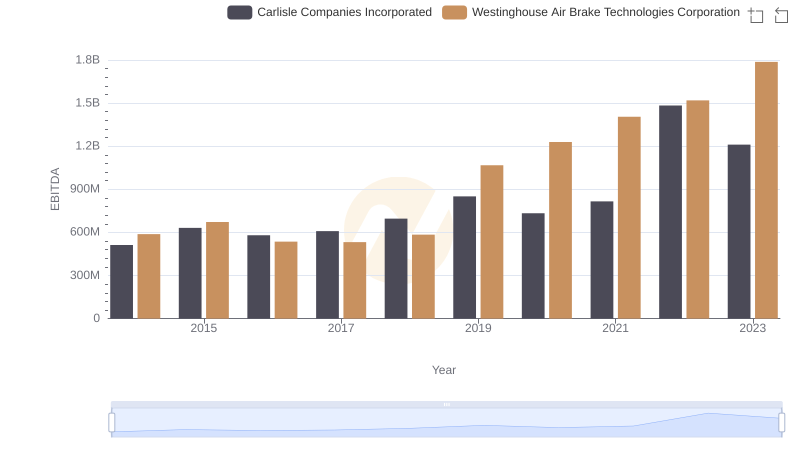

| __timestamp | Carlisle Companies Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 379000000 | 324539000 |

| Thursday, January 1, 2015 | 461900000 | 319173000 |

| Friday, January 1, 2016 | 532000000 | 327505000 |

| Sunday, January 1, 2017 | 589400000 | 482852000 |

| Monday, January 1, 2018 | 625400000 | 573644000 |

| Tuesday, January 1, 2019 | 667100000 | 936600000 |

| Wednesday, January 1, 2020 | 603200000 | 877100000 |

| Friday, January 1, 2021 | 698200000 | 1005000000 |

| Saturday, January 1, 2022 | 811500000 | 1020000000 |

| Sunday, January 1, 2023 | 625200000 | 1139000000 |

| Monday, January 1, 2024 | 722800000 | 1248000000 |

Unleashing the power of data

In the competitive landscape of the manufacturing and technology sectors, the efficiency of a company's selling, general, and administrative (SG&A) expenses can be a critical indicator of its operational health. This analysis focuses on two prominent players: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated. Over the past decade, these companies have navigated fluctuating market conditions, and their SG&A expenses reveal compelling insights into their operational strategies and financial health.

From 2014 to 2023, both companies have shown distinct trends in their SG&A expenses. Carlisle Companies, known for its diversified manufacturing portfolio, reported a steady increase in SG&A expenses, rising from approximately $379 million in 2014 to about $811 million in 2022. This represents a significant 114% increase over the period, highlighting the company's aggressive investment in marketing and administrative functions to support its growth strategy.

In contrast, Westinghouse Air Brake Technologies Corporation exhibited a more volatile SG&A expense pattern. Starting at around $324 million in 2014, the company experienced fluctuations, peaking at approximately $1.139 billion in 2023. This dramatic increase of over 250% may reflect strategic shifts, including expansion efforts or increased investment in technology and infrastructure.

Examining the year-on-year data reveals that both companies have faced unique challenges and opportunities. For instance, in 2019, Carlisle's SG&A expenses reached $667 million, while Westinghouse's were notably lower at $936 million. However, by 2021, Westinghouse had surged ahead, with SG&A expenses climbing to $1.005 billion, compared to Carlisle's $698 million. This shift underscores Westinghouse's strategic pivot, possibly in response to emerging market demands or competitive pressures.

Interestingly, the COVID-19 pandemic in 2020 brought about a decrease in SG&A expenses for both companies, with Carlisle reporting $603 million and Westinghouse $877 million. This reduction may have been a strategic response to the economic uncertainty, with both companies tightening their belts to navigate the crisis.

When comparing the SG&A efficiency of these two corporations, the data suggests that Carlisle Companies has maintained a more consistent growth trajectory, while Westinghouse's expenses have been subject to greater variability. The average SG&A expense for Carlisle over the analyzed period stands at approximately $599 million, while Westinghouse averages around $700 million. This indicates that while Westinghouse has invested heavily in its operations, it may need to refine its cost management strategies to enhance efficiency further.

