| __timestamp | Snap-on Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 767600000 | 588370000 |

| Thursday, January 1, 2015 | 848900000 | 672301000 |

| Friday, January 1, 2016 | 942400000 | 535893000 |

| Sunday, January 1, 2017 | 971900000 | 532795000 |

| Monday, January 1, 2018 | 1057400000 | 584199000 |

| Tuesday, January 1, 2019 | 1067000000 | 1067300000 |

| Wednesday, January 1, 2020 | 991400000 | 1229400000 |

| Friday, January 1, 2021 | 1249100000 | 1405000000 |

| Saturday, January 1, 2022 | 1351500000 | 1519000000 |

| Sunday, January 1, 2023 | 1478800000 | 1787000000 |

| Monday, January 1, 2024 | 1520700000 | 1609000000 |

Unleashing insights

In the ever-evolving landscape of industrial giants, Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated have carved out significant niches. Over the past decade, these companies have demonstrated remarkable resilience and growth, as evidenced by their EBITDA performance from 2014 to 2023.

Snap-on Incorporated, a leader in professional tools, has seen its EBITDA grow by approximately 93% over this period, starting from 768 million in 2014 to an impressive 1.48 billion in 2023. Meanwhile, Westinghouse Air Brake Technologies, a key player in rail technology, has outpaced Snap-on with a staggering 204% increase, from 588 million to 1.79 billion.

This data not only highlights the robust growth trajectories of these companies but also underscores the dynamic nature of the industrial sector. As we look to the future, these trends offer valuable insights into the strategic directions and market positions of these industry leaders.

