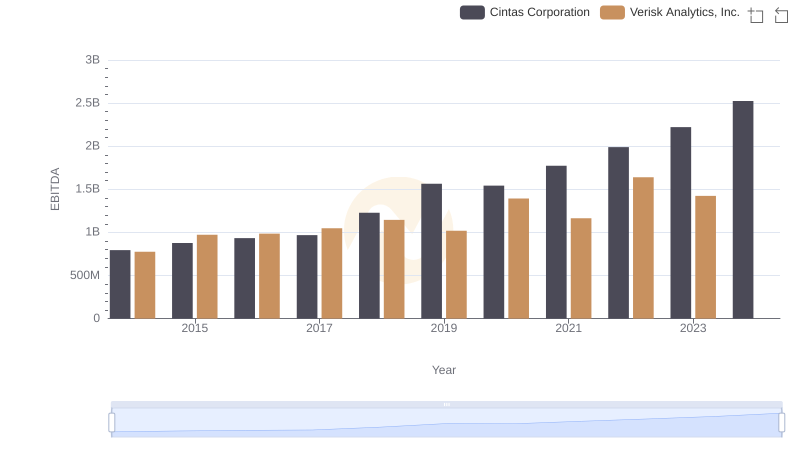

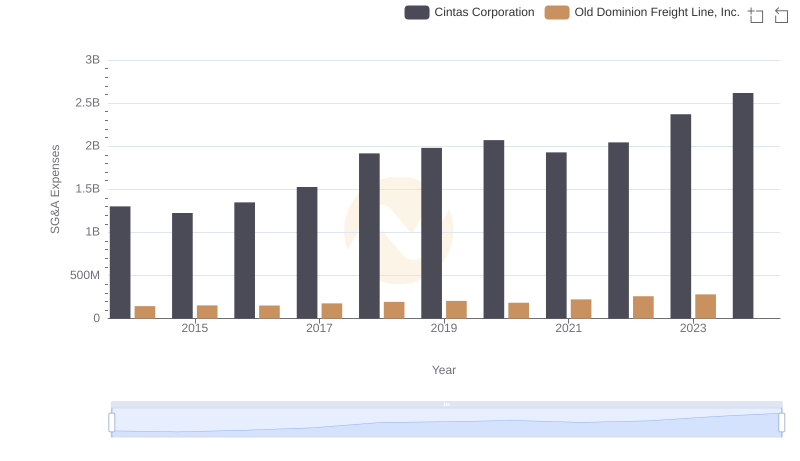

| __timestamp | Cintas Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 585590000 |

| Thursday, January 1, 2015 | 877761000 | 660570000 |

| Friday, January 1, 2016 | 933728000 | 671786000 |

| Sunday, January 1, 2017 | 968293000 | 783749000 |

| Monday, January 1, 2018 | 1227852000 | 1046059000 |

| Tuesday, January 1, 2019 | 1564228000 | 1078007000 |

| Wednesday, January 1, 2020 | 1542737000 | 1168149000 |

| Friday, January 1, 2021 | 1773591000 | 1651501000 |

| Saturday, January 1, 2022 | 1990046000 | 2118962000 |

| Sunday, January 1, 2023 | 2221676000 | 1972689000 |

| Monday, January 1, 2024 | 2523857000 |

Infusing magic into the data realm

In the competitive landscape of corporate America, Cintas Corporation and Old Dominion Freight Line, Inc. have emerged as formidable players. Over the past decade, Cintas has consistently outperformed Old Dominion in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Cintas saw its EBITDA grow by approximately 218%, while Old Dominion experienced a 237% increase until 2022. Notably, in 2022, Old Dominion briefly surpassed Cintas, marking a significant milestone in its financial journey. However, by 2023, Cintas reclaimed its lead, with an EBITDA of $2.22 billion compared to Old Dominion's $1.97 billion. This dynamic rivalry highlights the resilience and strategic prowess of both companies, as they navigate the ever-evolving economic landscape. The data for 2024 remains incomplete for Old Dominion, leaving room for speculation on future trends.

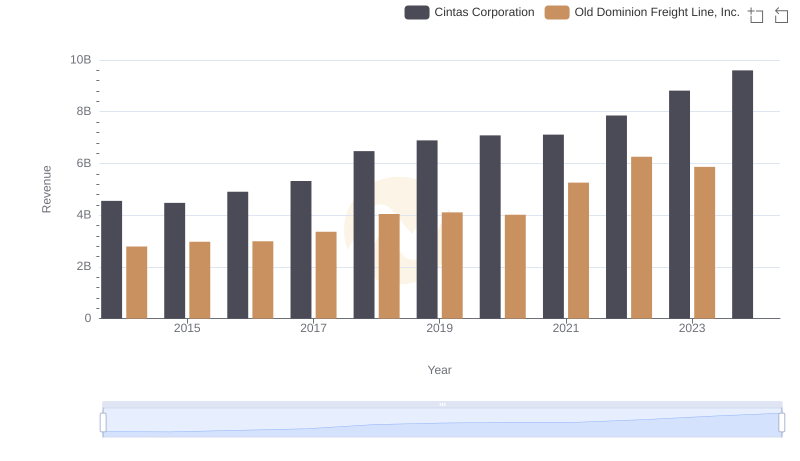

Revenue Insights: Cintas Corporation and Old Dominion Freight Line, Inc. Performance Compared

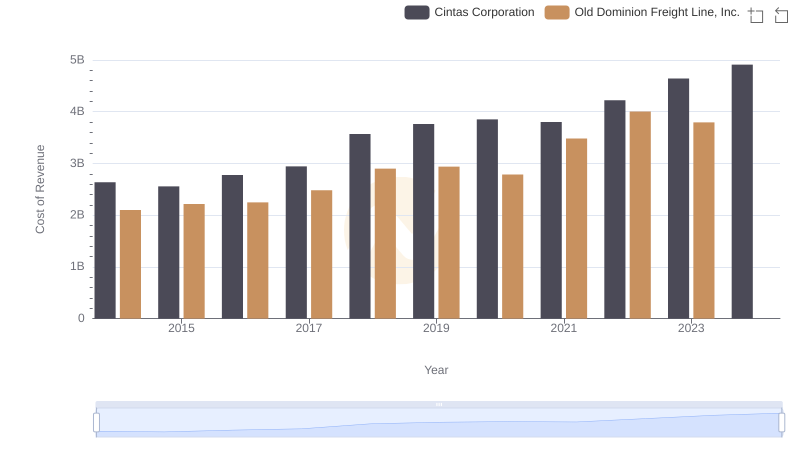

Cost Insights: Breaking Down Cintas Corporation and Old Dominion Freight Line, Inc.'s Expenses

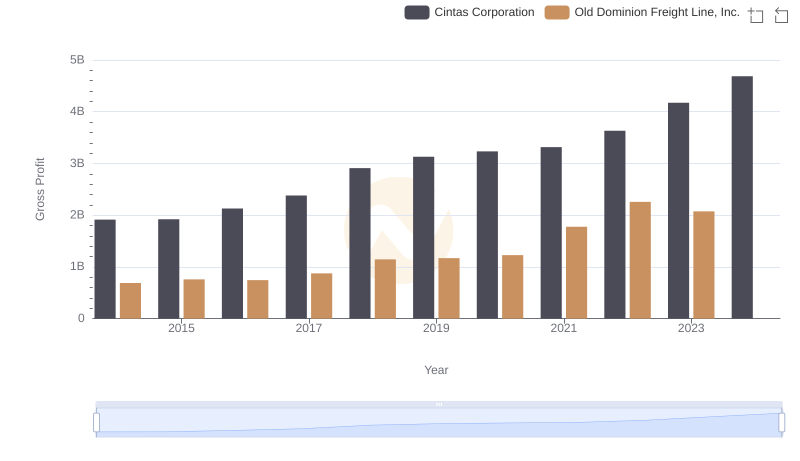

Gross Profit Analysis: Comparing Cintas Corporation and Old Dominion Freight Line, Inc.

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Verisk Analytics, Inc.

Selling, General, and Administrative Costs: Cintas Corporation vs Old Dominion Freight Line, Inc.

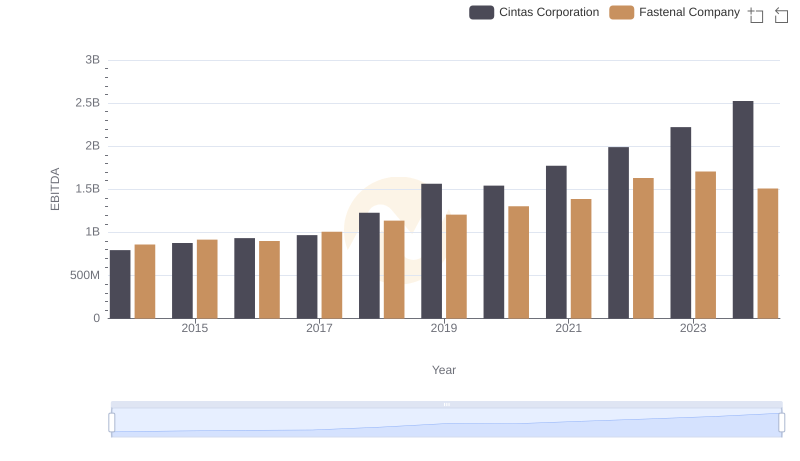

EBITDA Analysis: Evaluating Cintas Corporation Against Fastenal Company

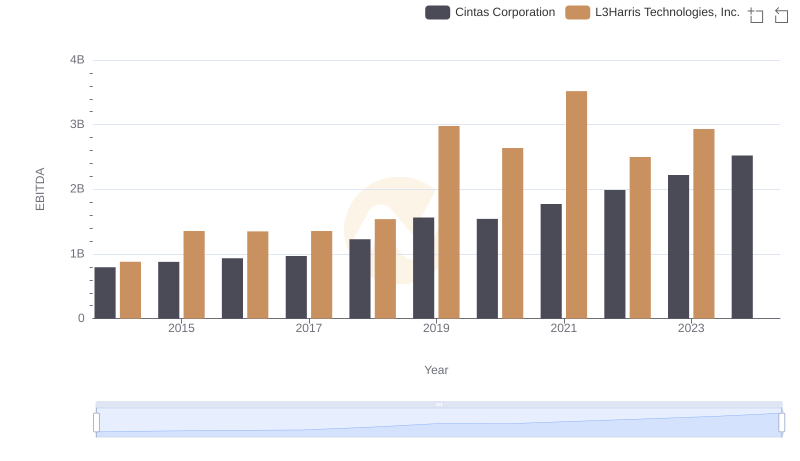

Comprehensive EBITDA Comparison: Cintas Corporation vs L3Harris Technologies, Inc.

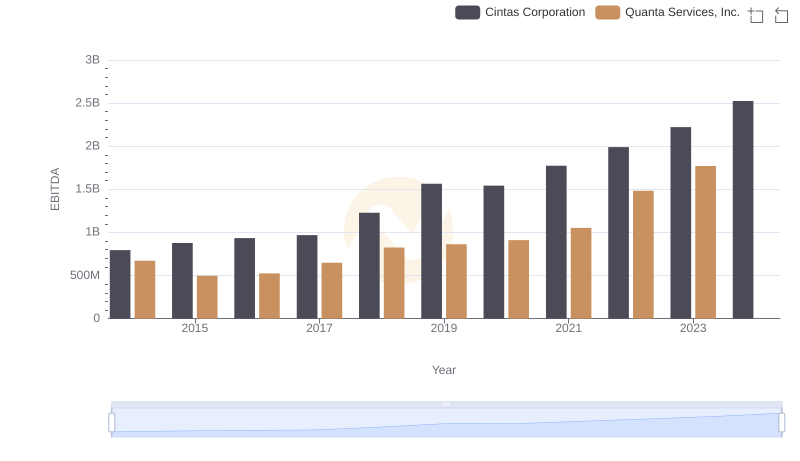

Comparative EBITDA Analysis: Cintas Corporation vs Quanta Services, Inc.

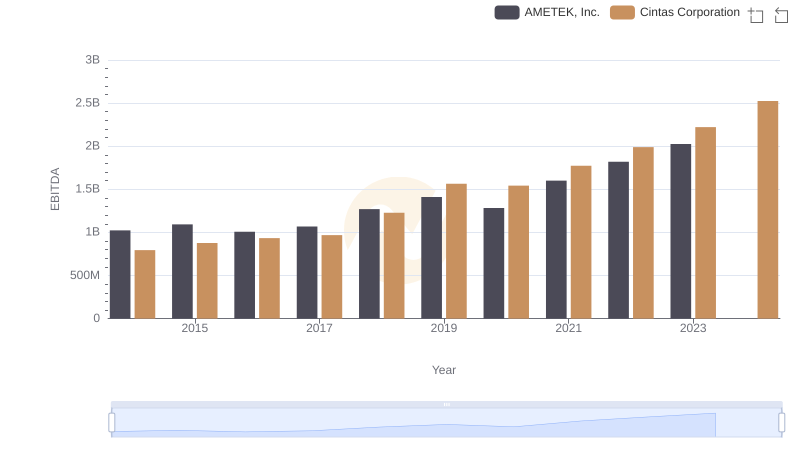

Cintas Corporation vs AMETEK, Inc.: In-Depth EBITDA Performance Comparison

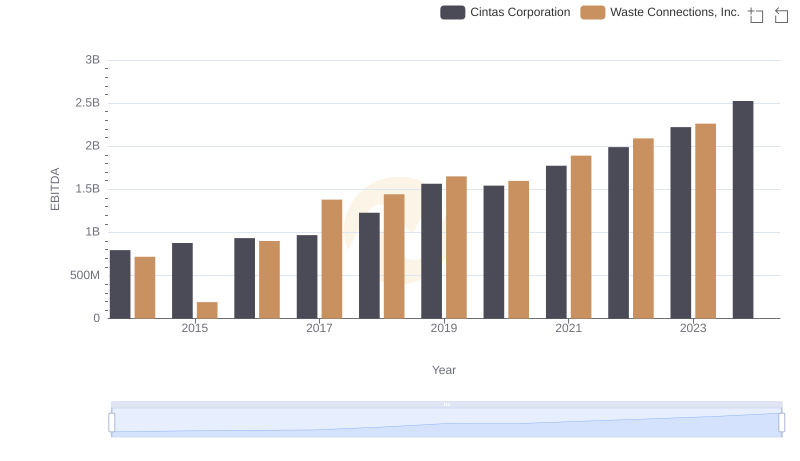

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Waste Connections, Inc.

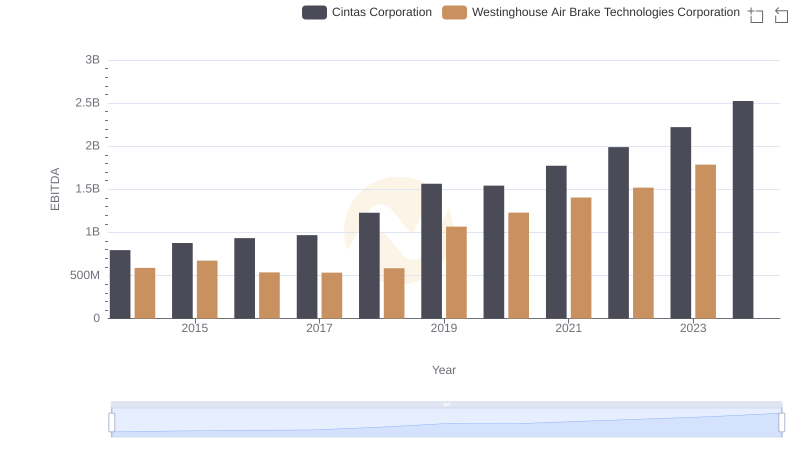

Comprehensive EBITDA Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

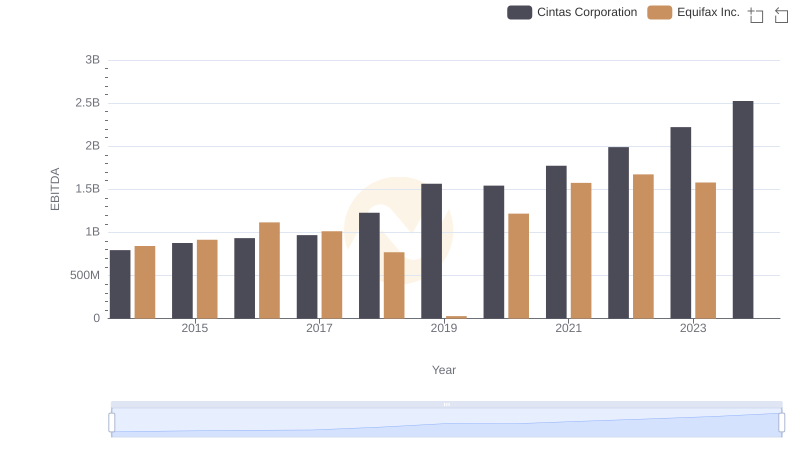

A Professional Review of EBITDA: Cintas Corporation Compared to Equifax Inc.