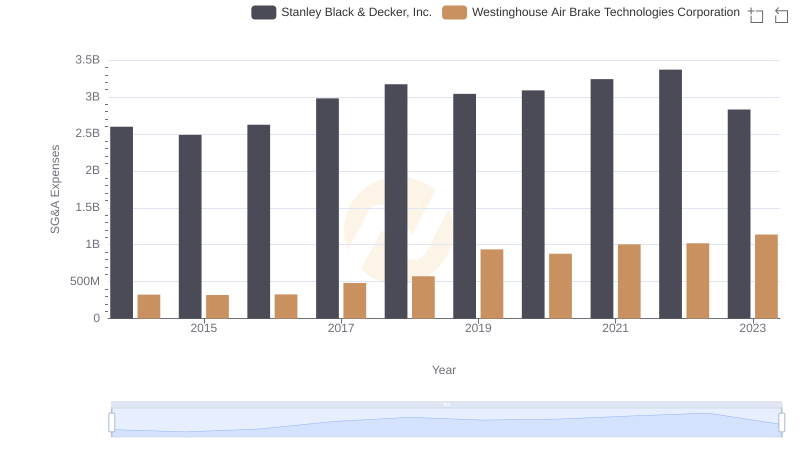

| __timestamp | Stanley Black & Decker, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2595900000 | 324539000 |

| Thursday, January 1, 2015 | 2486400000 | 319173000 |

| Friday, January 1, 2016 | 2623900000 | 327505000 |

| Sunday, January 1, 2017 | 2980100000 | 482852000 |

| Monday, January 1, 2018 | 3171700000 | 573644000 |

| Tuesday, January 1, 2019 | 3041000000 | 936600000 |

| Wednesday, January 1, 2020 | 3089600000 | 877100000 |

| Friday, January 1, 2021 | 3240400000 | 1005000000 |

| Saturday, January 1, 2022 | 3370000000 | 1020000000 |

| Sunday, January 1, 2023 | 2829300000 | 1139000000 |

| Monday, January 1, 2024 | 3310500000 | 1248000000 |

Cracking the code

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc. have demonstrated contrasting strategies in optimizing these costs.

From 2014 to 2023, Stanley Black & Decker's SG&A expenses fluctuated, peaking in 2022 with a 30% increase from 2014. However, 2023 saw a notable 16% reduction, indicating a strategic shift. Meanwhile, Westinghouse Air Brake Technologies consistently increased their SG&A expenses, with a staggering 250% rise over the same period, reflecting aggressive expansion or investment strategies.

This data highlights the diverse approaches these companies take in managing operational costs, offering insights into their financial strategies and market positioning. As businesses navigate economic challenges, understanding these trends becomes essential for stakeholders and investors alike.

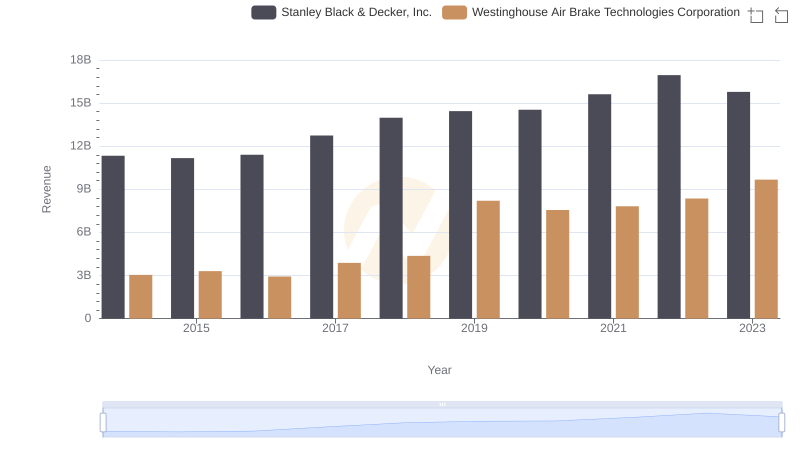

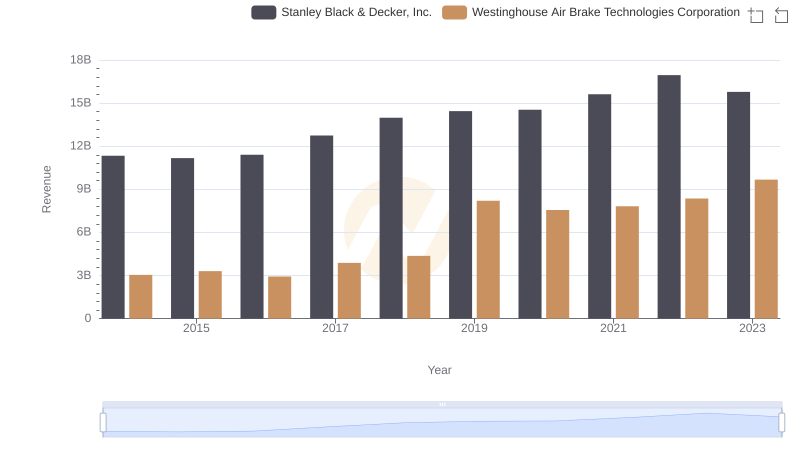

Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.: Examining Key Revenue Metrics

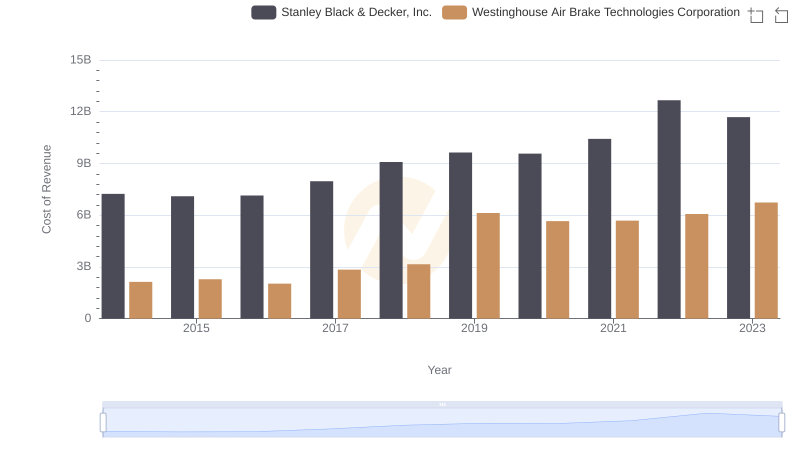

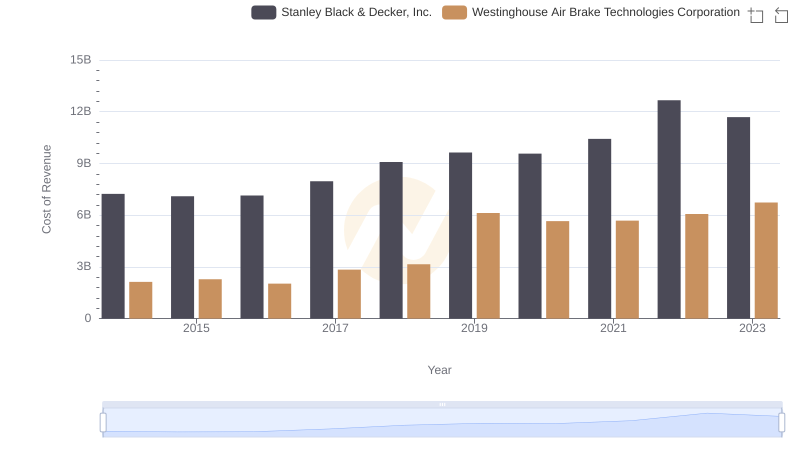

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

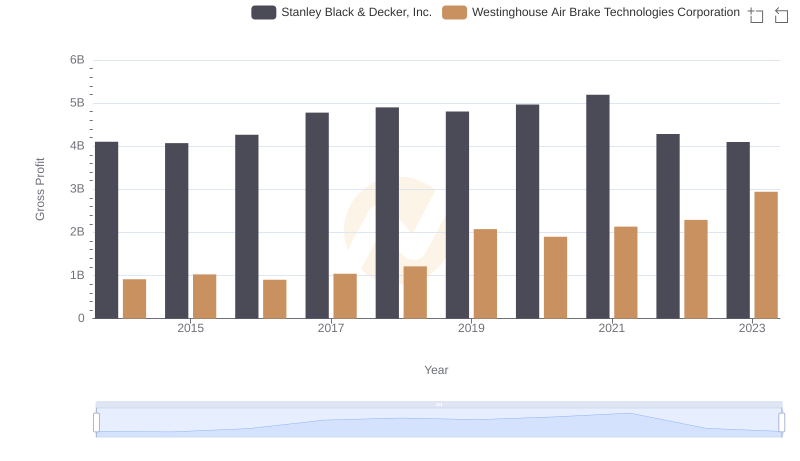

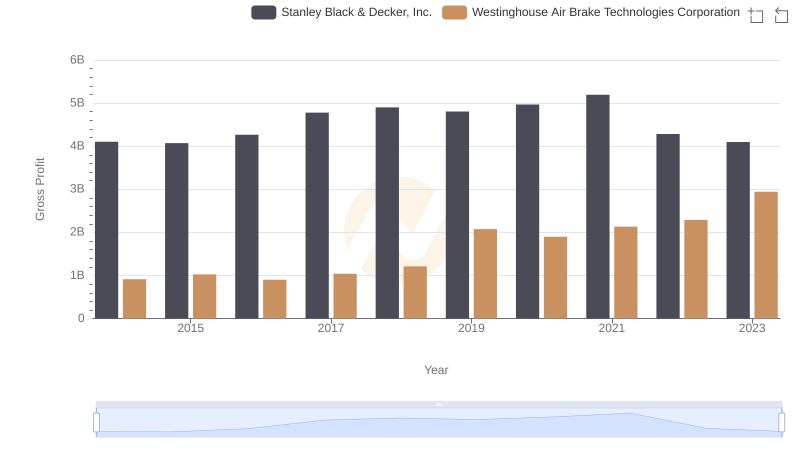

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

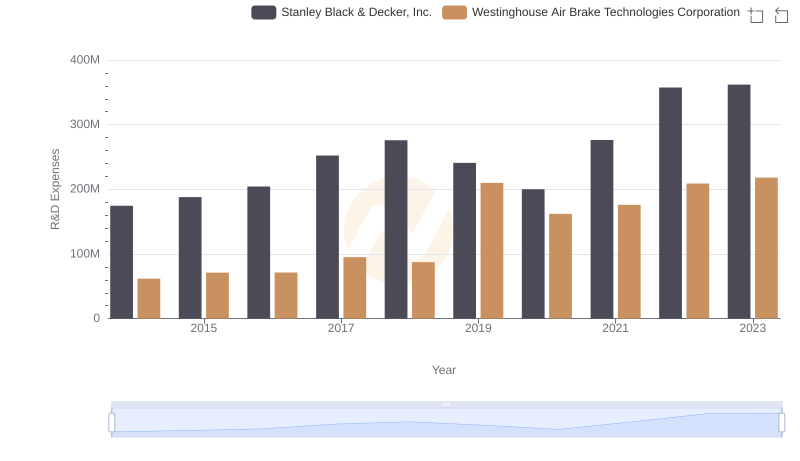

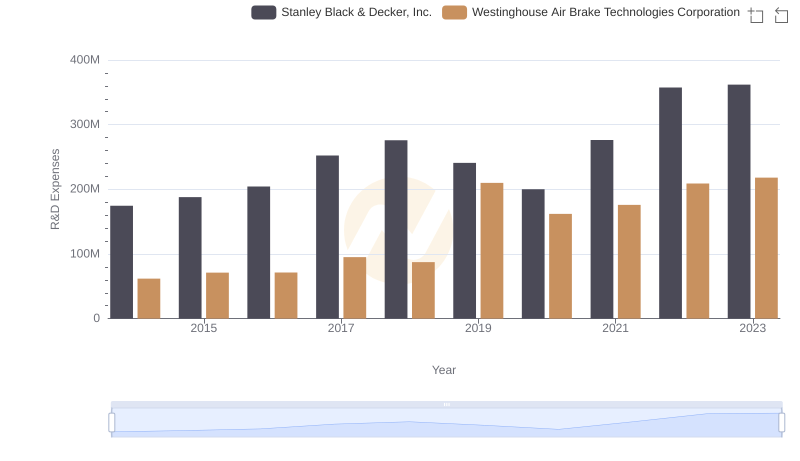

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.

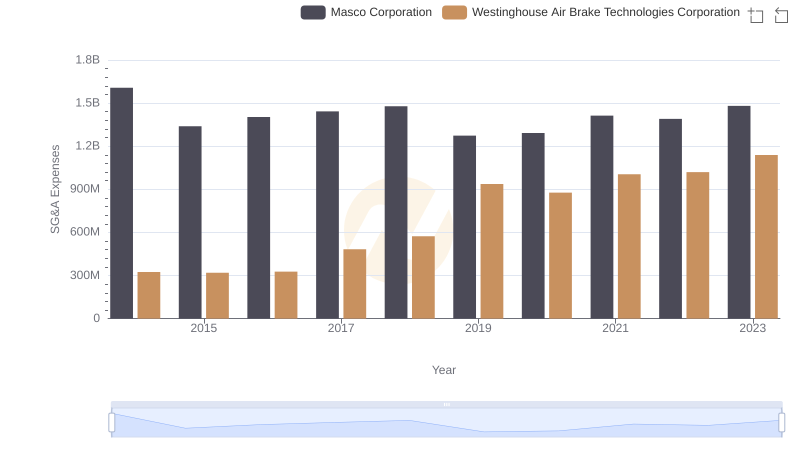

Westinghouse Air Brake Technologies Corporation or Masco Corporation: Who Manages SG&A Costs Better?

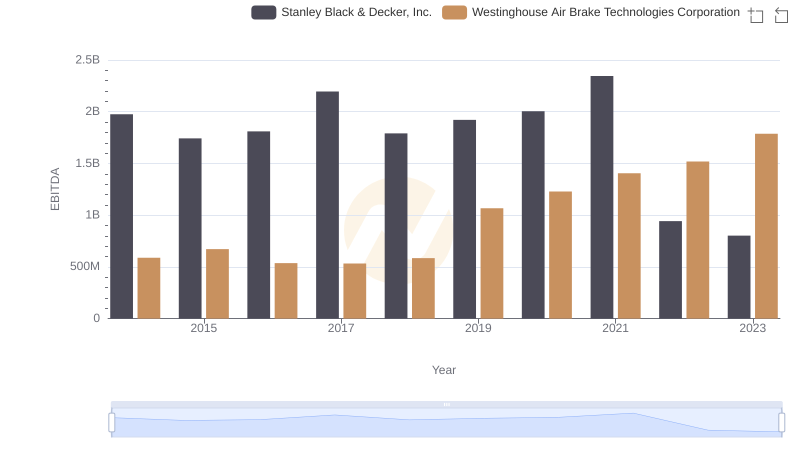

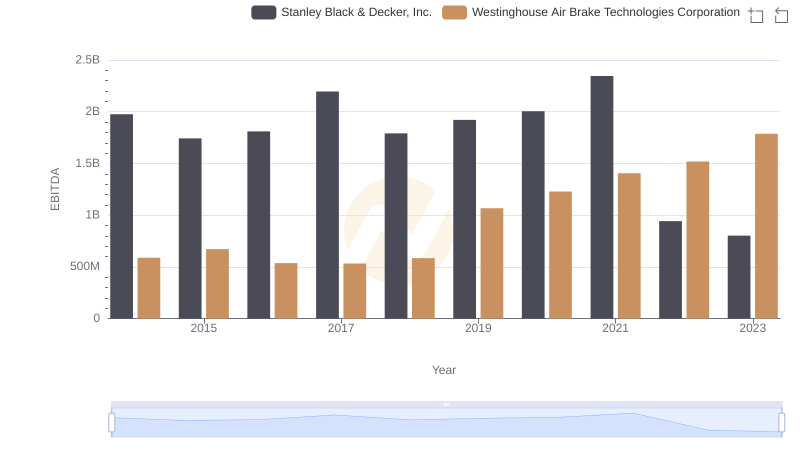

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Cost of Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.: Strategic Focus on R&D Spending

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance