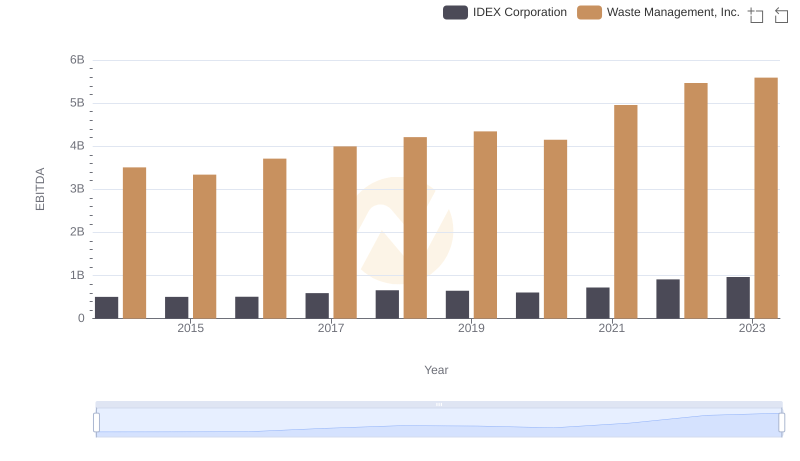

| __timestamp | IDEX Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 504419000 | 1481000000 |

| Thursday, January 1, 2015 | 479408000 | 1343000000 |

| Friday, January 1, 2016 | 498994000 | 1410000000 |

| Sunday, January 1, 2017 | 524940000 | 1468000000 |

| Monday, January 1, 2018 | 536724000 | 1453000000 |

| Tuesday, January 1, 2019 | 524987000 | 1631000000 |

| Wednesday, January 1, 2020 | 494935000 | 1728000000 |

| Friday, January 1, 2021 | 578200000 | 1864000000 |

| Saturday, January 1, 2022 | 652700000 | 1938000000 |

| Sunday, January 1, 2023 | 703500000 | 1926000000 |

| Monday, January 1, 2024 | 758700000 | 2264000000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts alike. Over the past decade, Waste Management, Inc. and IDEX Corporation have showcased distinct trajectories in their SG&A expenditures.

From 2014 to 2023, Waste Management, Inc. consistently reported higher SG&A expenses, peaking at nearly 1.93 billion in 2022, marking a 30% increase from 2014. This upward trend reflects the company's strategic investments in operational efficiency and market expansion. In contrast, IDEX Corporation's SG&A expenses grew by approximately 40% over the same period, reaching 703 million in 2023. This growth underscores IDEX's commitment to innovation and customer engagement.

These trends highlight the differing strategic priorities of these industry leaders, offering valuable insights into their operational philosophies and market positioning.

