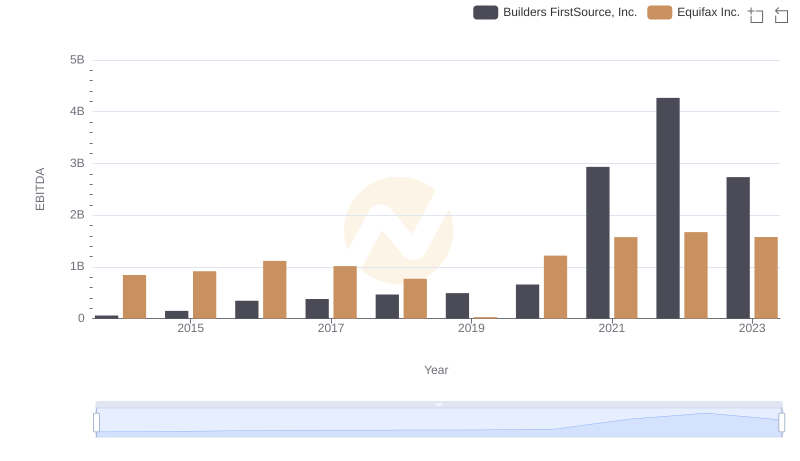

| __timestamp | Builders FirstSource, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 306508000 | 751700000 |

| Thursday, January 1, 2015 | 810841000 | 884300000 |

| Friday, January 1, 2016 | 1360412000 | 948200000 |

| Sunday, January 1, 2017 | 1442288000 | 1039100000 |

| Monday, January 1, 2018 | 1553972000 | 1213300000 |

| Tuesday, January 1, 2019 | 1584523000 | 1990200000 |

| Wednesday, January 1, 2020 | 1678730000 | 1322500000 |

| Friday, January 1, 2021 | 3463532000 | 1324600000 |

| Saturday, January 1, 2022 | 3974173000 | 1328900000 |

| Sunday, January 1, 2023 | 3836015000 | 1385700000 |

| Monday, January 1, 2024 | 1450500000 |

Unveiling the hidden dimensions of data

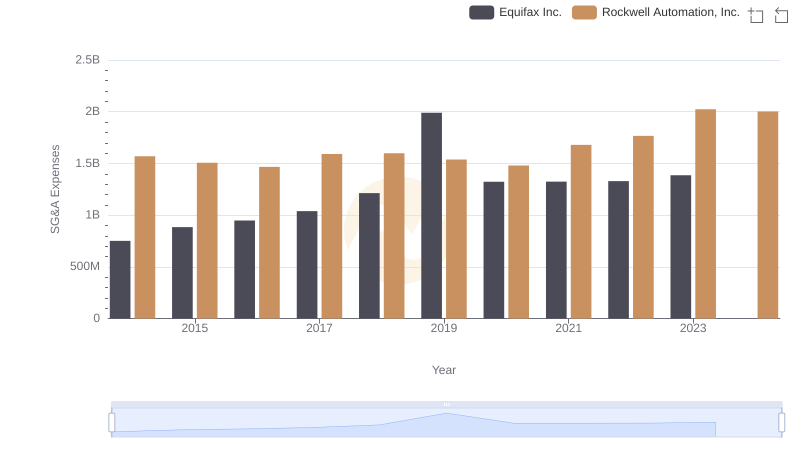

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of a company's operational efficiency. Over the past decade, Equifax Inc. and Builders FirstSource, Inc. have shown contrasting trends in their SG&A expenses. From 2014 to 2023, Builders FirstSource, Inc. saw a staggering increase of over 1,150% in their SG&A costs, peaking in 2022. This reflects their aggressive expansion and operational scaling. In contrast, Equifax Inc.'s SG&A expenses grew by a modest 84% over the same period, indicating a more stable and controlled growth strategy. Notably, in 2019, Equifax's expenses surged by 61%, possibly due to increased investments in data security following their 2017 data breach. These trends highlight the diverse strategies and challenges faced by these industry giants in managing their operational costs.

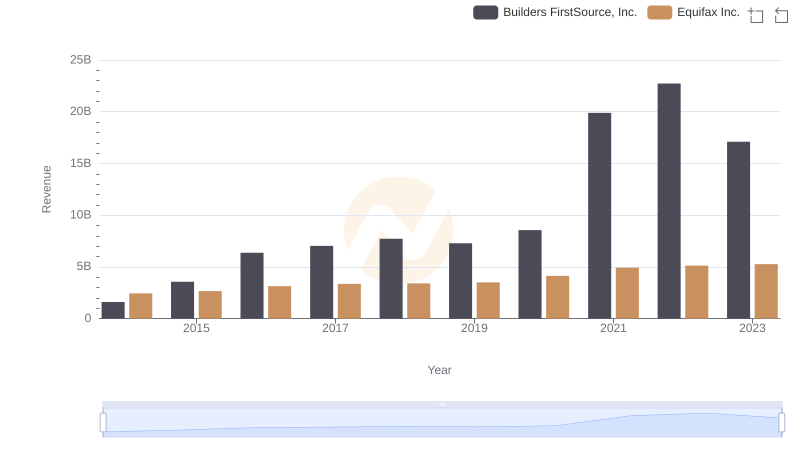

Annual Revenue Comparison: Equifax Inc. vs Builders FirstSource, Inc.

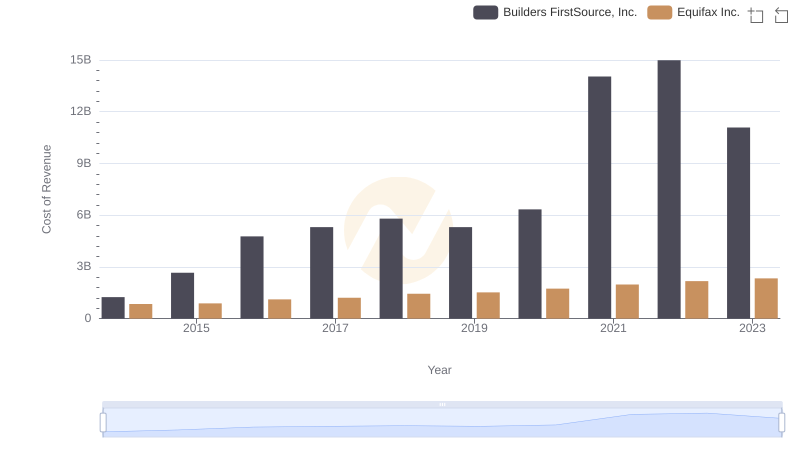

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

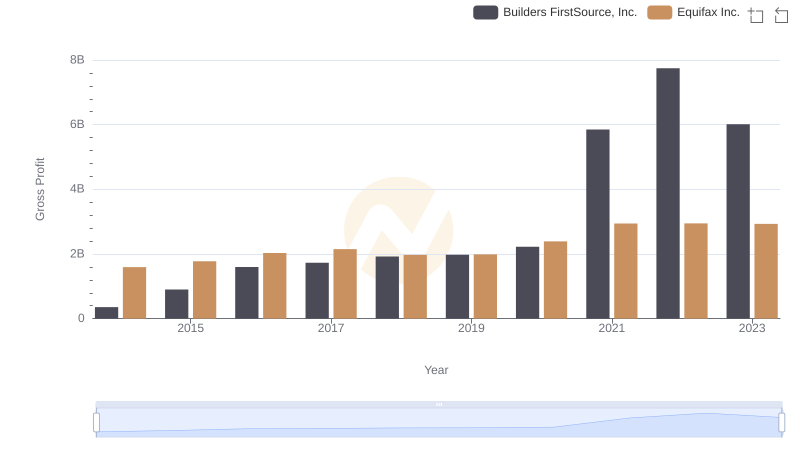

Key Insights on Gross Profit: Equifax Inc. vs Builders FirstSource, Inc.

SG&A Efficiency Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

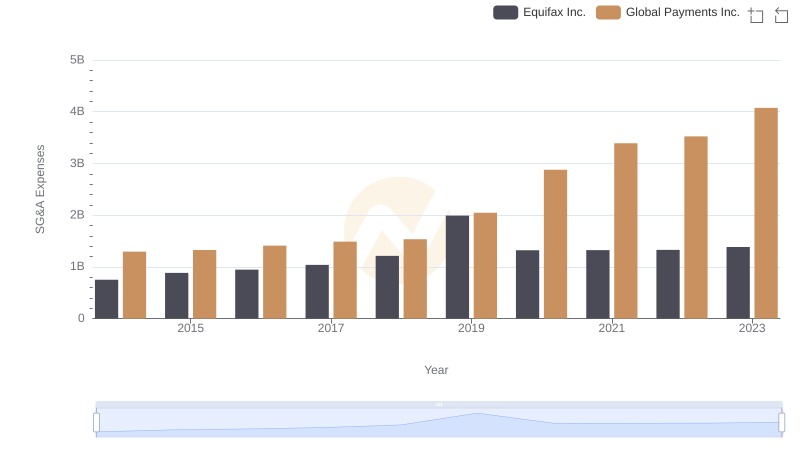

Breaking Down SG&A Expenses: Equifax Inc. vs Global Payments Inc.

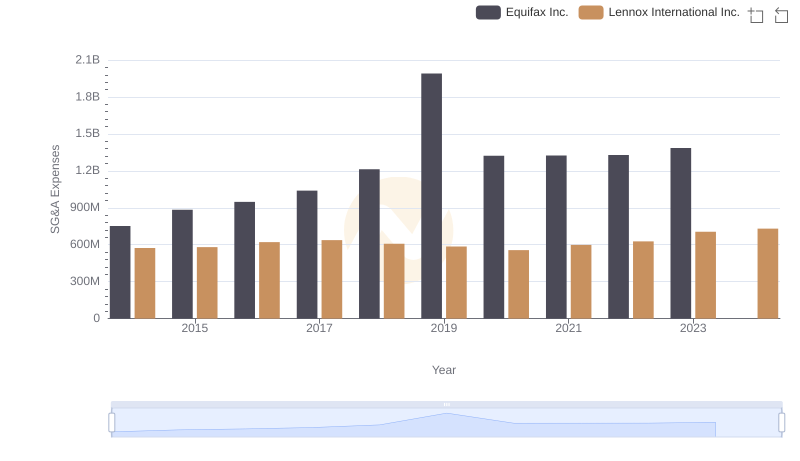

Selling, General, and Administrative Costs: Equifax Inc. vs Lennox International Inc.

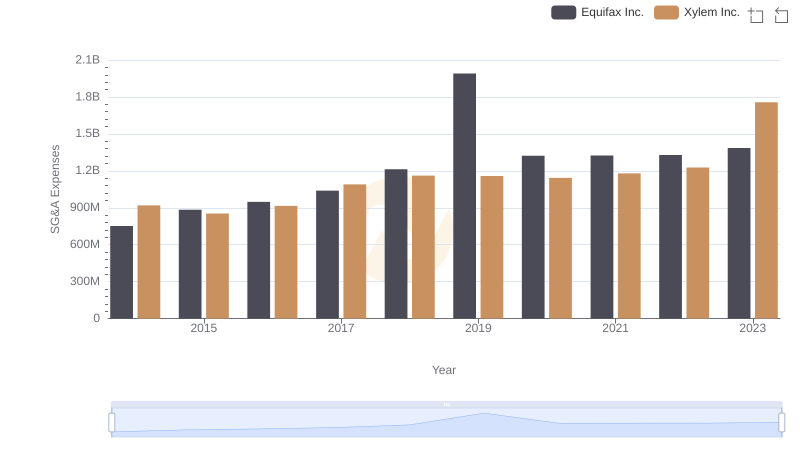

Equifax Inc. or Xylem Inc.: Who Manages SG&A Costs Better?

