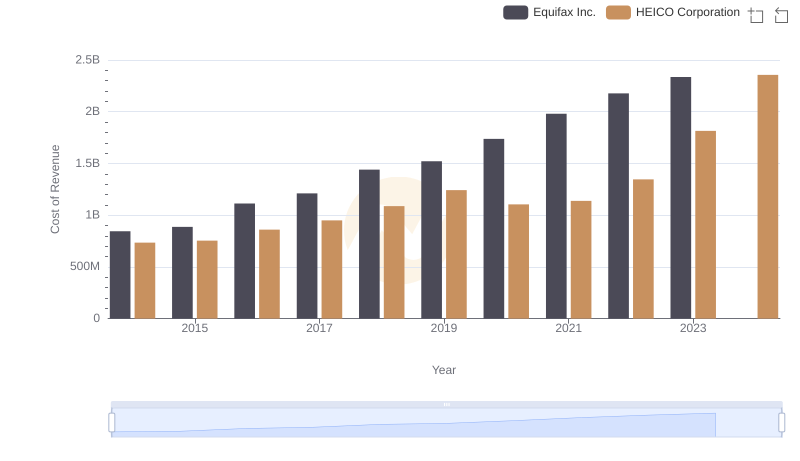

| __timestamp | Equifax Inc. | HEICO Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 194924000 |

| Thursday, January 1, 2015 | 884300000 | 204523000 |

| Friday, January 1, 2016 | 948200000 | 250147000 |

| Sunday, January 1, 2017 | 1039100000 | 268067000 |

| Monday, January 1, 2018 | 1213300000 | 314470000 |

| Tuesday, January 1, 2019 | 1990200000 | 356743000 |

| Wednesday, January 1, 2020 | 1322500000 | 305479000 |

| Friday, January 1, 2021 | 1324600000 | 334523000 |

| Saturday, January 1, 2022 | 1328900000 | 365915000 |

| Sunday, January 1, 2023 | 1385700000 | 516292000 |

| Monday, January 1, 2024 | 1450500000 | 677271000 |

Unleashing the power of data

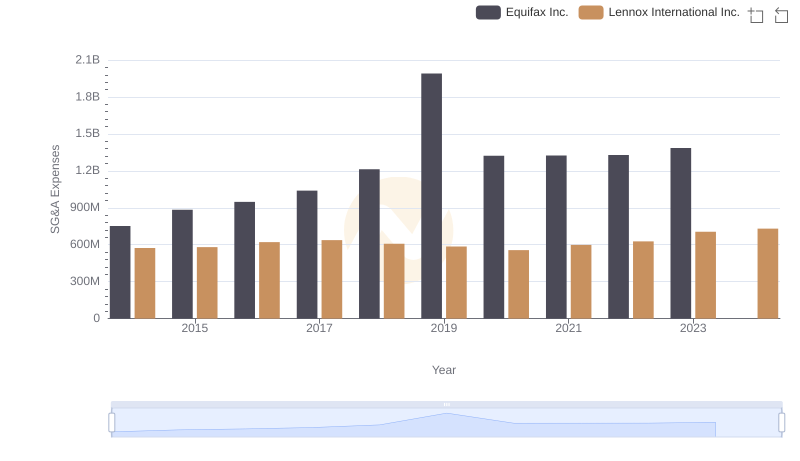

In the competitive landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for assessing a company’s operational efficiency and strategic direction. SG&A expenses encompass a wide range of costs that are not directly tied to the production of goods or services, including marketing, salaries, and office supplies. This analysis focuses on two prominent players in their respective industries: Equifax Inc. and HEICO Corporation.

Equifax Inc., a global data and analytics company, has exhibited a notable upward trend in SG&A expenses over the years. Starting from approximately $751 million in 2014, Equifax's SG&A expenses surged by an impressive 165% to reach around $1.39 billion by 2023. This growth trajectory reflects the company's aggressive investment in technology and marketing to enhance its data services and maintain its competitive edge in the ever-evolving financial landscape.

The data indicates that Equifax's SG&A expenses have consistently increased year-on-year, with the most significant jump occurring between 2018 and 2019, where expenses soared from $1.21 billion to nearly $1.99 billion—a staggering increase of about 64%. This spike can be attributed to strategic initiatives aimed at expanding their market reach and improving operational capabilities.

In contrast, HEICO Corporation, a leader in aerospace and electronics, has maintained a more measured growth in SG&A expenses. Beginning at approximately $195 million in 2014, HEICO's expenses have steadily increased to about $516 million in 2023, representing a growth of nearly 164% over the same period. This steady rise indicates a strategic approach to scaling operations without overextending financial resources.

HEICO's SG&A expenses have shown consistent growth, with a notable increase in 2023, where expenses rose to $516 million. This growth may reflect the company's investments in research and development, as well as efforts to expand its product offerings in the aerospace sector.

When comparing the SG&A expenses of these two corporations, it is evident that Equifax has significantly higher expenses than HEICO. In 2023, Equifax's SG&A expenses were approximately 2.68 times higher than those of HEICO. This disparity underscores the differing business models and operational strategies of the two firms. Equifax's focus on data analytics and technology necessitates higher expenditures in marketing and administrative functions, while HEICO's more focused approach allows for controlled growth in expenses.

However, it is important to note that the data for HEICO in 2024 is missing, which could potentially skew future comparisons and insights. As both companies continue to evolve, monitoring these trends will provide valuable insights into their operational strategies and market positioning.

In conclusion, the analysis of SG&A expenses for Equifax Inc. and HEICO Corporation reveals distinct operational strategies and growth trajectories. Equifax's aggressive spending reflects its commitment to innovation and market expansion, while HEICO's controlled approach indicates a focus on sustainable growth. As investors and analysts continue to scrutinize these trends, understanding the implications of SG&A expenses will remain a vital component of financial analysis in the corporate world.

Equifax Inc. vs HEICO Corporation: Efficiency in Cost of Revenue Explored

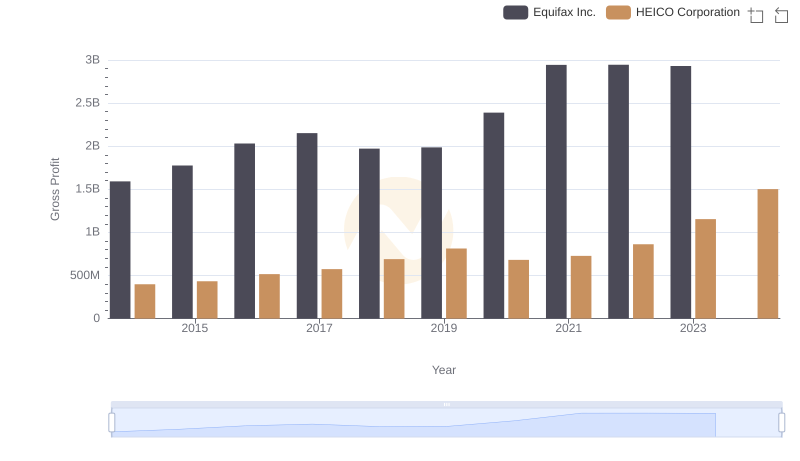

Gross Profit Comparison: Equifax Inc. and HEICO Corporation Trends

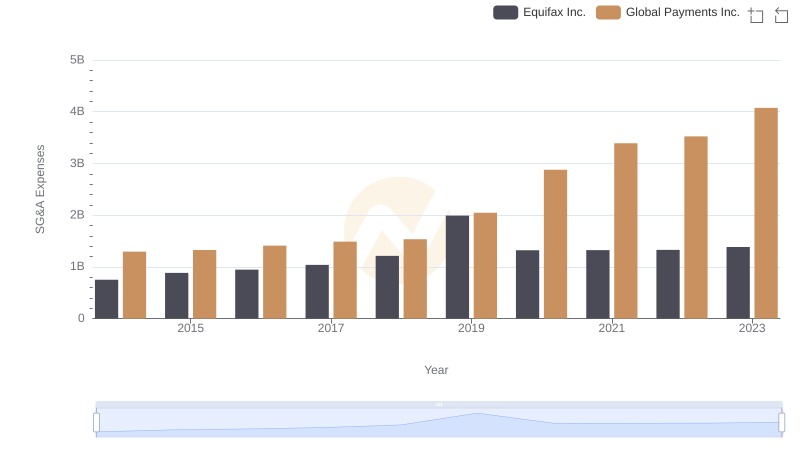

Breaking Down SG&A Expenses: Equifax Inc. vs Global Payments Inc.

Selling, General, and Administrative Costs: Equifax Inc. vs Lennox International Inc.

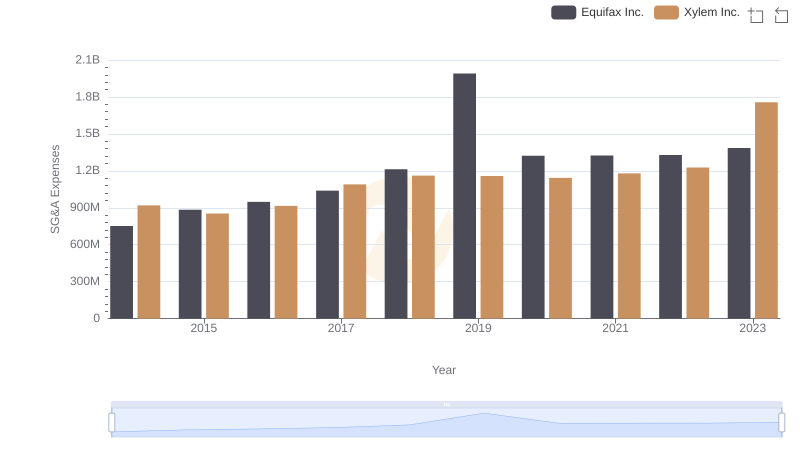

Equifax Inc. or Xylem Inc.: Who Manages SG&A Costs Better?

