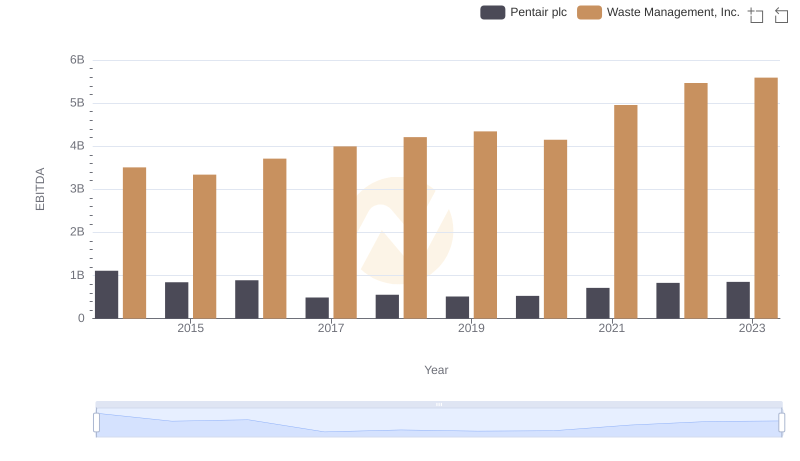

| __timestamp | Pentair plc | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1493800000 | 1481000000 |

| Thursday, January 1, 2015 | 1334300000 | 1343000000 |

| Friday, January 1, 2016 | 979300000 | 1410000000 |

| Sunday, January 1, 2017 | 1032500000 | 1468000000 |

| Monday, January 1, 2018 | 534300000 | 1453000000 |

| Tuesday, January 1, 2019 | 540100000 | 1631000000 |

| Wednesday, January 1, 2020 | 520500000 | 1728000000 |

| Friday, January 1, 2021 | 596400000 | 1864000000 |

| Saturday, January 1, 2022 | 677100000 | 1938000000 |

| Sunday, January 1, 2023 | 680200000 | 1926000000 |

| Monday, January 1, 2024 | 701400000 | 2264000000 |

Infusing magic into the data realm

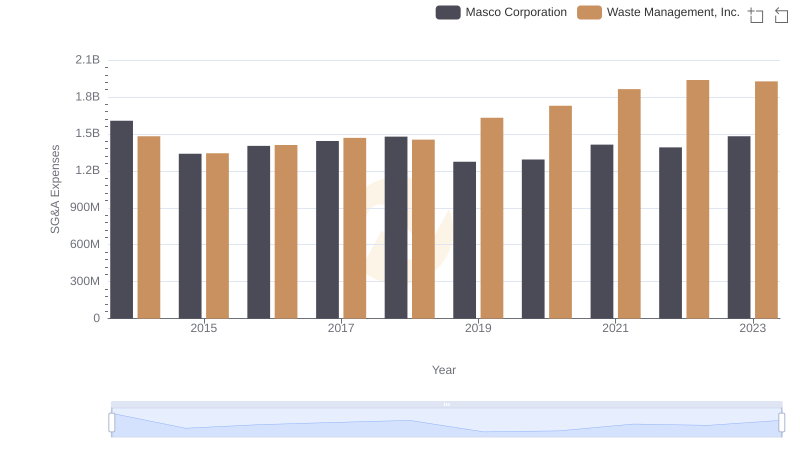

In the competitive landscape of corporate America, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Waste Management, Inc. and Pentair plc, two industry giants, offer a fascinating study in contrasts from 2014 to 2023.

Over the past decade, Waste Management, Inc. has consistently increased its SG&A expenses, peaking at nearly 1.93 billion in 2022. This represents a 30% rise from 2014, reflecting strategic investments in operational efficiency and customer service.

Conversely, Pentair plc experienced a significant drop in SG&A expenses, plummeting by 65% from 2014 to 2018. However, a gradual recovery is evident, with expenses stabilizing around 680 million in 2023. This fluctuation highlights Pentair's adaptive strategies in response to market dynamics.