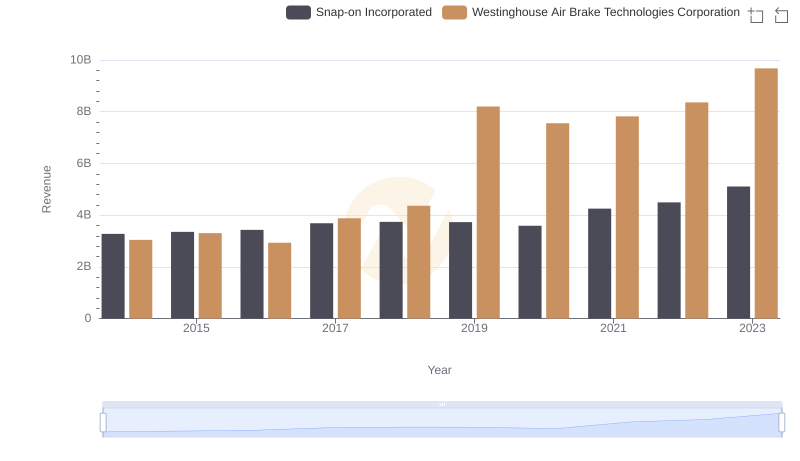

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Performance Compared

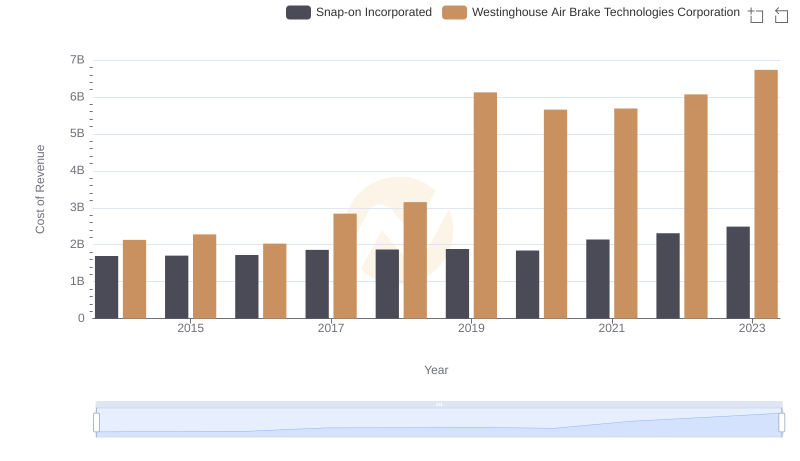

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Snap-on Incorporated

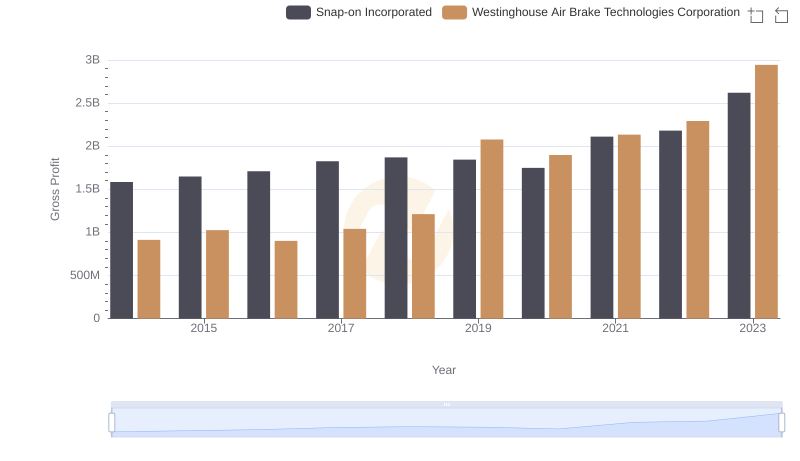

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

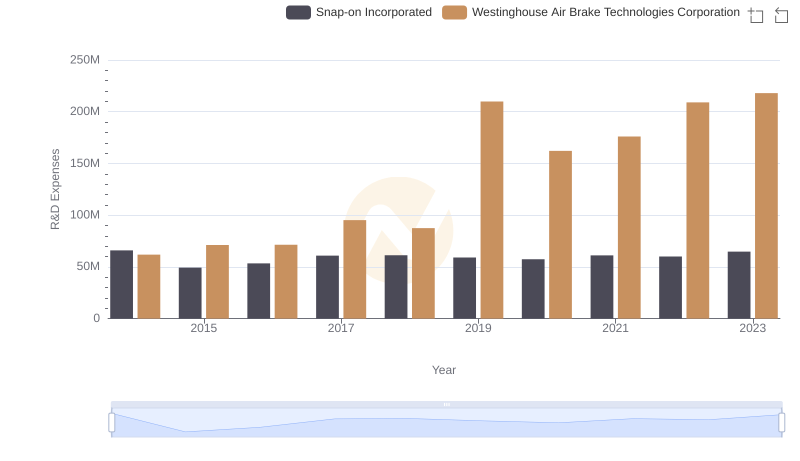

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Allocate Funds

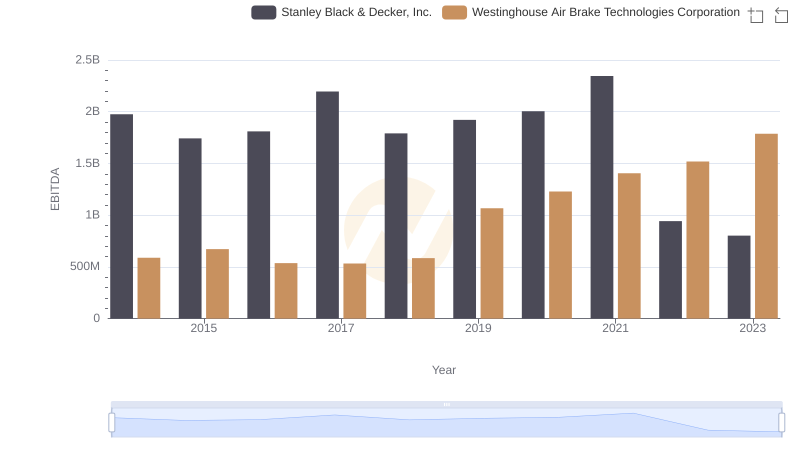

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

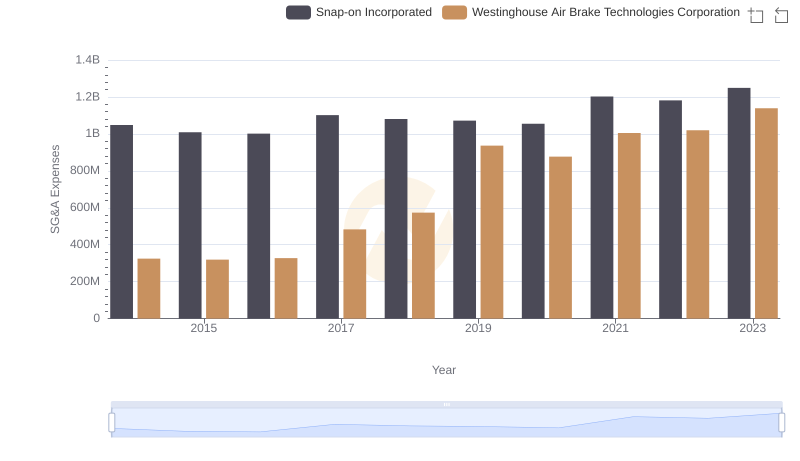

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

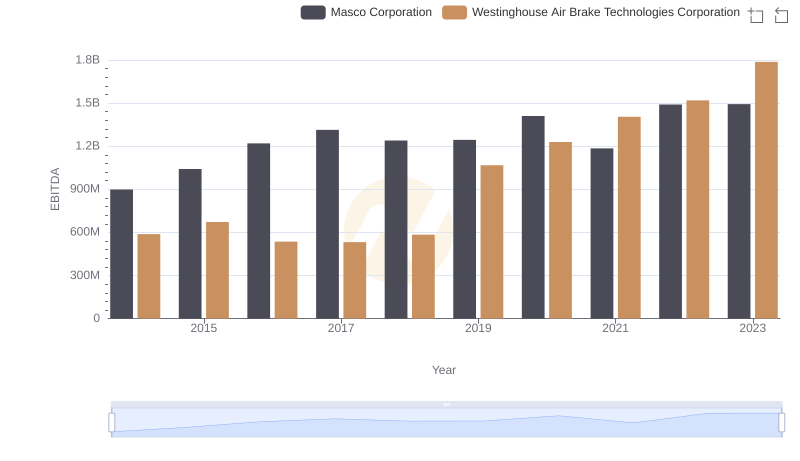

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Masco Corporation

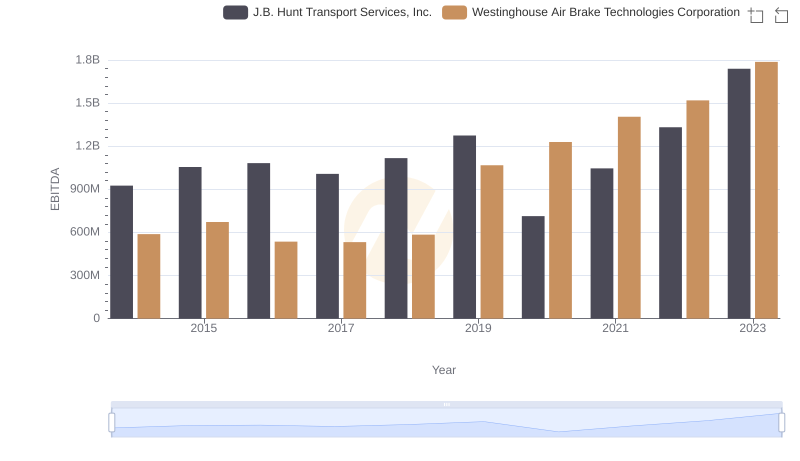

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to J.B. Hunt Transport Services, Inc.

Comprehensive EBITDA Comparison: Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation

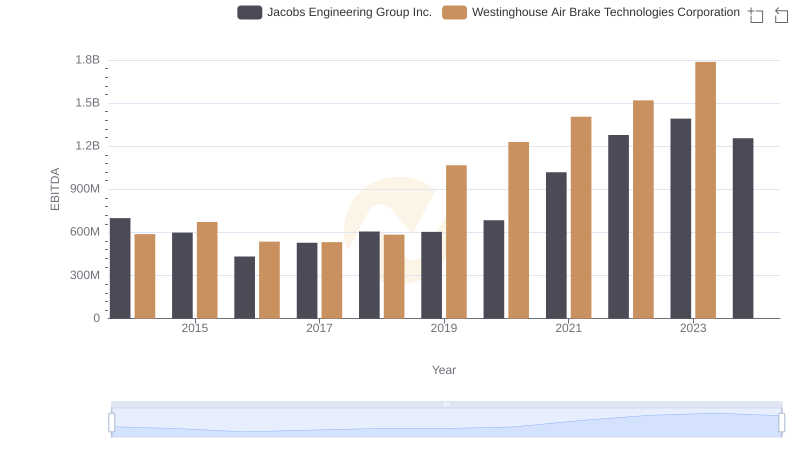

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc.

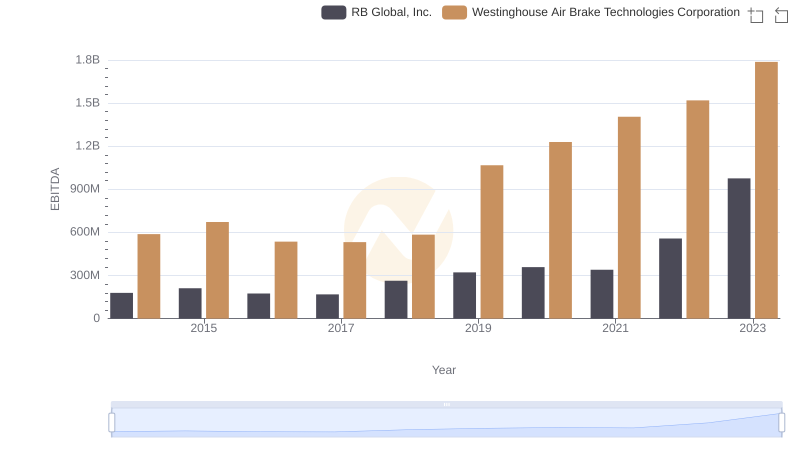

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against RB Global, Inc.

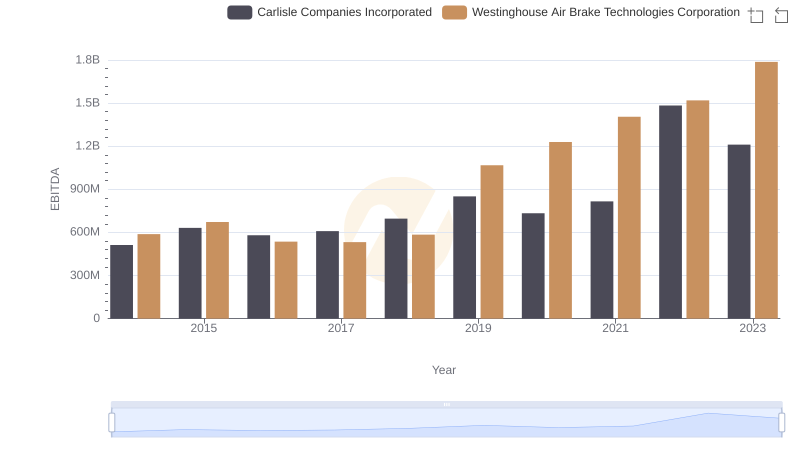

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated