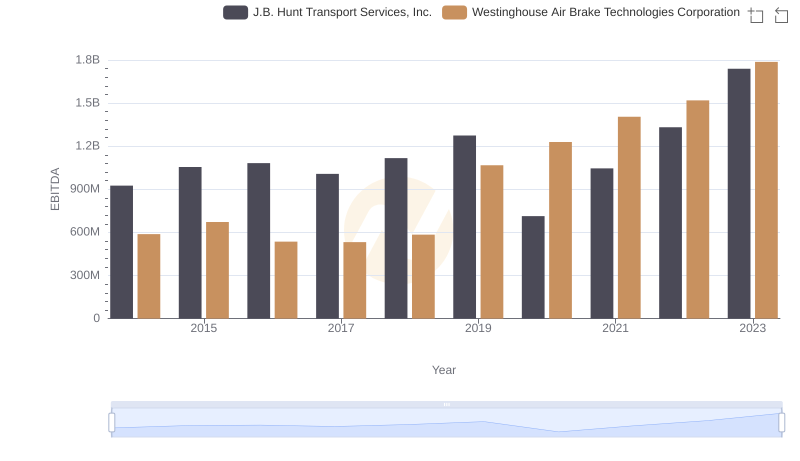

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to J.B. Hunt Transport Services, Inc.

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation

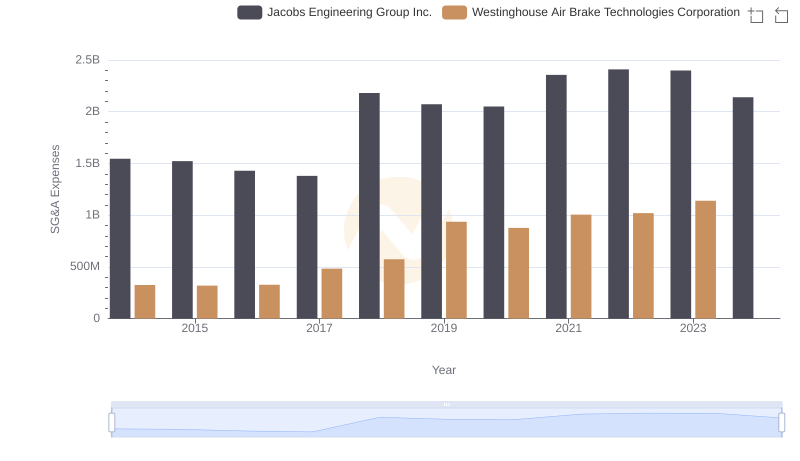

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc. Trends and Insights

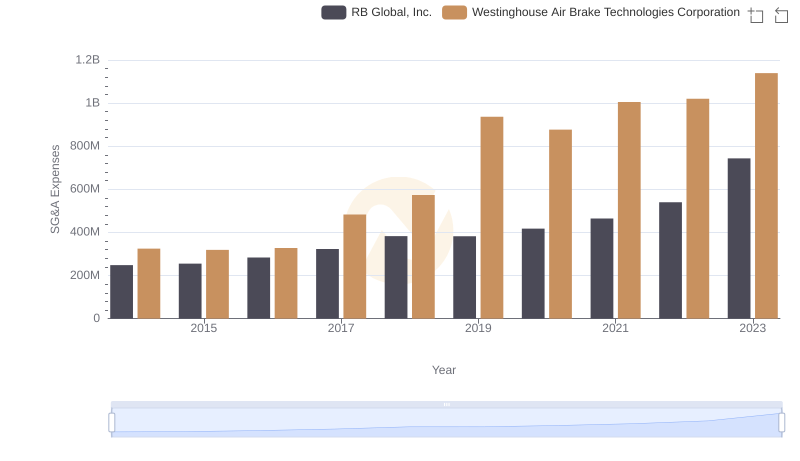

Westinghouse Air Brake Technologies Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated