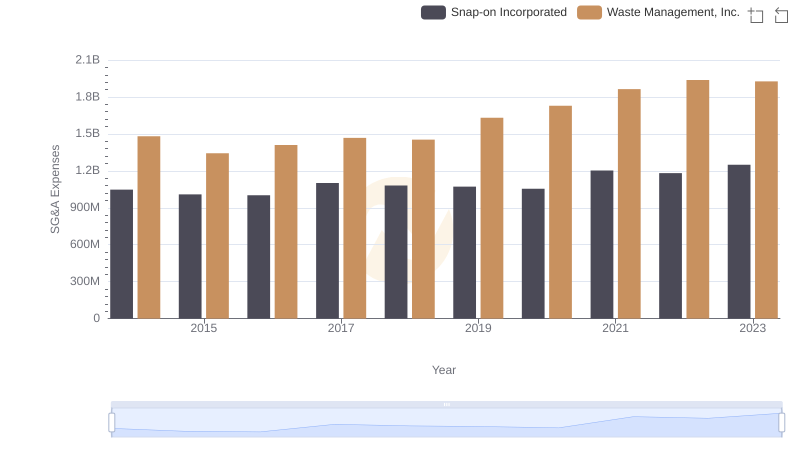

| __timestamp | Masco Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1607000000 | 1481000000 |

| Thursday, January 1, 2015 | 1339000000 | 1343000000 |

| Friday, January 1, 2016 | 1403000000 | 1410000000 |

| Sunday, January 1, 2017 | 1442000000 | 1468000000 |

| Monday, January 1, 2018 | 1478000000 | 1453000000 |

| Tuesday, January 1, 2019 | 1274000000 | 1631000000 |

| Wednesday, January 1, 2020 | 1292000000 | 1728000000 |

| Friday, January 1, 2021 | 1413000000 | 1864000000 |

| Saturday, January 1, 2022 | 1390000000 | 1938000000 |

| Sunday, January 1, 2023 | 1481000000 | 1926000000 |

| Monday, January 1, 2024 | 1468000000 | 2264000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a crucial indicator of operational efficiency. Over the past decade, Waste Management, Inc. and Masco Corporation have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Waste Management, Inc. has seen a steady increase in SG&A costs, peaking in 2022 with a 31% rise from 2014. This upward trend reflects the company's expanding operations and strategic investments in sustainability initiatives.

Conversely, Masco Corporation's SG&A expenses have remained relatively stable, with a slight dip in 2019. By 2023, their costs increased by only 5% compared to 2014, highlighting a focus on cost control and operational efficiency.

These insights offer a window into the strategic priorities of these industry giants, providing valuable lessons for businesses aiming to balance growth with fiscal prudence.

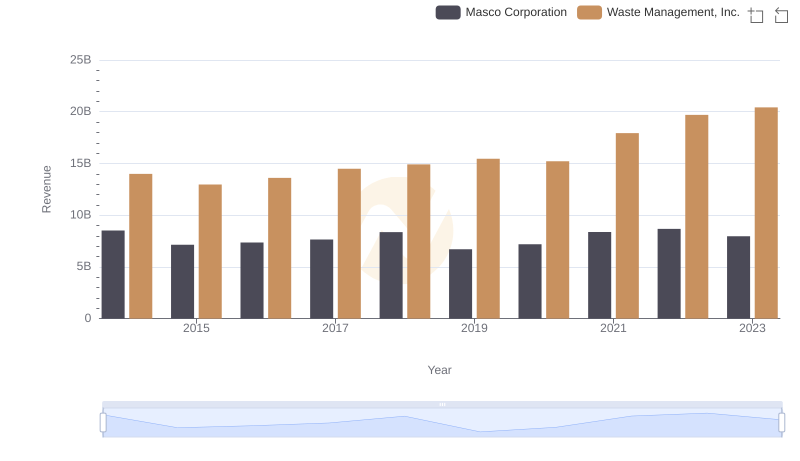

Revenue Showdown: Waste Management, Inc. vs Masco Corporation

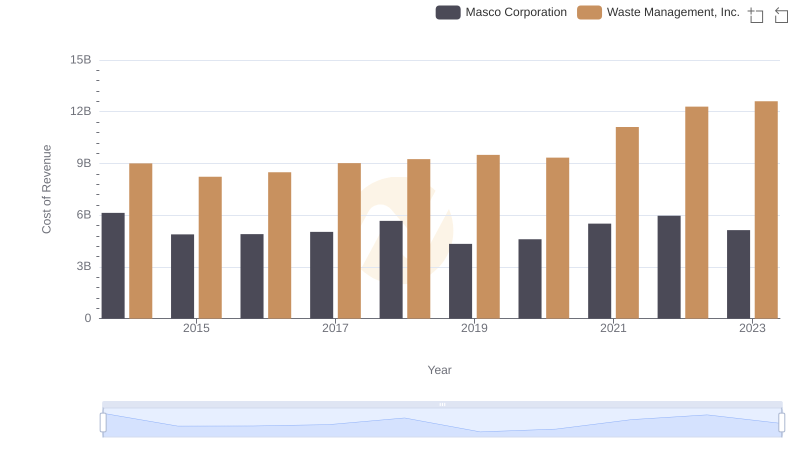

Cost Insights: Breaking Down Waste Management, Inc. and Masco Corporation's Expenses

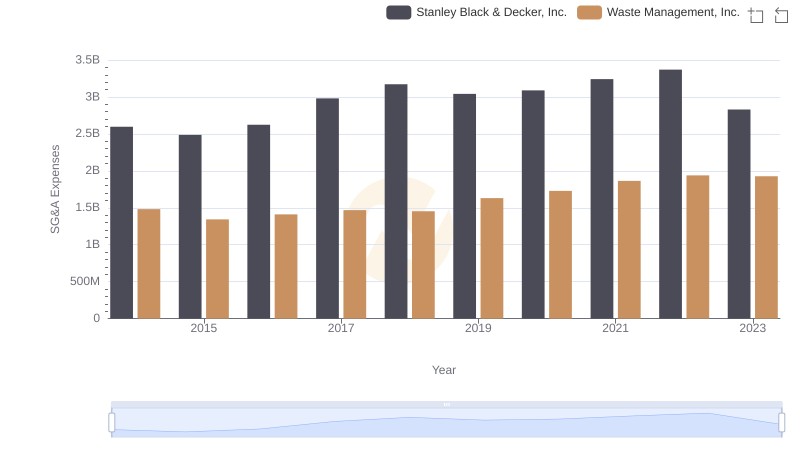

Waste Management, Inc. or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Snap-on Incorporated

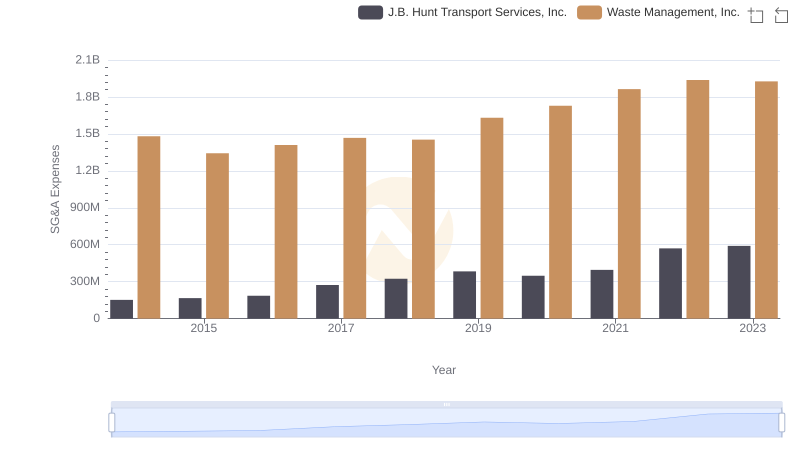

Waste Management, Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

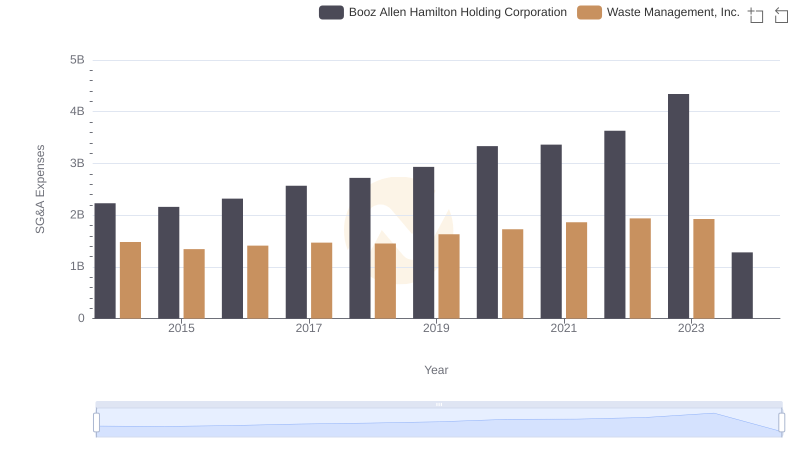

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Booz Allen Hamilton Holding Corporation

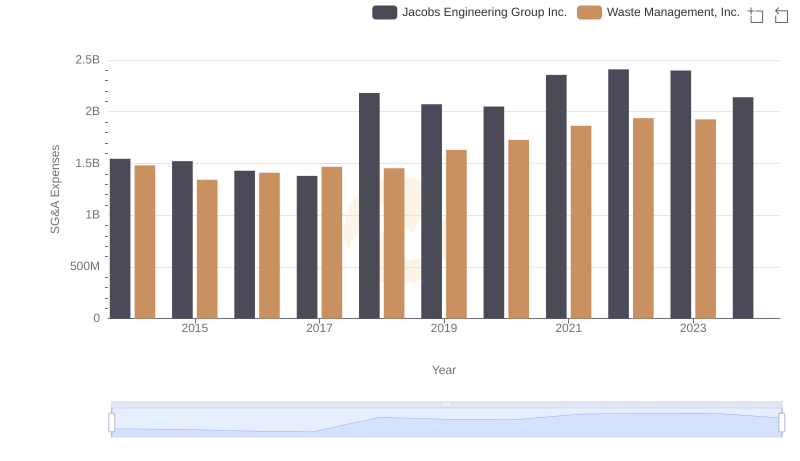

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Jacobs Engineering Group Inc.

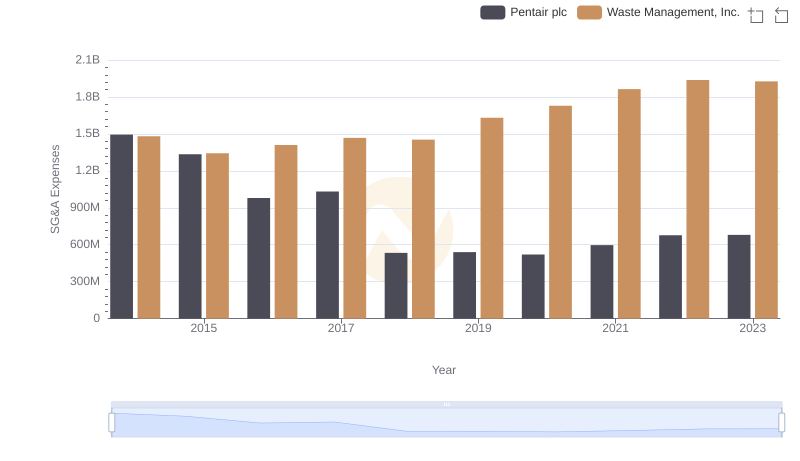

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Pentair plc

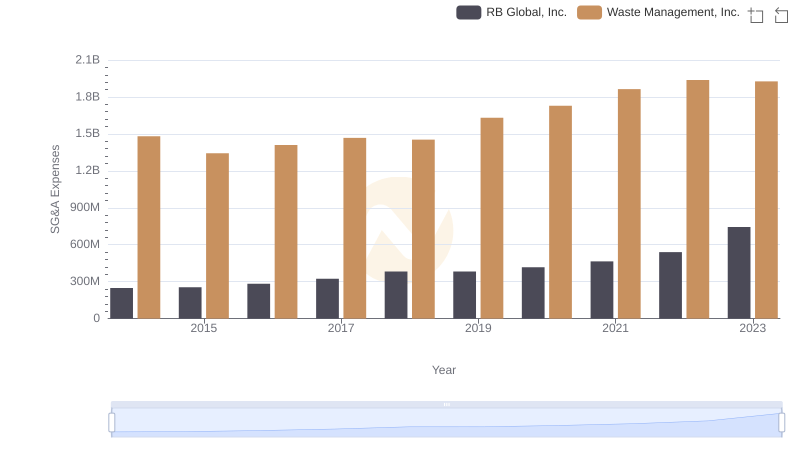

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and RB Global, Inc.

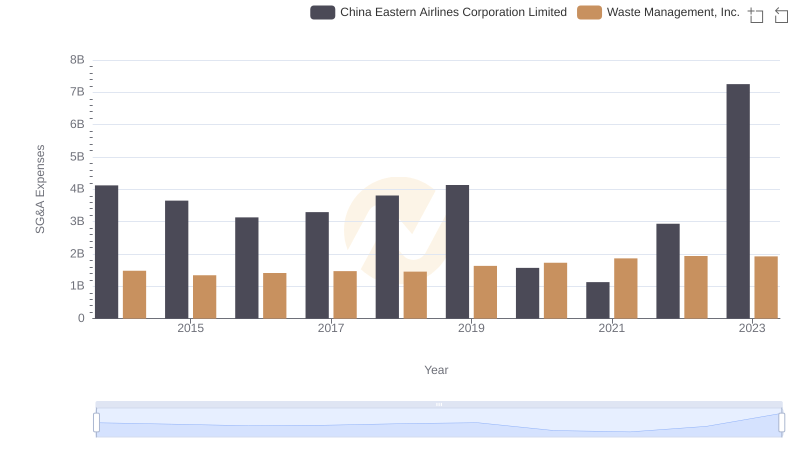

Selling, General, and Administrative Costs: Waste Management, Inc. vs China Eastern Airlines Corporation Limited