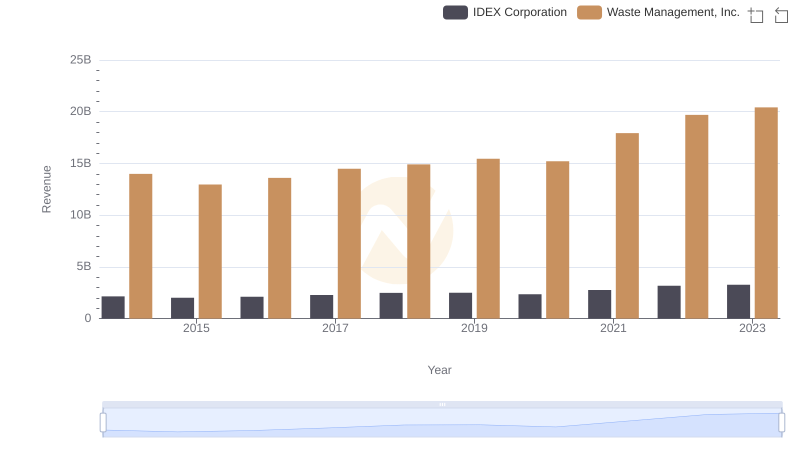

Waste Management, Inc. and IDEX Corporation: A Comprehensive Revenue Analysis

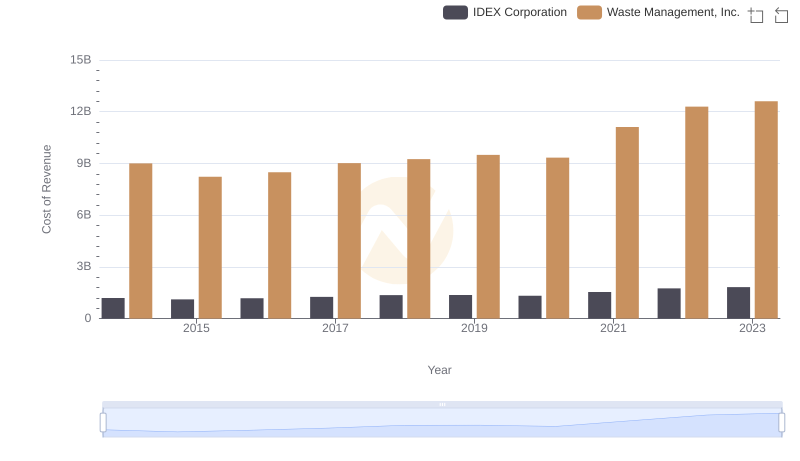

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs IDEX Corporation

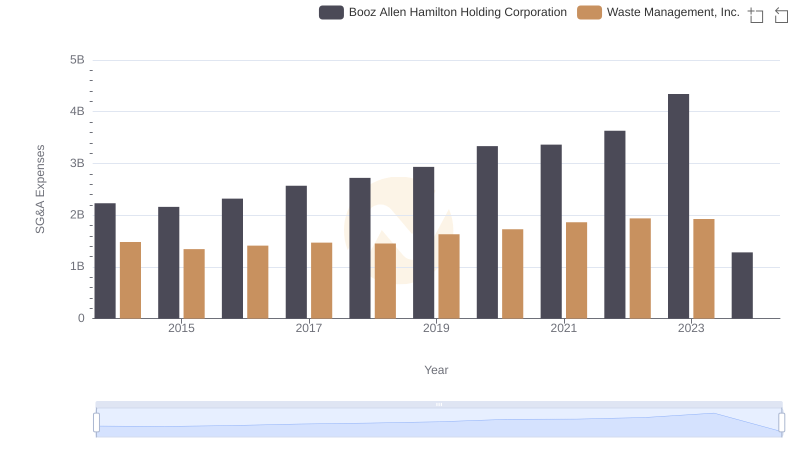

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Booz Allen Hamilton Holding Corporation

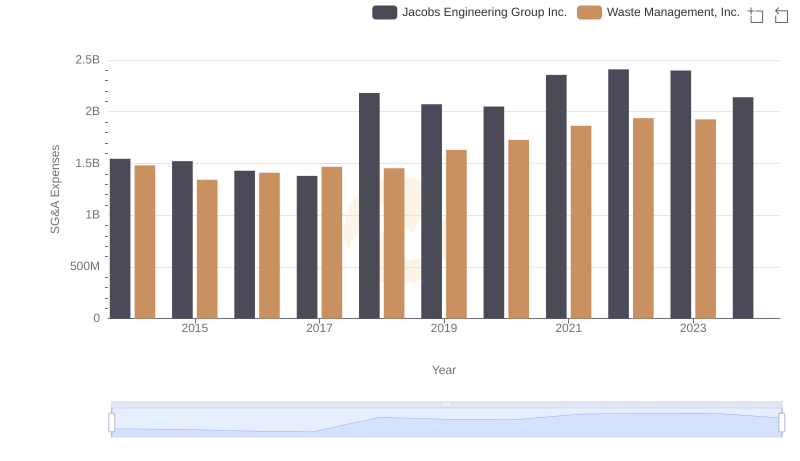

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Jacobs Engineering Group Inc.

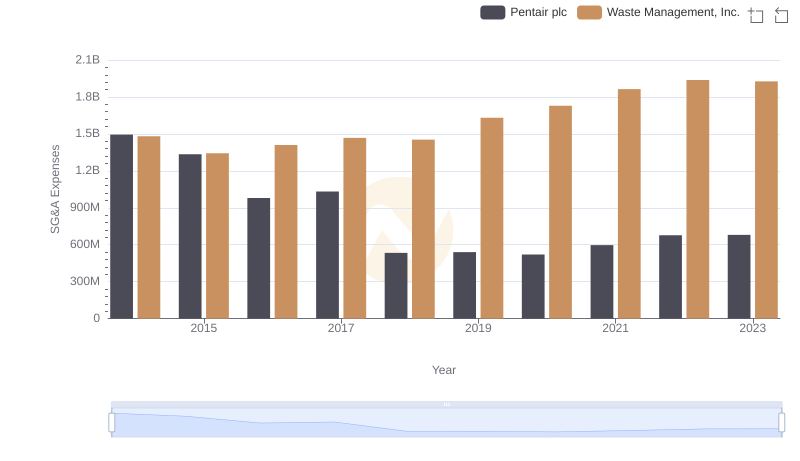

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Pentair plc

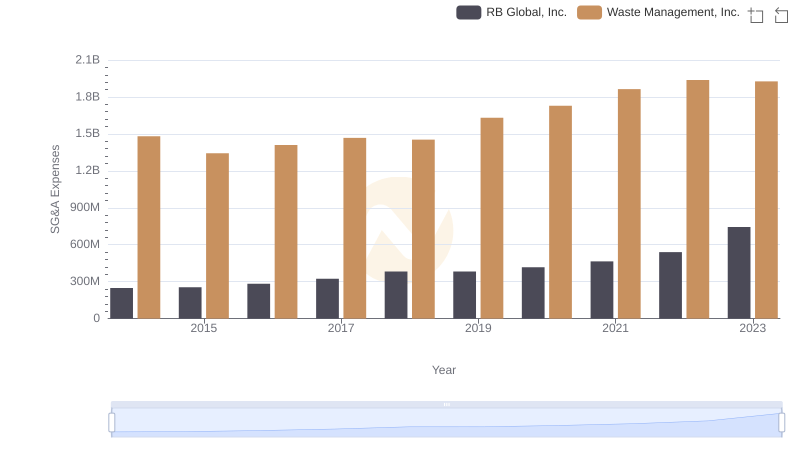

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and RB Global, Inc.

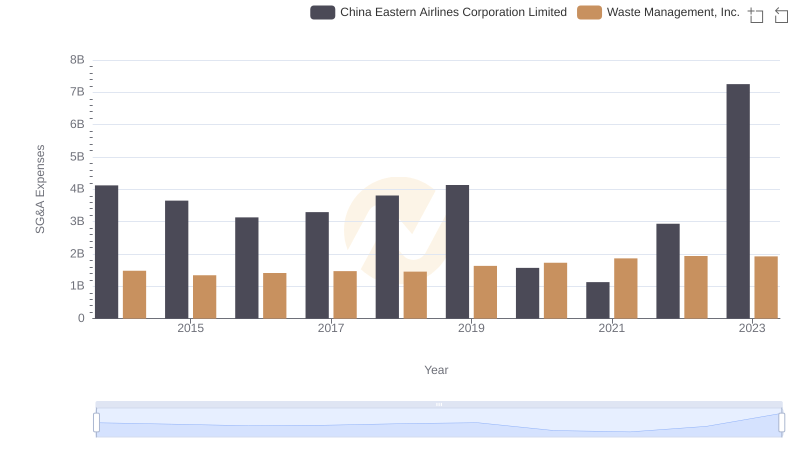

Selling, General, and Administrative Costs: Waste Management, Inc. vs China Eastern Airlines Corporation Limited

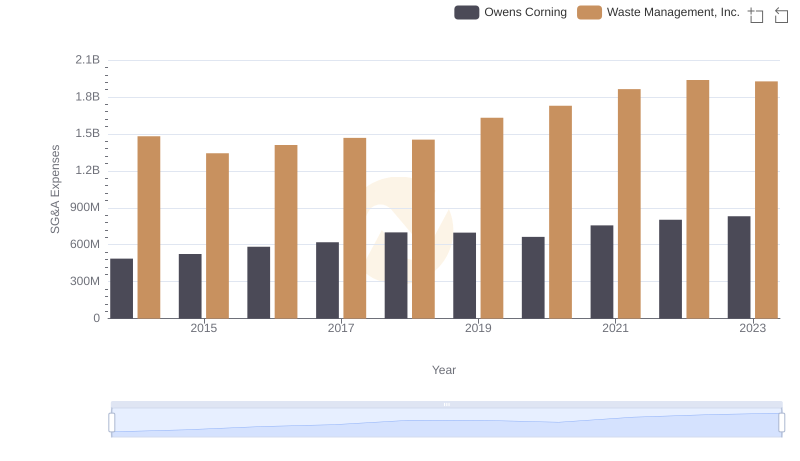

Selling, General, and Administrative Costs: Waste Management, Inc. vs Owens Corning

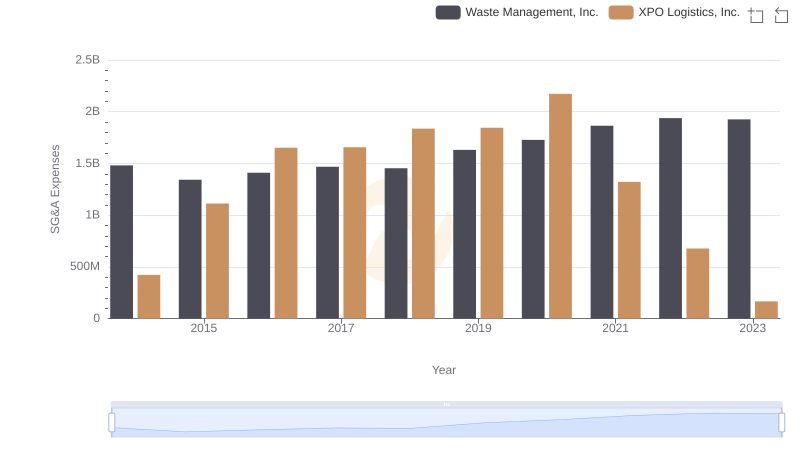

Waste Management, Inc. vs XPO Logistics, Inc.: SG&A Expense Trends

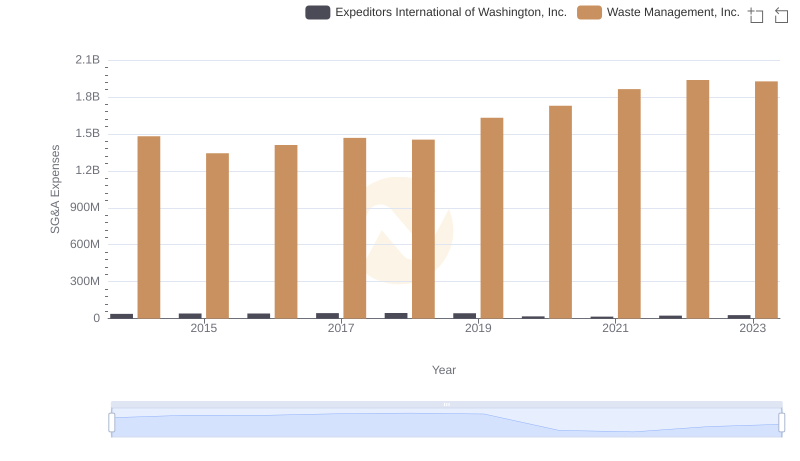

Comparing SG&A Expenses: Waste Management, Inc. vs Expeditors International of Washington, Inc. Trends and Insights

Professional EBITDA Benchmarking: Waste Management, Inc. vs IDEX Corporation