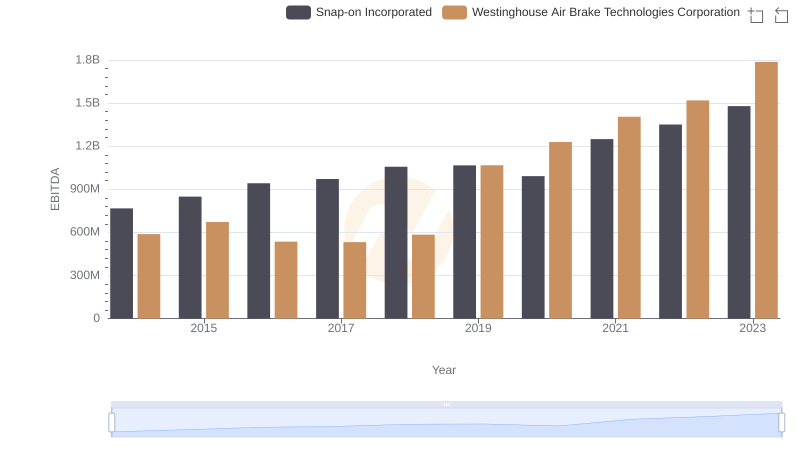

| __timestamp | Snap-on Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 66000000 | 61886000 |

| Thursday, January 1, 2015 | 49300000 | 71213000 |

| Friday, January 1, 2016 | 53400000 | 71375000 |

| Sunday, January 1, 2017 | 60900000 | 95166000 |

| Monday, January 1, 2018 | 61200000 | 87450000 |

| Tuesday, January 1, 2019 | 59100000 | 209900000 |

| Wednesday, January 1, 2020 | 57400000 | 162100000 |

| Friday, January 1, 2021 | 61100000 | 176000000 |

| Saturday, January 1, 2022 | 60100000 | 209000000 |

| Sunday, January 1, 2023 | 64700000 | 218000000 |

| Monday, January 1, 2024 | 0 | 206000000 |

Unleashing the power of data

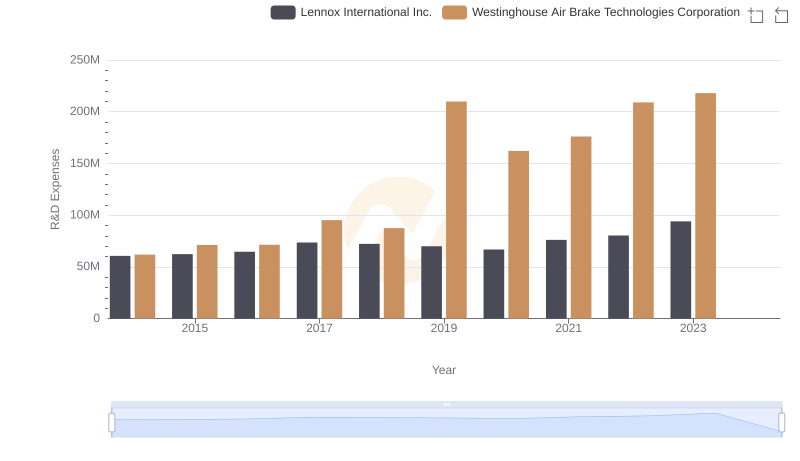

In the ever-evolving landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated have demonstrated distinct strategies in their R&D allocations.

From 2014 to 2023, Westinghouse Air Brake Technologies Corporation has shown a remarkable increase in R&D spending, with a growth of approximately 252%. This surge underscores their strategic focus on technological advancements and innovation, particularly in the transportation sector. By 2023, their R&D expenses reached a peak, reflecting a robust commitment to maintaining a competitive edge.

Conversely, Snap-on Incorporated's R&D investment has remained relatively stable, with a modest increase of around 10% over the same period. This steady approach suggests a focus on incremental improvements and sustaining their market position in the tool manufacturing industry.

These contrasting strategies highlight the diverse approaches companies take in navigating the competitive landscape, emphasizing the importance of tailored R&D investments in driving long-term success.

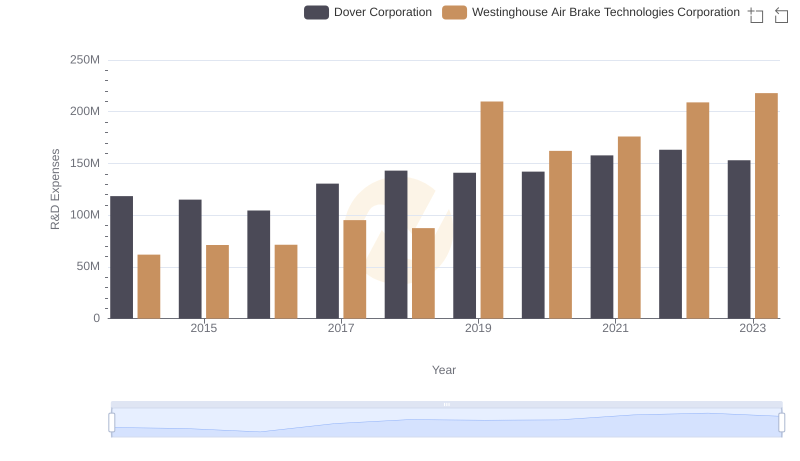

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Dover Corporation Allocate Funds

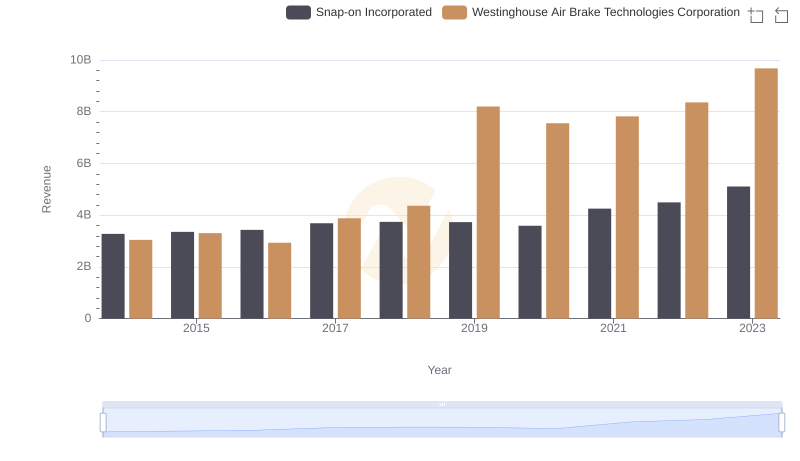

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Performance Compared

Research and Development Expenses Breakdown: Westinghouse Air Brake Technologies Corporation vs Lennox International Inc.

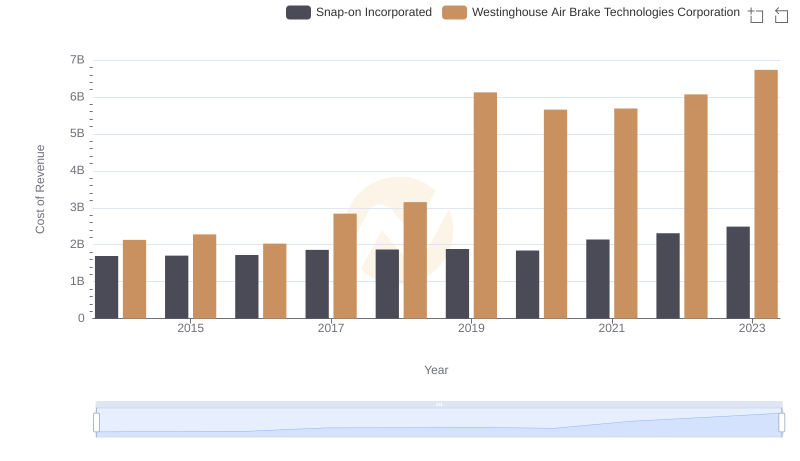

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Snap-on Incorporated

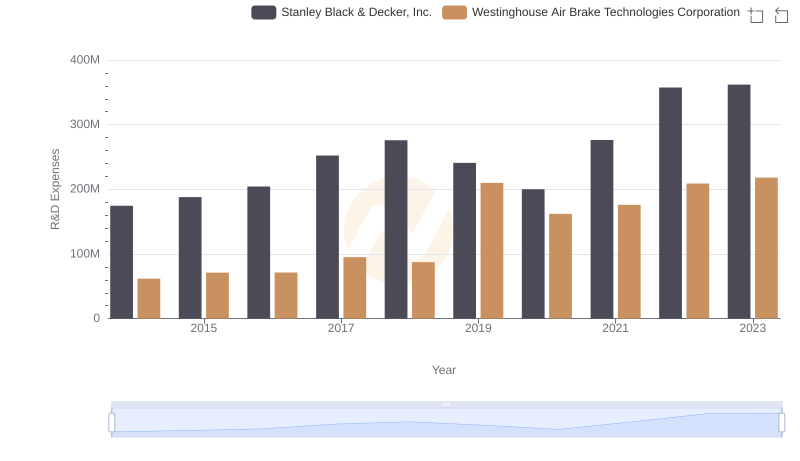

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.

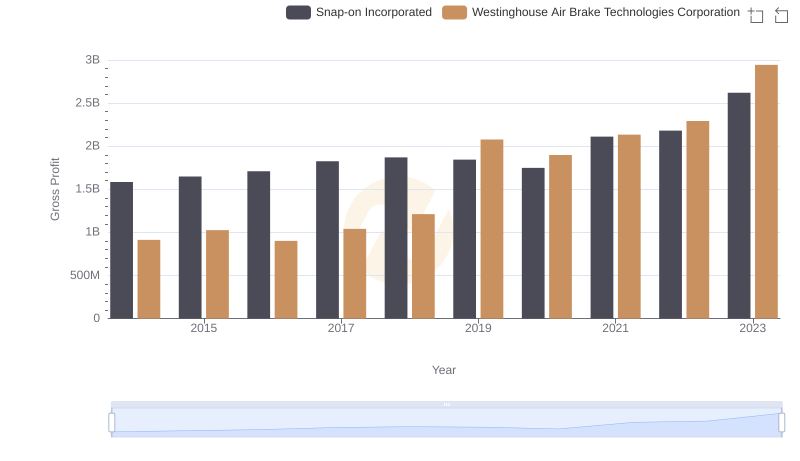

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

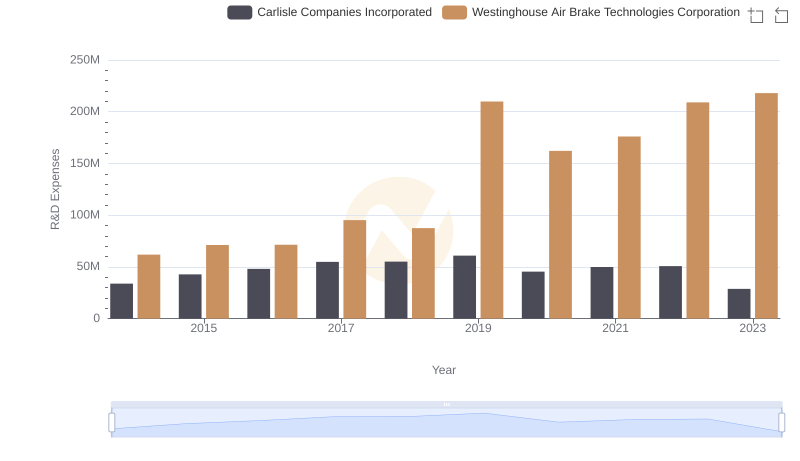

Research and Development Investment: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

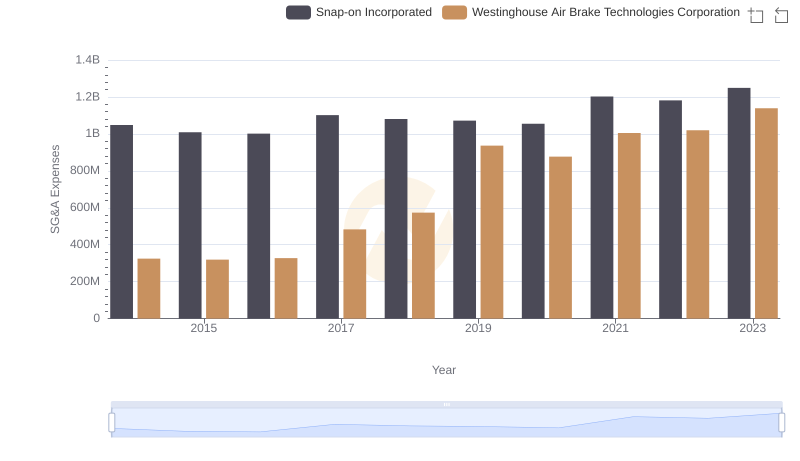

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

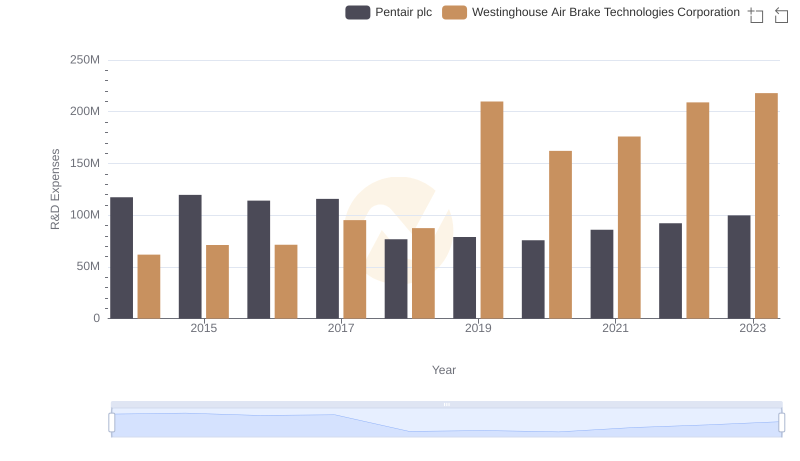

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Pentair plc

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against Snap-on Incorporated

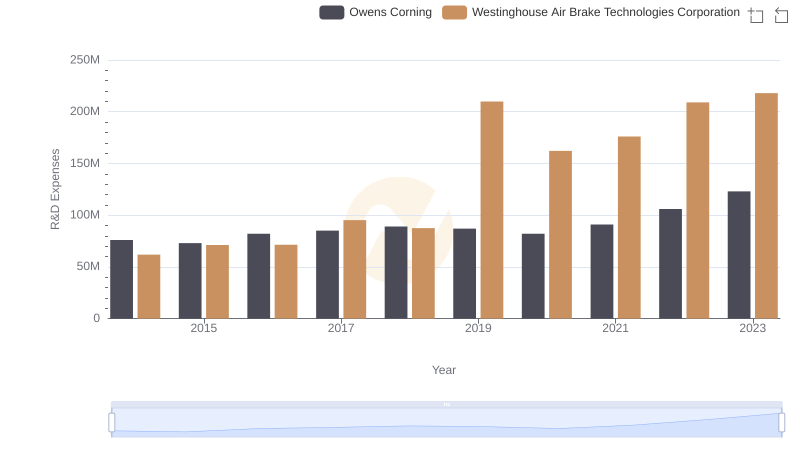

Westinghouse Air Brake Technologies Corporation vs Owens Corning: Strategic Focus on R&D Spending

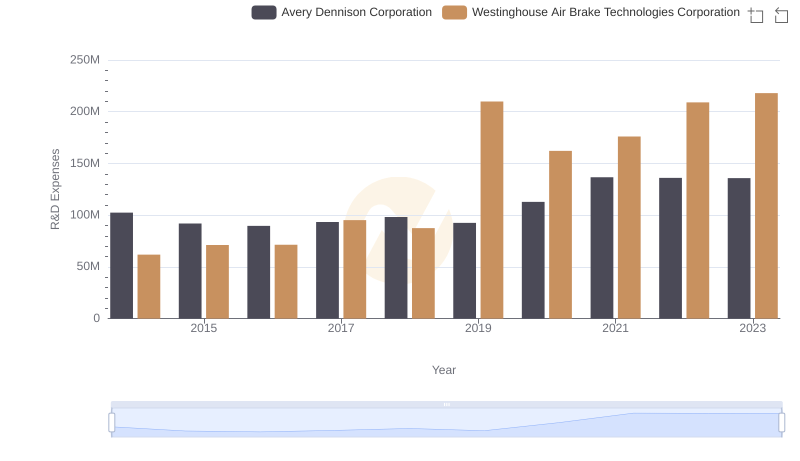

Westinghouse Air Brake Technologies Corporation or Avery Dennison Corporation: Who Invests More in Innovation?