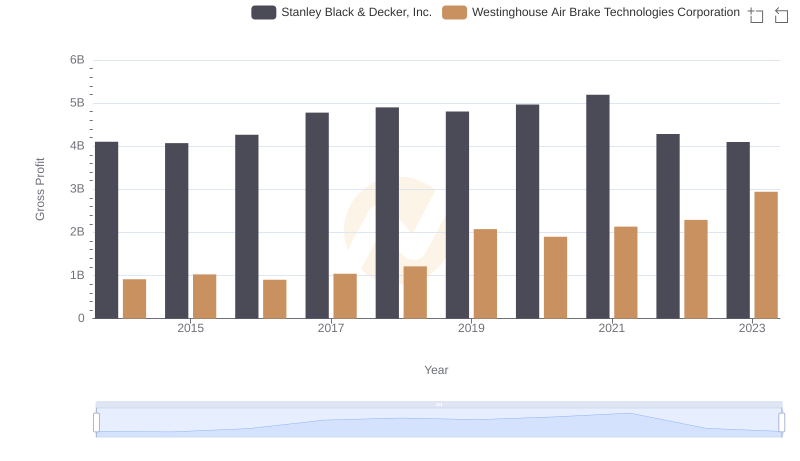

| __timestamp | Snap-on Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1584300000 | 913534000 |

| Thursday, January 1, 2015 | 1648300000 | 1026153000 |

| Friday, January 1, 2016 | 1709600000 | 901541000 |

| Sunday, January 1, 2017 | 1824900000 | 1040597000 |

| Monday, January 1, 2018 | 1870000000 | 1211731000 |

| Tuesday, January 1, 2019 | 1844000000 | 2077600000 |

| Wednesday, January 1, 2020 | 1748500000 | 1898700000 |

| Friday, January 1, 2021 | 2110800000 | 2135000000 |

| Saturday, January 1, 2022 | 2181100000 | 2292000000 |

| Sunday, January 1, 2023 | 2619800000 | 2944000000 |

| Monday, January 1, 2024 | 2377900000 | 3366000000 |

Unleashing the power of data

In the competitive landscape of industrial manufacturing, Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated have showcased remarkable growth in gross profit over the past decade. From 2014 to 2023, Snap-on Incorporated's gross profit surged by approximately 65%, reaching a peak in 2023. Meanwhile, Westinghouse Air Brake Technologies Corporation demonstrated an even more impressive growth of around 222% during the same period.

Starting in 2014, Snap-on Incorporated reported a gross profit of $1.58 billion, steadily climbing to $2.62 billion by 2023. Westinghouse Air Brake Technologies Corporation, on the other hand, began with a more modest $913 million in 2014, but by 2023, it had nearly tripled to $2.94 billion. This growth trajectory highlights the dynamic shifts and strategic advancements within these companies, reflecting their resilience and adaptability in a rapidly evolving market.

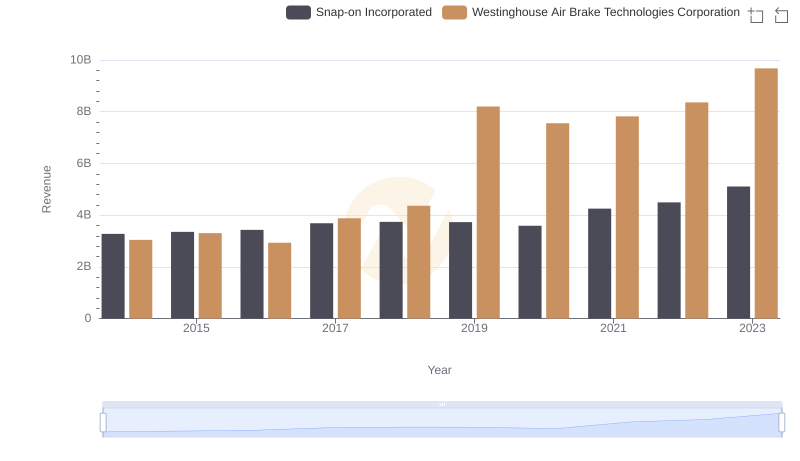

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Performance Compared

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

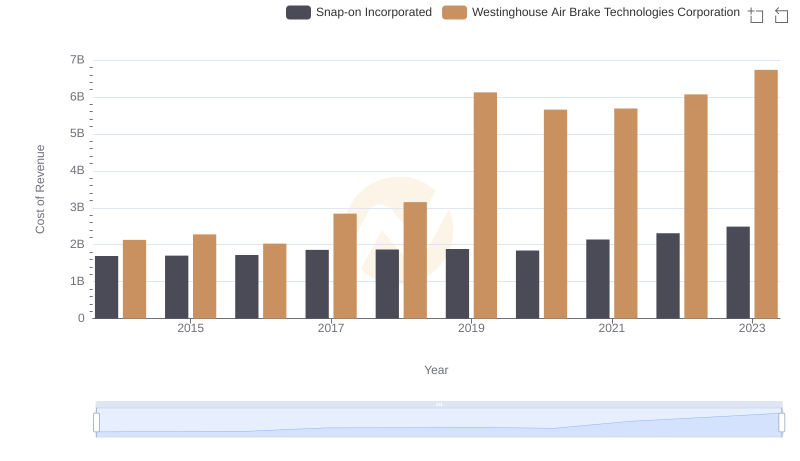

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Snap-on Incorporated

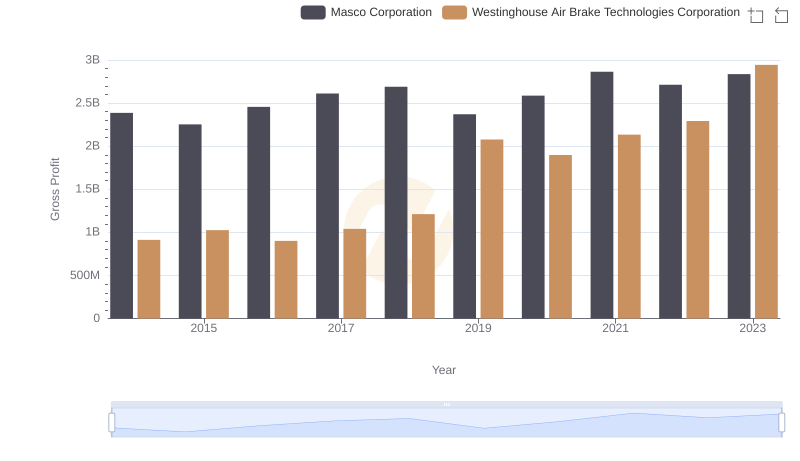

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Masco Corporation

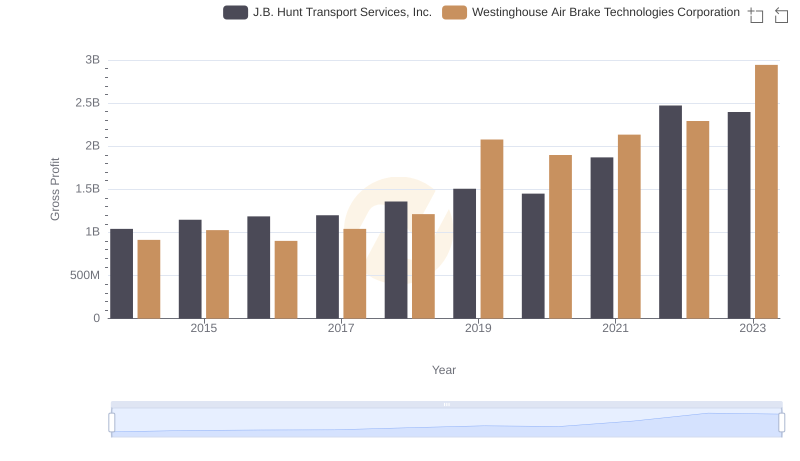

Westinghouse Air Brake Technologies Corporation vs J.B. Hunt Transport Services, Inc.: A Gross Profit Performance Breakdown

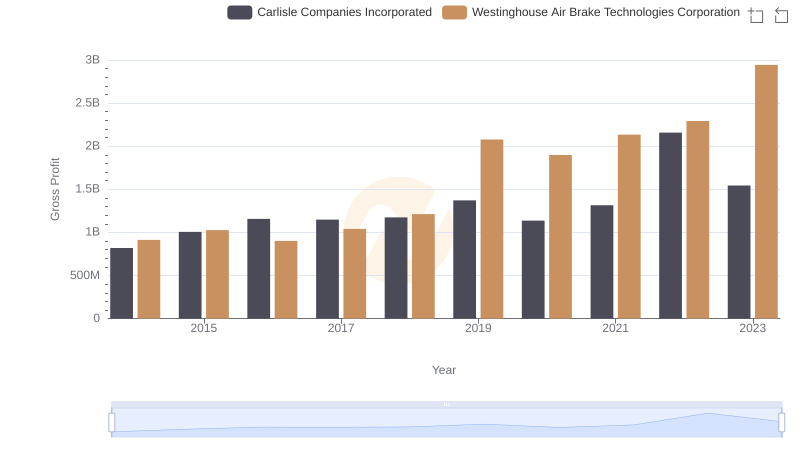

Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated: A Detailed Gross Profit Analysis

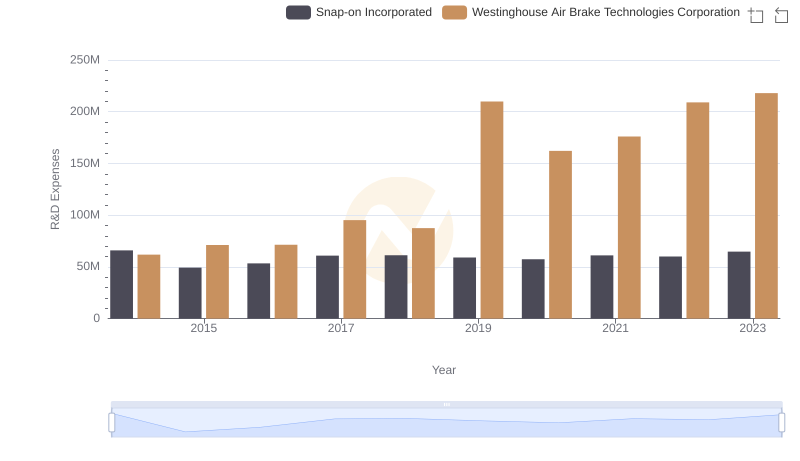

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Allocate Funds

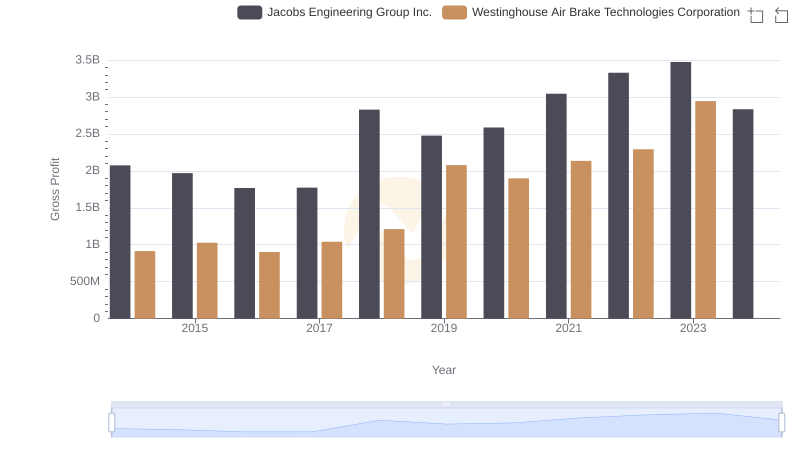

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc.

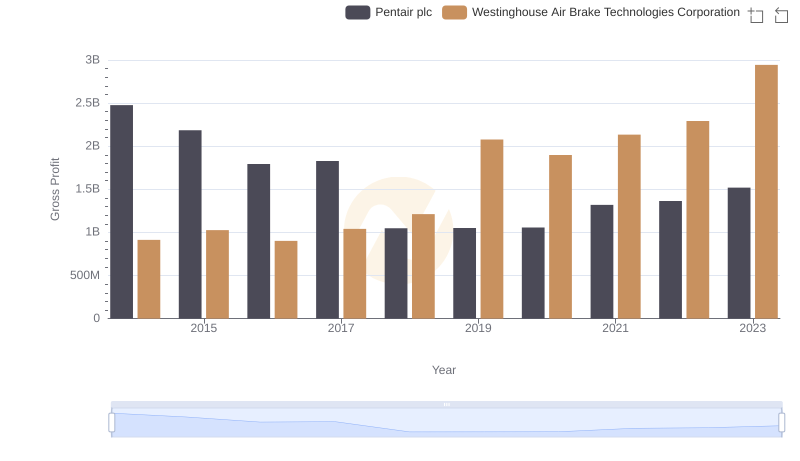

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pentair plc Trends

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation Trends

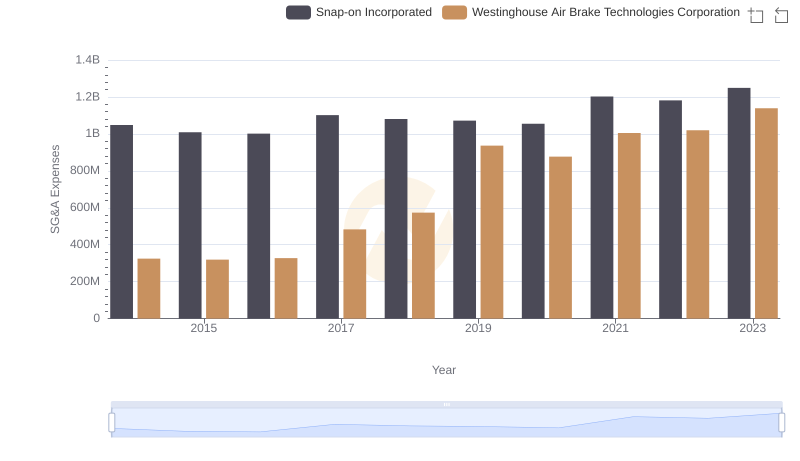

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

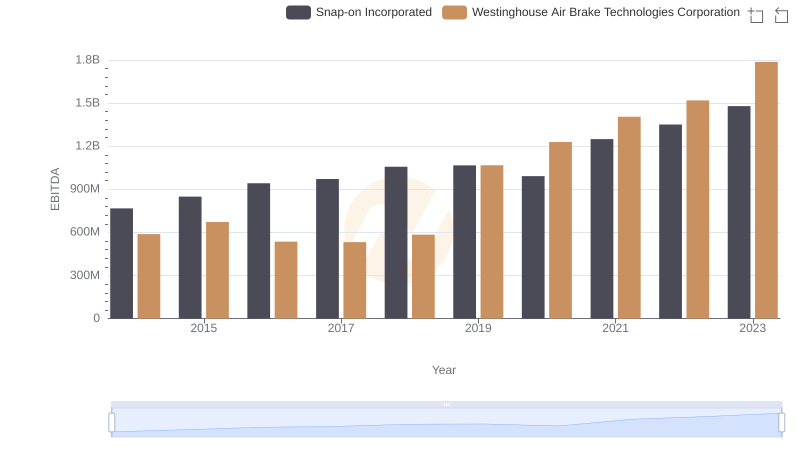

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against Snap-on Incorporated