Both companies showcase unique approaches to managing SG&A expenses, offering valuable insights into corporate financial strategies.

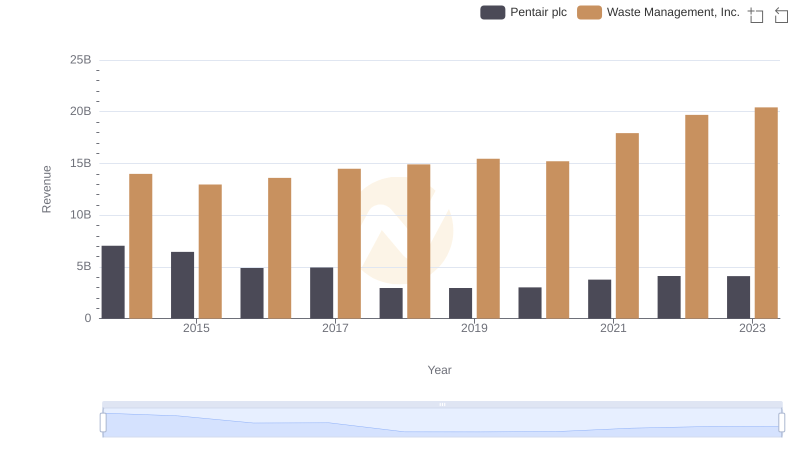

Annual Revenue Comparison: Waste Management, Inc. vs Pentair plc

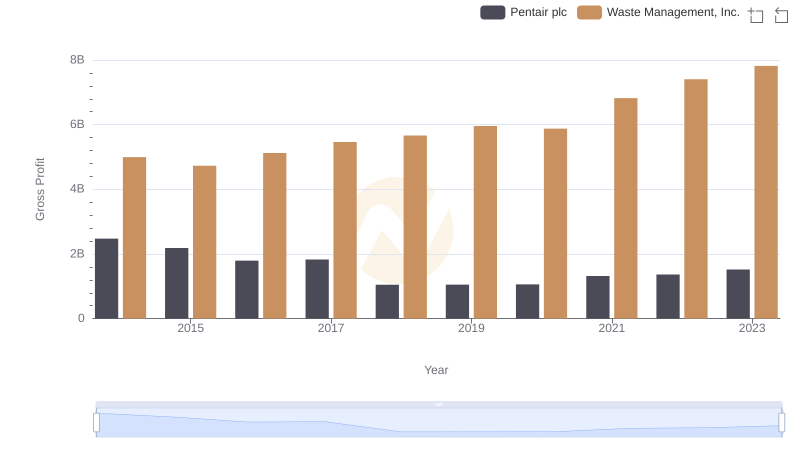

Who Generates Higher Gross Profit? Waste Management, Inc. or Pentair plc

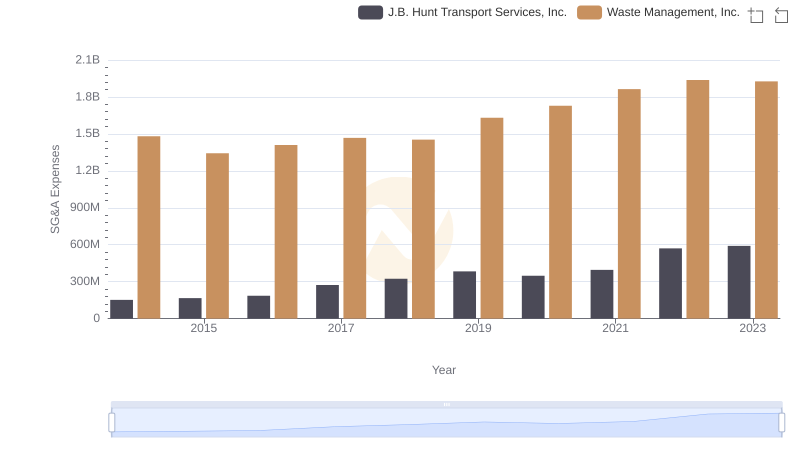

Waste Management, Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Waste Management, Inc. vs Masco Corporation

