| __timestamp | Booz Allen Hamilton Holding Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 1481000000 |

| Thursday, January 1, 2015 | 2159439000 | 1343000000 |

| Friday, January 1, 2016 | 2319592000 | 1410000000 |

| Sunday, January 1, 2017 | 2568511000 | 1468000000 |

| Monday, January 1, 2018 | 2719909000 | 1453000000 |

| Tuesday, January 1, 2019 | 2932602000 | 1631000000 |

| Wednesday, January 1, 2020 | 3334378000 | 1728000000 |

| Friday, January 1, 2021 | 3362722000 | 1864000000 |

| Saturday, January 1, 2022 | 3633150000 | 1938000000 |

| Sunday, January 1, 2023 | 4341769000 | 1926000000 |

| Monday, January 1, 2024 | 1281443000 | 2264000000 |

Igniting the spark of knowledge

In the competitive landscape of corporate America, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Waste Management, Inc. and Booz Allen Hamilton Holding Corporation, two industry leaders, offer a fascinating comparison. Over the past decade, Booz Allen Hamilton has seen a steady increase in SG&A expenses, peaking in 2023 with a 95% rise from 2014. In contrast, Waste Management's SG&A expenses have grown more modestly, with a 30% increase over the same period. This divergence highlights differing strategic priorities and operational efficiencies. Notably, Booz Allen's expenses surged by 30% from 2020 to 2023, reflecting potential investments in growth or restructuring. Meanwhile, Waste Management's expenses plateaued, suggesting a focus on cost control. Missing data for 2024 indicates potential reporting delays or strategic shifts. This analysis underscores the importance of SG&A management in sustaining competitive advantage.

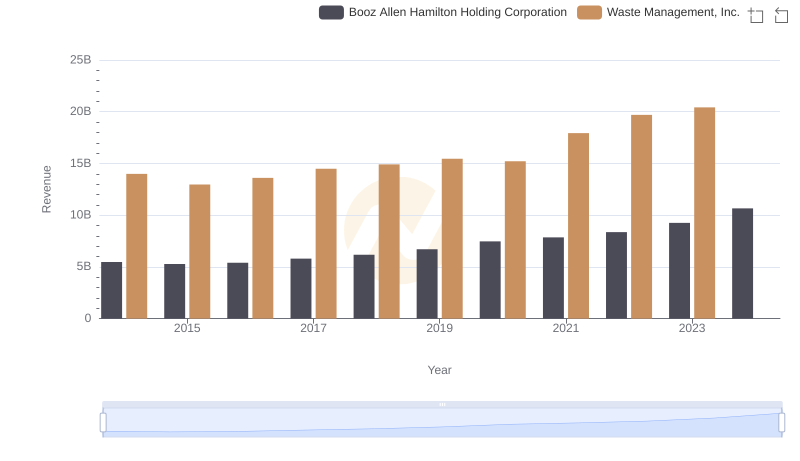

Breaking Down Revenue Trends: Waste Management, Inc. vs Booz Allen Hamilton Holding Corporation

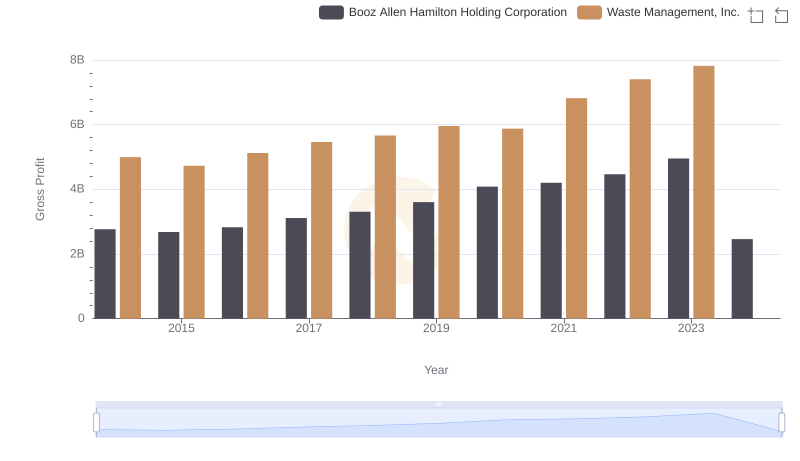

Key Insights on Gross Profit: Waste Management, Inc. vs Booz Allen Hamilton Holding Corporation

