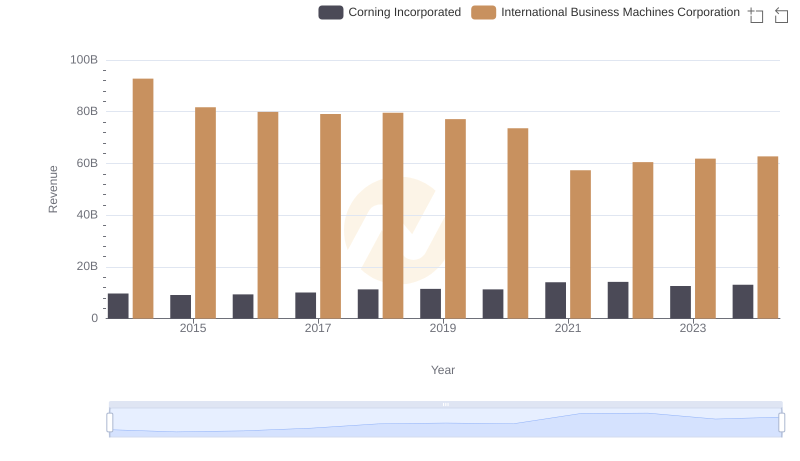

| __timestamp | Corning Incorporated | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4052000000 | 46407000000 |

| Thursday, January 1, 2015 | 3653000000 | 40684000000 |

| Friday, January 1, 2016 | 3746000000 | 38516000000 |

| Sunday, January 1, 2017 | 4032000000 | 36943000000 |

| Monday, January 1, 2018 | 4461000000 | 36936000000 |

| Tuesday, January 1, 2019 | 4035000000 | 31533000000 |

| Wednesday, January 1, 2020 | 3531000000 | 30865000000 |

| Friday, January 1, 2021 | 5063000000 | 31486000000 |

| Saturday, January 1, 2022 | 4506000000 | 32687000000 |

| Sunday, January 1, 2023 | 3931000000 | 34300000000 |

| Monday, January 1, 2024 | 4276000000 | 35551000000 |

Unleashing the power of data

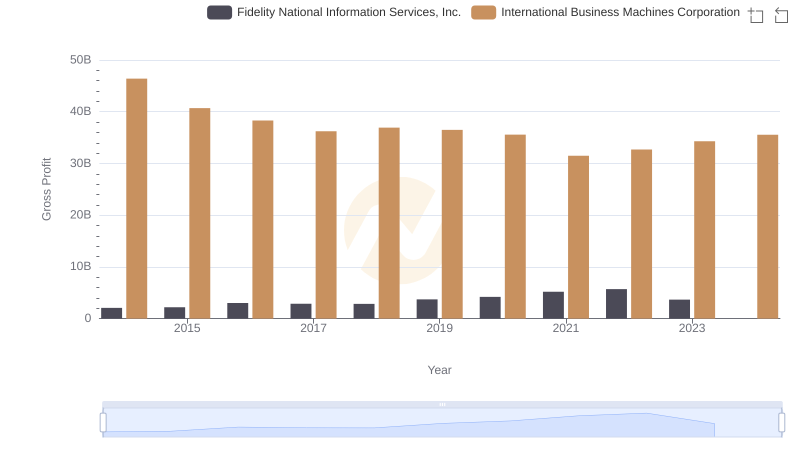

In the ever-evolving landscape of technology and innovation, International Business Machines Corporation (IBM) and Corning Incorporated stand as titans with distinct trajectories. Over the past decade, IBM's gross profit has seen a notable decline, dropping from a peak in 2014 to a more modest figure in 2023. This represents a decrease of approximately 26%, reflecting the challenges faced by the tech giant in adapting to new market demands.

Conversely, Corning Incorporated, renowned for its glass and ceramics expertise, has demonstrated resilience. Despite fluctuations, Corning's gross profit in 2023 is nearly 6% higher than its 2014 figure, showcasing its ability to innovate and capture market share.

This comparison highlights the dynamic nature of the industry, where adaptability and innovation are key to sustaining growth. As we look to the future, these insights offer a glimpse into the strategic maneuvers of these industry leaders.

International Business Machines Corporation vs Corning Incorporated: Annual Revenue Growth Compared

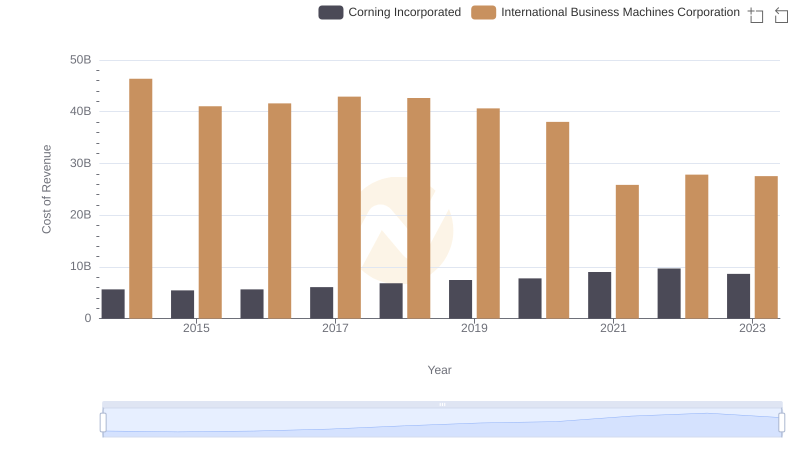

Cost of Revenue: Key Insights for International Business Machines Corporation and Corning Incorporated

Who Generates Higher Gross Profit? International Business Machines Corporation or Fidelity National Information Services, Inc.

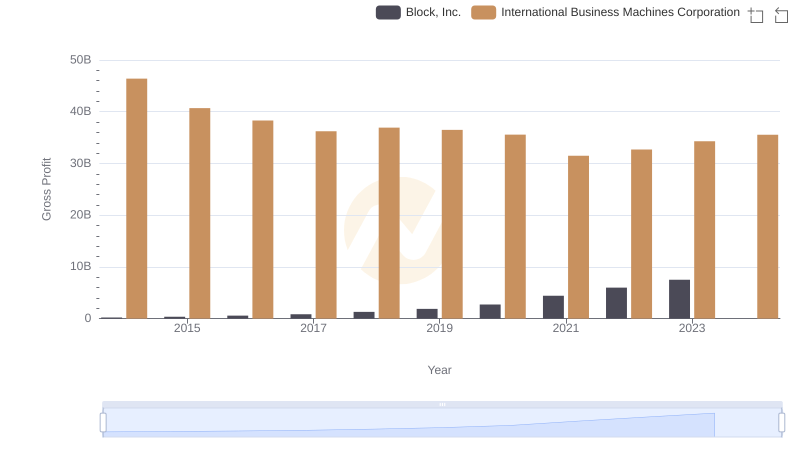

Who Generates Higher Gross Profit? International Business Machines Corporation or Block, Inc.

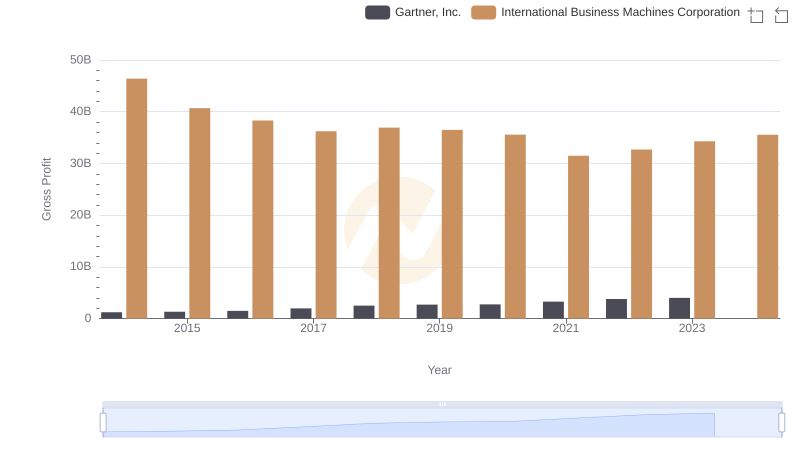

Who Generates Higher Gross Profit? International Business Machines Corporation or Gartner, Inc.

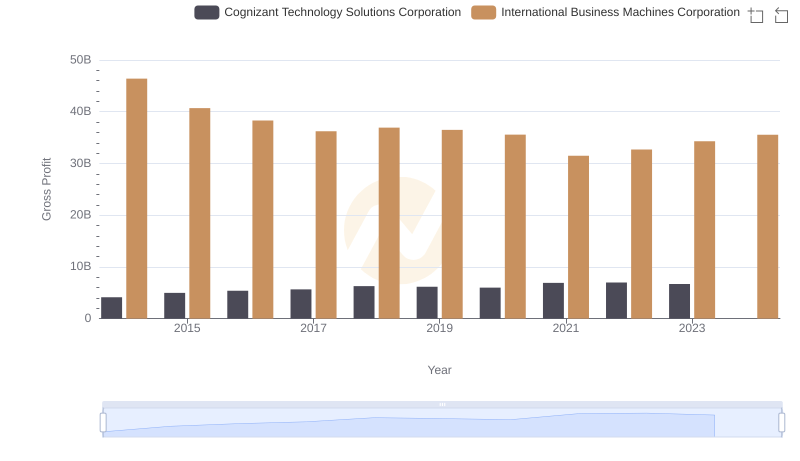

International Business Machines Corporation vs Cognizant Technology Solutions Corporation: A Gross Profit Performance Breakdown

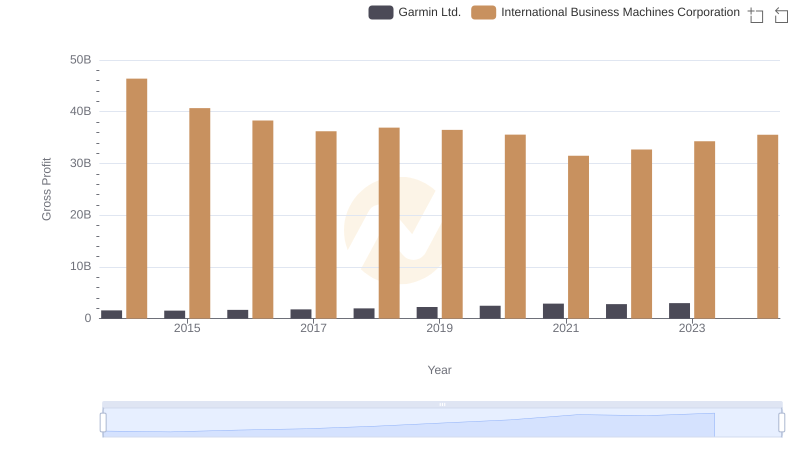

Gross Profit Trends Compared: International Business Machines Corporation vs Garmin Ltd.

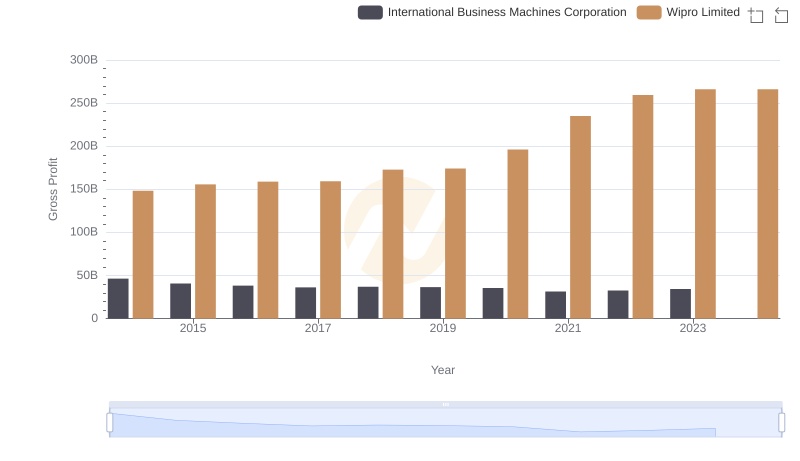

Who Generates Higher Gross Profit? International Business Machines Corporation or Wipro Limited

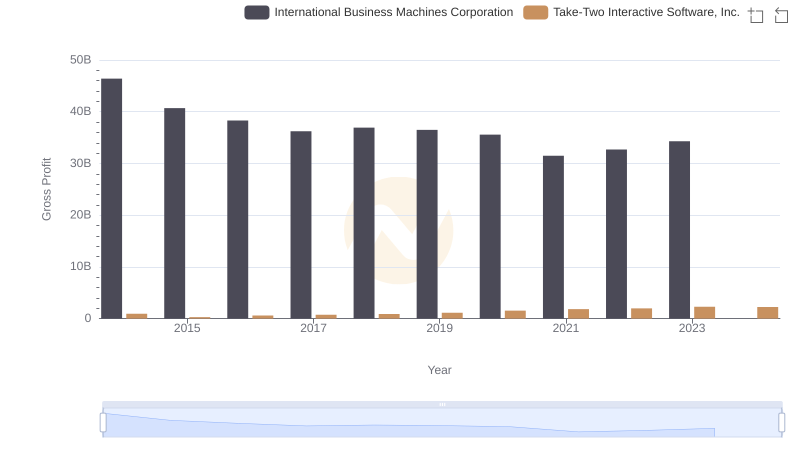

International Business Machines Corporation and Take-Two Interactive Software, Inc.: A Detailed Gross Profit Analysis

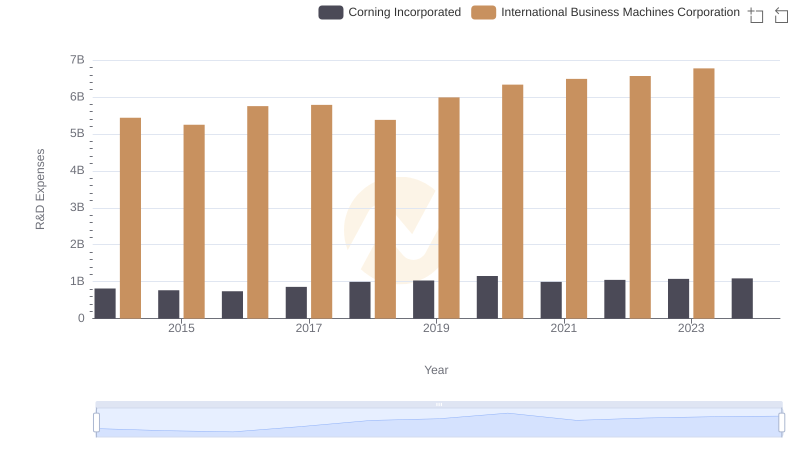

Research and Development: Comparing Key Metrics for International Business Machines Corporation and Corning Incorporated

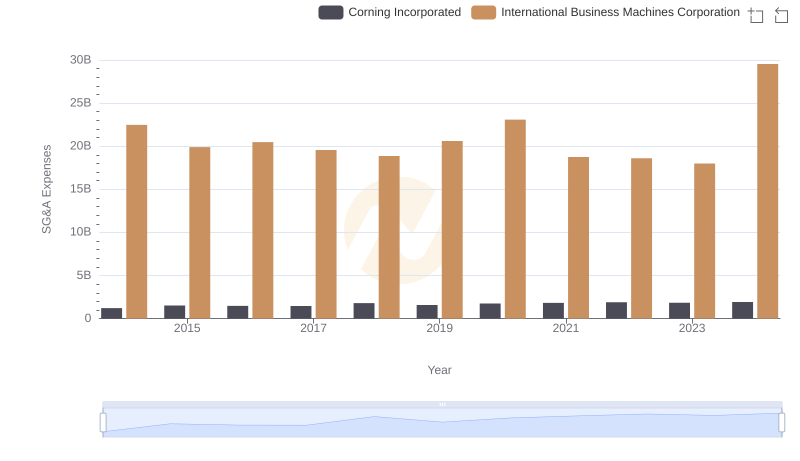

Selling, General, and Administrative Costs: International Business Machines Corporation vs Corning Incorporated

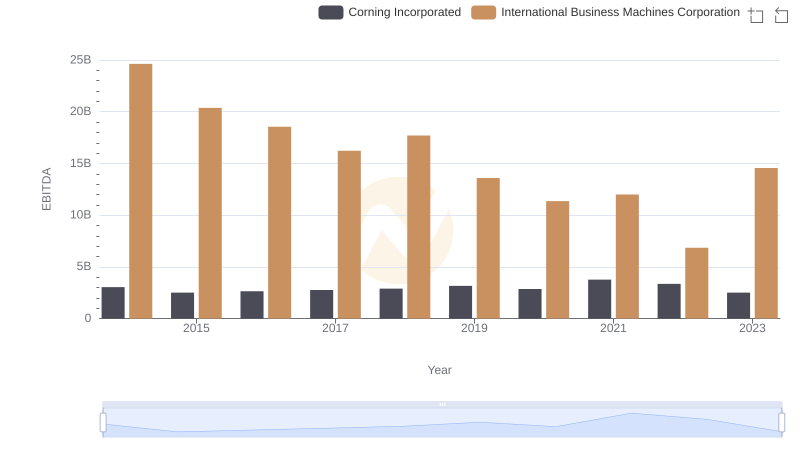

Comprehensive EBITDA Comparison: International Business Machines Corporation vs Corning Incorporated