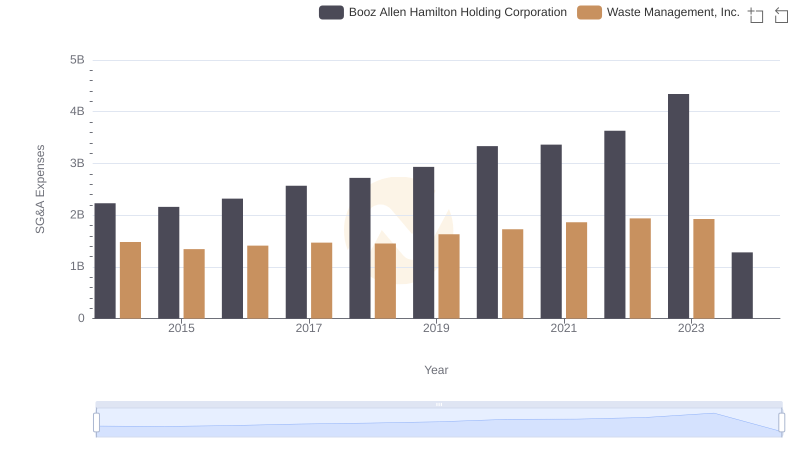

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Booz Allen Hamilton Holding Corporation

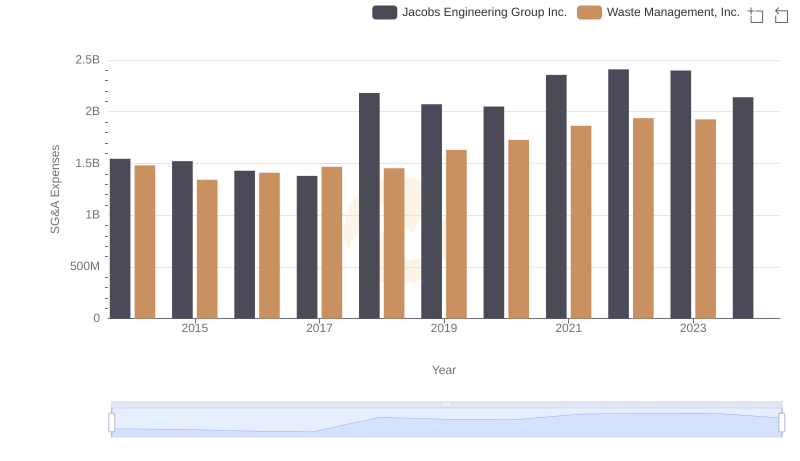

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Jacobs Engineering Group Inc.

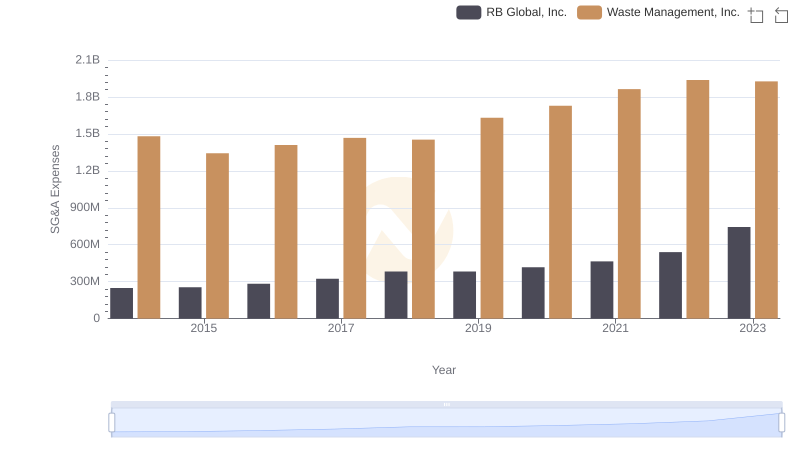

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and RB Global, Inc.

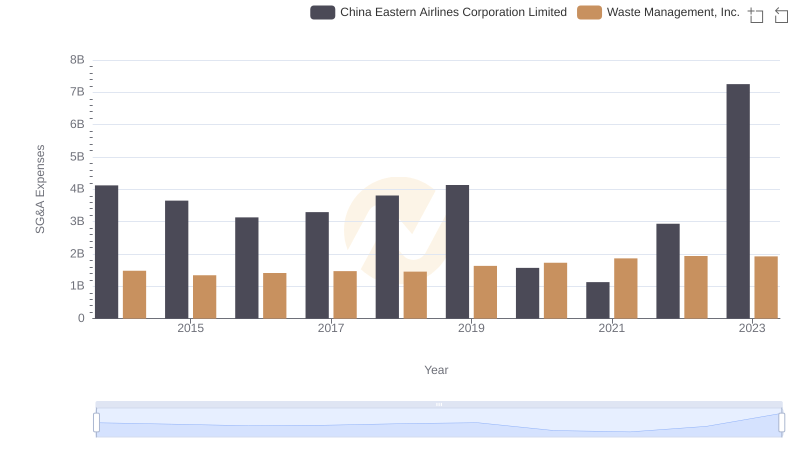

Selling, General, and Administrative Costs: Waste Management, Inc. vs China Eastern Airlines Corporation Limited

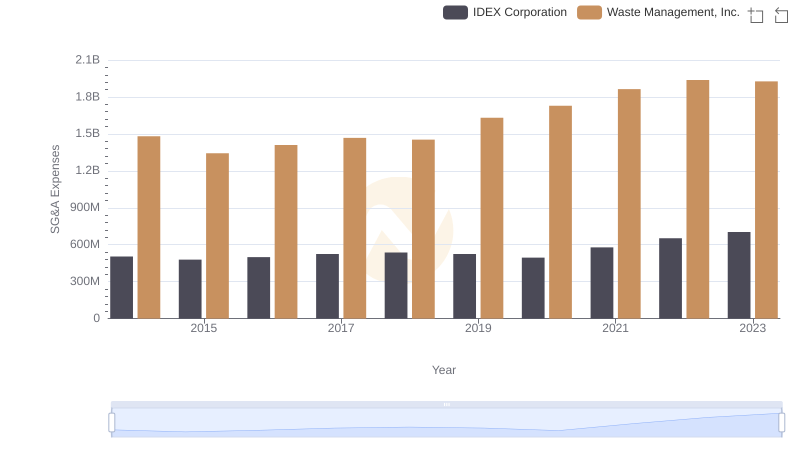

Waste Management, Inc. vs IDEX Corporation: SG&A Expense Trends

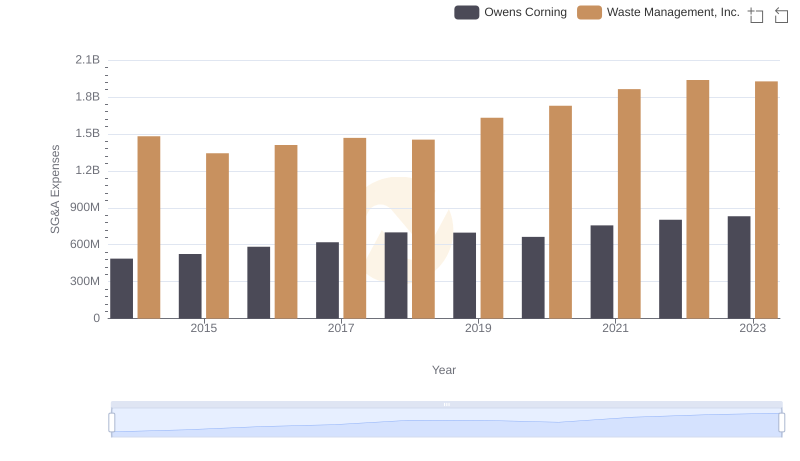

Selling, General, and Administrative Costs: Waste Management, Inc. vs Owens Corning

EBITDA Metrics Evaluated: Waste Management, Inc. vs Pentair plc