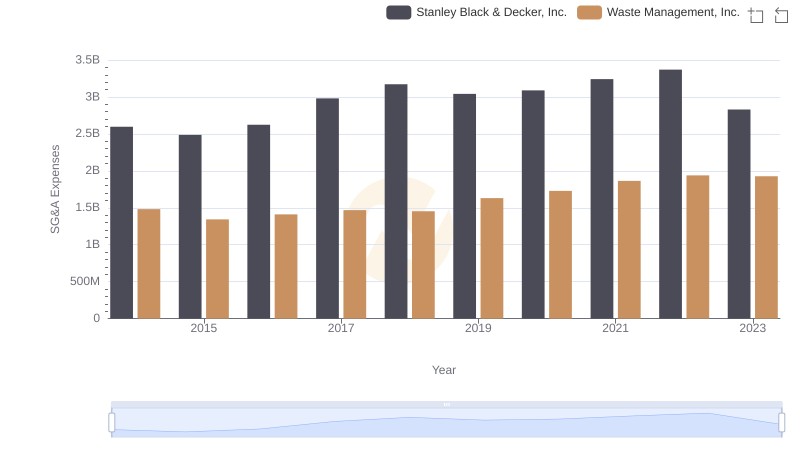

Waste Management, Inc. or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

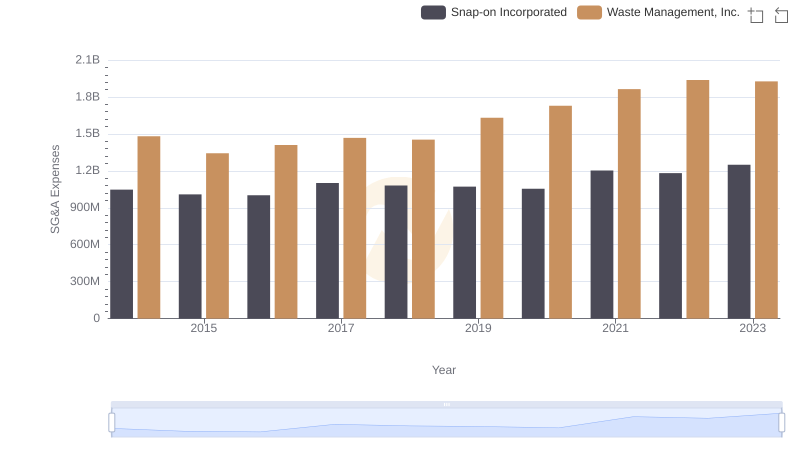

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Snap-on Incorporated

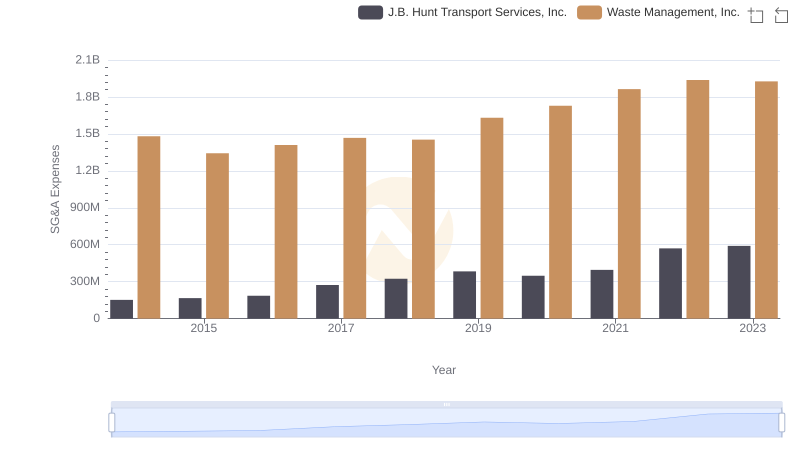

Waste Management, Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

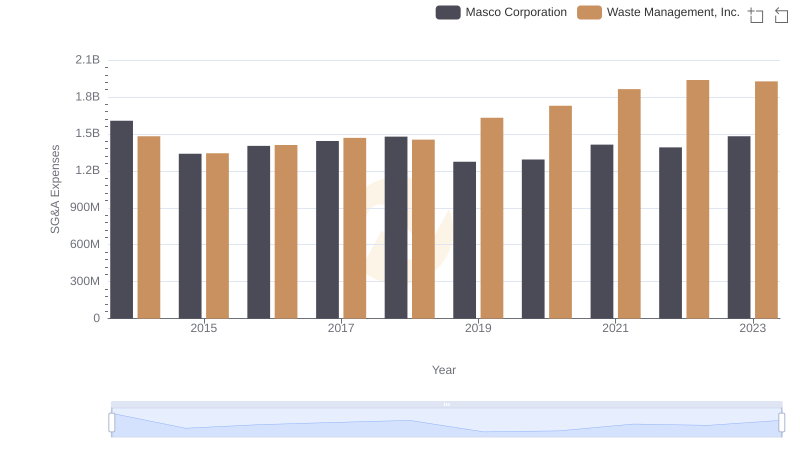

Selling, General, and Administrative Costs: Waste Management, Inc. vs Masco Corporation

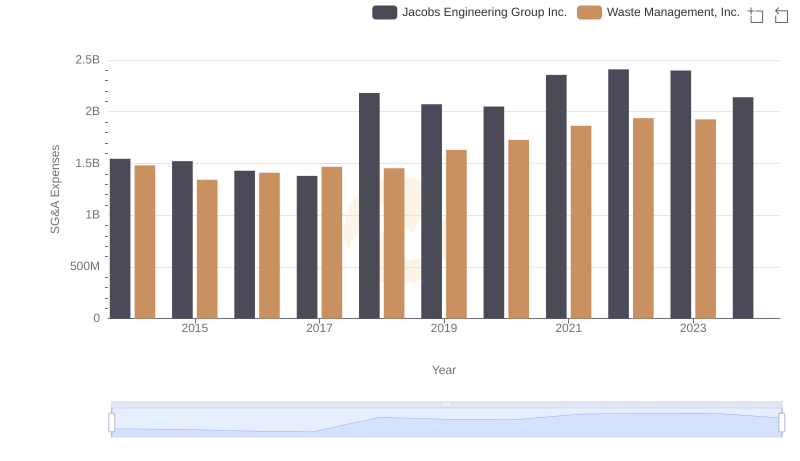

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Jacobs Engineering Group Inc.

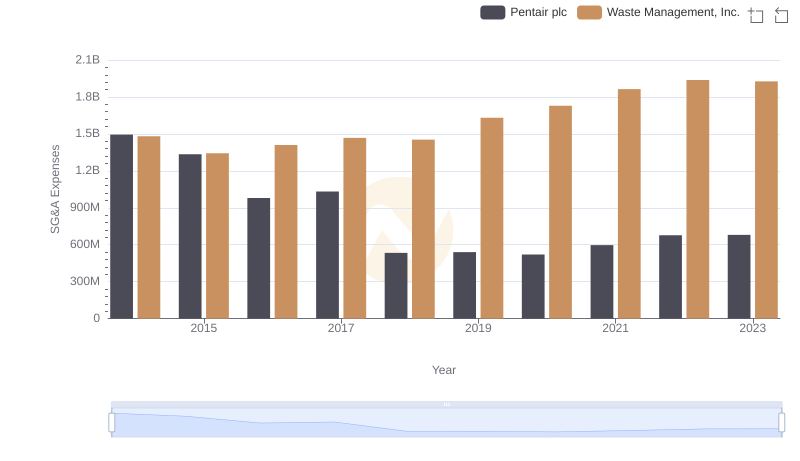

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Pentair plc

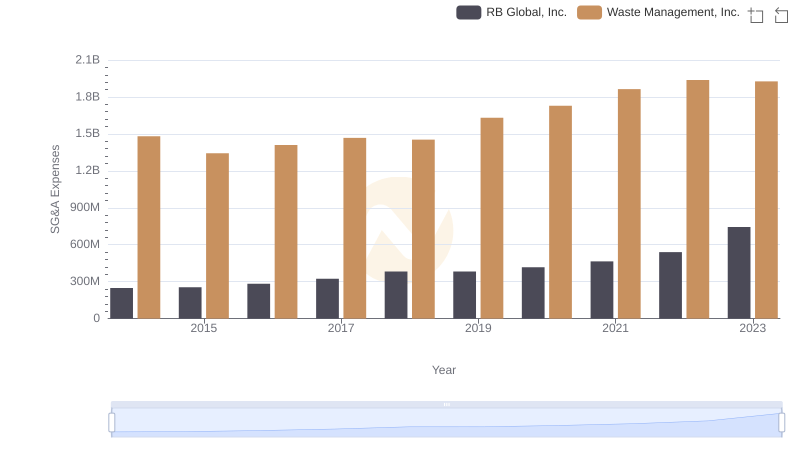

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and RB Global, Inc.

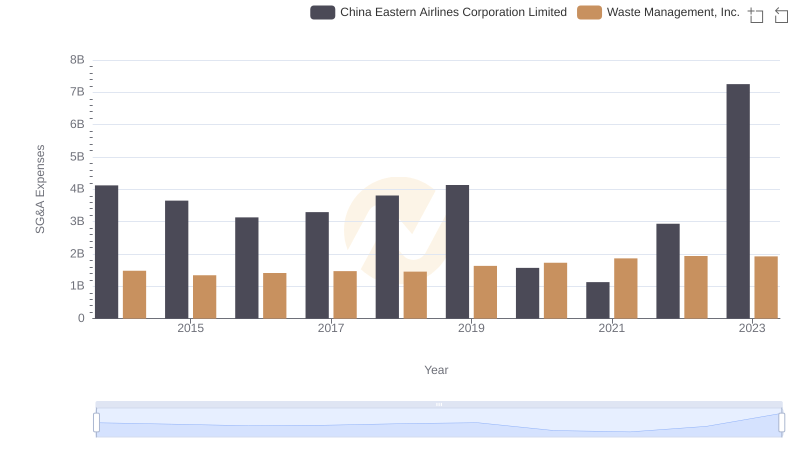

Selling, General, and Administrative Costs: Waste Management, Inc. vs China Eastern Airlines Corporation Limited