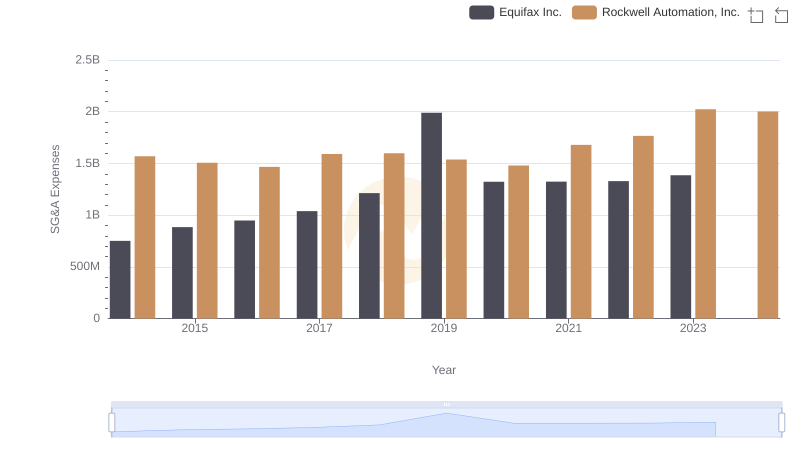

| __timestamp | Equifax Inc. | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 920000000 |

| Thursday, January 1, 2015 | 884300000 | 854000000 |

| Friday, January 1, 2016 | 948200000 | 915000000 |

| Sunday, January 1, 2017 | 1039100000 | 1090000000 |

| Monday, January 1, 2018 | 1213300000 | 1161000000 |

| Tuesday, January 1, 2019 | 1990200000 | 1158000000 |

| Wednesday, January 1, 2020 | 1322500000 | 1143000000 |

| Friday, January 1, 2021 | 1324600000 | 1179000000 |

| Saturday, January 1, 2022 | 1328900000 | 1227000000 |

| Sunday, January 1, 2023 | 1385700000 | 1757000000 |

| Monday, January 1, 2024 | 1450500000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Equifax Inc. and Xylem Inc. have demonstrated contrasting approaches to handling these costs. From 2014 to 2023, Equifax's SG&A expenses grew by approximately 84%, peaking in 2019. In contrast, Xylem's expenses increased by about 91%, with a significant spike in 2023.

Equifax's expenses surged notably in 2019, reaching their highest point, while Xylem's costs remained relatively stable until a sharp rise in 2023. This suggests that while Equifax faced challenges in controlling costs during certain years, Xylem's recent increase may indicate strategic investments or operational shifts. Understanding these trends provides valuable insights into each company's financial strategies and their implications for future growth.

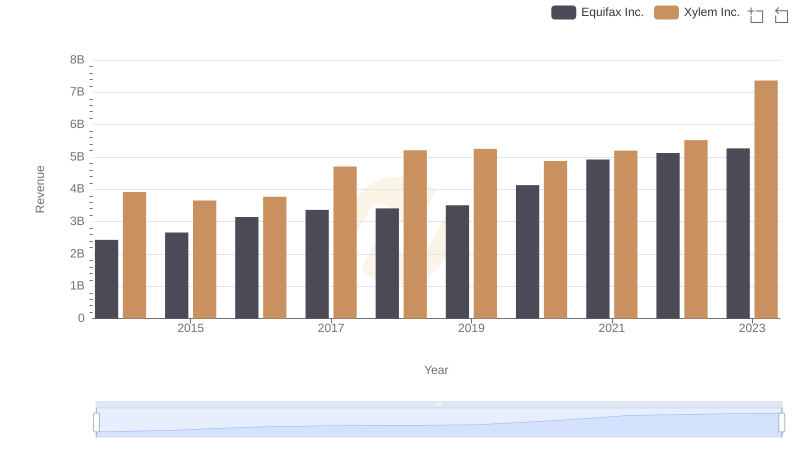

Annual Revenue Comparison: Equifax Inc. vs Xylem Inc.

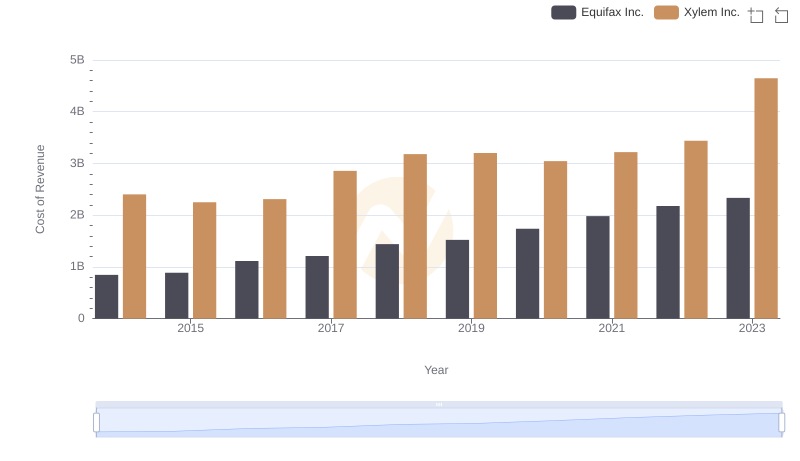

Analyzing Cost of Revenue: Equifax Inc. and Xylem Inc.

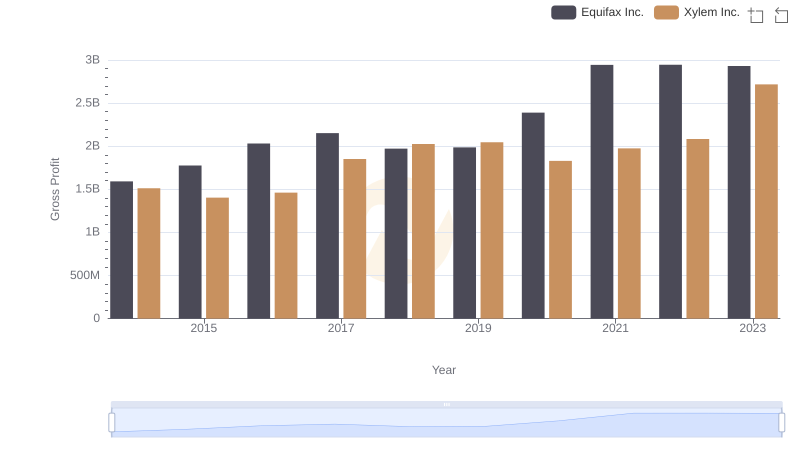

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

SG&A Efficiency Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

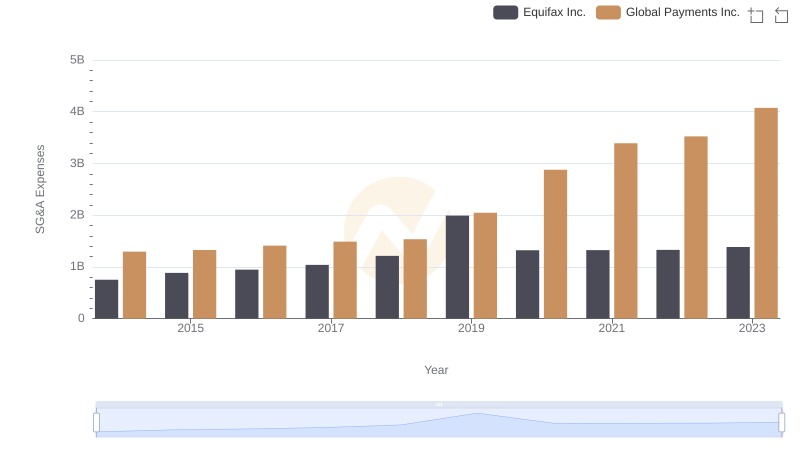

Breaking Down SG&A Expenses: Equifax Inc. vs Global Payments Inc.

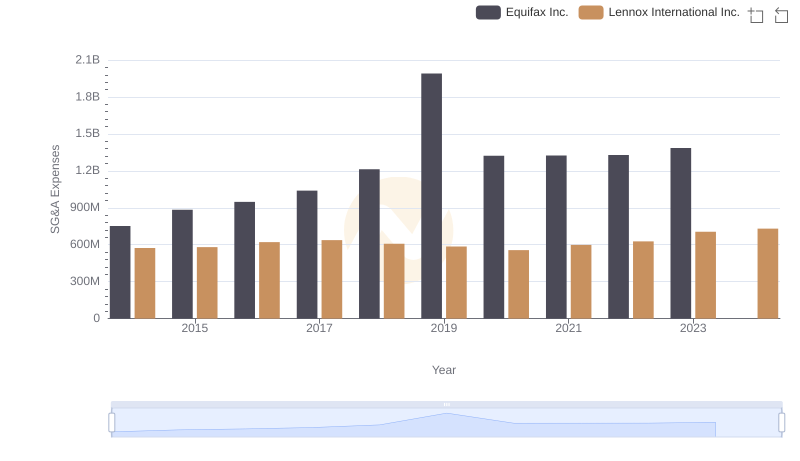

Selling, General, and Administrative Costs: Equifax Inc. vs Lennox International Inc.

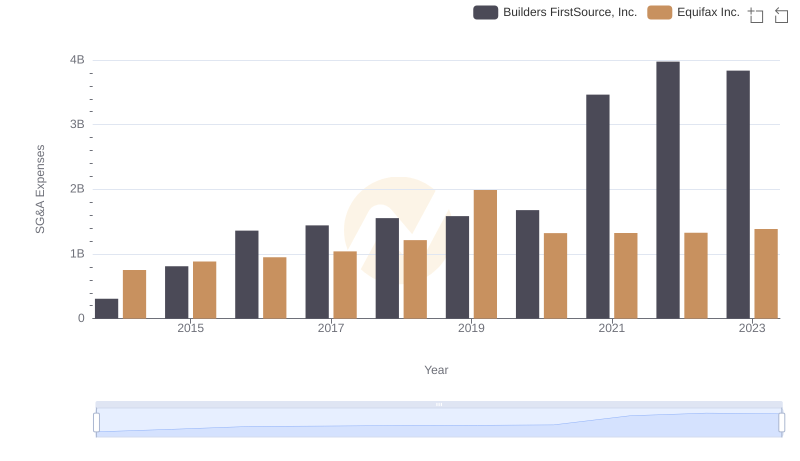

Selling, General, and Administrative Costs: Equifax Inc. vs Builders FirstSource, Inc.

