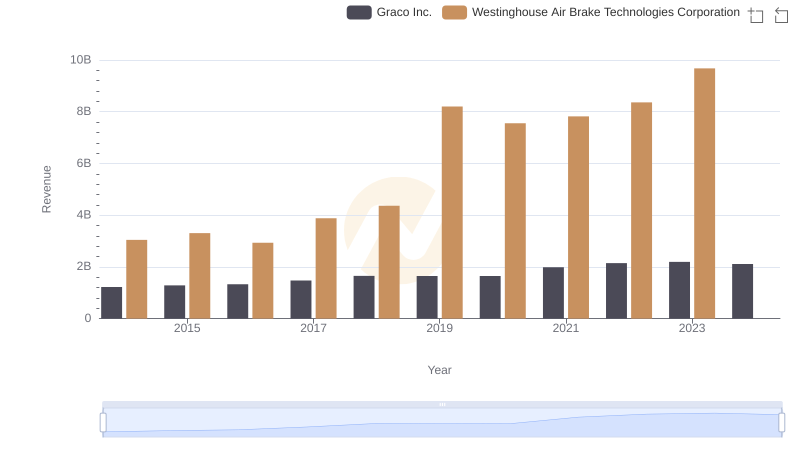

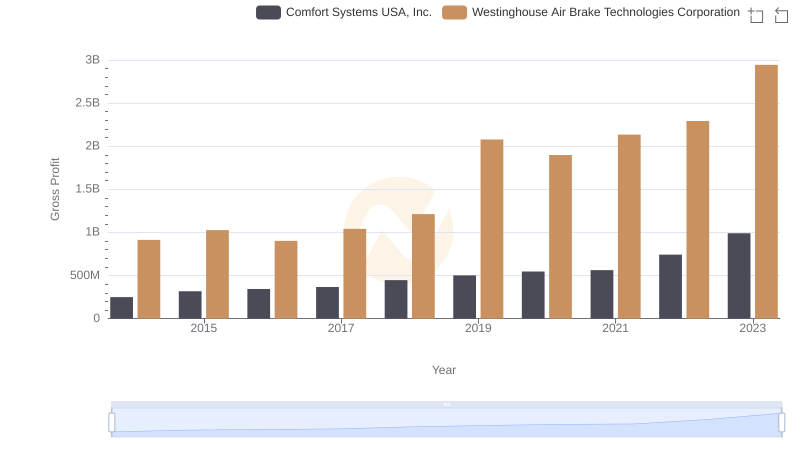

| __timestamp | Graco Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 666736000 | 913534000 |

| Thursday, January 1, 2015 | 684700000 | 1026153000 |

| Friday, January 1, 2016 | 708239000 | 901541000 |

| Sunday, January 1, 2017 | 793049000 | 1040597000 |

| Monday, January 1, 2018 | 882539000 | 1211731000 |

| Tuesday, January 1, 2019 | 859756000 | 2077600000 |

| Wednesday, January 1, 2020 | 854937000 | 1898700000 |

| Friday, January 1, 2021 | 1033949000 | 2135000000 |

| Saturday, January 1, 2022 | 1057439000 | 2292000000 |

| Sunday, January 1, 2023 | 1161021000 | 2944000000 |

| Monday, January 1, 2024 | 1122461000 | 3366000000 |

Unlocking the unknown

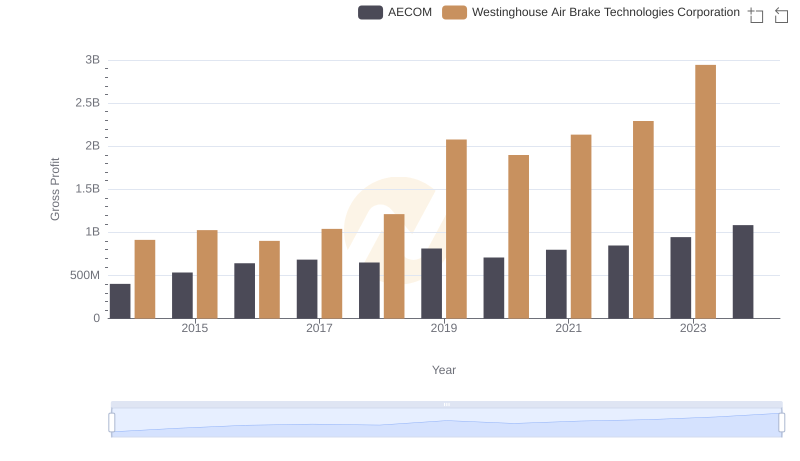

In the competitive landscape of industrial manufacturing, two titans stand out: Graco Inc. and Westinghouse Air Brake Technologies Corporation. Over the past decade, these companies have showcased their prowess in generating gross profit, a key indicator of financial health and operational efficiency.

From 2014 to 2023, Westinghouse consistently outperformed Graco, with gross profits peaking at nearly 2.9 billion in 2023, a staggering 60% higher than Graco's 1.2 billion. This trend highlights Westinghouse's robust growth strategy and market dominance. However, Graco's steady increase, with a 74% rise from 2014 to 2023, underscores its resilience and adaptability in a dynamic market.

While Westinghouse's data for 2024 remains elusive, Graco's continued performance will be crucial in determining if it can close the gap. As these industrial giants forge ahead, their financial trajectories offer valuable insights into the sector's evolving dynamics.

Westinghouse Air Brake Technologies Corporation vs Graco Inc.: Annual Revenue Growth Compared

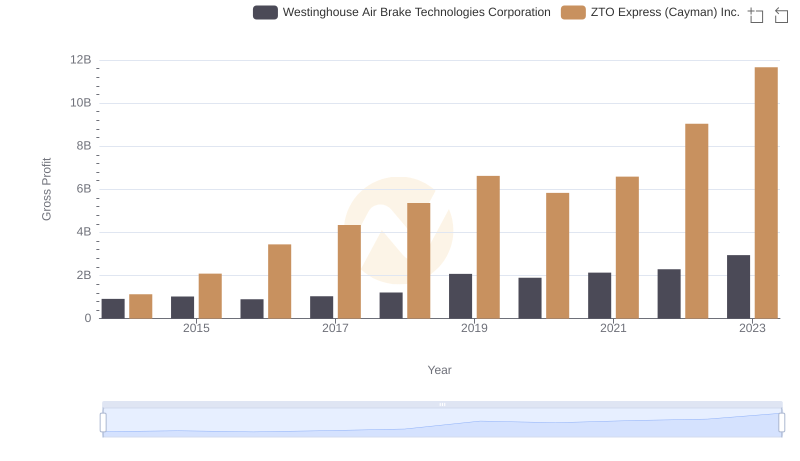

Westinghouse Air Brake Technologies Corporation and ZTO Express (Cayman) Inc.: A Detailed Gross Profit Analysis

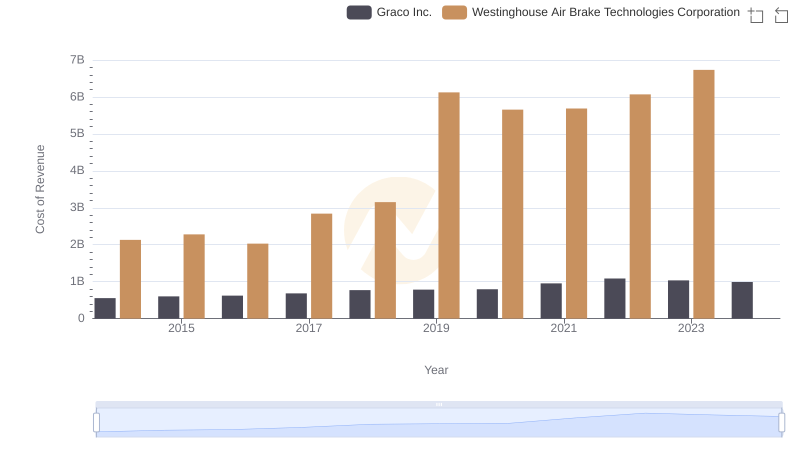

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and Graco Inc.

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and AECOM Trends

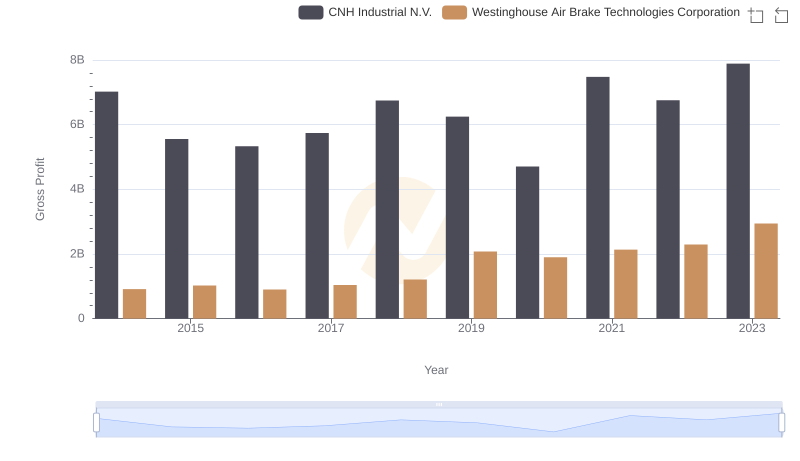

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V. Trends

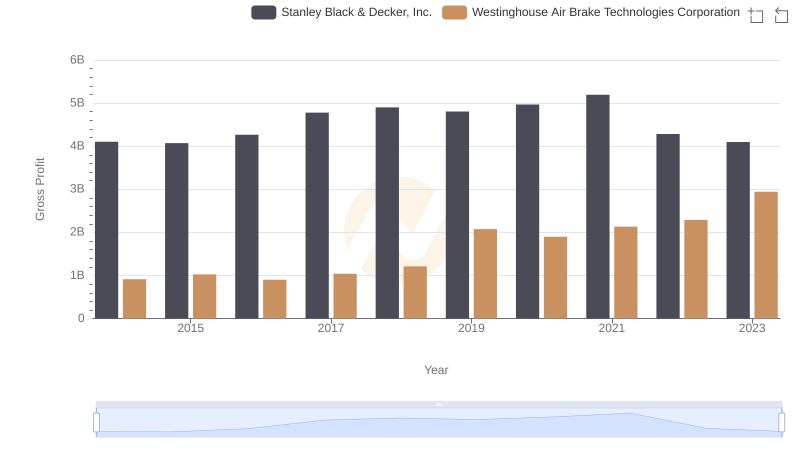

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

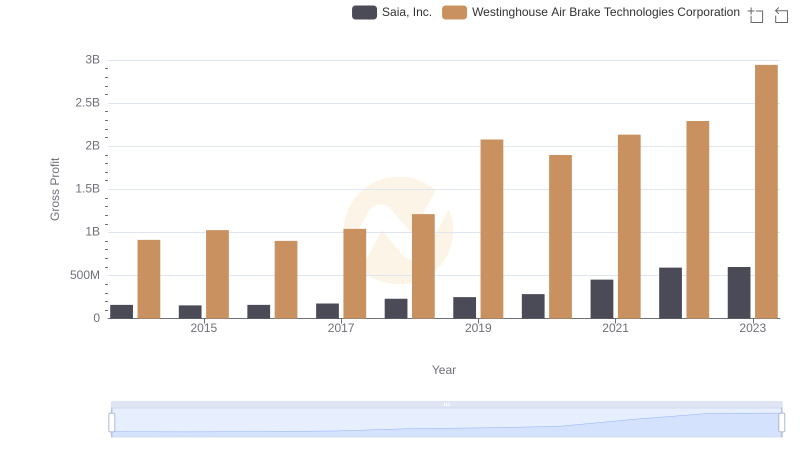

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Saia, Inc.

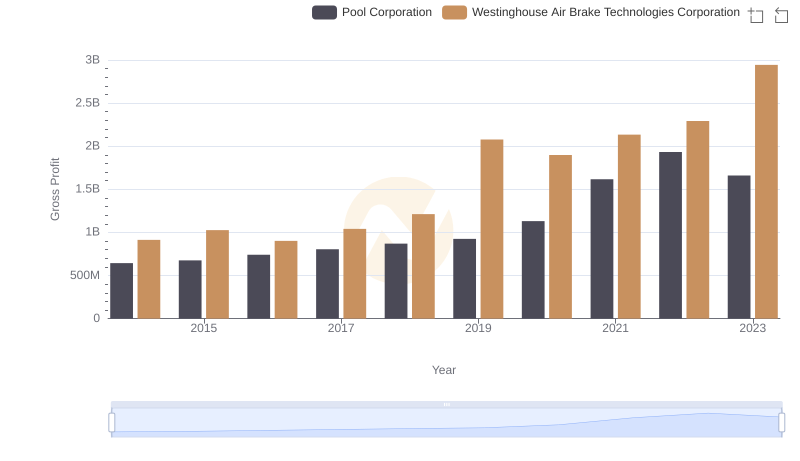

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pool Corporation Trends

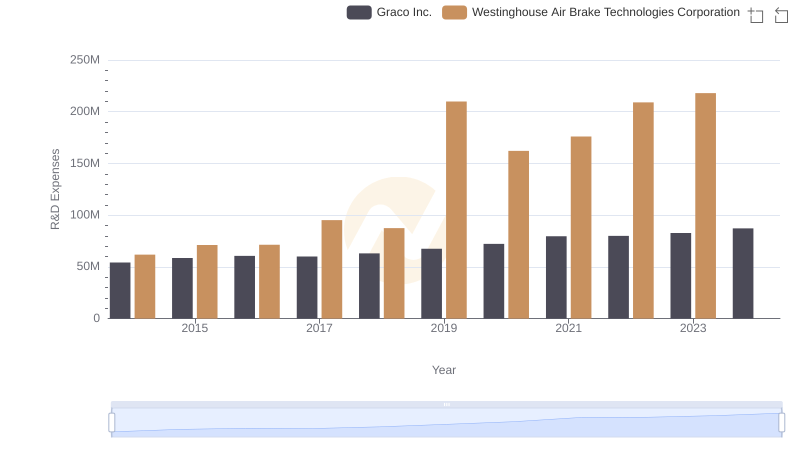

Who Prioritizes Innovation? R&D Spending Compared for Westinghouse Air Brake Technologies Corporation and Graco Inc.

Westinghouse Air Brake Technologies Corporation and Comfort Systems USA, Inc.: A Detailed Gross Profit Analysis

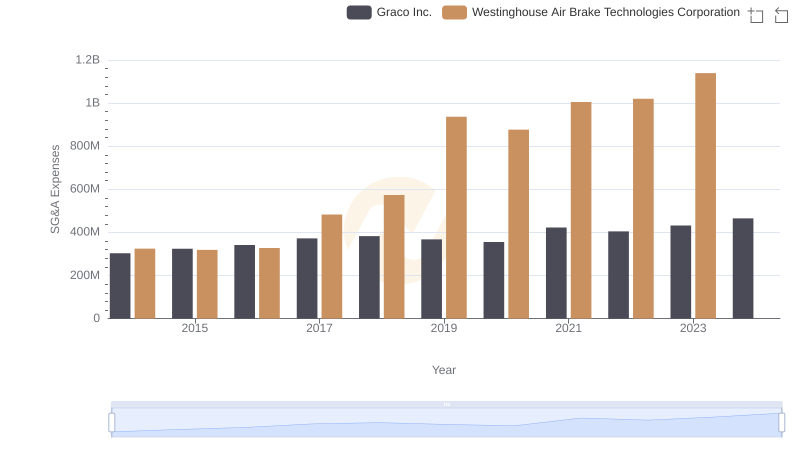

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Graco Inc.

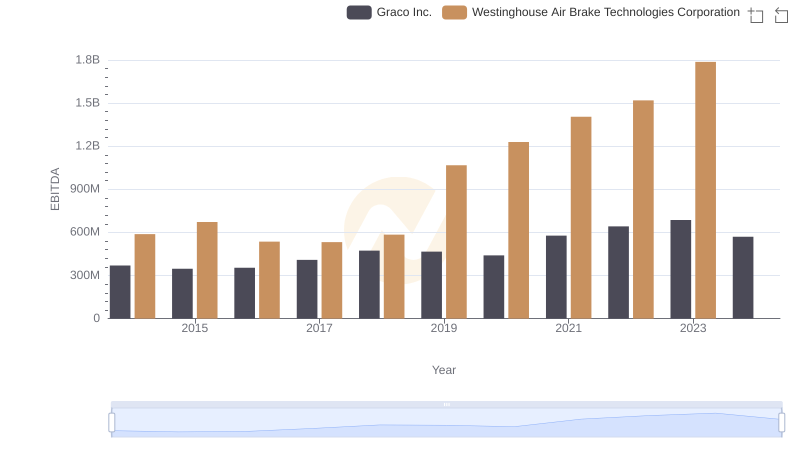

Westinghouse Air Brake Technologies Corporation and Graco Inc.: A Detailed Examination of EBITDA Performance