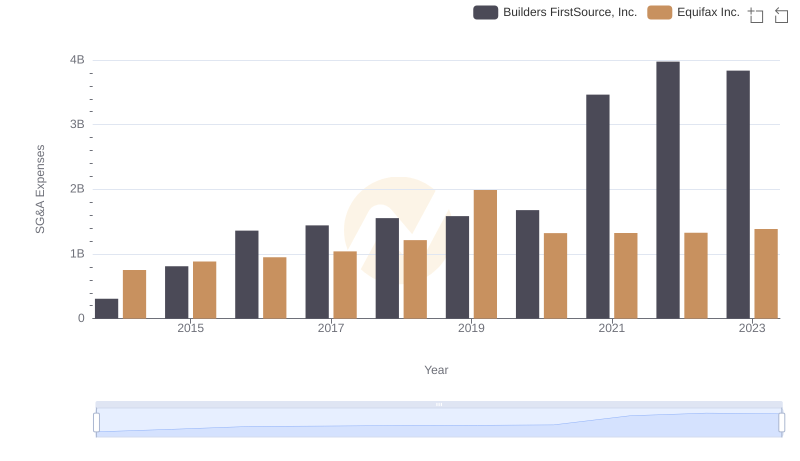

Selling, General, and Administrative Costs: Equifax Inc. vs Builders FirstSource, Inc.

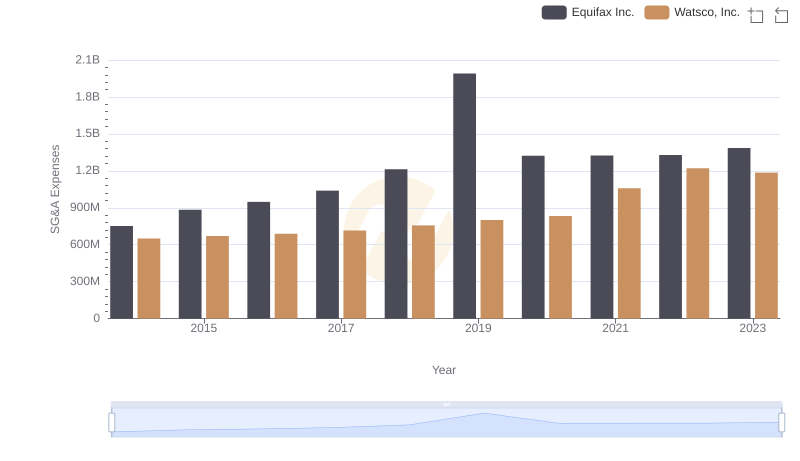

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.

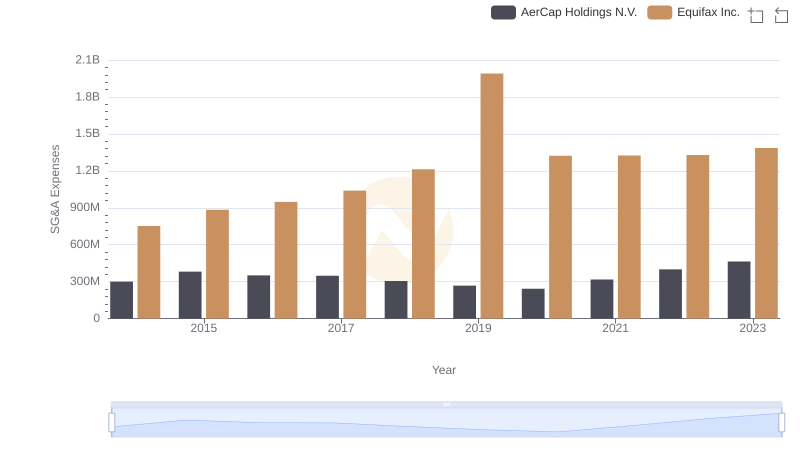

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

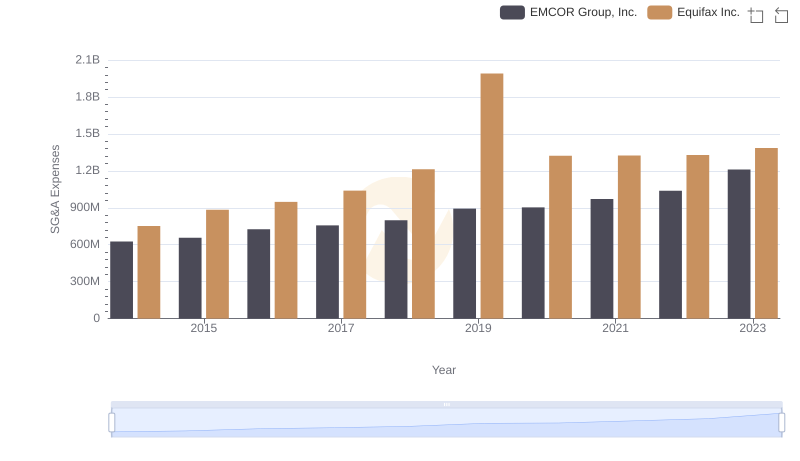

Breaking Down SG&A Expenses: Equifax Inc. vs EMCOR Group, Inc.