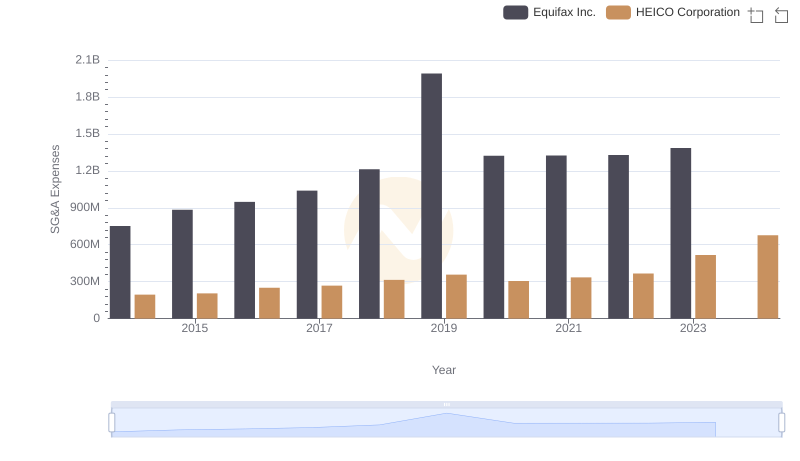

Comparing SG&A Expenses: Equifax Inc. vs HEICO Corporation Trends and Insights

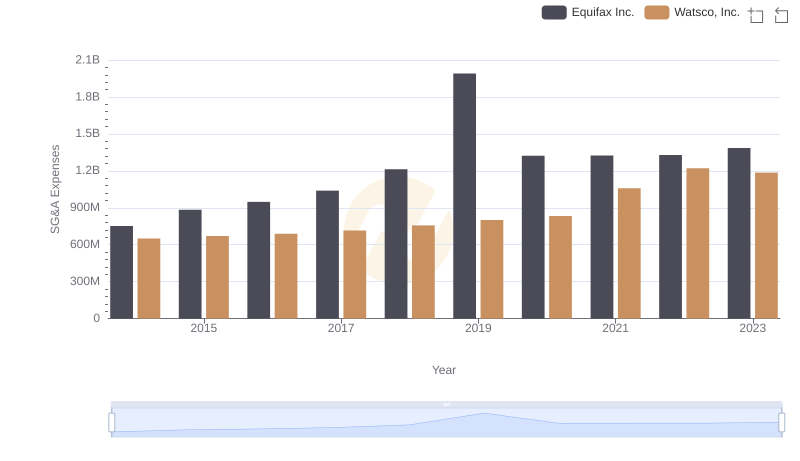

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.

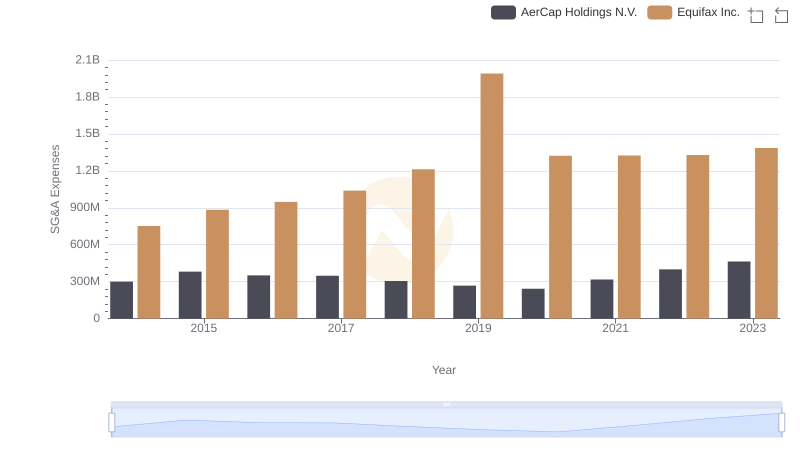

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

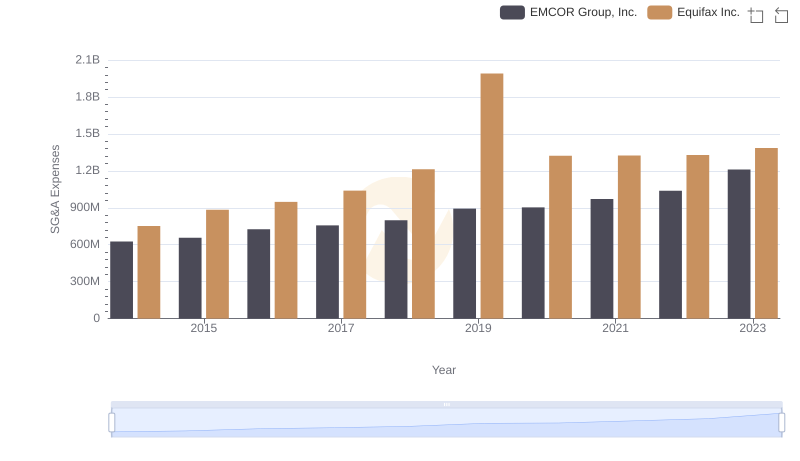

Breaking Down SG&A Expenses: Equifax Inc. vs EMCOR Group, Inc.