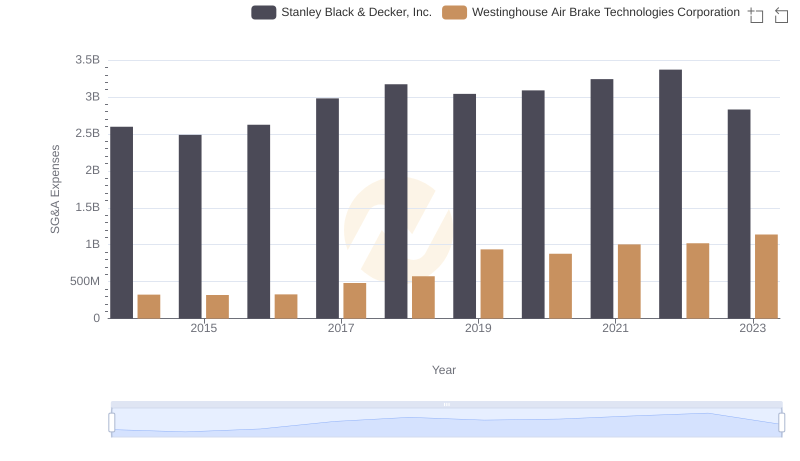

| __timestamp | Stanley Black & Decker, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2595900000 | 324539000 |

| Thursday, January 1, 2015 | 2486400000 | 319173000 |

| Friday, January 1, 2016 | 2623900000 | 327505000 |

| Sunday, January 1, 2017 | 2980100000 | 482852000 |

| Monday, January 1, 2018 | 3171700000 | 573644000 |

| Tuesday, January 1, 2019 | 3041000000 | 936600000 |

| Wednesday, January 1, 2020 | 3089600000 | 877100000 |

| Friday, January 1, 2021 | 3240400000 | 1005000000 |

| Saturday, January 1, 2022 | 3370000000 | 1020000000 |

| Sunday, January 1, 2023 | 2829300000 | 1139000000 |

| Monday, January 1, 2024 | 3310500000 | 1248000000 |

Unleashing insights

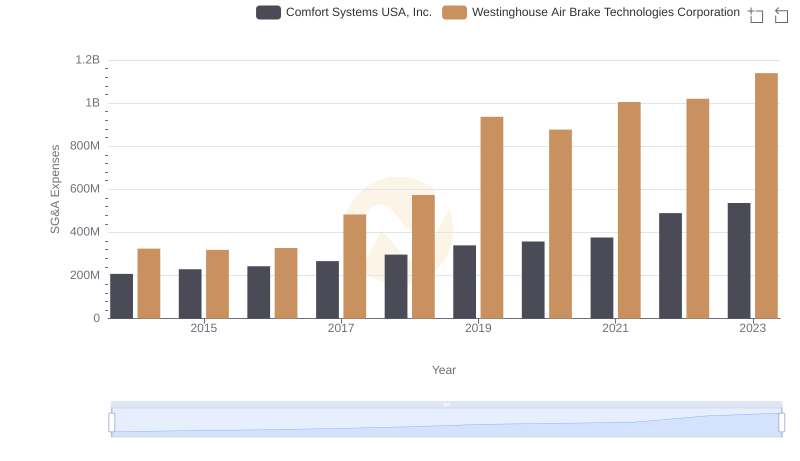

In the ever-evolving landscape of industrial manufacturing, understanding the financial dynamics of key players is crucial. Over the past decade, Stanley Black & Decker, Inc. and Westinghouse Air Brake Technologies Corporation have showcased contrasting trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Stanley Black & Decker's SG&A expenses have seen a steady increase, peaking in 2022 with a 30% rise from 2014. However, 2023 marked a notable decline of approximately 16% from the previous year, reflecting potential strategic shifts or market conditions.

Conversely, Westinghouse Air Brake Technologies Corporation has experienced a more dramatic growth in SG&A expenses, with a staggering 250% increase from 2014 to 2023. This surge, particularly evident from 2019 onwards, suggests aggressive expansion or investment strategies. These insights provide a window into the operational priorities and market positioning of these industrial titans.

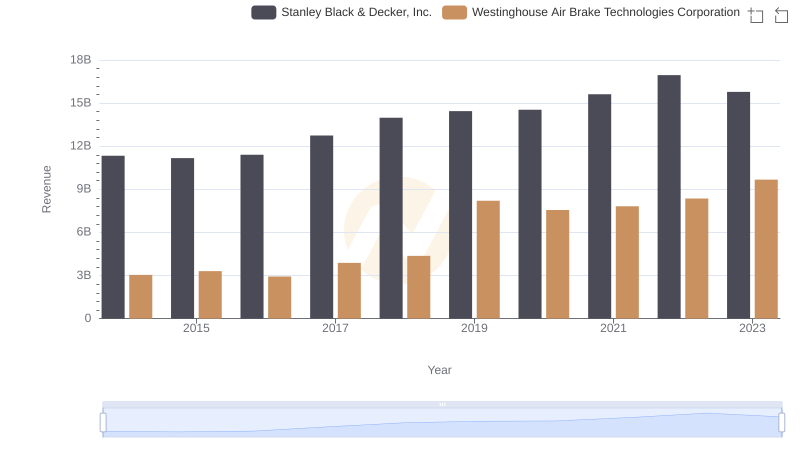

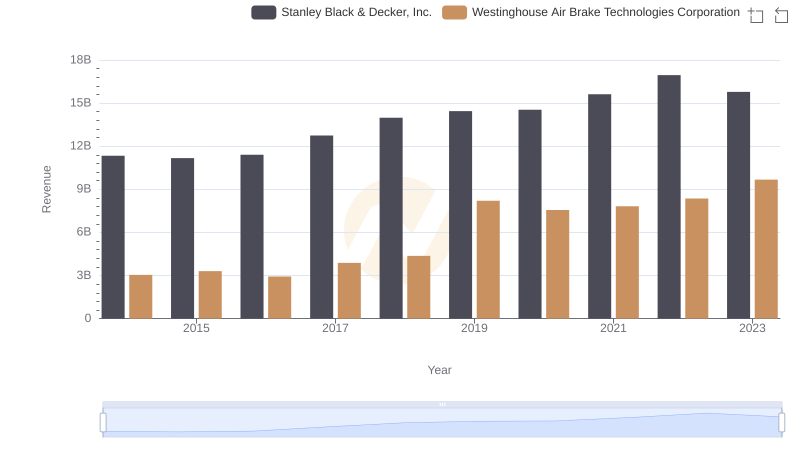

Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.: Examining Key Revenue Metrics

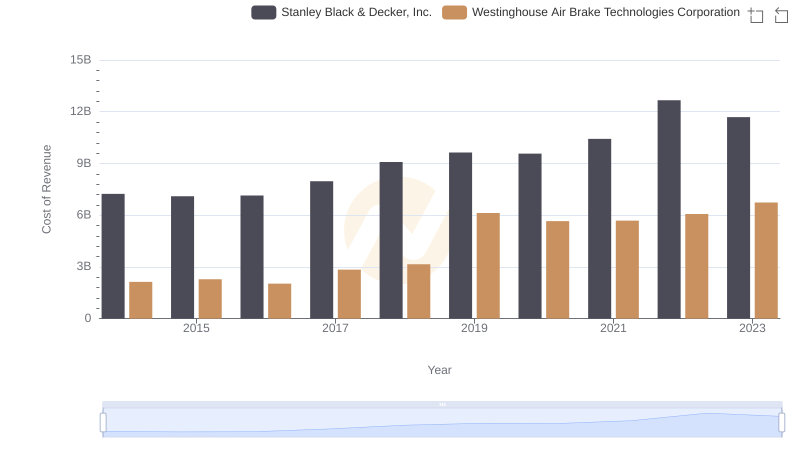

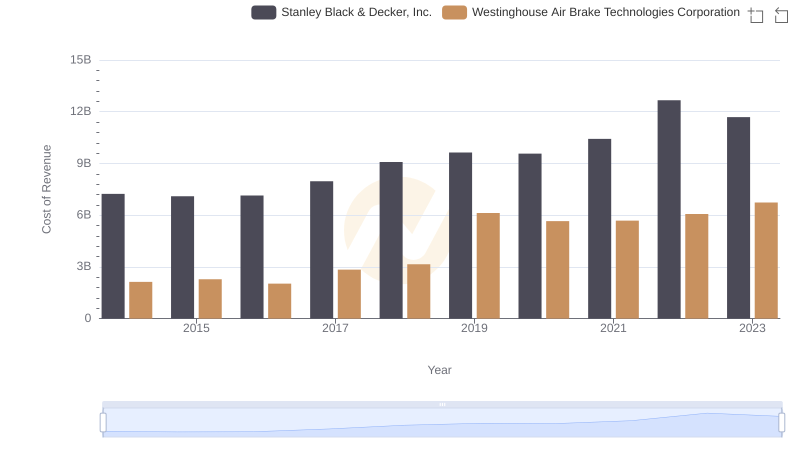

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

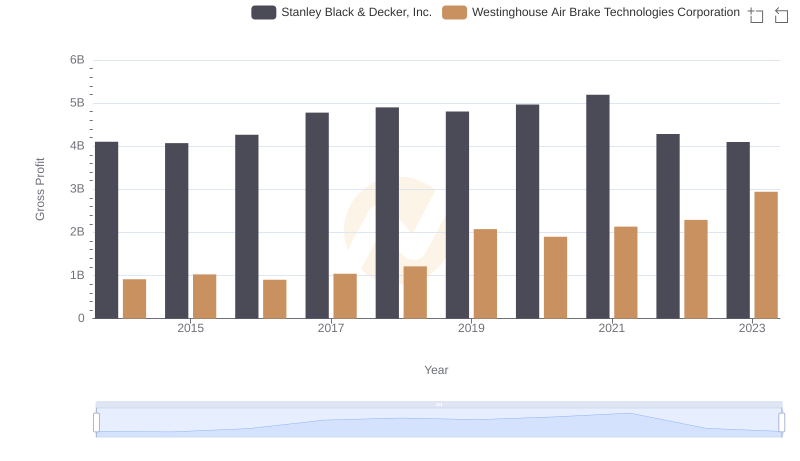

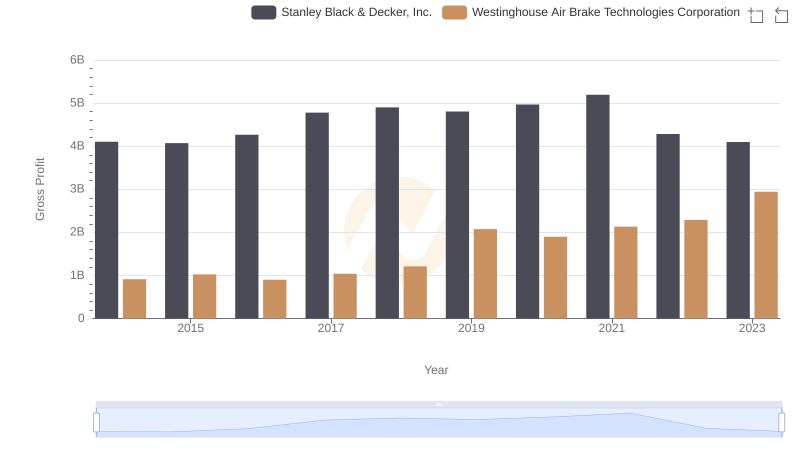

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

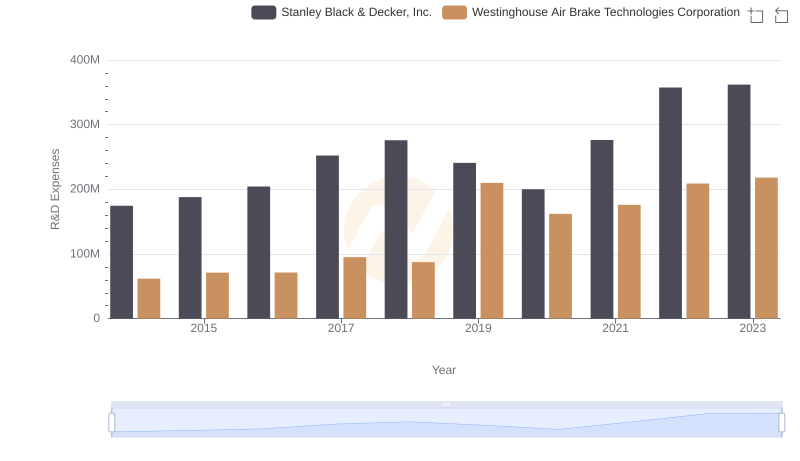

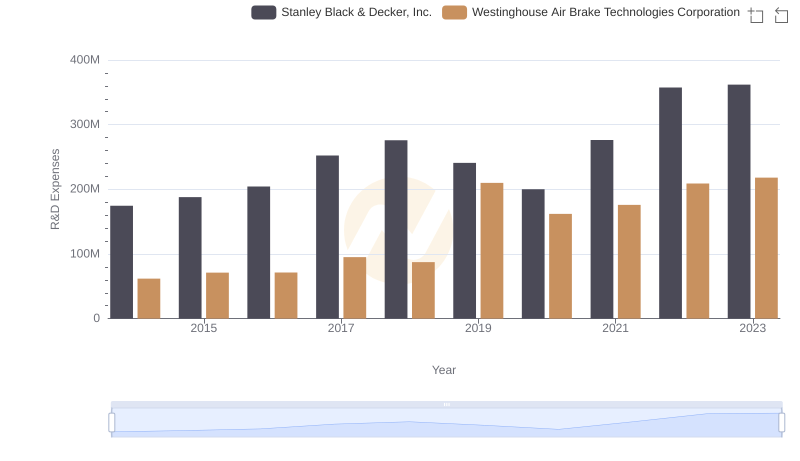

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

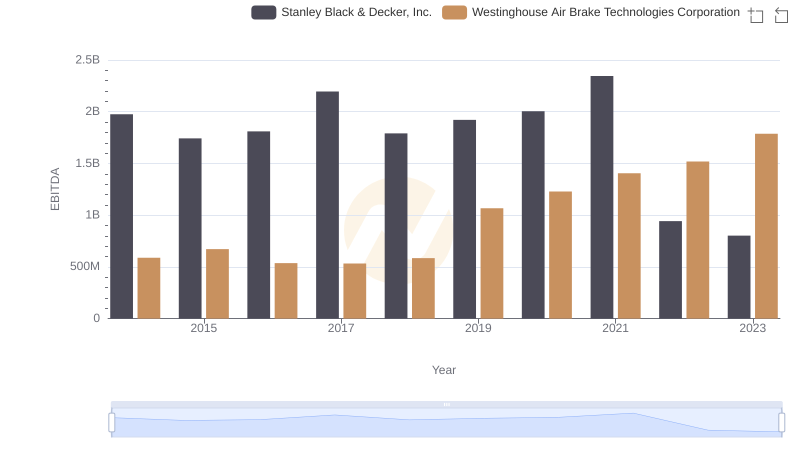

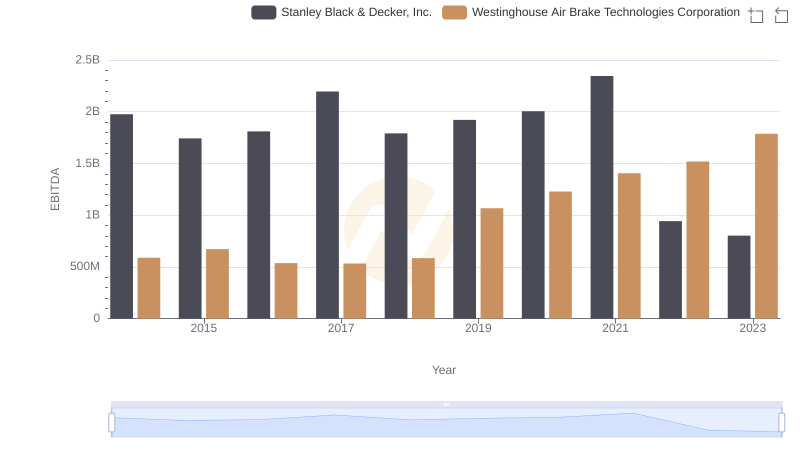

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Cost of Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.: Strategic Focus on R&D Spending

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: SG&A Expense Trends

Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance