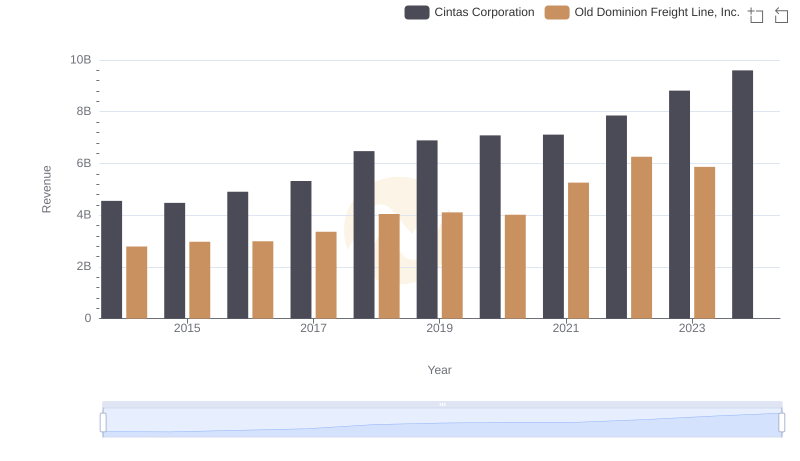

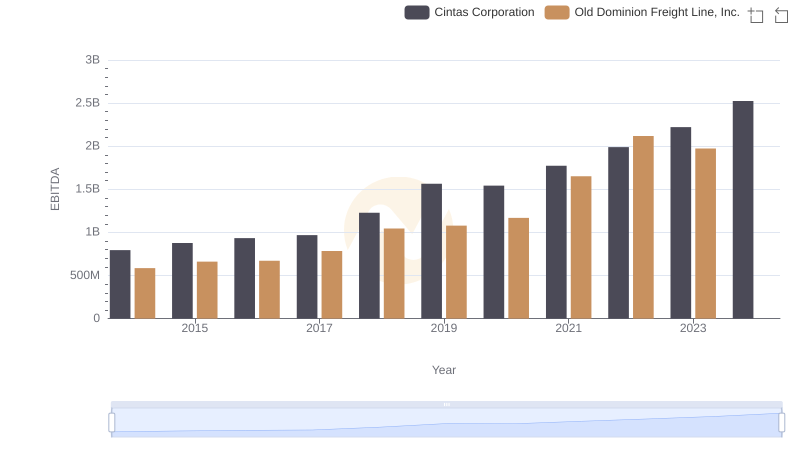

| __timestamp | Cintas Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 687488000 |

