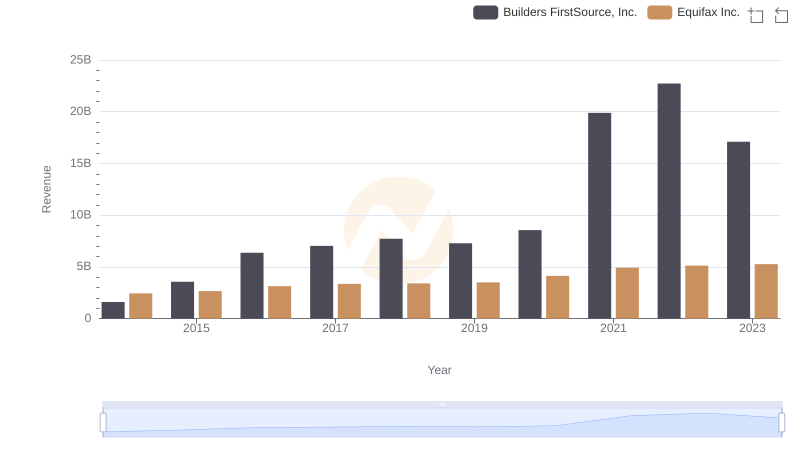

| __timestamp | Builders FirstSource, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 356997000 | 1591700000 |

| Thursday, January 1, 2015 | 901458000 | 1776200000 |

| Friday, January 1, 2016 | 1596748000 | 2031500000 |

| Sunday, January 1, 2017 | 1727391000 | 2151500000 |

| Monday, January 1, 2018 | 1922940000 | 1971700000 |

| Tuesday, January 1, 2019 | 1976829000 | 1985900000 |

| Wednesday, January 1, 2020 | 2222584000 | 2390100000 |

| Friday, January 1, 2021 | 5850956000 | 2943000000 |

| Saturday, January 1, 2022 | 7744379000 | 2945000000 |

| Sunday, January 1, 2023 | 6012334000 | 2930100000 |

| Monday, January 1, 2024 | 5681100000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding gross profit trends is crucial for investors and analysts alike. Over the past decade, Builders FirstSource, Inc. has demonstrated a remarkable growth trajectory, with its gross profit surging by over 1,500% from 2014 to 2023. This impressive rise is highlighted by a peak in 2022, where the company achieved a gross profit of approximately $7.7 billion, a significant leap from $357 million in 2014.

Conversely, Equifax Inc. has maintained a steady growth pattern, with its gross profit increasing by around 84% over the same period. Despite a more modest growth rate compared to Builders FirstSource, Equifax's consistent performance underscores its stability in the market.

These insights reveal the dynamic nature of the financial sector, where companies like Builders FirstSource can experience rapid growth, while others like Equifax provide steady returns.

Annual Revenue Comparison: Equifax Inc. vs Builders FirstSource, Inc.

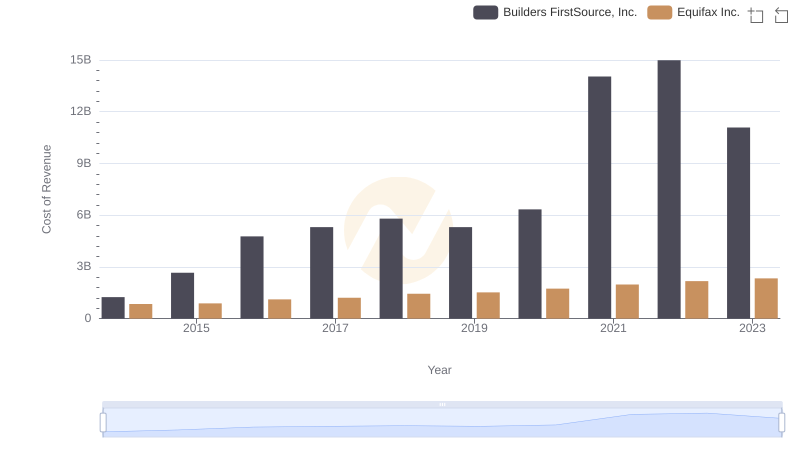

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

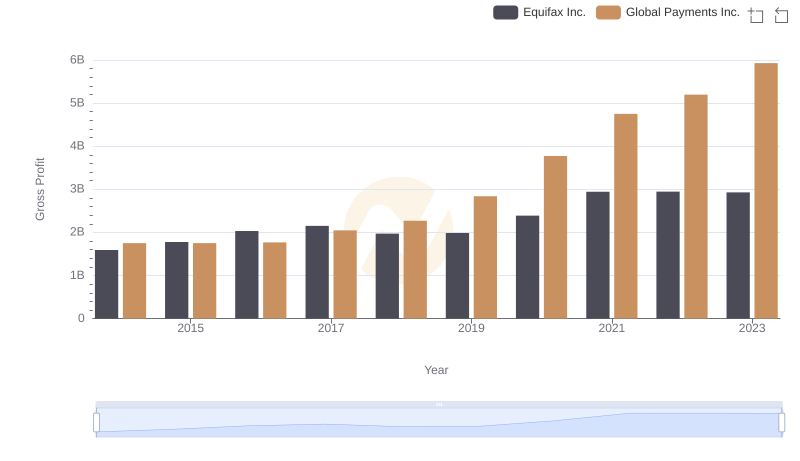

Who Generates Higher Gross Profit? Equifax Inc. or Global Payments Inc.

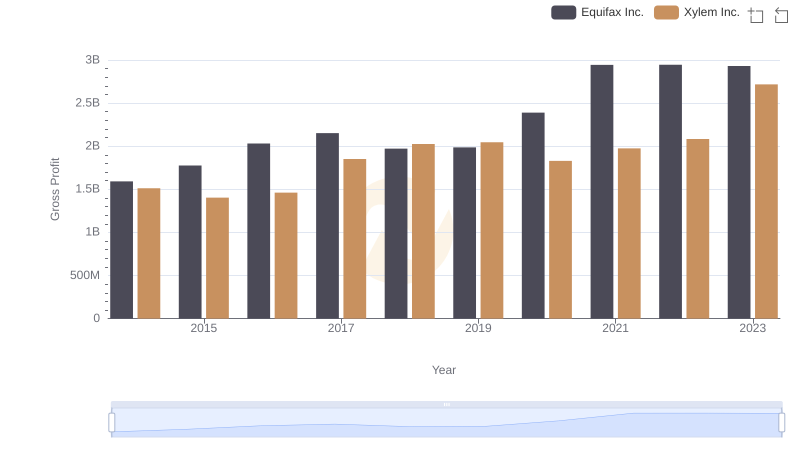

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

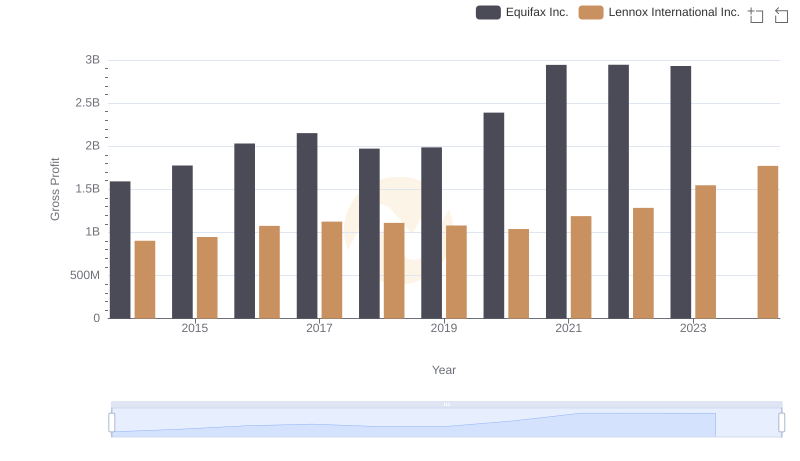

Equifax Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

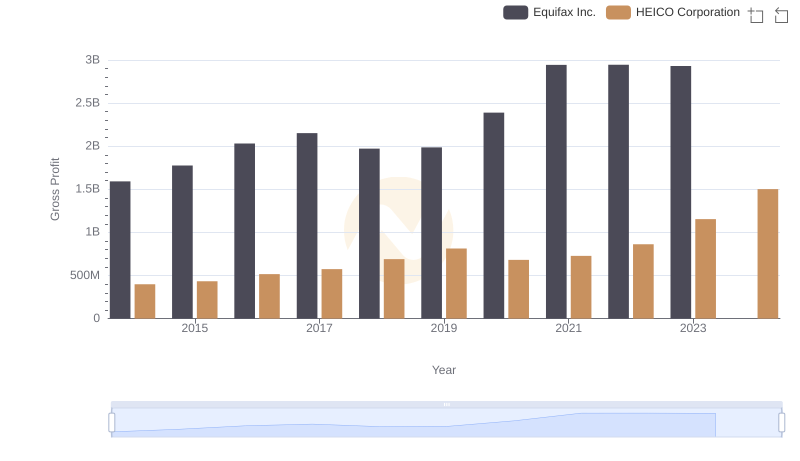

Gross Profit Comparison: Equifax Inc. and HEICO Corporation Trends

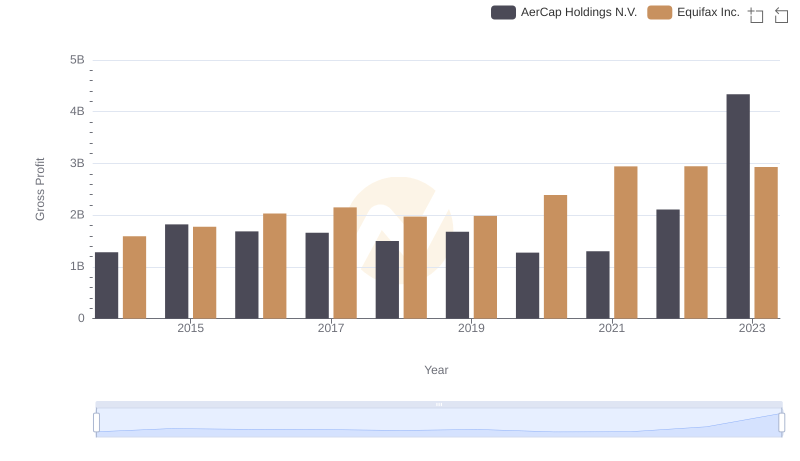

Key Insights on Gross Profit: Equifax Inc. vs AerCap Holdings N.V.

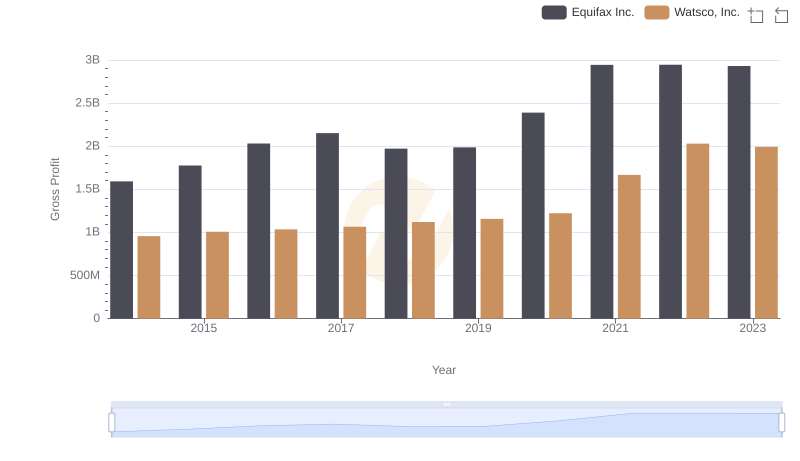

Equifax Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

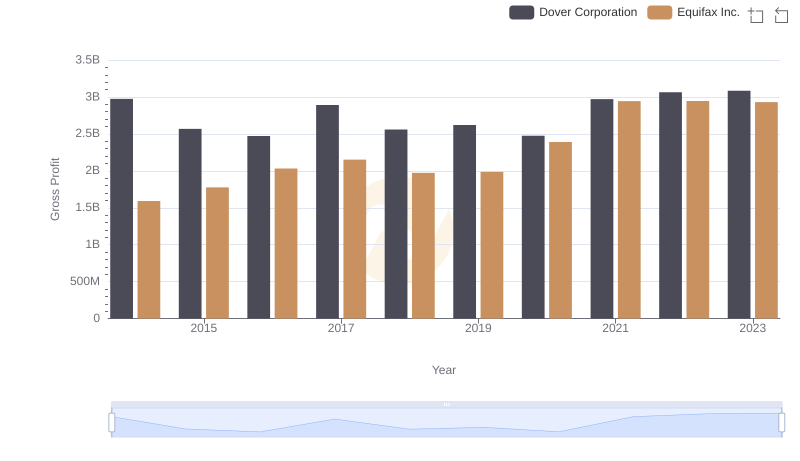

Equifax Inc. vs Dover Corporation: A Gross Profit Performance Breakdown

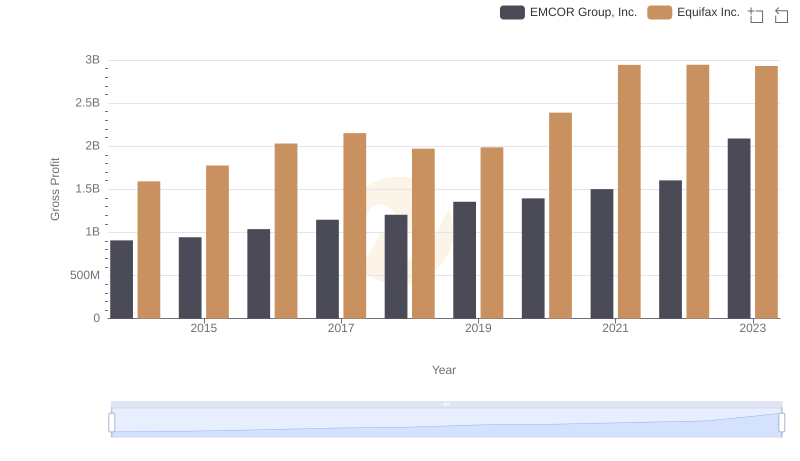

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.

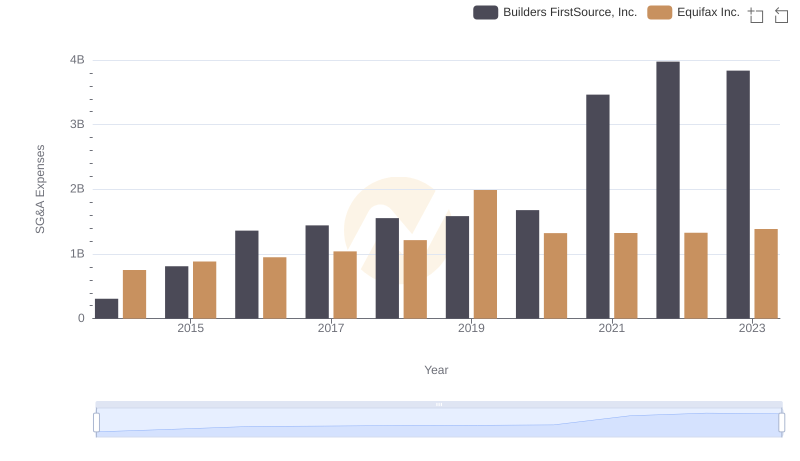

Selling, General, and Administrative Costs: Equifax Inc. vs Builders FirstSource, Inc.

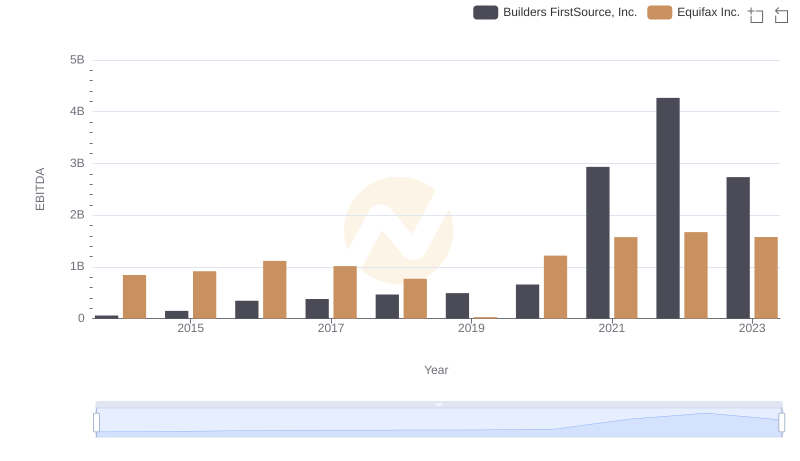

Comparative EBITDA Analysis: Equifax Inc. vs Builders FirstSource, Inc.