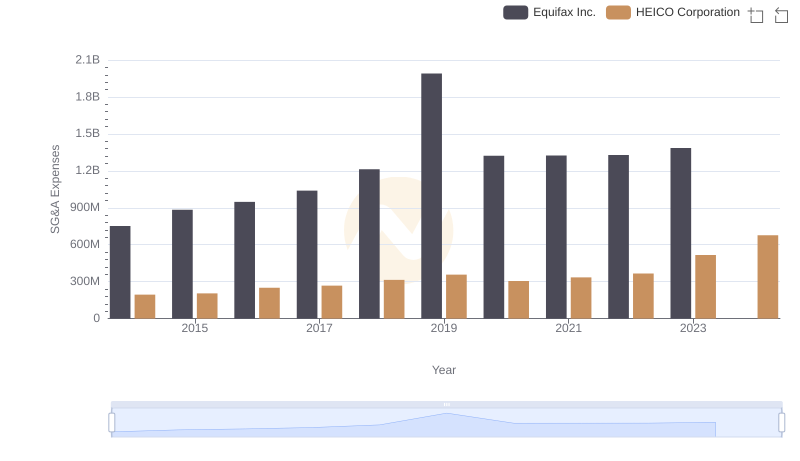

Comparing SG&A Expenses: Equifax Inc. vs HEICO Corporation Trends and Insights

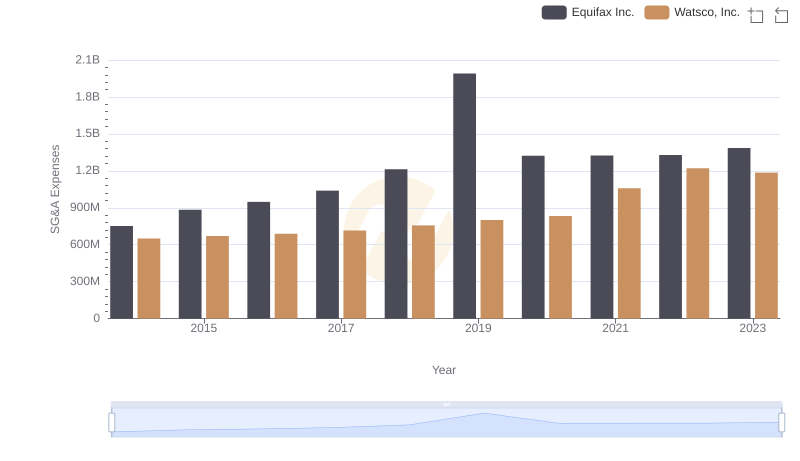

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.

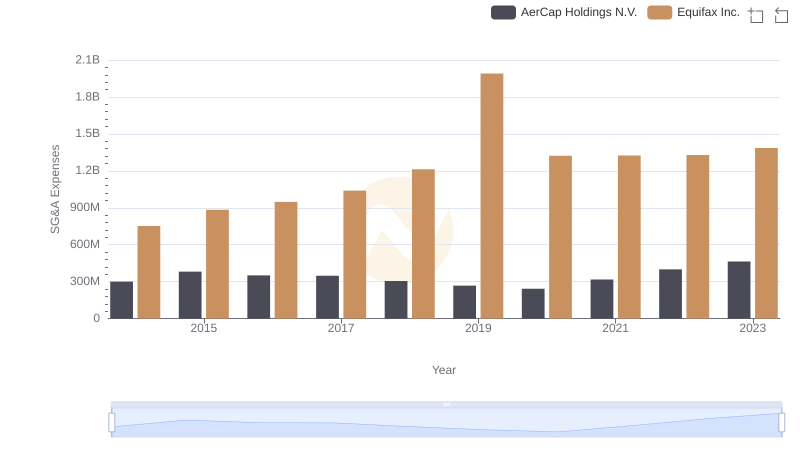

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

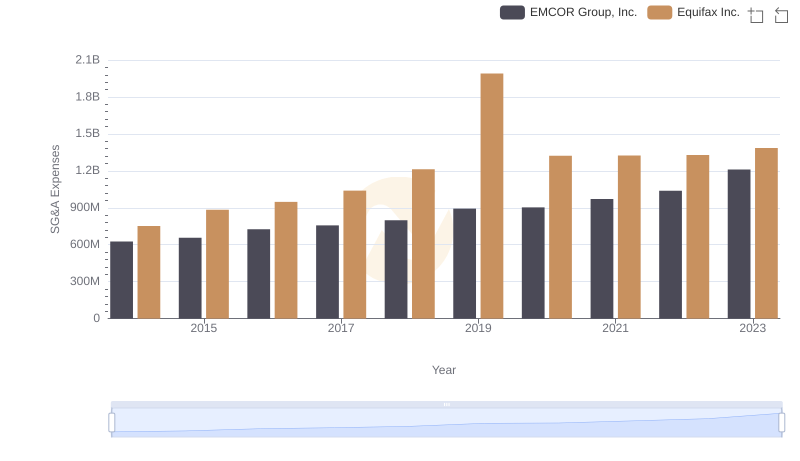

Breaking Down SG&A Expenses: Equifax Inc. vs EMCOR Group, Inc.

Comparative EBITDA Analysis: Equifax Inc. vs Builders FirstSource, Inc.