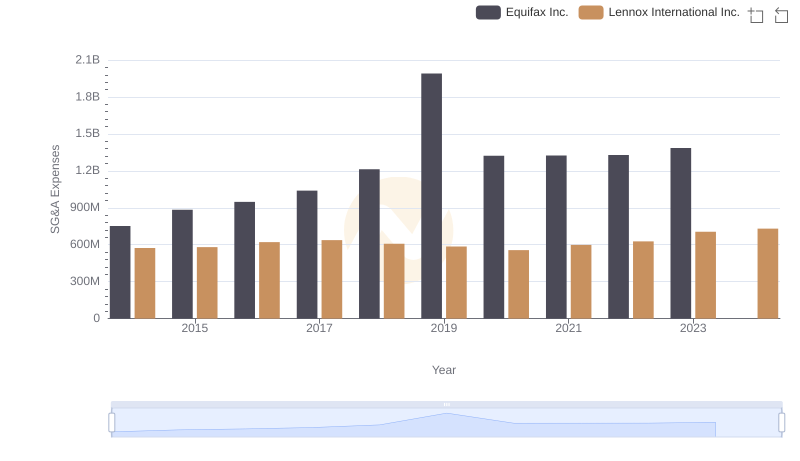

| __timestamp | Equifax Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 650655000 |

| Thursday, January 1, 2015 | 884300000 | 670609000 |

| Friday, January 1, 2016 | 948200000 | 688952000 |

| Sunday, January 1, 2017 | 1039100000 | 715671000 |

| Monday, January 1, 2018 | 1213300000 | 757452000 |

| Tuesday, January 1, 2019 | 1990200000 | 800328000 |

| Wednesday, January 1, 2020 | 1322500000 | 833051000 |

| Friday, January 1, 2021 | 1324600000 | 1058316000 |

| Saturday, January 1, 2022 | 1328900000 | 1221382000 |

| Sunday, January 1, 2023 | 1385700000 | 1185626000 |

| Monday, January 1, 2024 | 1450500000 | 1262938000 |

Infusing magic into the data realm

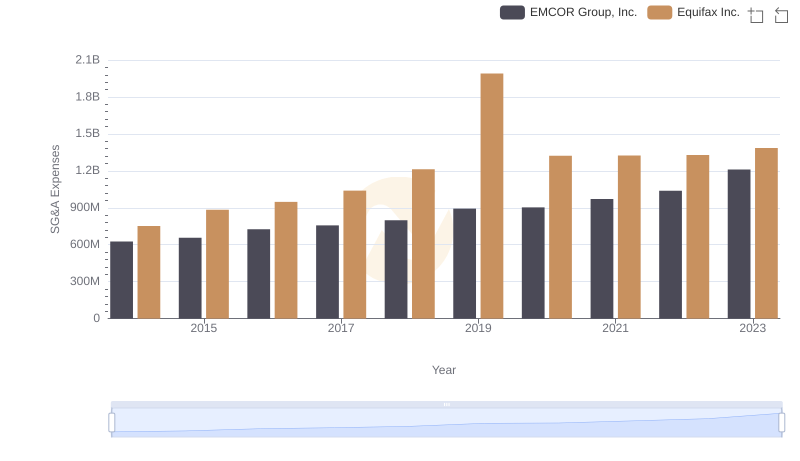

In the ever-evolving landscape of corporate finance, effective cost management is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Equifax Inc. and Watsco, Inc. from 2014 to 2023. Over this period, Equifax's SG&A expenses surged by approximately 84%, peaking in 2019, while Watsco's expenses grew by about 82%, reaching their highest in 2022.

Equifax's SG&A expenses consistently increased, with a notable spike in 2019, reflecting strategic investments and expansion efforts. Despite a slight dip in 2020, the trend remained upward, indicating robust financial management.

Watsco's expenses followed a similar trajectory, with a significant rise in 2021 and 2022, underscoring its growth strategy. This trend highlights the company's focus on scaling operations while maintaining cost efficiency.

Both companies exemplify strategic cost management, adapting to market demands while optimizing operational expenses.

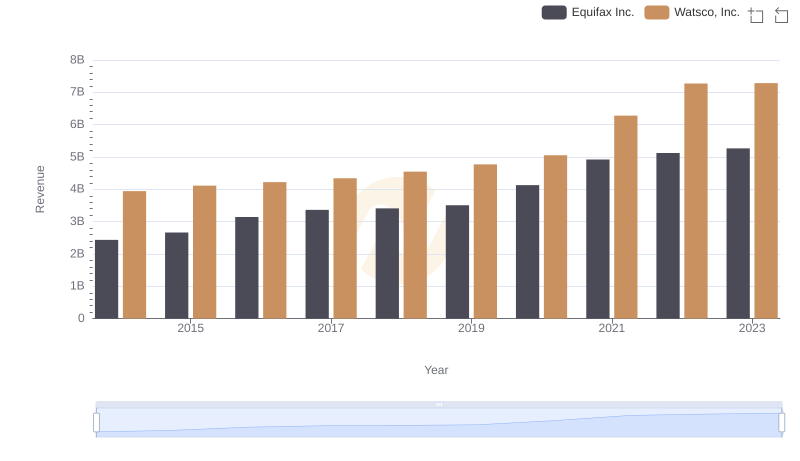

Equifax Inc. or Watsco, Inc.: Who Leads in Yearly Revenue?

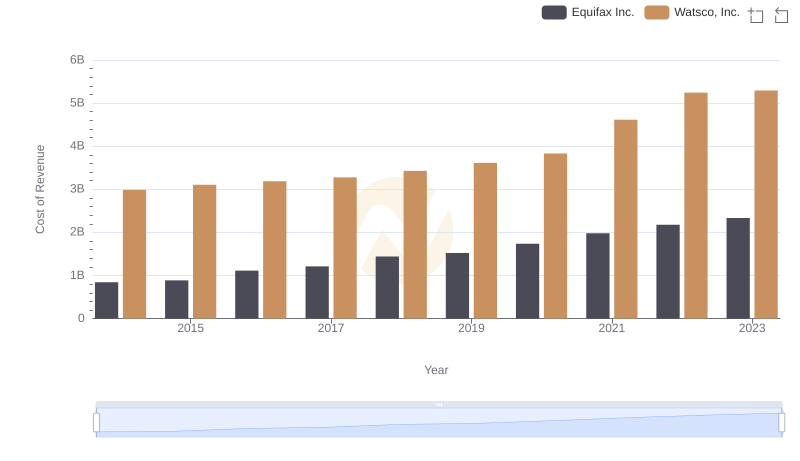

Cost of Revenue: Key Insights for Equifax Inc. and Watsco, Inc.

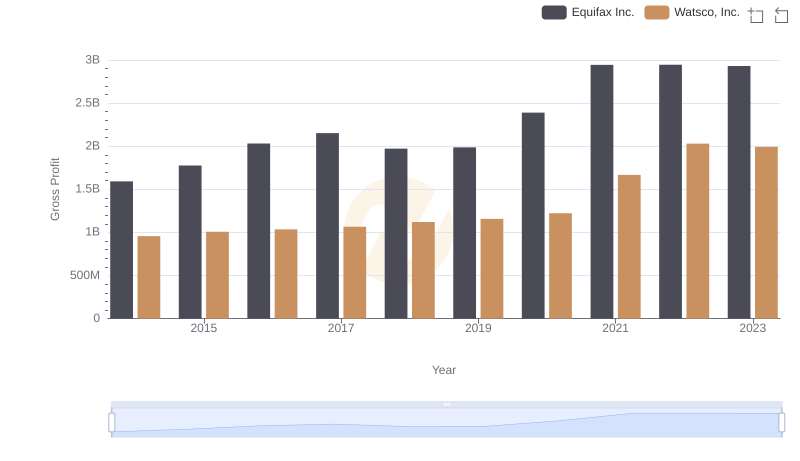

Equifax Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

Selling, General, and Administrative Costs: Equifax Inc. vs Lennox International Inc.

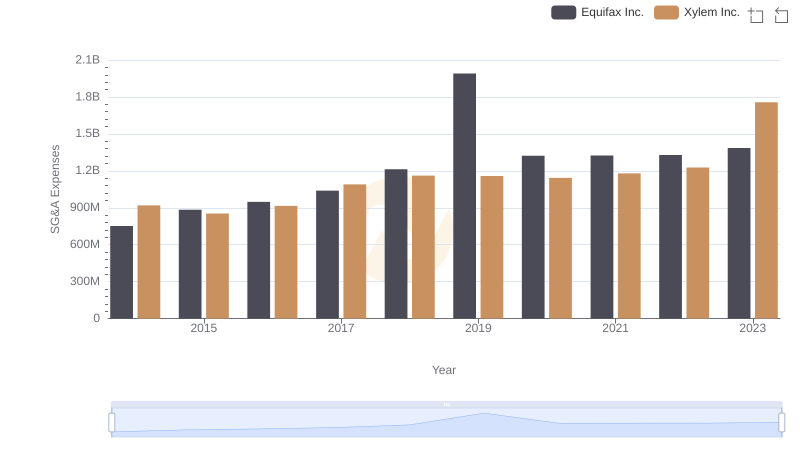

Equifax Inc. or Xylem Inc.: Who Manages SG&A Costs Better?

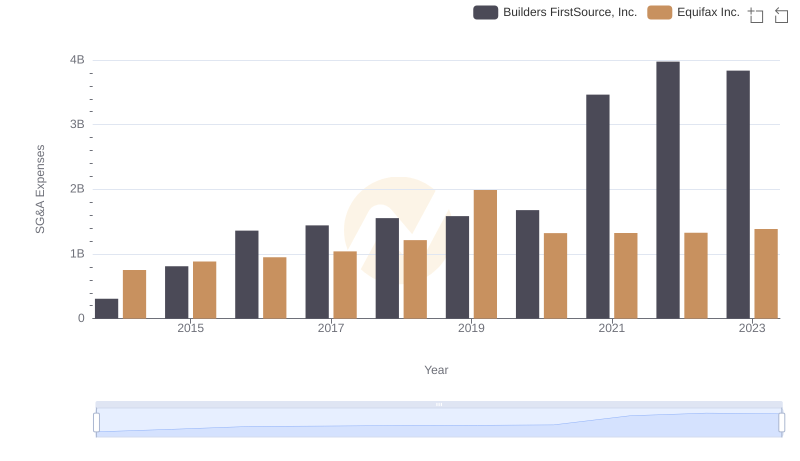

Selling, General, and Administrative Costs: Equifax Inc. vs Builders FirstSource, Inc.

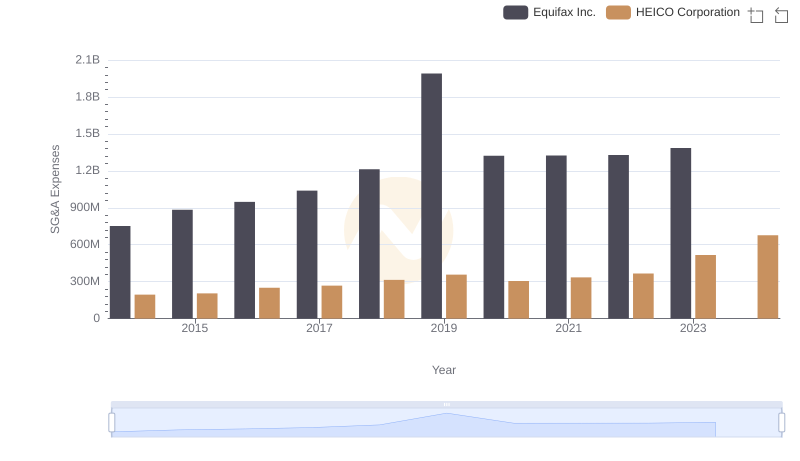

Comparing SG&A Expenses: Equifax Inc. vs HEICO Corporation Trends and Insights

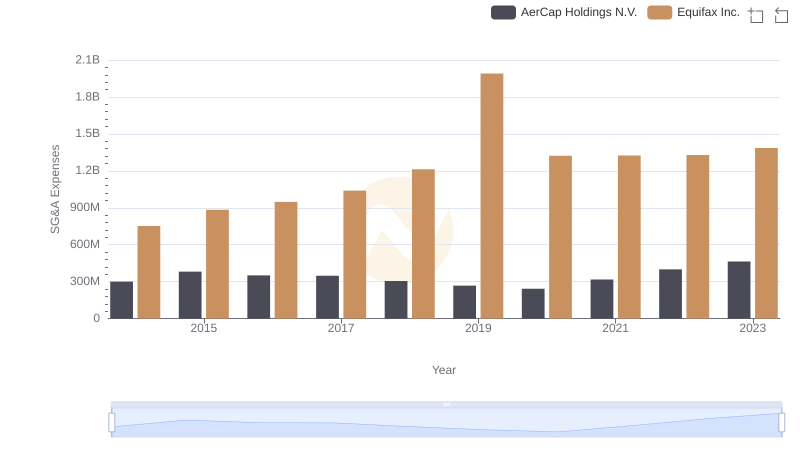

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

Breaking Down SG&A Expenses: Equifax Inc. vs EMCOR Group, Inc.