| __timestamp | Booz Allen Hamilton Holding Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 324539000 |

| Thursday, January 1, 2015 | 2159439000 | 319173000 |

| Friday, January 1, 2016 | 2319592000 | 327505000 |

| Sunday, January 1, 2017 | 2568511000 | 482852000 |

| Monday, January 1, 2018 | 2719909000 | 573644000 |

| Tuesday, January 1, 2019 | 2932602000 | 936600000 |

| Wednesday, January 1, 2020 | 3334378000 | 877100000 |

| Friday, January 1, 2021 | 3362722000 | 1005000000 |

| Saturday, January 1, 2022 | 3633150000 | 1020000000 |

| Sunday, January 1, 2023 | 4341769000 | 1139000000 |

| Monday, January 1, 2024 | 1281443000 | 1248000000 |

Igniting the spark of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis compares the SG&A efficiency of Booz Allen Hamilton Holding Corporation and Westinghouse Air Brake Technologies Corporation from 2014 to 2023.

Booz Allen Hamilton, a leader in management consulting, has seen its SG&A expenses grow by approximately 95% over the decade, peaking in 2023. This reflects its strategic investments in expanding its consulting services. In contrast, Westinghouse Air Brake Technologies, a key player in the transportation sector, experienced a more modest increase of around 250% in SG&A expenses, indicating a steady but controlled growth strategy.

Interestingly, 2024 data for Westinghouse is missing, suggesting potential reporting delays or strategic shifts. This comparison highlights the diverse approaches to SG&A management in different industries, offering valuable insights for investors and analysts.

Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation: Annual Revenue Growth Compared

Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

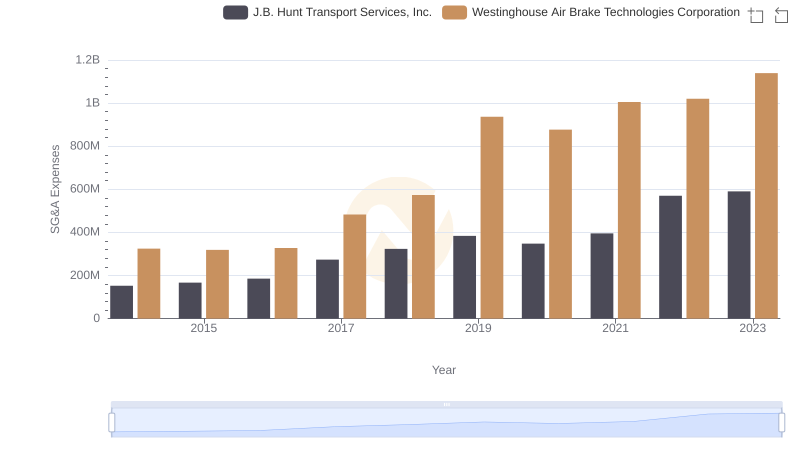

Westinghouse Air Brake Technologies Corporation and J.B. Hunt Transport Services, Inc.: SG&A Spending Patterns Compared

