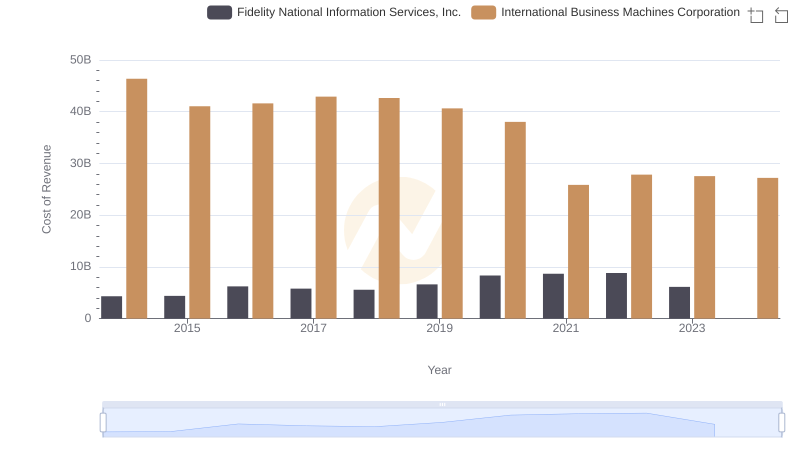

| __timestamp | Fidelity National Information Services, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 6413800000 | 92793000000 |

| Thursday, January 1, 2015 | 6595200000 | 81742000000 |

| Friday, January 1, 2016 | 9241000000 | 79920000000 |

| Sunday, January 1, 2017 | 8668000000 | 79139000000 |

| Monday, January 1, 2018 | 8423000000 | 79591000000 |

| Tuesday, January 1, 2019 | 10333000000 | 57714000000 |

| Wednesday, January 1, 2020 | 12552000000 | 55179000000 |

| Friday, January 1, 2021 | 13877000000 | 57351000000 |

| Saturday, January 1, 2022 | 14528000000 | 60530000000 |

| Sunday, January 1, 2023 | 9821000000 | 61860000000 |

| Monday, January 1, 2024 | 10127000000 | 62753000000 |

Cracking the code

In the ever-evolving landscape of technology and financial services, International Business Machines Corporation (IBM) and Fidelity National Information Services, Inc. (FIS) stand as titans. Over the past decade, IBM's revenue has seen a notable decline, dropping from its peak in 2014 to a 33% decrease by 2023. Meanwhile, FIS has experienced a robust growth trajectory, with its revenue surging by approximately 53% over the same period.

As we look to the future, the contrasting revenue trends of these two industry leaders offer a fascinating glimpse into the dynamics of their respective markets.

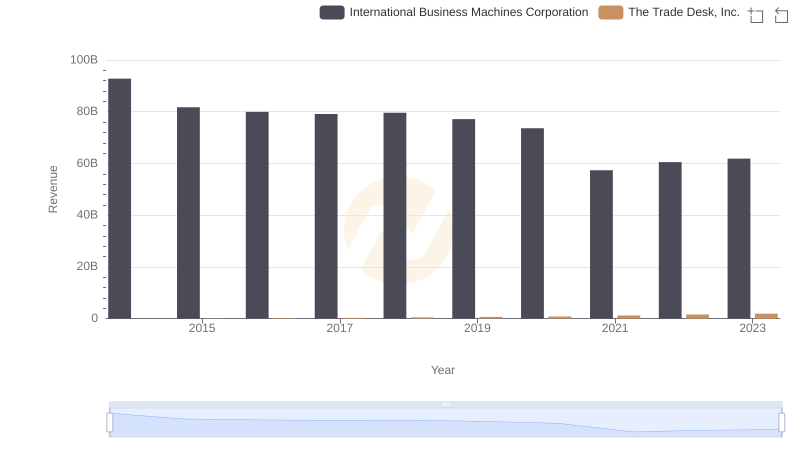

International Business Machines Corporation and The Trade Desk, Inc.: A Comprehensive Revenue Analysis

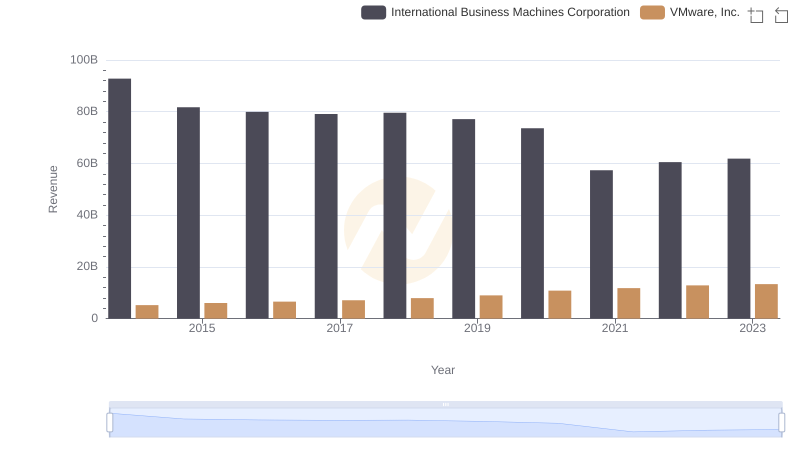

Revenue Insights: International Business Machines Corporation and VMware, Inc. Performance Compared

Comparing Revenue Performance: International Business Machines Corporation or NXP Semiconductors N.V.?

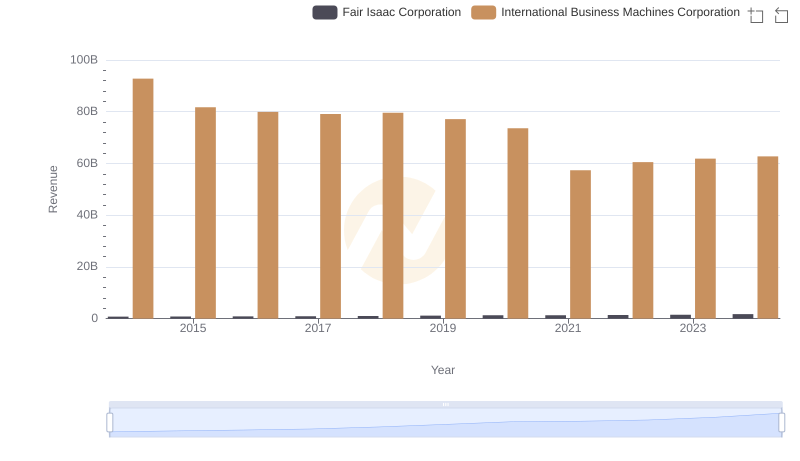

Revenue Showdown: International Business Machines Corporation vs Fair Isaac Corporation

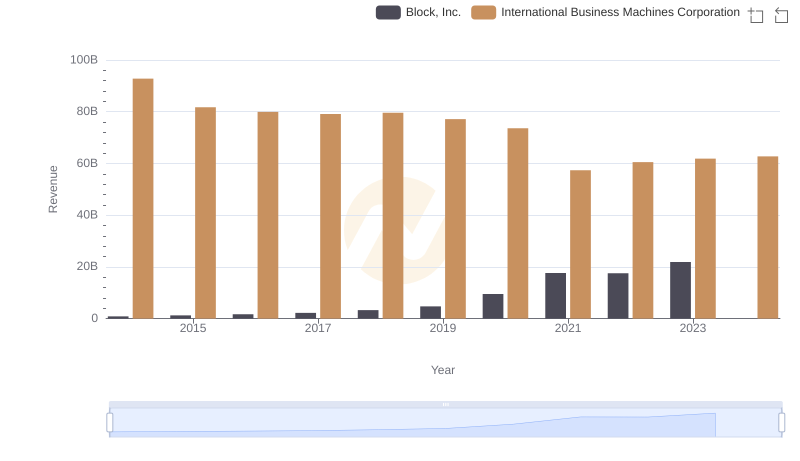

Who Generates More Revenue? International Business Machines Corporation or Block, Inc.

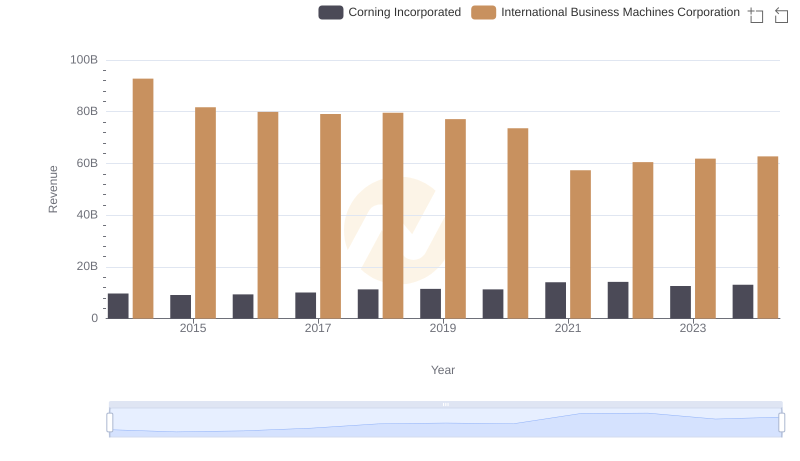

International Business Machines Corporation vs Corning Incorporated: Annual Revenue Growth Compared

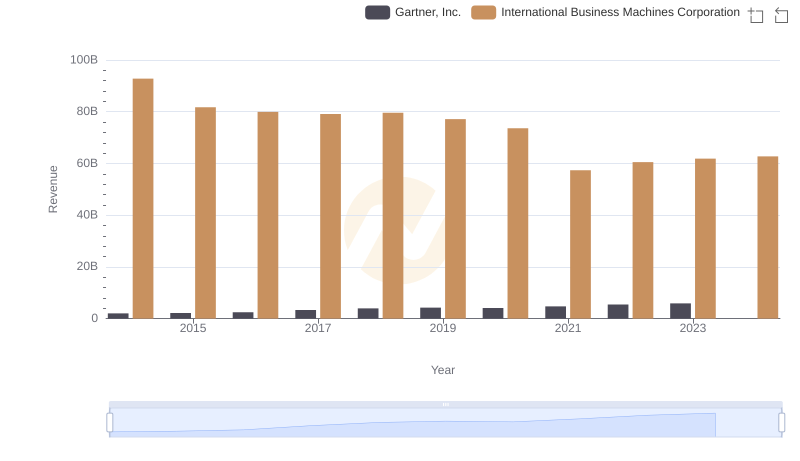

International Business Machines Corporation vs Gartner, Inc.: Examining Key Revenue Metrics

Analyzing Cost of Revenue: International Business Machines Corporation and Fidelity National Information Services, Inc.

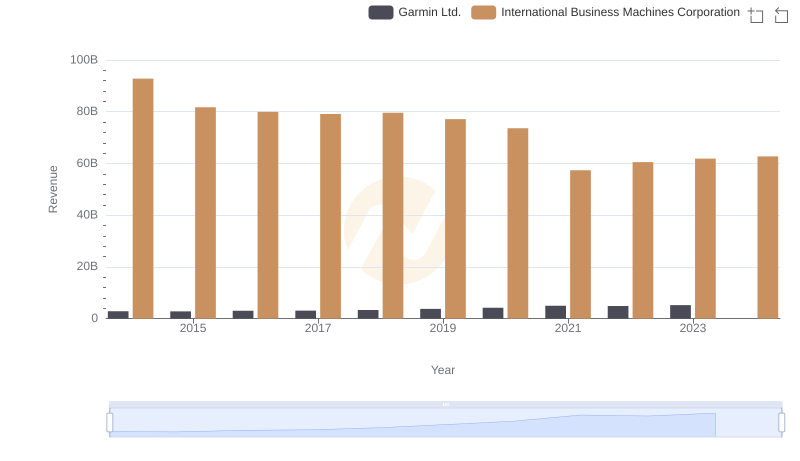

International Business Machines Corporation vs Garmin Ltd.: Examining Key Revenue Metrics

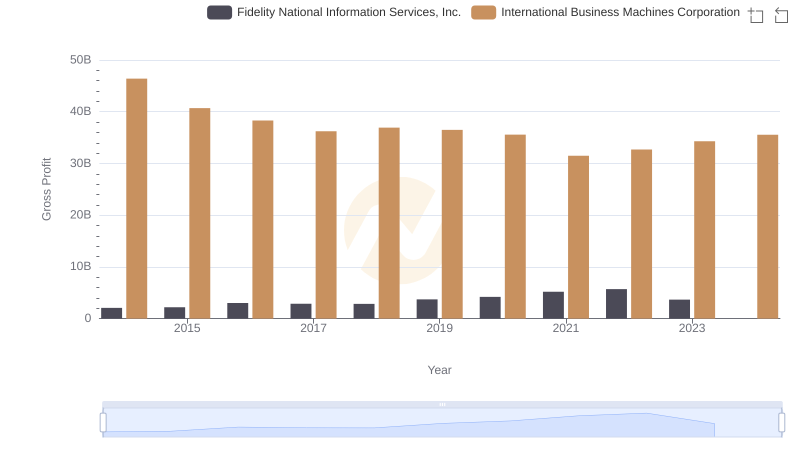

Who Generates Higher Gross Profit? International Business Machines Corporation or Fidelity National Information Services, Inc.

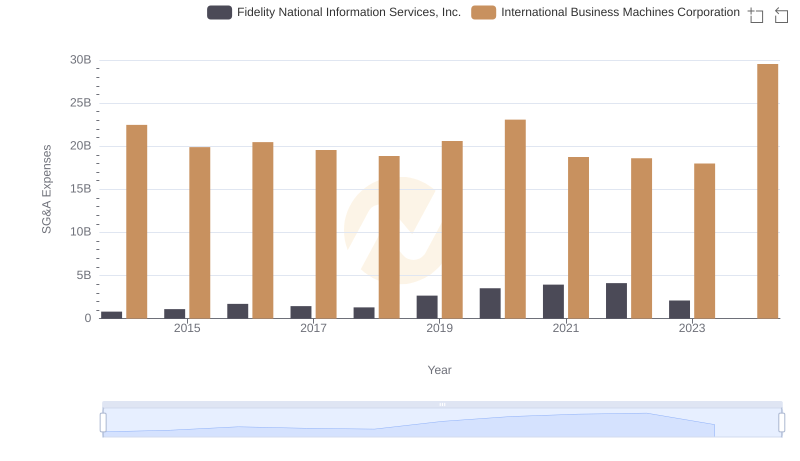

Comparing SG&A Expenses: International Business Machines Corporation vs Fidelity National Information Services, Inc. Trends and Insights

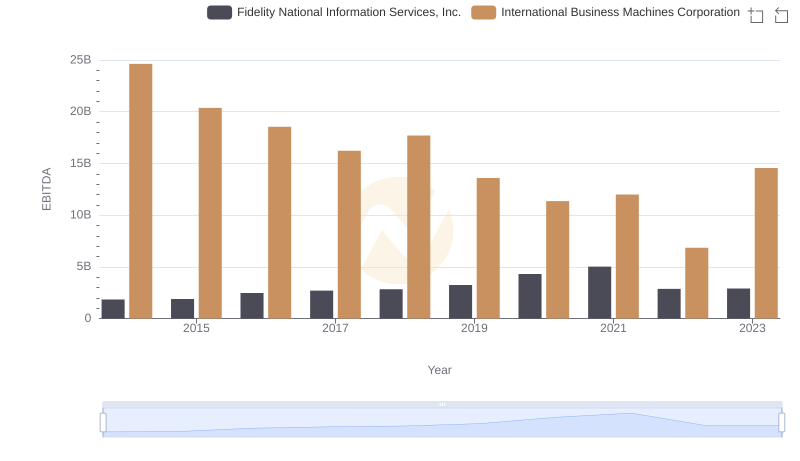

International Business Machines Corporation vs Fidelity National Information Services, Inc.: In-Depth EBITDA Performance Comparison