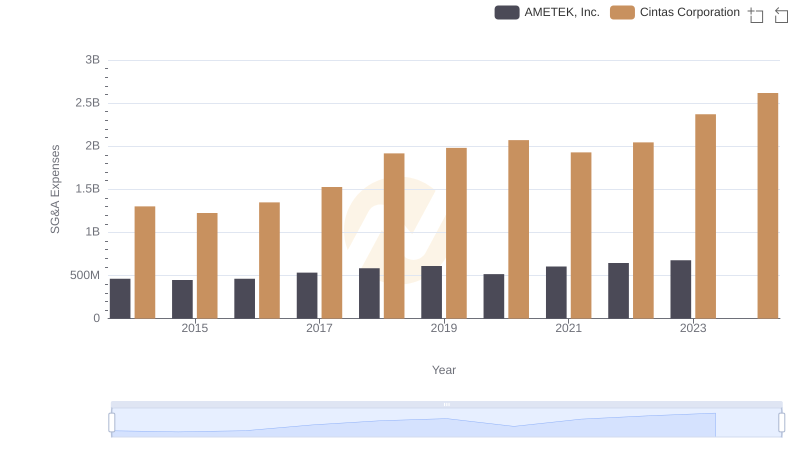

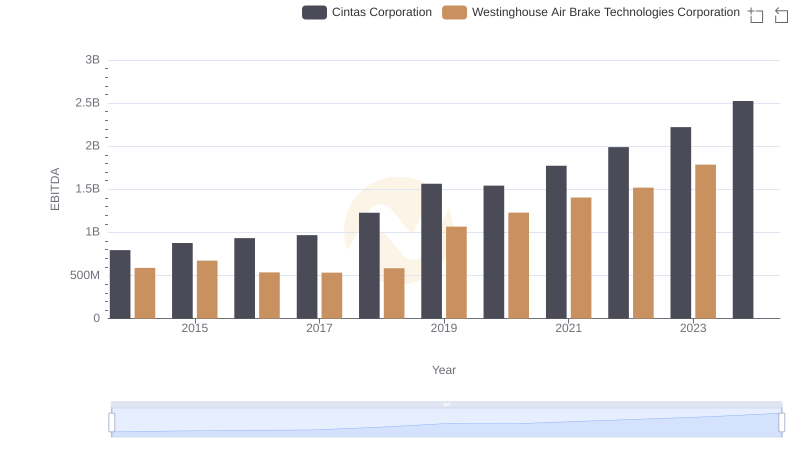

| __timestamp | Cintas Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 324539000 |

| Thursday, January 1, 2015 | 1224930000 | 319173000 |

| Friday, January 1, 2016 | 1348122000 | 327505000 |

| Sunday, January 1, 2017 | 1527380000 | 482852000 |

| Monday, January 1, 2018 | 1916792000 | 573644000 |

| Tuesday, January 1, 2019 | 1980644000 | 936600000 |

| Wednesday, January 1, 2020 | 2071052000 | 877100000 |

| Friday, January 1, 2021 | 1929159000 | 1005000000 |

| Saturday, January 1, 2022 | 2044876000 | 1020000000 |

| Sunday, January 1, 2023 | 2370704000 | 1139000000 |

| Monday, January 1, 2024 | 2617783000 | 1248000000 |

In pursuit of knowledge

In the competitive landscape of corporate America, understanding the financial health of companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Cintas Corporation and Westinghouse Air Brake Technologies Corporation, from 2014 to 2023.

Cintas Corporation, a leader in corporate identity uniform programs, has seen a steady increase in its SG&A expenses, growing by approximately 101% over the decade. This trend reflects its aggressive expansion and investment in operational efficiencies. In contrast, Westinghouse Air Brake Technologies, a key player in the rail industry, experienced a more modest 251% increase, indicating a more conservative approach to cost management.

Interestingly, the data for 2024 is incomplete, highlighting the dynamic nature of financial reporting. As these companies continue to evolve, monitoring their SG&A expenses will provide valuable insights into their strategic priorities.

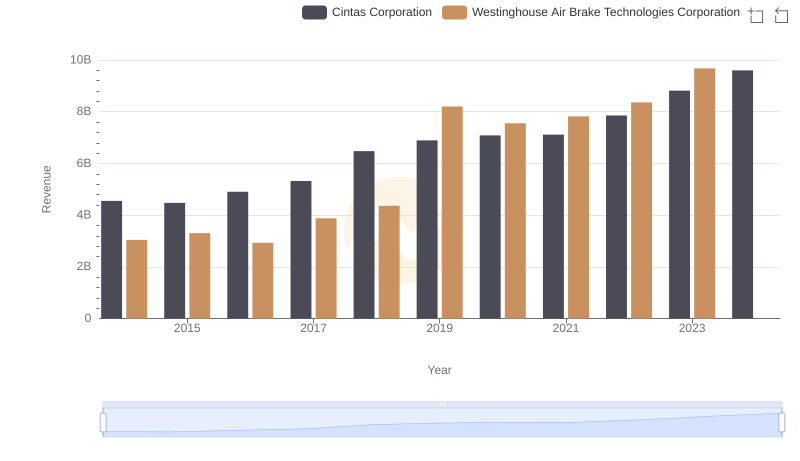

Revenue Showdown: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

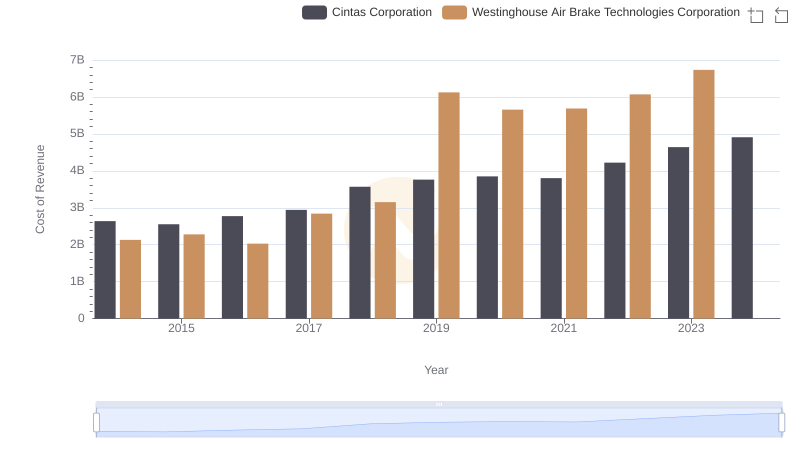

Cost of Revenue Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

Cintas Corporation vs AMETEK, Inc.: SG&A Expense Trends

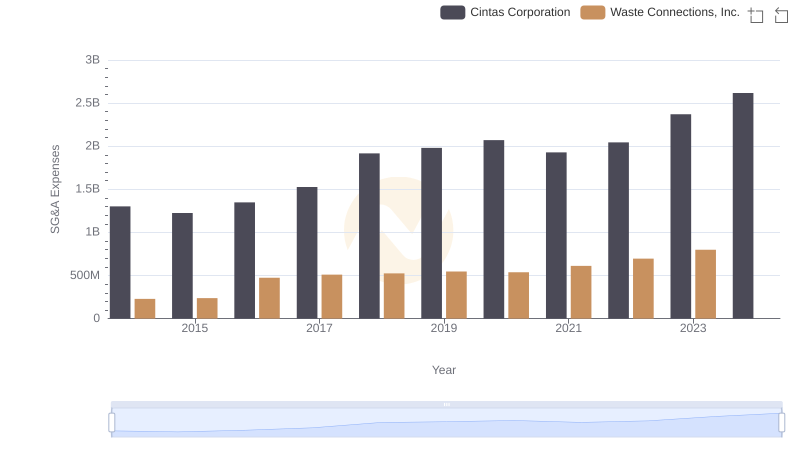

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

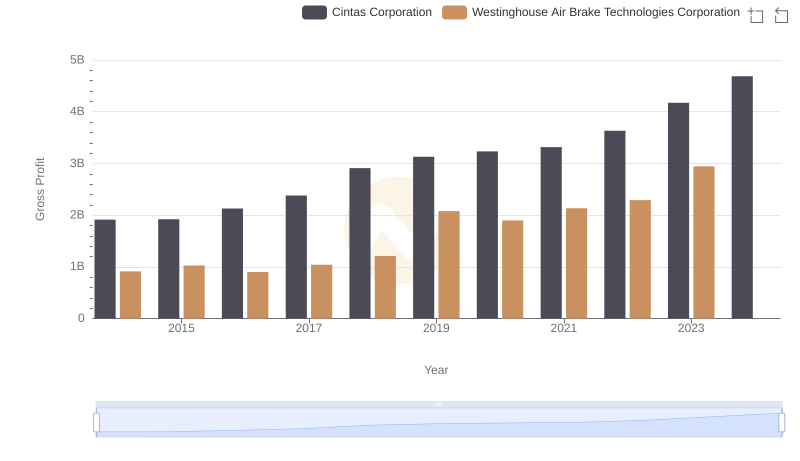

Who Generates Higher Gross Profit? Cintas Corporation or Westinghouse Air Brake Technologies Corporation

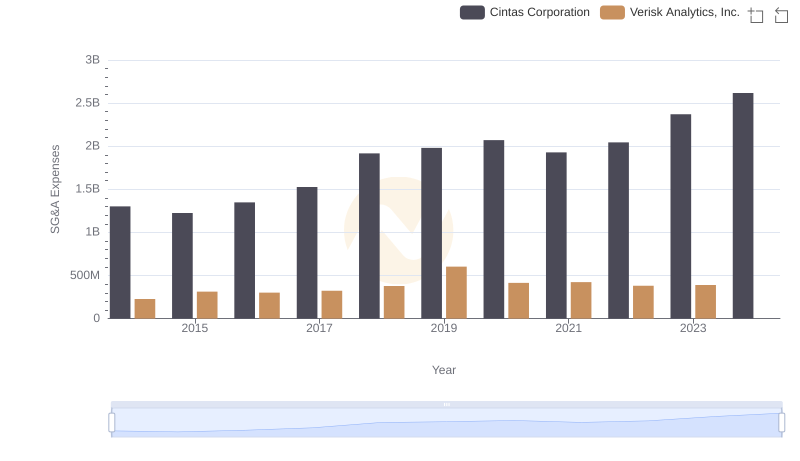

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

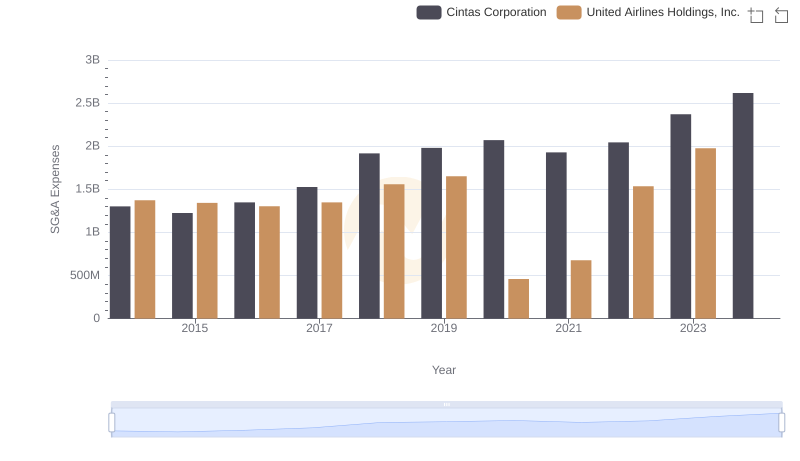

SG&A Efficiency Analysis: Comparing Cintas Corporation and United Airlines Holdings, Inc.

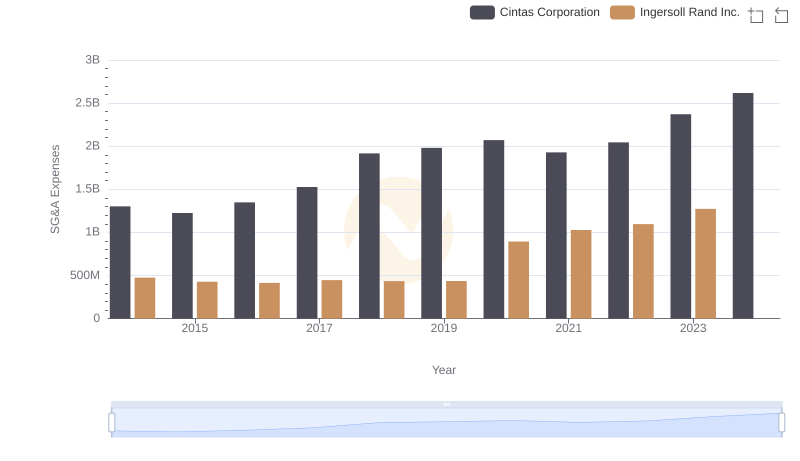

Cintas Corporation and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

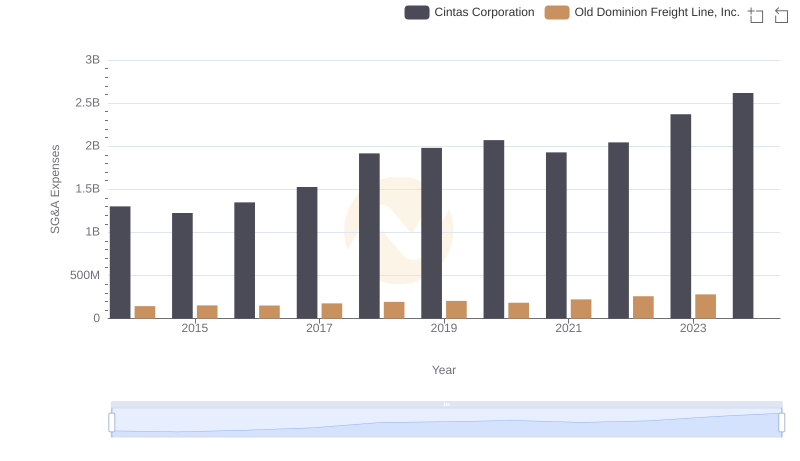

Selling, General, and Administrative Costs: Cintas Corporation vs Old Dominion Freight Line, Inc.

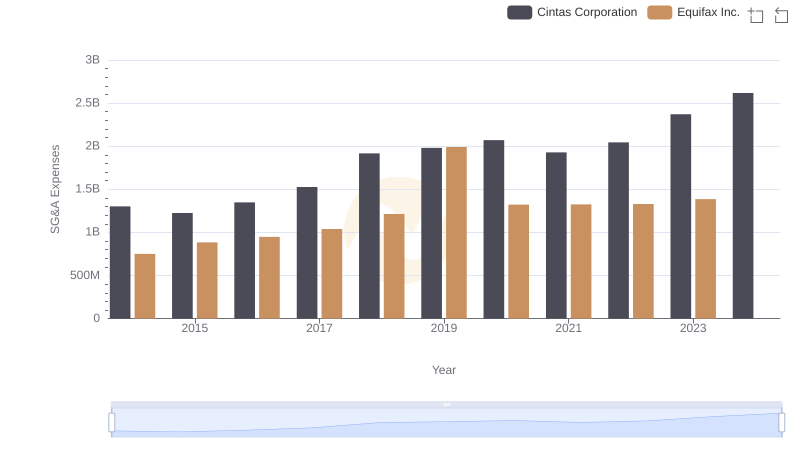

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

Comprehensive EBITDA Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation