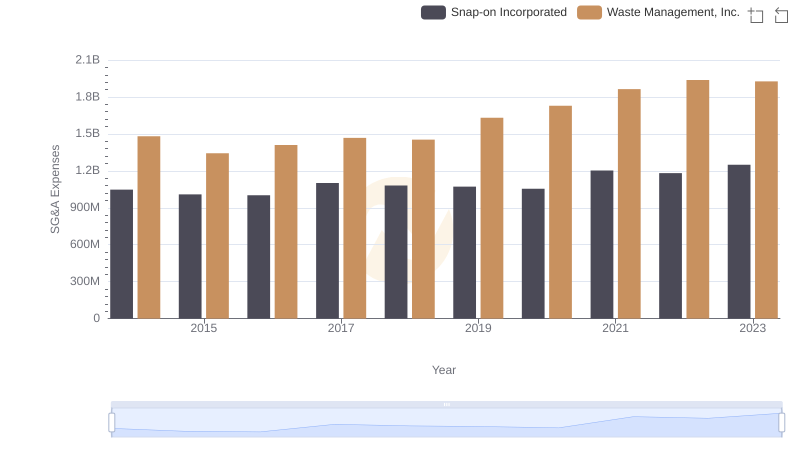

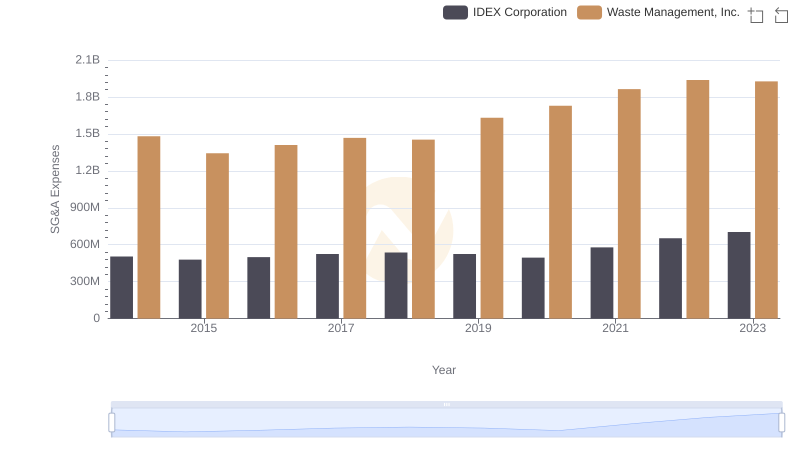

| __timestamp | Jacobs Engineering Group Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1545716000 | 1481000000 |

| Thursday, January 1, 2015 | 1522811000 | 1343000000 |

| Friday, January 1, 2016 | 1429233000 | 1410000000 |

| Sunday, January 1, 2017 | 1379983000 | 1468000000 |

| Monday, January 1, 2018 | 2180399000 | 1453000000 |

| Tuesday, January 1, 2019 | 2072177000 | 1631000000 |

| Wednesday, January 1, 2020 | 2050695000 | 1728000000 |

| Friday, January 1, 2021 | 2355683000 | 1864000000 |

| Saturday, January 1, 2022 | 2409190000 | 1938000000 |

| Sunday, January 1, 2023 | 2398078000 | 1926000000 |

| Monday, January 1, 2024 | 2140320000 | 2264000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, effective cost management remains a cornerstone of success. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Waste Management, Inc. and Jacobs Engineering Group Inc., from 2014 to 2023.

Over the past decade, Jacobs Engineering Group Inc. has seen a notable 55% increase in SG&A expenses, peaking in 2022. This upward trend reflects strategic investments in operational efficiency and expansion. Conversely, Waste Management, Inc. has maintained a more stable trajectory, with a modest 30% rise over the same period, indicating a focus on steady growth and cost control.

The data reveals a fascinating narrative of financial strategy, with Jacobs Engineering's aggressive growth contrasting Waste Management's conservative approach. As we look to the future, these insights offer valuable lessons in balancing growth with fiscal responsibility.

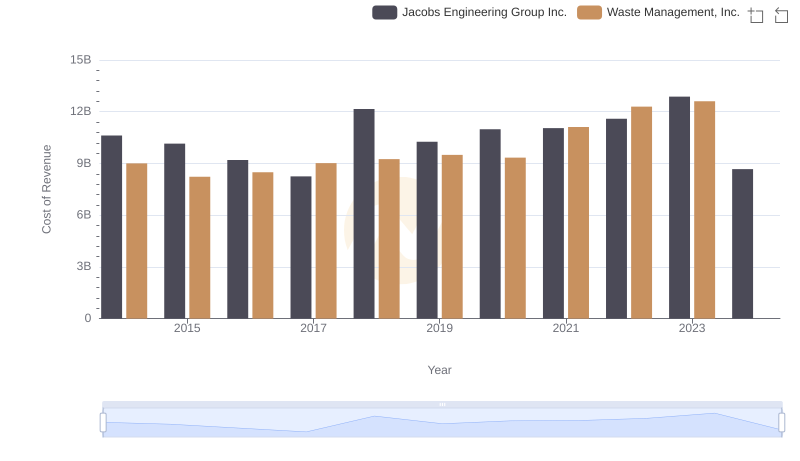

Cost of Revenue: Key Insights for Waste Management, Inc. and Jacobs Engineering Group Inc.

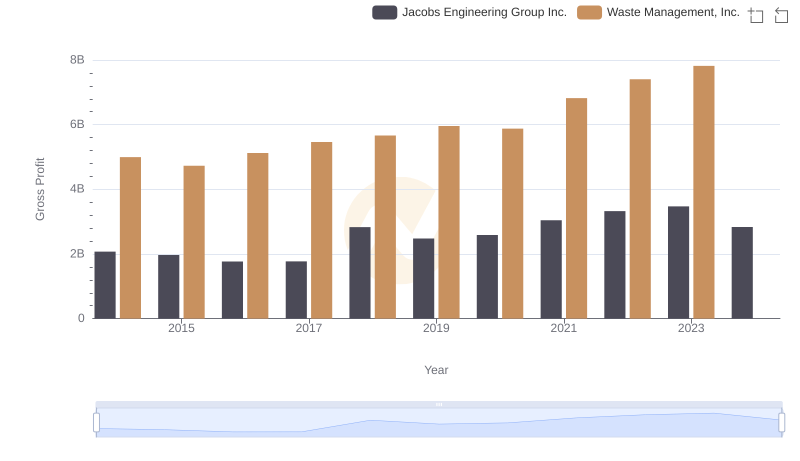

Waste Management, Inc. and Jacobs Engineering Group Inc.: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Snap-on Incorporated

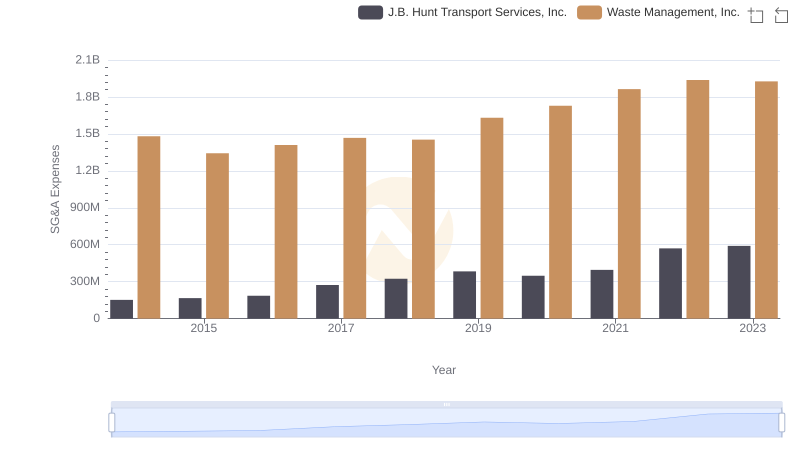

Waste Management, Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

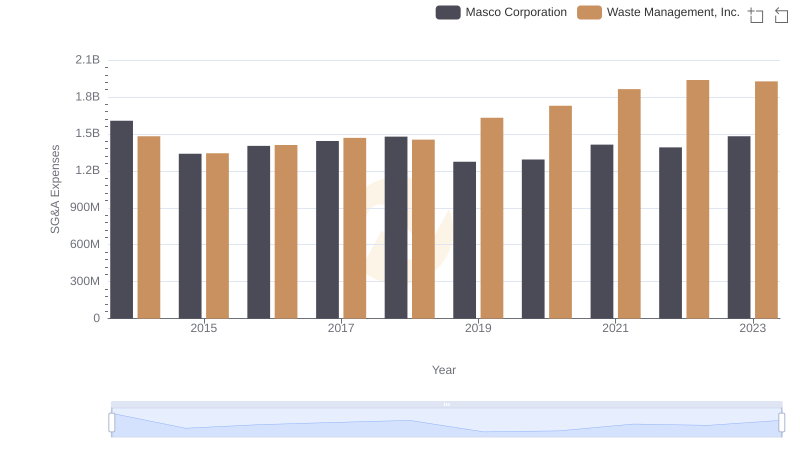

Selling, General, and Administrative Costs: Waste Management, Inc. vs Masco Corporation

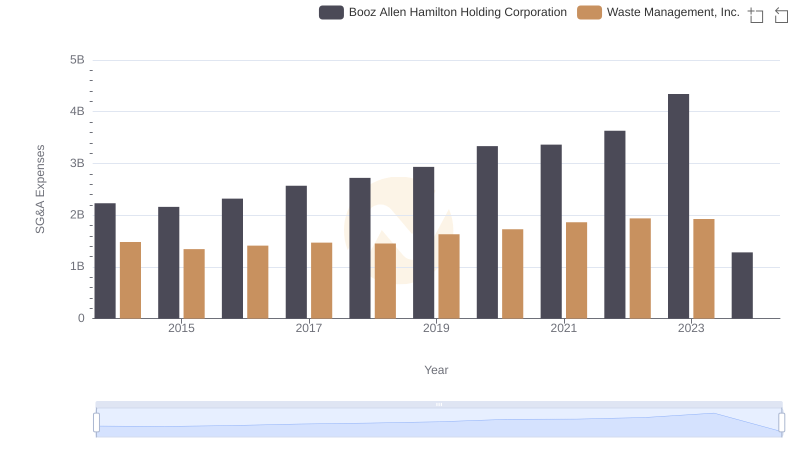

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Booz Allen Hamilton Holding Corporation

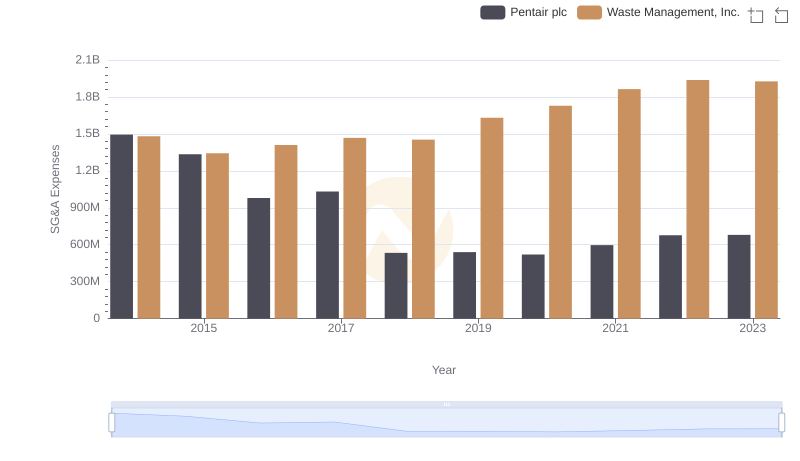

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Pentair plc

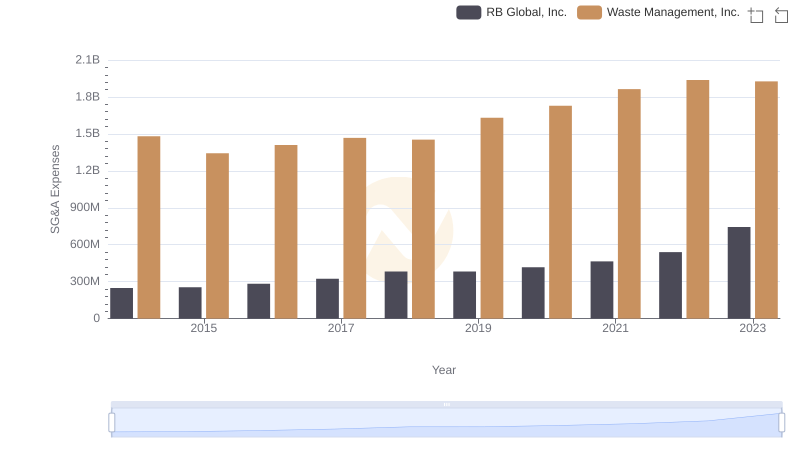

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and RB Global, Inc.

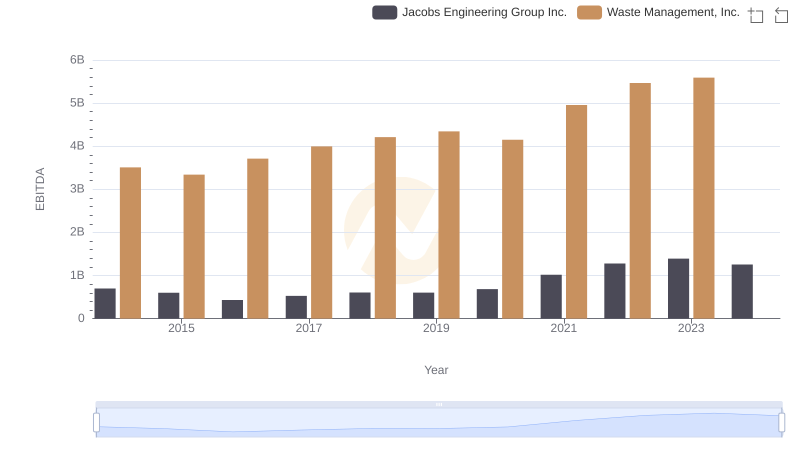

Comparative EBITDA Analysis: Waste Management, Inc. vs Jacobs Engineering Group Inc.

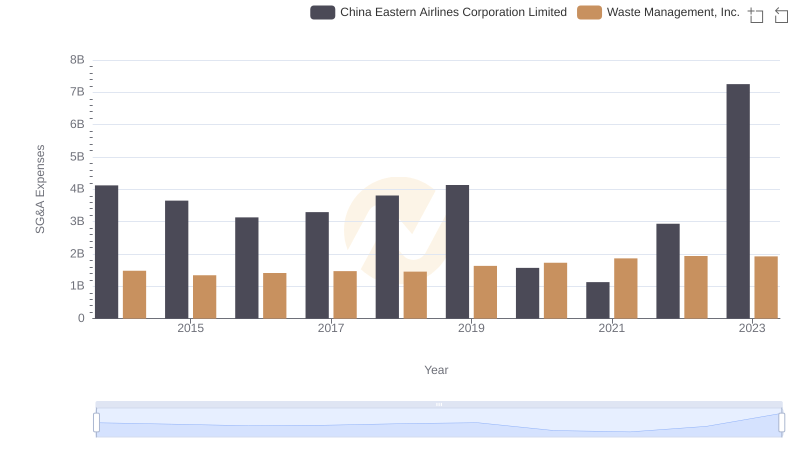

Selling, General, and Administrative Costs: Waste Management, Inc. vs China Eastern Airlines Corporation Limited

Waste Management, Inc. vs IDEX Corporation: SG&A Expense Trends