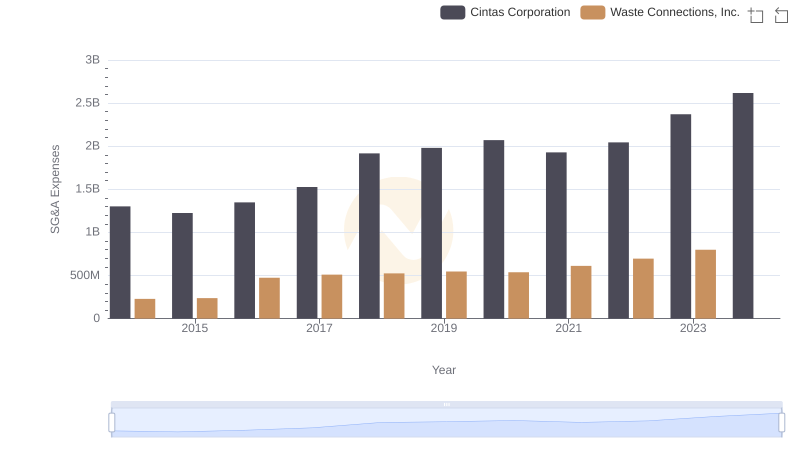

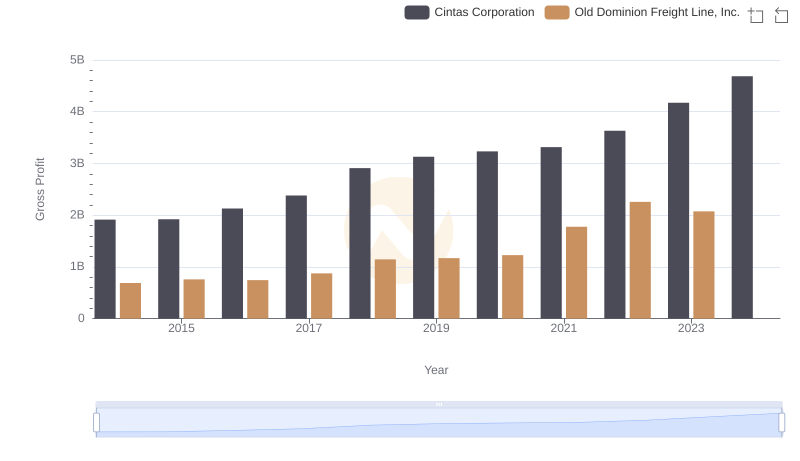

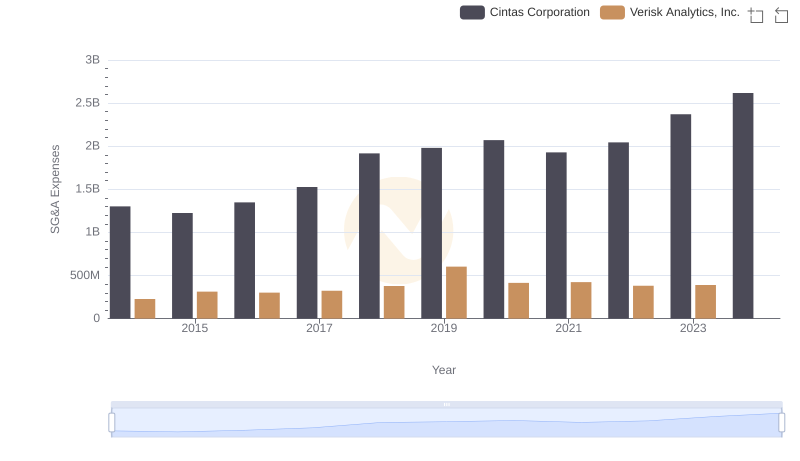

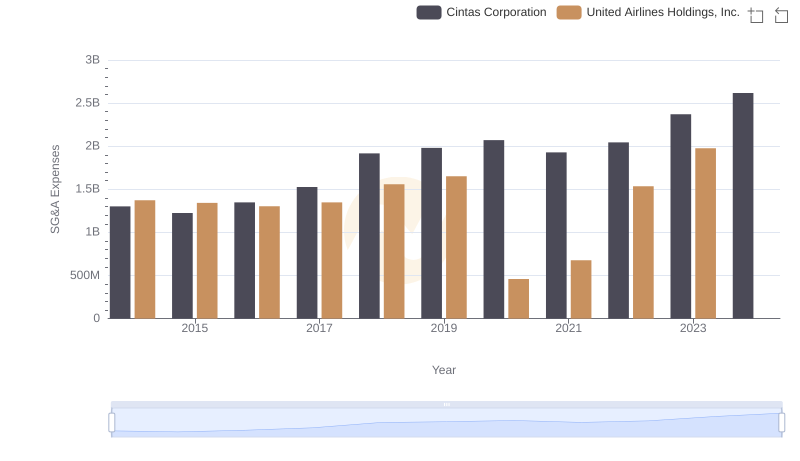

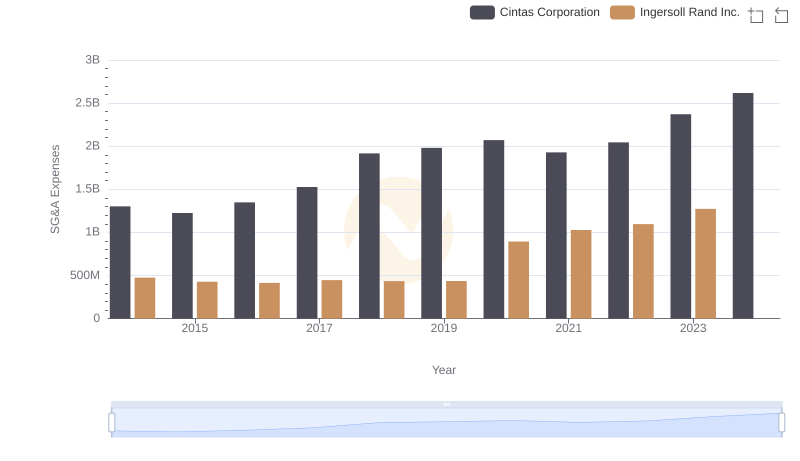

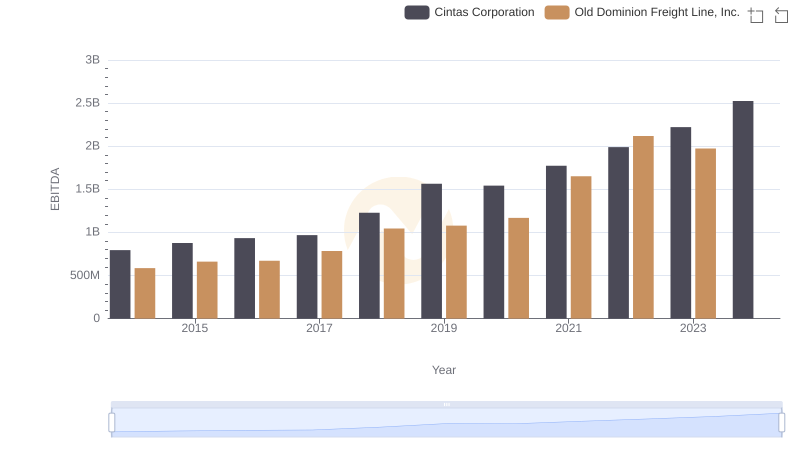

| __timestamp | Cintas Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 144817000 |

| Thursday, January 1, 2015 | 1224930000 | 153589000 |

| Friday, January 1, 2016 | 1348122000 | 152391000 |

| Sunday, January 1, 2017 | 1527380000 | 177205000 |

| Monday, January 1, 2018 | 1916792000 | 194368000 |

| Tuesday, January 1, 2019 | 1980644000 | 206125000 |

| Wednesday, January 1, 2020 | 2071052000 | 184185000 |

| Friday, January 1, 2021 | 1929159000 | 223757000 |

| Saturday, January 1, 2022 | 2044876000 | 258883000 |

| Sunday, January 1, 2023 | 2370704000 | 281053000 |

| Monday, January 1, 2024 | 2617783000 |

Data in motion

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of a company's operational efficiency. Over the past decade, Cintas Corporation and Old Dominion Freight Line, Inc. have showcased contrasting trends in their SG&A expenses. From 2014 to 2023, Cintas Corporation's SG&A expenses surged by approximately 100%, reflecting a robust growth trajectory. In contrast, Old Dominion Freight Line, Inc. experienced a more modest increase of around 94% over the same period. Notably, Cintas consistently reported higher SG&A expenses, peaking at an impressive $2.37 billion in 2023, while Old Dominion reached $281 million. This disparity highlights the differing scales and operational strategies of these two industry giants. As we look to the future, the absence of data for Old Dominion in 2024 leaves room for speculation on its strategic direction.

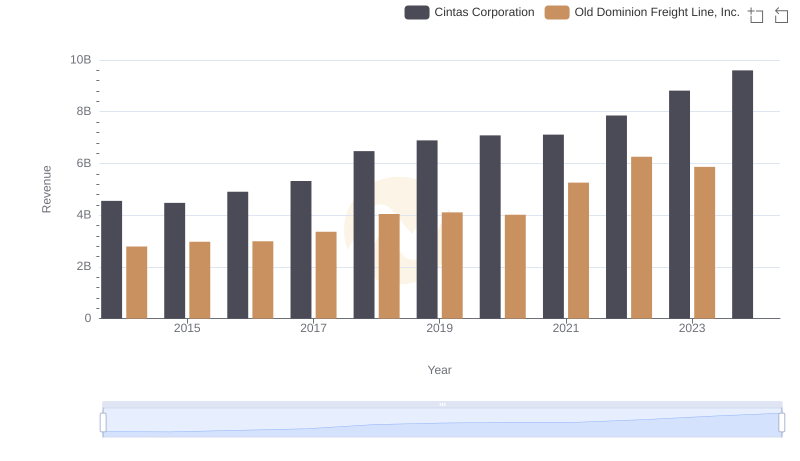

Revenue Insights: Cintas Corporation and Old Dominion Freight Line, Inc. Performance Compared

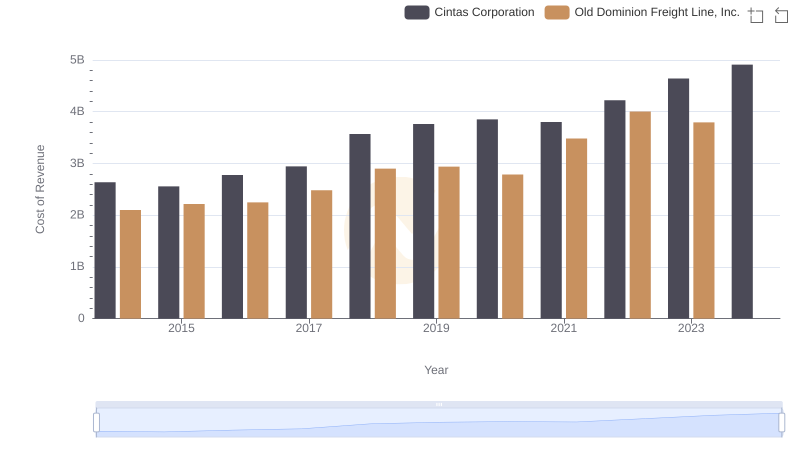

Cost Insights: Breaking Down Cintas Corporation and Old Dominion Freight Line, Inc.'s Expenses

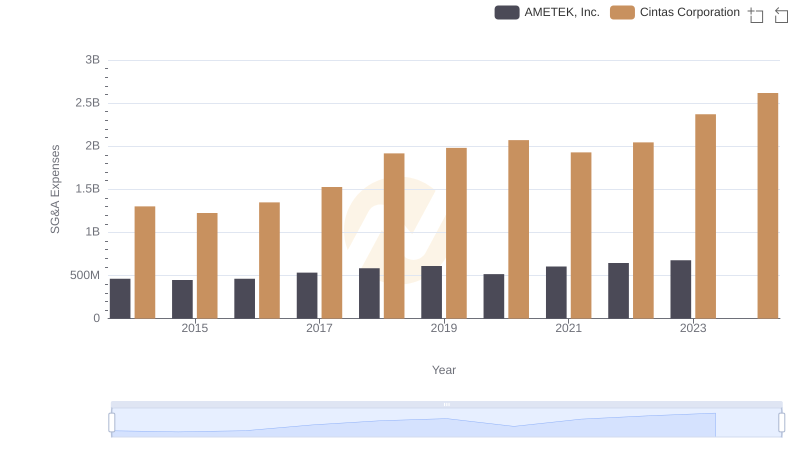

Cintas Corporation vs AMETEK, Inc.: SG&A Expense Trends

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

Gross Profit Analysis: Comparing Cintas Corporation and Old Dominion Freight Line, Inc.

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

SG&A Efficiency Analysis: Comparing Cintas Corporation and United Airlines Holdings, Inc.

Cintas Corporation and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

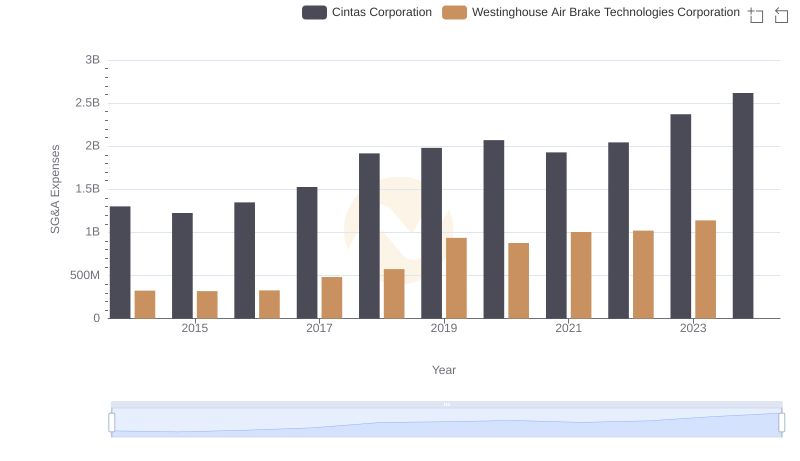

Cintas Corporation vs Westinghouse Air Brake Technologies Corporation: SG&A Expense Trends

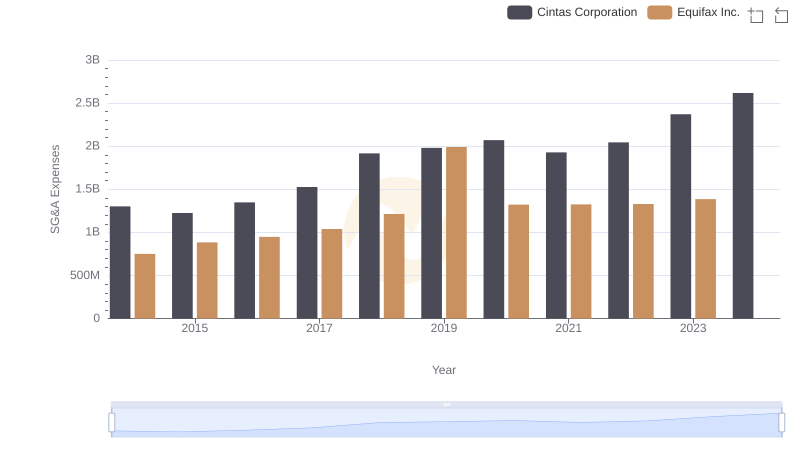

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

Professional EBITDA Benchmarking: Cintas Corporation vs Old Dominion Freight Line, Inc.