In conclusion, the SG&A efficiency analysis of Carlisle Companies and Westinghouse Air Brake Technologies Corporation provides valuable insights into their operational strategies and financial health. As both companies continue to evolve in an ever-changing market landscape, understanding these trends will be crucial for investors, analysts, and stakeholders alike. The data not only highlights the importance of managing SG&A expenses but also reflects broader industry trends that can impact future performance.

As we look ahead, it will be fascinating to observe how these companies adapt their strategies to sustain growth while optimizing their operational efficiencies.

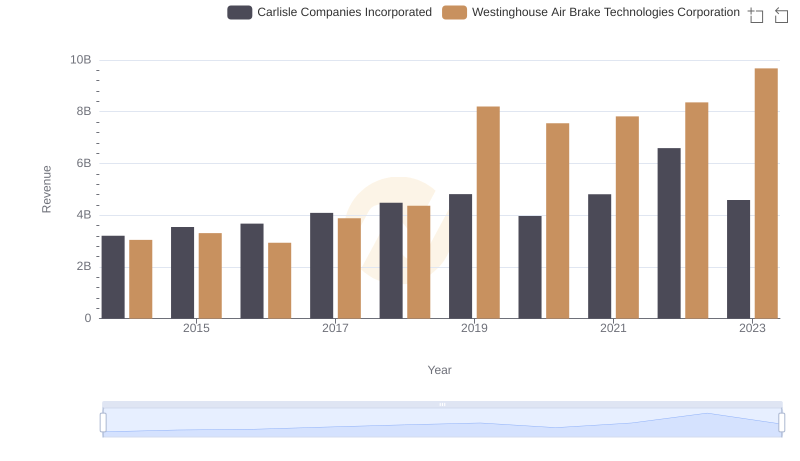

Comparing Revenue Performance: Westinghouse Air Brake Technologies Corporation or Carlisle Companies Incorporated?

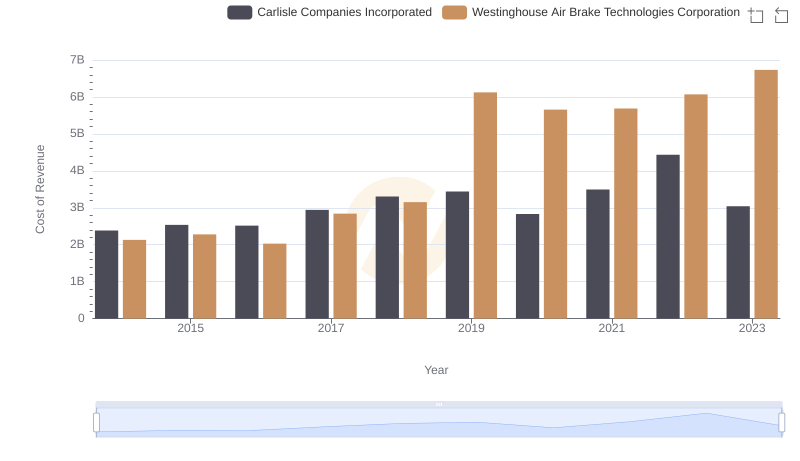

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

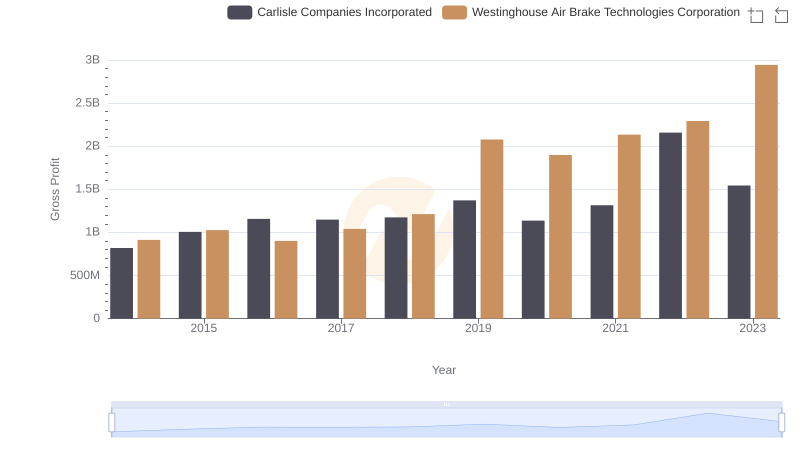

Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated: A Detailed Gross Profit Analysis

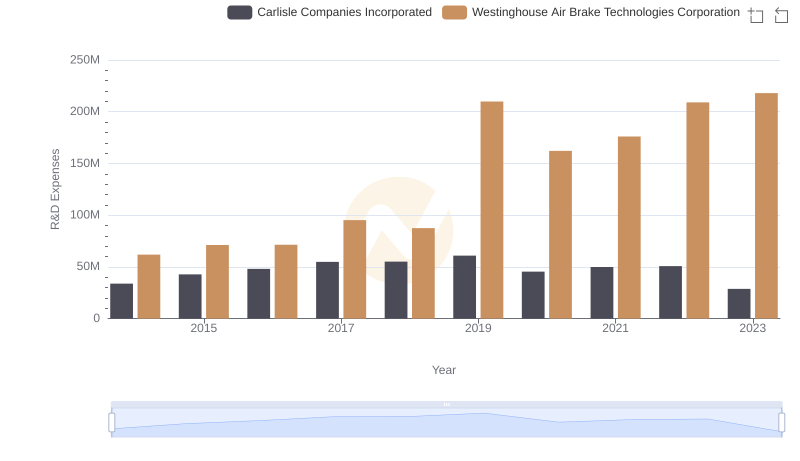

Research and Development Investment: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

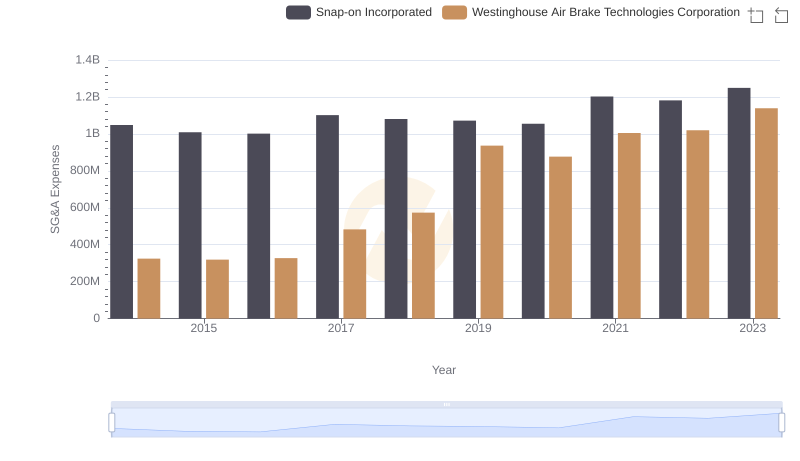

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation

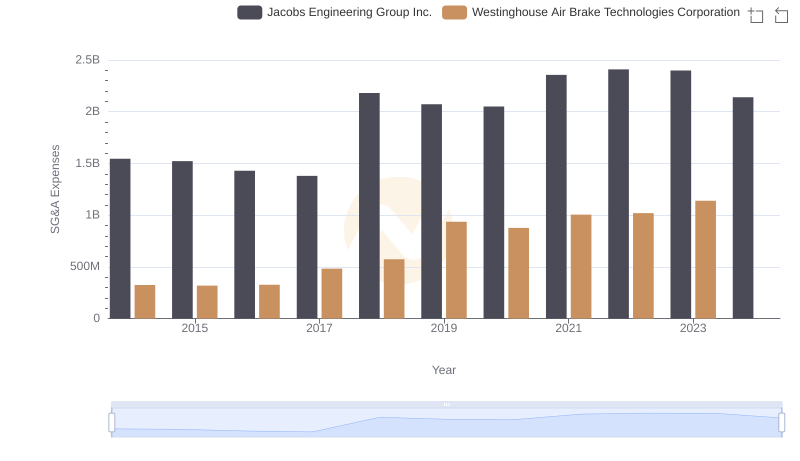

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc. Trends and Insights

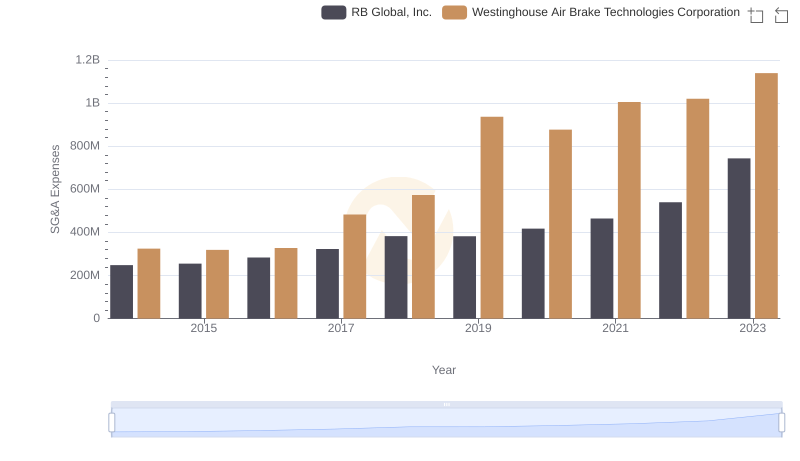

Westinghouse Air Brake Technologies Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

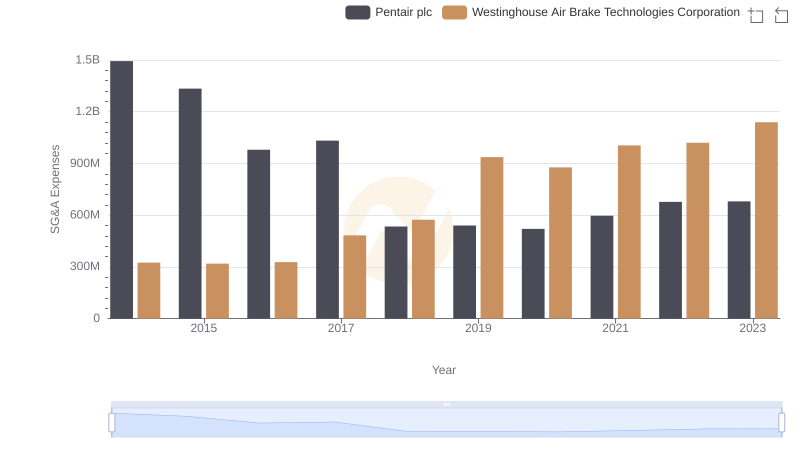

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

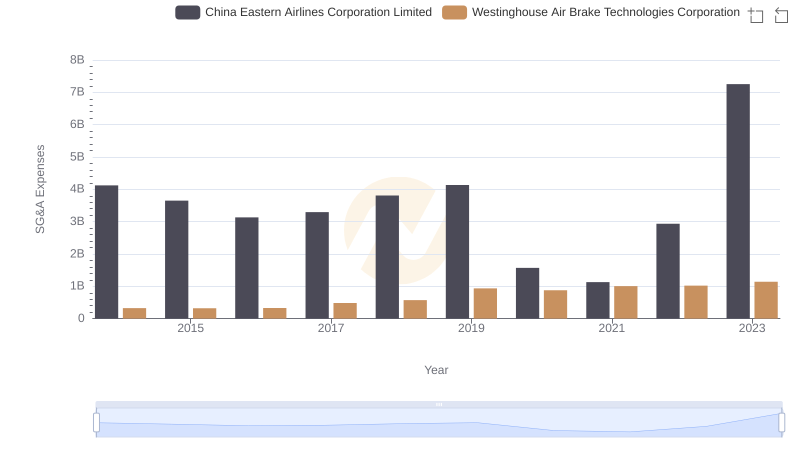

Westinghouse Air Brake Technologies Corporation or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

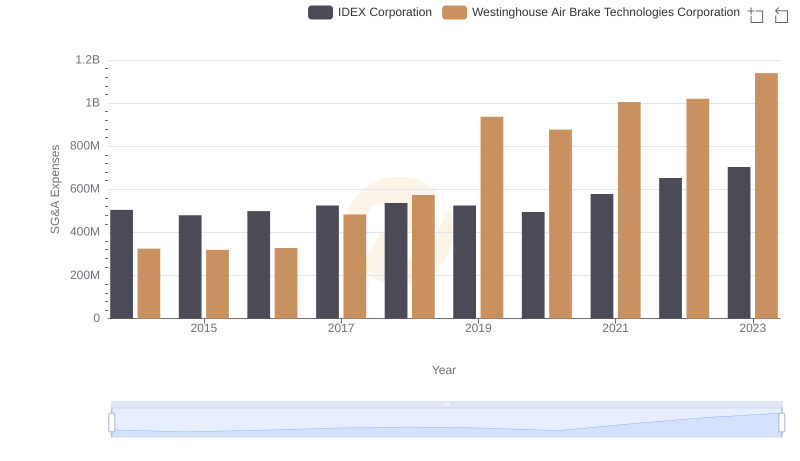

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated