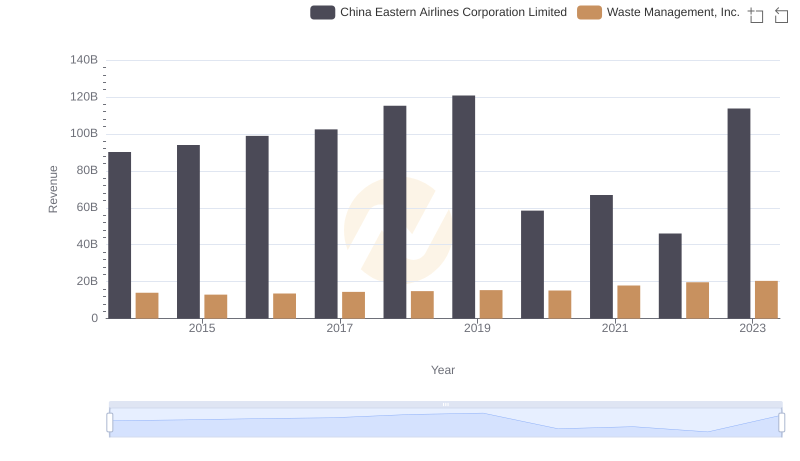

| __timestamp | China Eastern Airlines Corporation Limited | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4120000000 | 1481000000 |

| Thursday, January 1, 2015 | 3651000000 | 1343000000 |

| Friday, January 1, 2016 | 3133000000 | 1410000000 |

| Sunday, January 1, 2017 | 3294000000 | 1468000000 |

| Monday, January 1, 2018 | 3807000000 | 1453000000 |

| Tuesday, January 1, 2019 | 4134000000 | 1631000000 |

| Wednesday, January 1, 2020 | 1570000000 | 1728000000 |

| Friday, January 1, 2021 | 1128000000 | 1864000000 |

| Saturday, January 1, 2022 | 2933000000 | 1938000000 |

| Sunday, January 1, 2023 | 7254000000 | 1926000000 |

| Monday, January 1, 2024 | 2264000000 |

Igniting the spark of knowledge

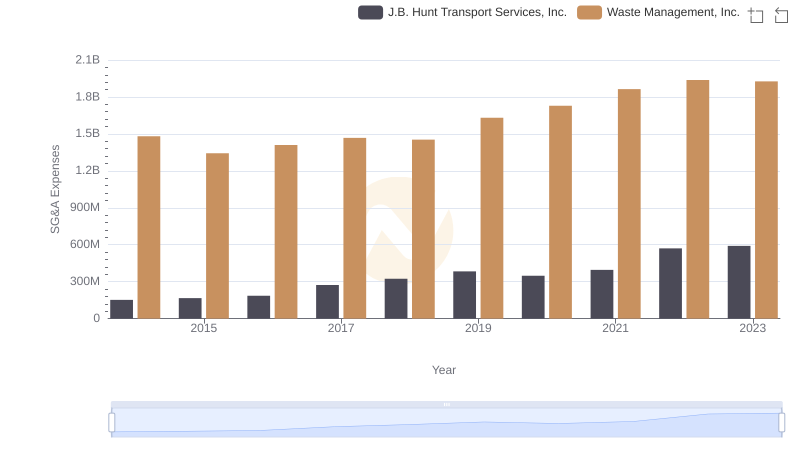

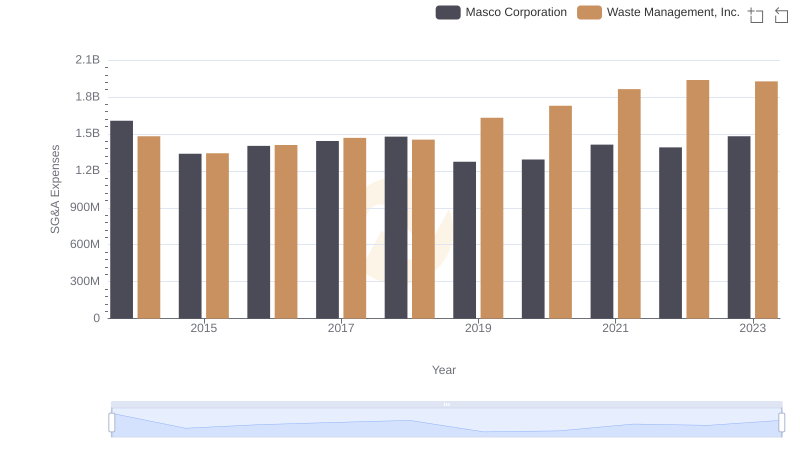

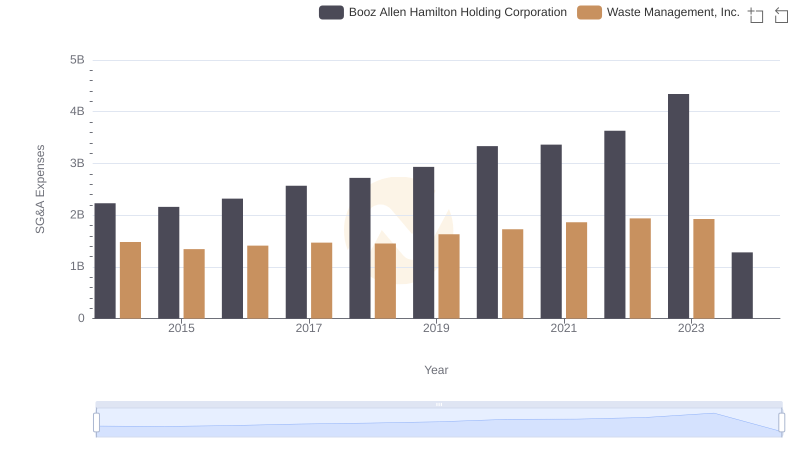

In the ever-evolving landscape of corporate expenses, Selling, General, and Administrative (SG&A) costs offer a window into a company's operational efficiency. Over the past decade, Waste Management, Inc. and China Eastern Airlines Corporation Limited have showcased contrasting trends in their SG&A expenses. From 2014 to 2023, China Eastern Airlines saw a dramatic 76% increase in SG&A costs, peaking in 2023. This surge reflects the airline industry's volatile nature, influenced by global events and fluctuating fuel prices. In contrast, Waste Management, Inc. maintained a more stable trajectory, with a modest 30% rise over the same period. This stability underscores the waste management sector's resilience and consistent demand. As businesses navigate economic uncertainties, understanding these expense patterns is crucial for investors and stakeholders alike.

Waste Management, Inc. vs China Eastern Airlines Corporation Limited: Annual Revenue Growth Compared

Waste Management, Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Waste Management, Inc. vs Masco Corporation

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Booz Allen Hamilton Holding Corporation

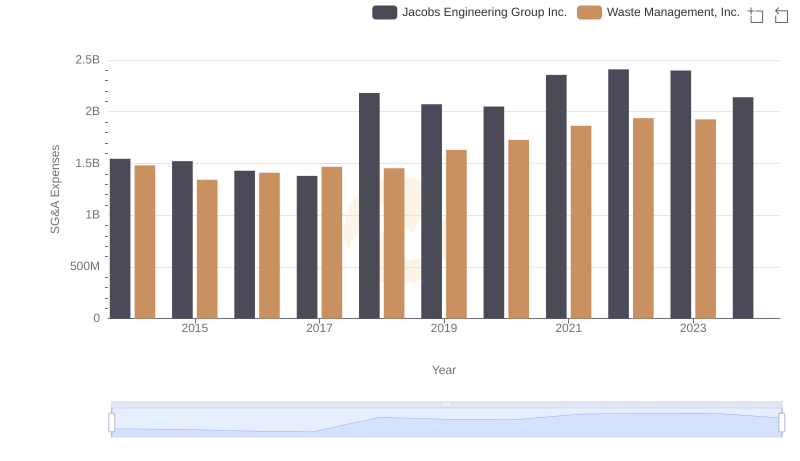

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Jacobs Engineering Group Inc.

Cost of Revenue: Key Insights for Waste Management, Inc. and China Eastern Airlines Corporation Limited

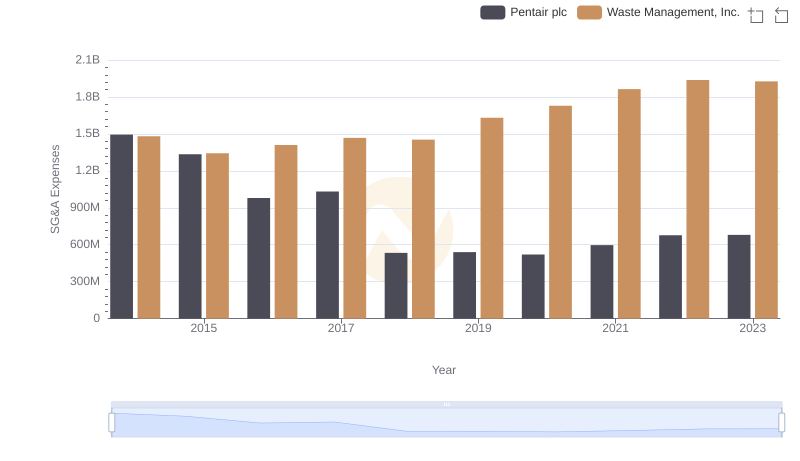

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Pentair plc

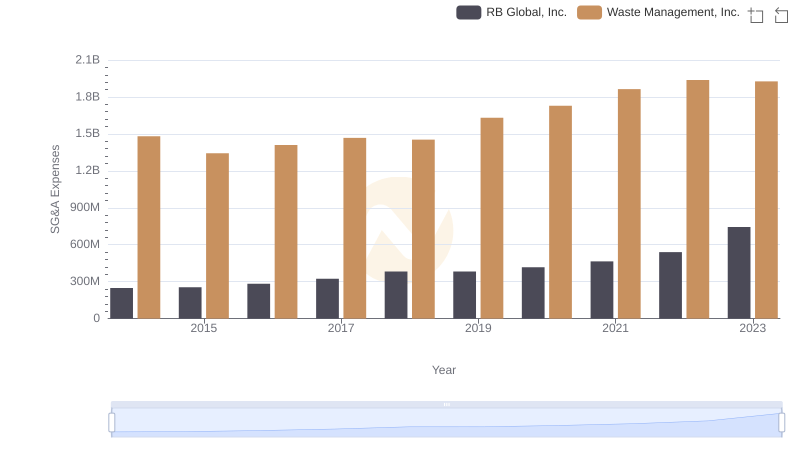

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and RB Global, Inc.

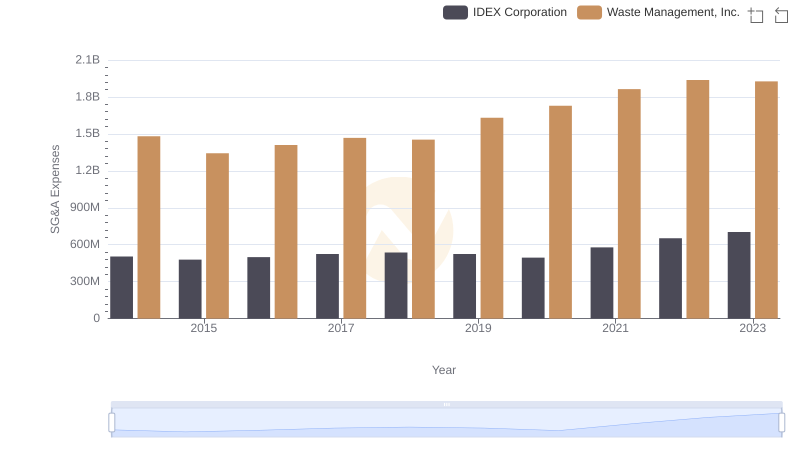

Waste Management, Inc. vs IDEX Corporation: SG&A Expense Trends

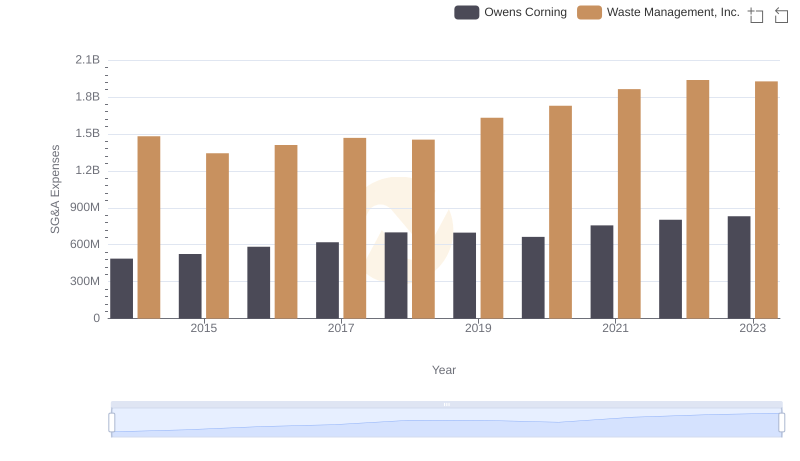

Selling, General, and Administrative Costs: Waste Management, Inc. vs Owens Corning

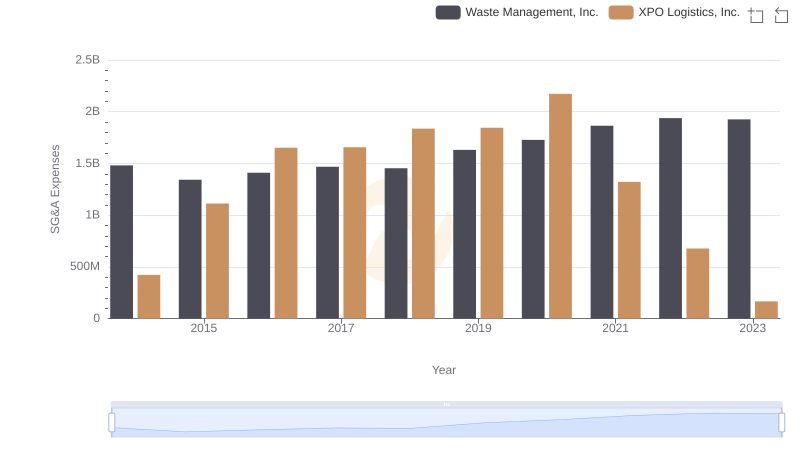

Waste Management, Inc. vs XPO Logistics, Inc.: SG&A Expense Trends

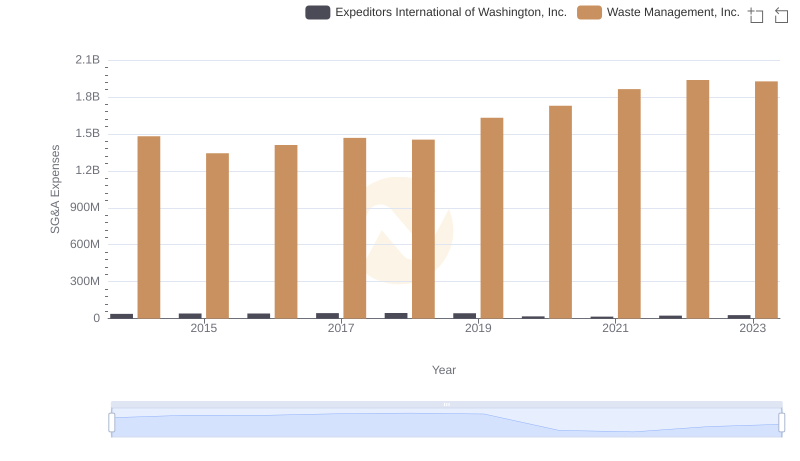

Comparing SG&A Expenses: Waste Management, Inc. vs Expeditors International of Washington, Inc. Trends and Insights