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation Trends

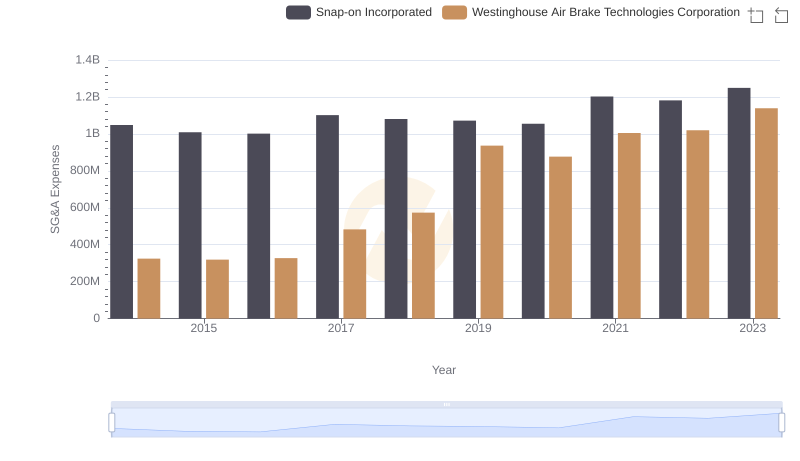

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

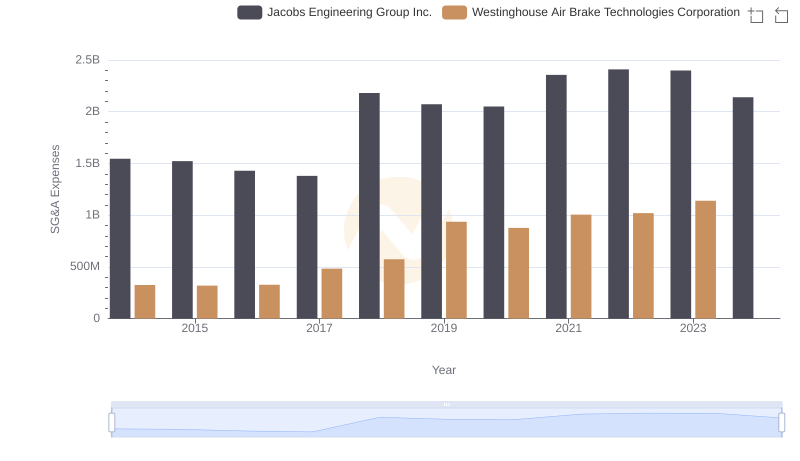

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc. Trends and Insights

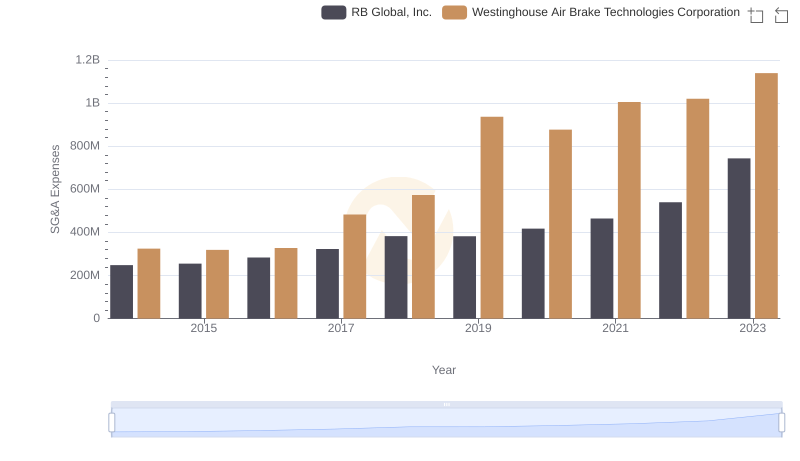

Westinghouse Air Brake Technologies Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

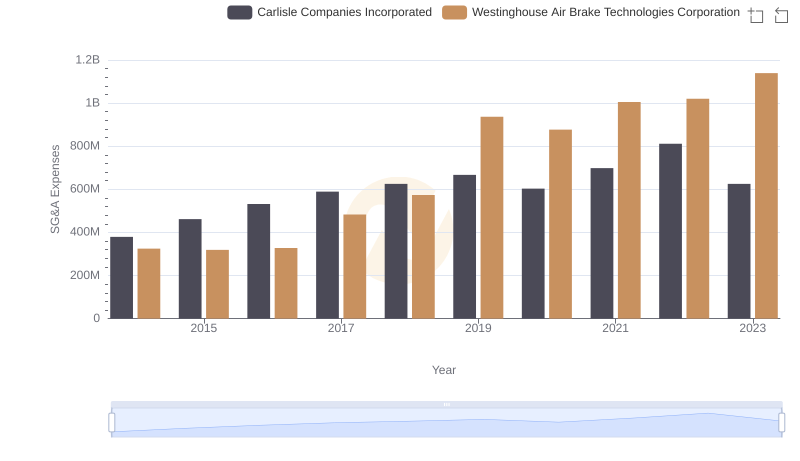

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

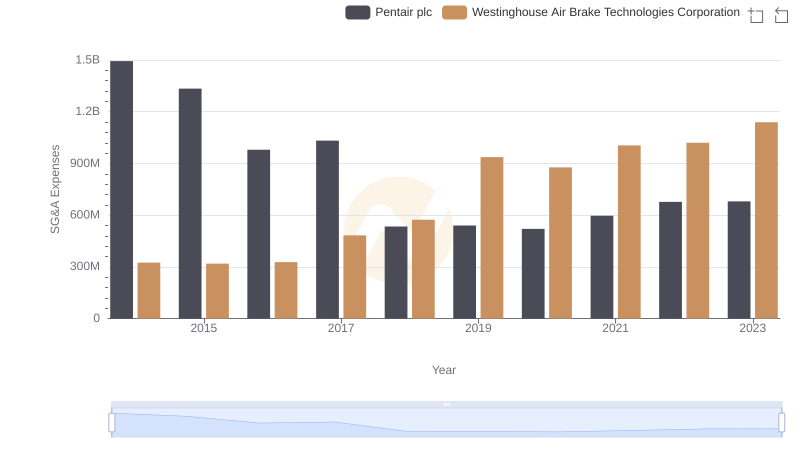

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

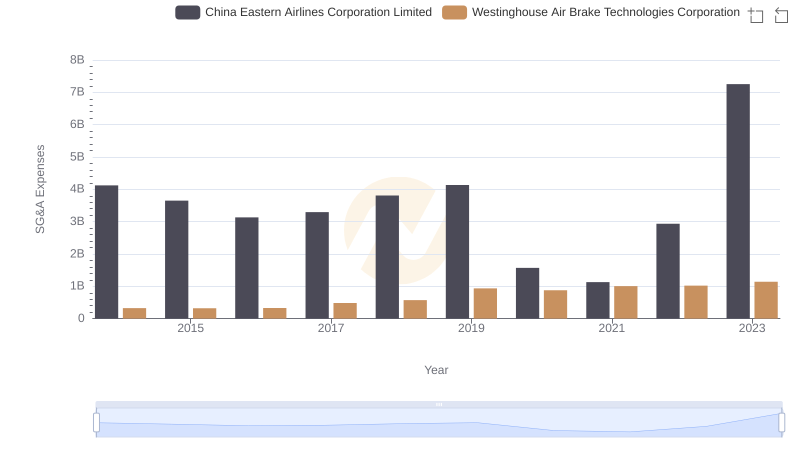

Westinghouse Air Brake Technologies Corporation or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation

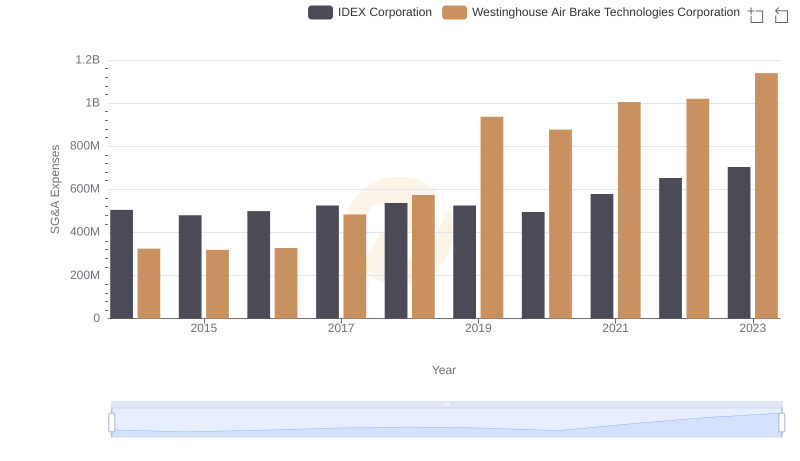

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation