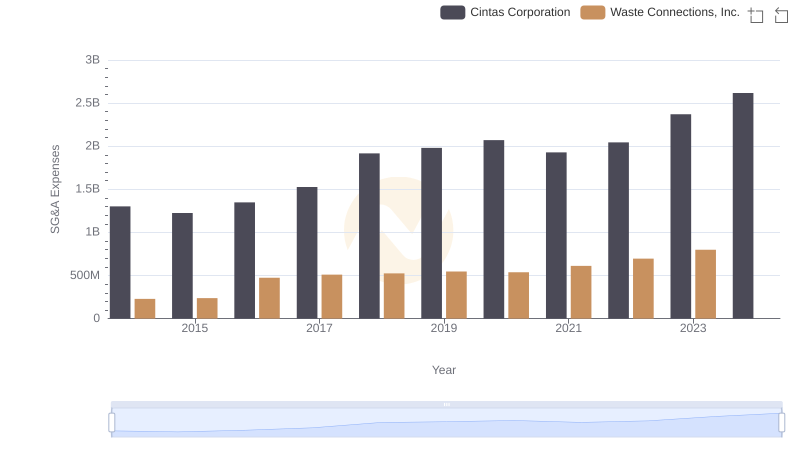

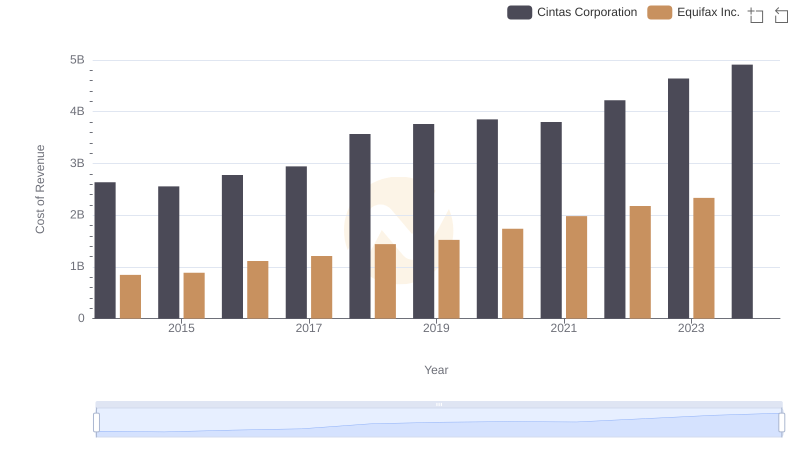

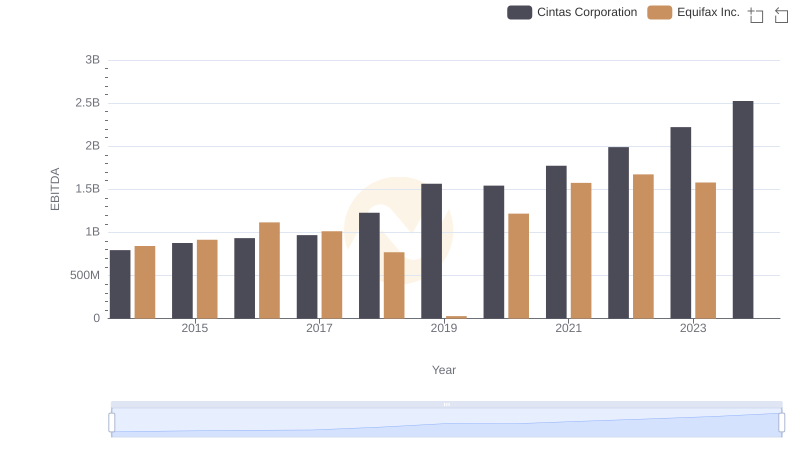

| __timestamp | Cintas Corporation | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 751700000 |

| Thursday, January 1, 2015 | 1224930000 | 884300000 |

| Friday, January 1, 2016 | 1348122000 | 948200000 |

| Sunday, January 1, 2017 | 1527380000 | 1039100000 |

| Monday, January 1, 2018 | 1916792000 | 1213300000 |

| Tuesday, January 1, 2019 | 1980644000 | 1990200000 |

| Wednesday, January 1, 2020 | 2071052000 | 1322500000 |

| Friday, January 1, 2021 | 1929159000 | 1324600000 |

| Saturday, January 1, 2022 | 2044876000 | 1328900000 |

| Sunday, January 1, 2023 | 2370704000 | 1385700000 |

| Monday, January 1, 2024 | 2617783000 | 1450500000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Cintas Corporation and Equifax Inc. have demonstrated distinct trajectories in their SG&A expenditures. From 2014 to 2023, Cintas Corporation's SG&A expenses surged by approximately 100%, reflecting its strategic investments and expansion efforts. In contrast, Equifax Inc. experienced a more modest increase of around 84% during the same period, highlighting a more conservative approach.

The year 2019 marked a pivotal point where Equifax's SG&A expenses peaked, aligning with its data breach recovery efforts. Meanwhile, Cintas continued its upward trend, reaching its highest in 2023. Notably, data for Equifax in 2024 is missing, suggesting potential reporting delays or strategic shifts. This analysis underscores the importance of SG&A management in shaping corporate growth and resilience.

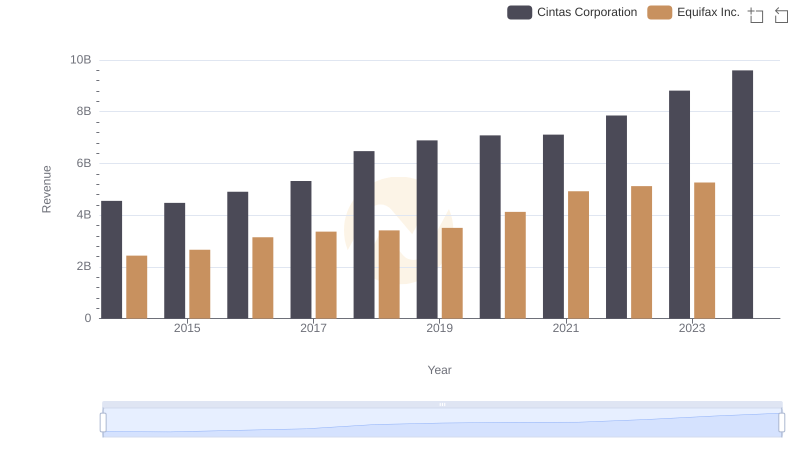

Cintas Corporation vs Equifax Inc.: Examining Key Revenue Metrics

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

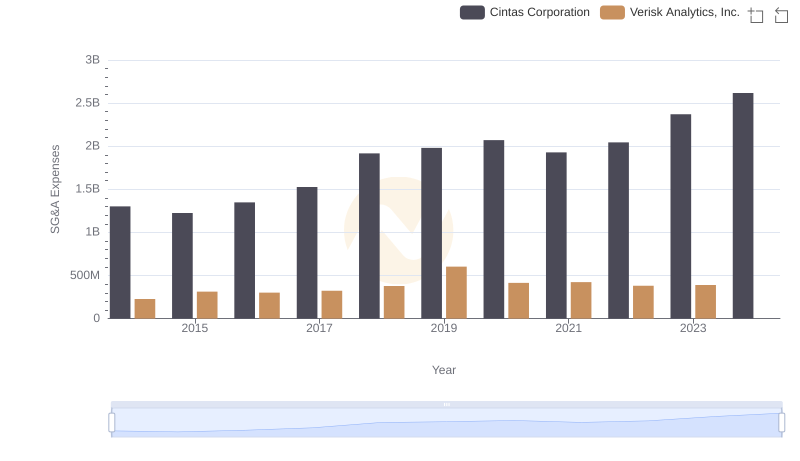

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

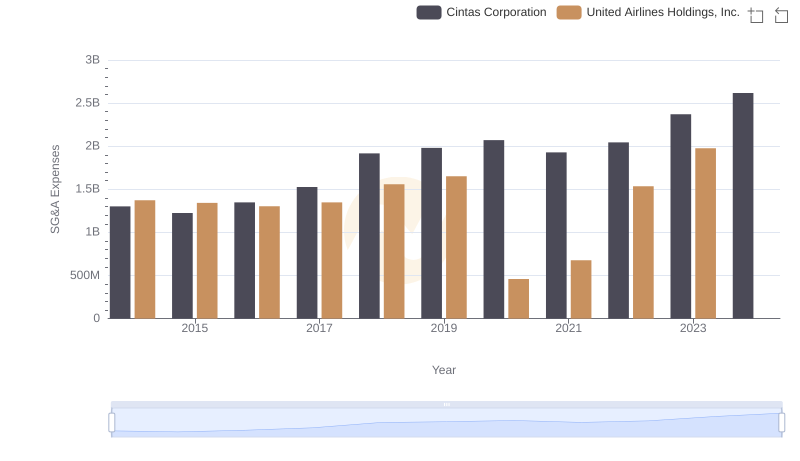

SG&A Efficiency Analysis: Comparing Cintas Corporation and United Airlines Holdings, Inc.

Cost of Revenue Trends: Cintas Corporation vs Equifax Inc.

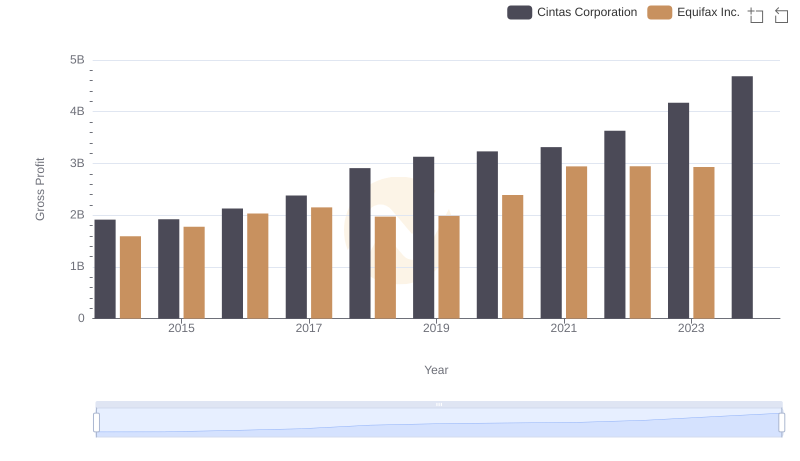

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

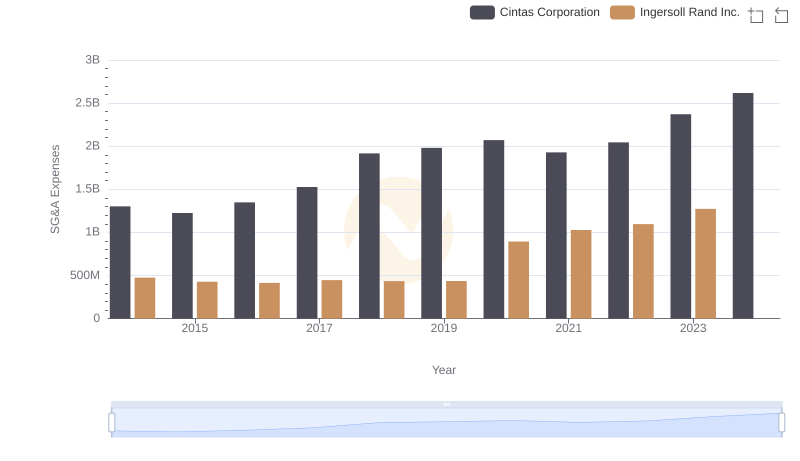

Cintas Corporation and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

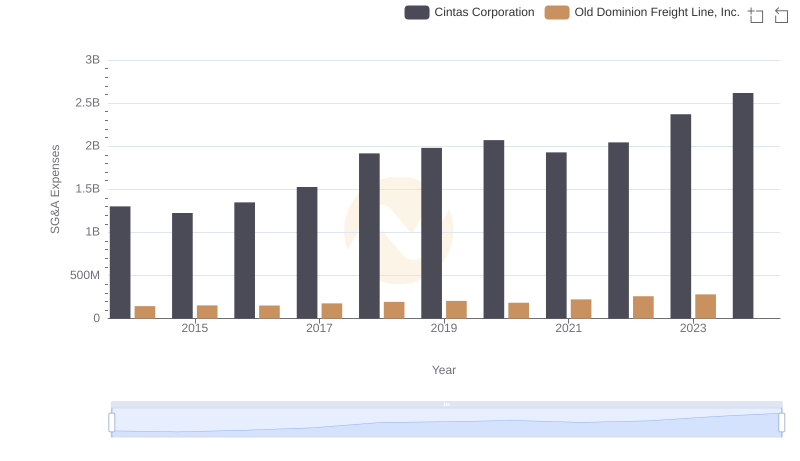

Selling, General, and Administrative Costs: Cintas Corporation vs Old Dominion Freight Line, Inc.

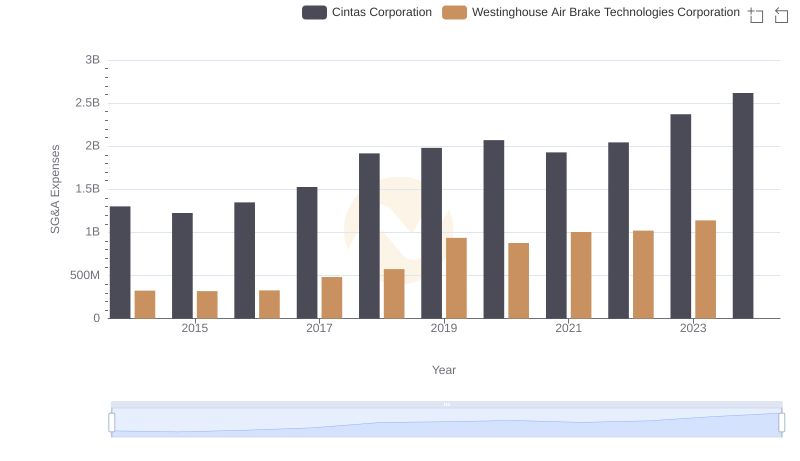

Cintas Corporation vs Westinghouse Air Brake Technologies Corporation: SG&A Expense Trends

A Professional Review of EBITDA: Cintas Corporation Compared to Equifax Inc.

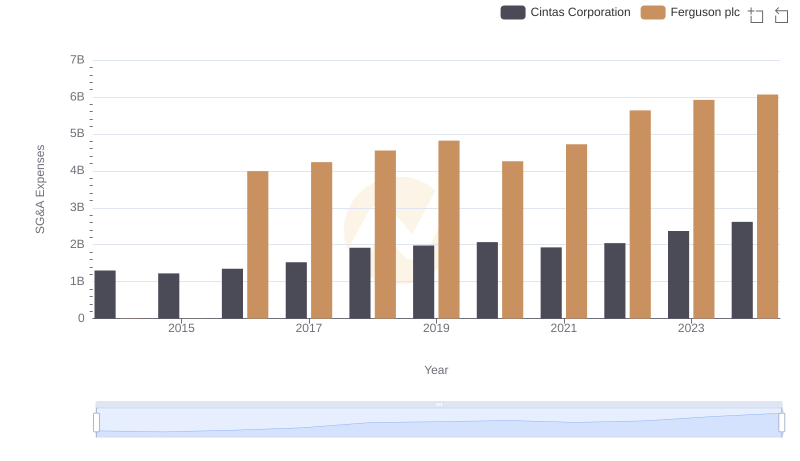

Selling, General, and Administrative Costs: Cintas Corporation vs Ferguson plc