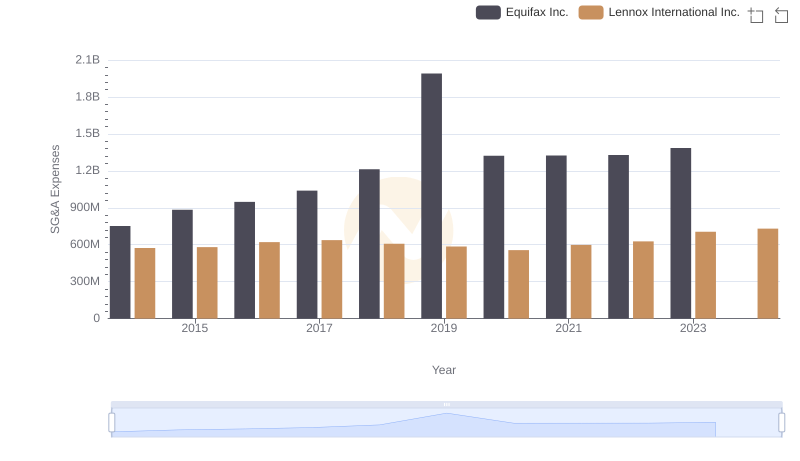

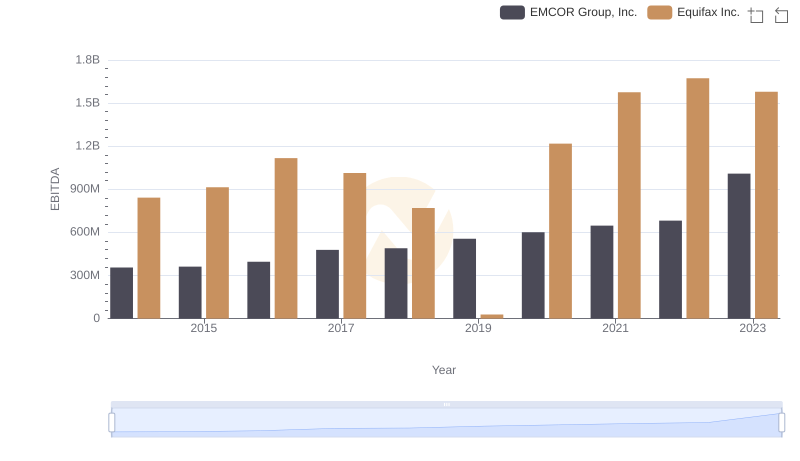

| __timestamp | EMCOR Group, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 751700000 |

| Thursday, January 1, 2015 | 656573000 | 884300000 |

| Friday, January 1, 2016 | 725538000 | 948200000 |

| Sunday, January 1, 2017 | 757062000 | 1039100000 |

| Monday, January 1, 2018 | 799157000 | 1213300000 |

| Tuesday, January 1, 2019 | 893453000 | 1990200000 |

| Wednesday, January 1, 2020 | 903584000 | 1322500000 |

| Friday, January 1, 2021 | 970937000 | 1324600000 |

| Saturday, January 1, 2022 | 1038717000 | 1328900000 |

| Sunday, January 1, 2023 | 1211233000 | 1385700000 |

| Monday, January 1, 2024 | 1450500000 |

Infusing magic into the data realm

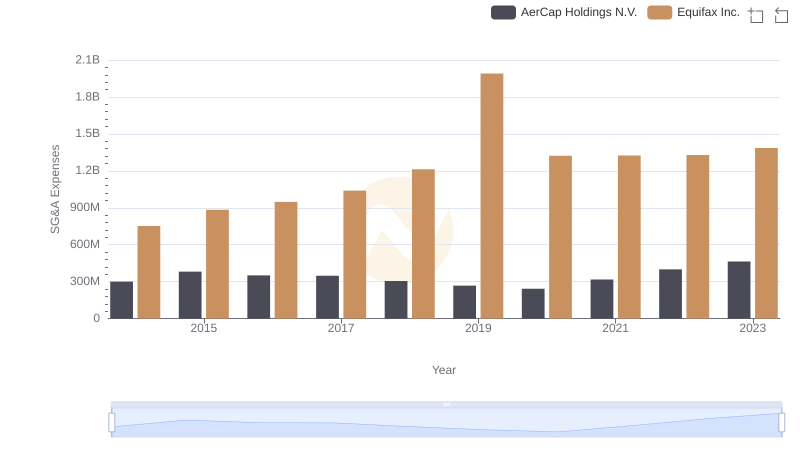

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Equifax Inc. and EMCOR Group, Inc. have demonstrated distinct trajectories in their SG&A expenditures. From 2014 to 2023, Equifax's SG&A expenses surged by approximately 84%, peaking in 2019, while EMCOR's expenses grew by about 93%, reaching their highest in 2023. This trend highlights Equifax's strategic investments in administrative functions, especially post-2017, likely in response to increased regulatory scrutiny. Meanwhile, EMCOR's consistent rise reflects its expansion and operational scaling. As of 2023, Equifax's SG&A expenses are about 14% higher than EMCOR's, underscoring the differing operational strategies of these industry giants. This analysis provides a window into how these companies allocate resources to maintain competitive edges in their respective sectors.

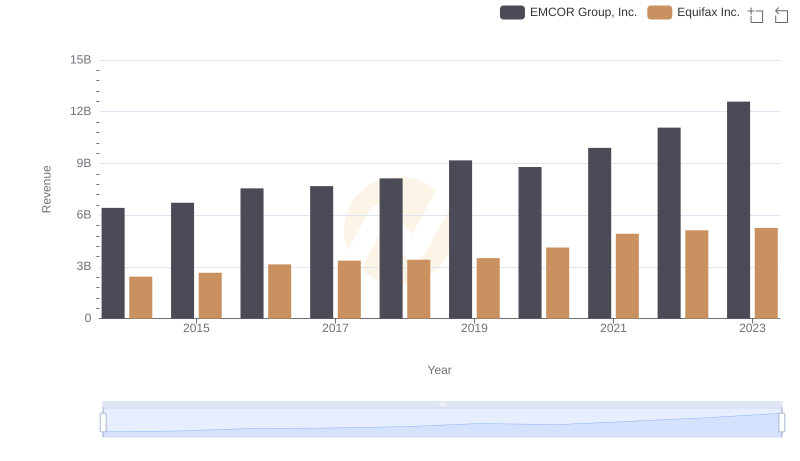

Breaking Down Revenue Trends: Equifax Inc. vs EMCOR Group, Inc.

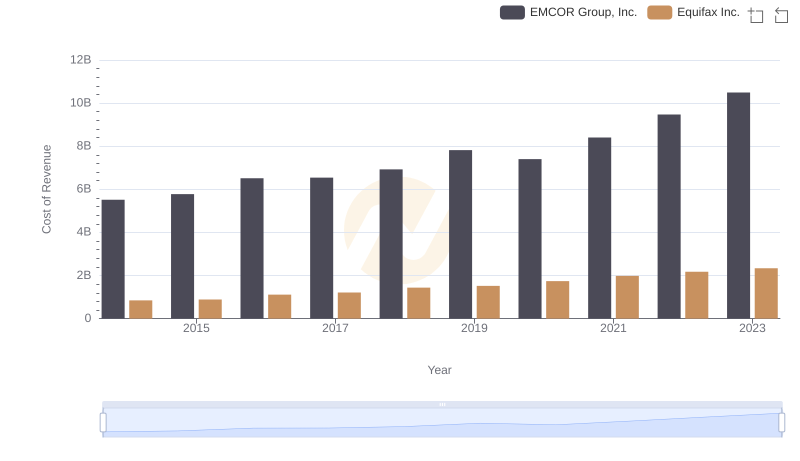

Equifax Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

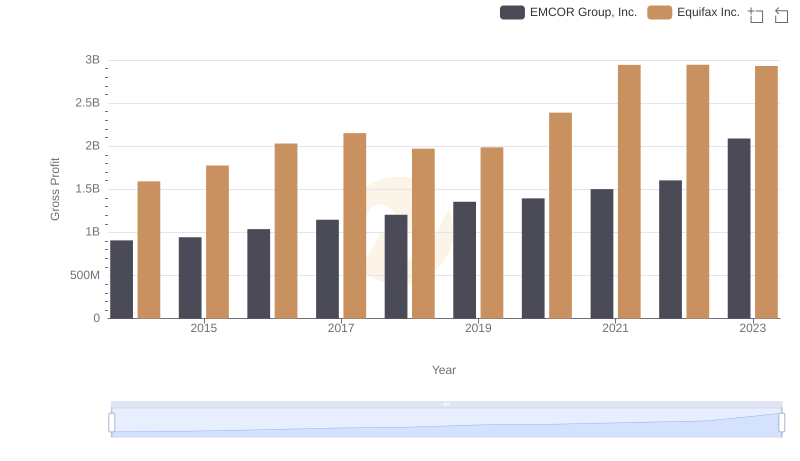

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.

Selling, General, and Administrative Costs: Equifax Inc. vs Lennox International Inc.

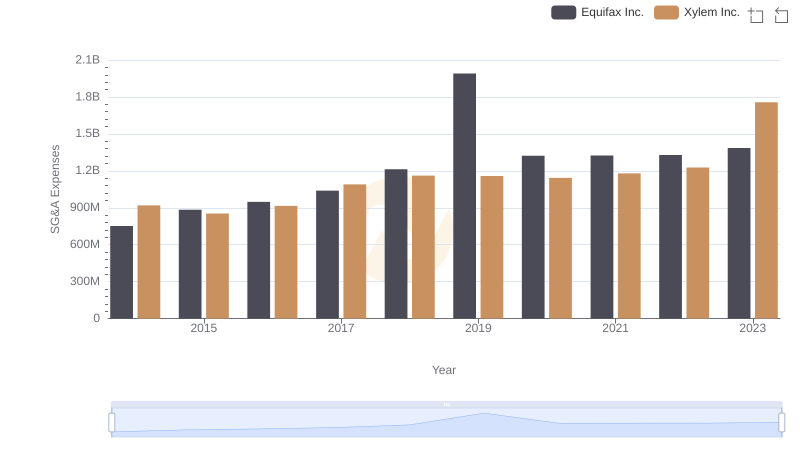

Equifax Inc. or Xylem Inc.: Who Manages SG&A Costs Better?

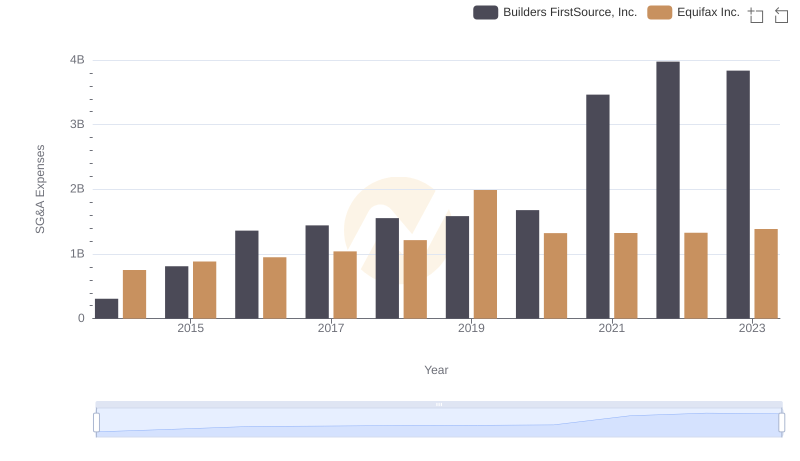

Selling, General, and Administrative Costs: Equifax Inc. vs Builders FirstSource, Inc.

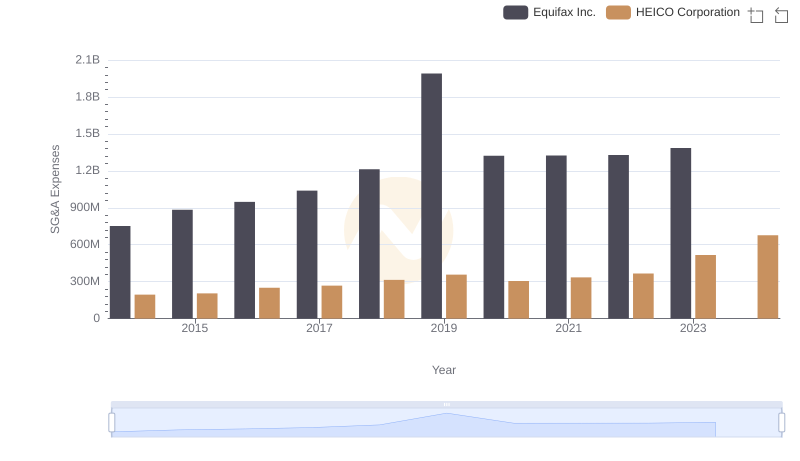

Comparing SG&A Expenses: Equifax Inc. vs HEICO Corporation Trends and Insights

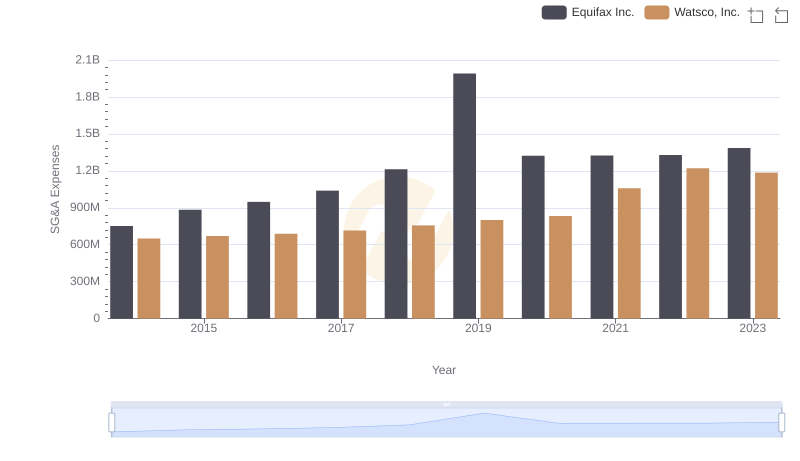

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

Equifax Inc. and EMCOR Group, Inc.: A Detailed Examination of EBITDA Performance