| Thursday, January 1, 2015 | 1921337000 | 757499000 |

| Friday, January 1, 2016 | 2129870000 | 744627000 |

| Sunday, January 1, 2017 | 2380295000 | 875380000 |

| Monday, January 1, 2018 | 2908523000 | 1144243000 |

| Tuesday, January 1, 2019 | 3128588000 | 1170216000 |

| Wednesday, January 1, 2020 | 3233748000 | 1228598000 |

| Friday, January 1, 2021 | 3314651000 | 1775060000 |

| Saturday, January 1, 2022 | 3632246000 | 2256126000 |

| Sunday, January 1, 2023 | 4173368000 | 2072199000 |

| Monday, January 1, 2024 | 4686416000 |

Igniting the spark of knowledge

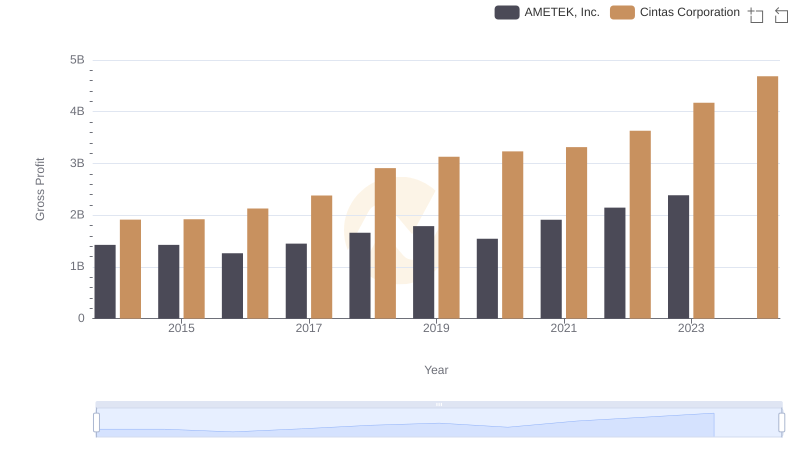

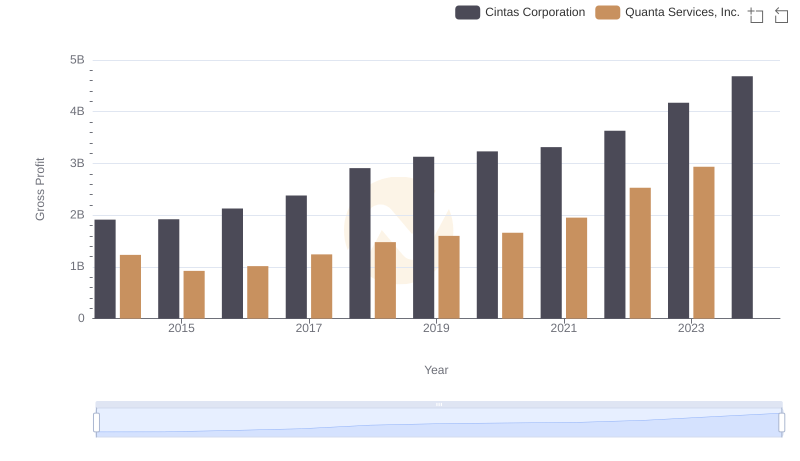

In the competitive landscape of American business, Cintas Corporation and Old Dominion Freight Line, Inc. have emerged as leaders in their respective industries. Over the past decade, Cintas has demonstrated a remarkable growth trajectory, with its gross profit increasing by approximately 145% from 2014 to 2023. This growth reflects Cintas's strategic expansion and operational efficiency. In contrast, Old Dominion Freight Line, Inc. has also shown impressive growth, with its gross profit nearly tripling from 2014 to 2022, highlighting its robust logistics capabilities. However, data for 2024 is missing, leaving room for speculation on future performance. As these companies continue to evolve, their financial health remains a testament to their resilience and adaptability in a dynamic market. This analysis provides a snapshot of their financial journey, offering insights into their strategic maneuvers and market positioning.

Revenue Insights: Cintas Corporation and Old Dominion Freight Line, Inc. Performance Compared

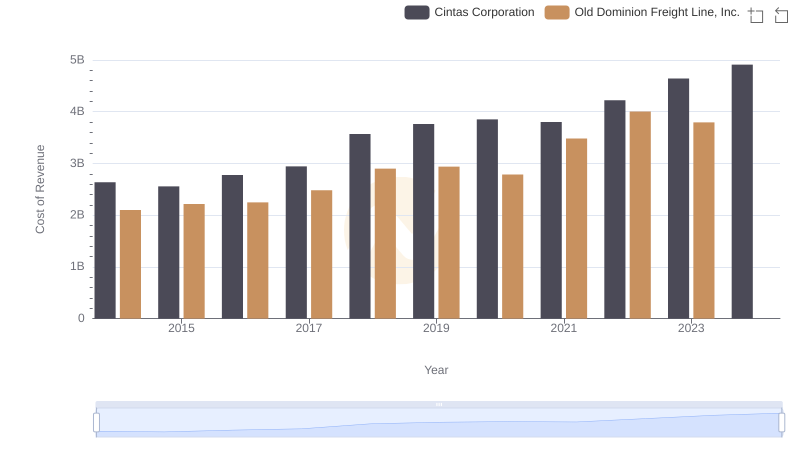

Cost Insights: Breaking Down Cintas Corporation and Old Dominion Freight Line, Inc.'s Expenses

Cintas Corporation vs AMETEK, Inc.: A Gross Profit Performance Breakdown

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

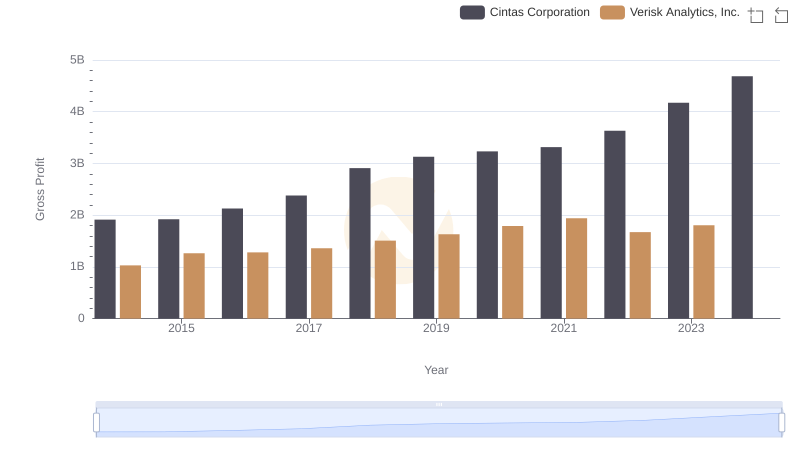

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

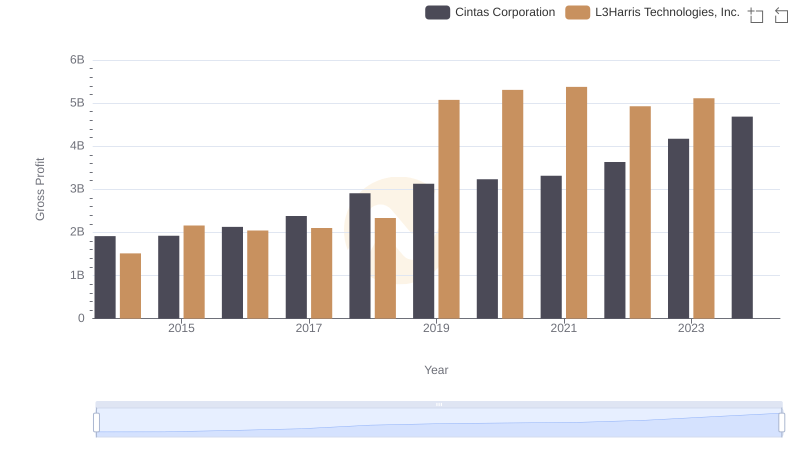

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

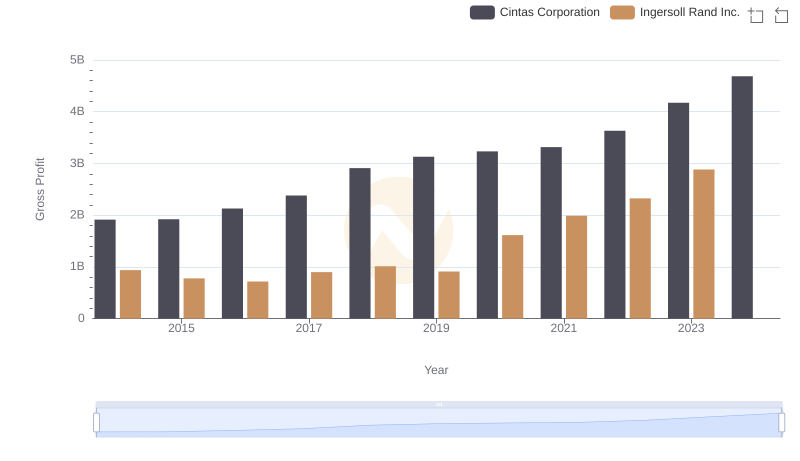

Gross Profit Trends Compared: Cintas Corporation vs Ingersoll Rand Inc.

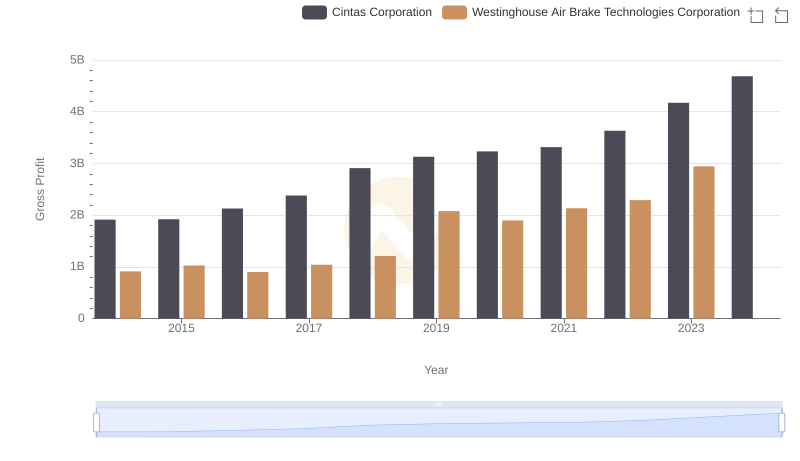

Who Generates Higher Gross Profit? Cintas Corporation or Westinghouse Air Brake Technologies Corporation

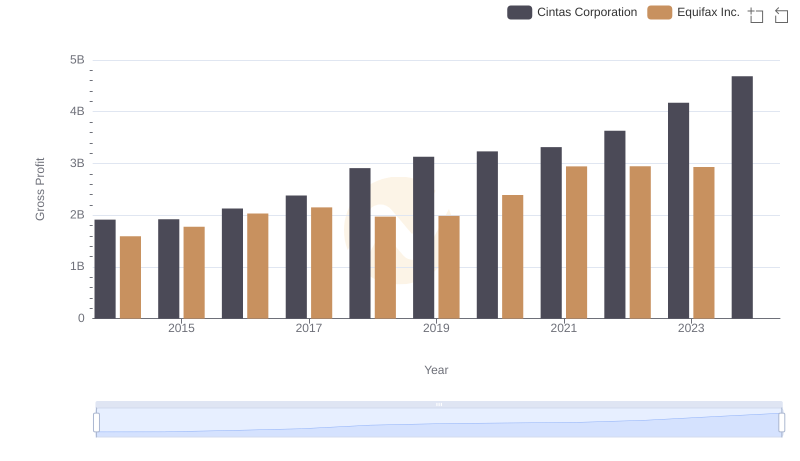

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

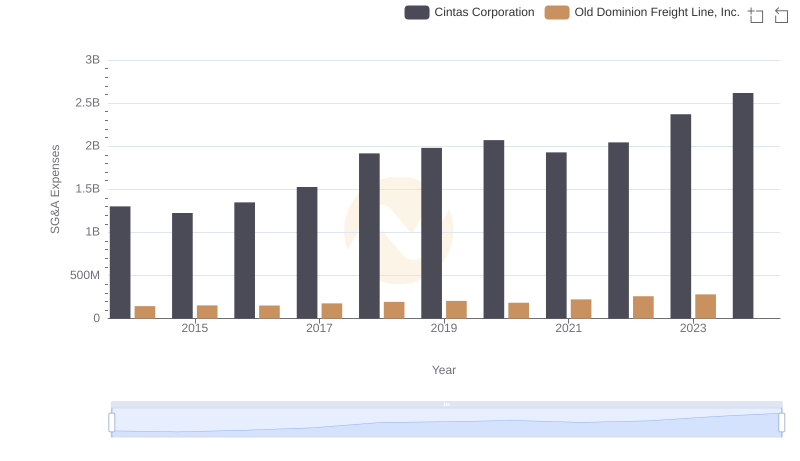

Selling, General, and Administrative Costs: Cintas Corporation vs Old Dominion Freight Line, Inc.

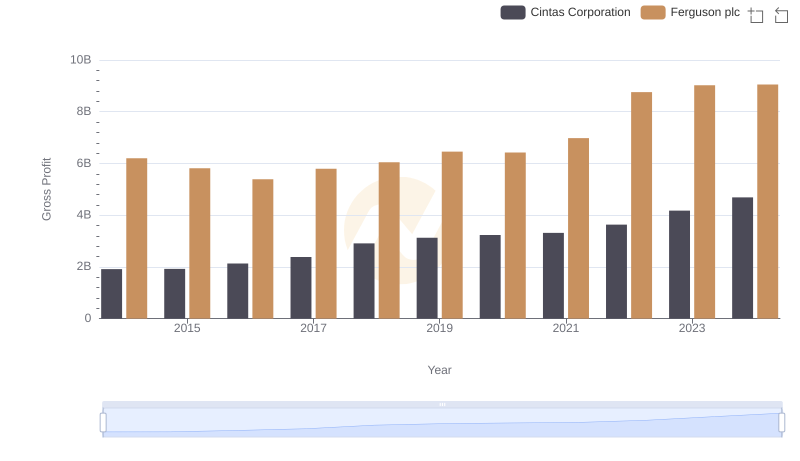

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc

Professional EBITDA Benchmarking: Cintas Corporation vs Old Dominion Freight Line, Inc.